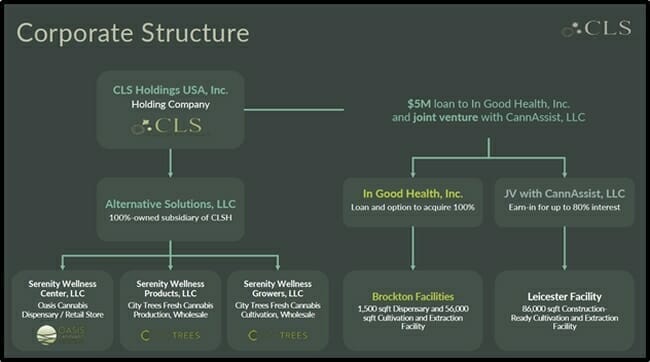

Cannabis Life Sciences Holdings (CSE:CLSH.U) is a “diversified cannabis company that acts as an integrated cannabis producer and retailer through its Oasis Cannabis subsidiaries in Nevada” – while lining up opportunities in other states including Massachusetts.

This company has a lot of moving parts, many of which are already spitting out cash.

“Four deals are either completed or in play, to this point, in growing, developing products, and dispensaries,” wrote Equity Guru’s Chris Parry on March 28, 2019.

They’re not a retail cannabis play, though they definitely do retail cannabis, with an agreement to acquire the In Good Health dispensary in MA which serves 18,000 people, with 1,700 home delivery customers.

And they’re not an IP play, though they have a patent pending proprietary method of extracting and processing cannabidiols from cannabis that, they say, will result in a higher level of quality for the oil extracted, and the products ensuing.

“The total of its parts defies easy categorization,” admitted Parry – before invoking a Bob Ross (“Happy Little Clouds”) analogy to elucidate CLSH’s sprawling ambition.

It turns out that it’s easier to keep track of CLSH at the cash register than through a map, a milestone-review or a transaction flow-sheet.

The Q3, 2019 financials ending February 28, 2019.

- Total revenues of $2.4 million (25% increase)

- $1.4 million from The Oasis Dispensary (up 10%)

- Oasis gross margin of 39% (up 17%)

- $1 million revenue from The City Trees (up 84%)

- City Tress gross margin of 39% (up 7%).

CLSH has been has been working to increase revenues at the Oasis Dispensary through “customer-focused initiatives”. The one-time costs have already been absorbed, resulting in improved product selection and streamlined purchasing protocols.

The $1 million revenue from The City Trees brand contributed significantly to CLSH’s revenue growth bringing in about $1 million. City Trees’ products are now available in 44 locations across the state of Nevada.

”I want to thank all of our employees who made it possible for these improved results since CLS acquired Alternative Solutions (Oasis and City Trees),” stated Jeffrey Binder, Chairman and CEO of CLSH.

Next month, Cannabis Life Sciences expects to close a deal for the CannAssist cultivation opportunity in the City of Leicester, Massachusetts (pop. 11,000).

The definitive agreement allows CLSH to acquire an 80% ownership interest in CannAssist, advancing the goal of establishing a footprint in the rapidly growing Mass market.

There is anecdotal evidence that the City of Leicester has considerable local and out-of-state pent up demand for cannabis. The first recreational dispensary to open caused traffic jams. An emergency townhall meeting was convened to discuss the impact of the new pot business on the neighbourhood.

“The store served about 1,000 customers on opening day,” stated a CBS affiliate, “the Friday after Thanksgiving was the busiest, reporting nearly $480,000 in gross sales.”

“This is what a small town like Leicester needs,” stated one Leicester resident, “The guy’s overly successful. You want to punish him for that. I’m sorry that’s just not the American way.”

CannAssist Deal Summary:

- Entered into a contract with the City of Leicester

- Application for a state cultivation grow license

- 86,000 sq. ft facility

- targeted 1st harvest in Q1, 2020

- Production capacity of 28,000 pounds of flower

- Could produce 240,000 grams of extract.

Once fully operational, total revenues from the grow facility are anticipated to exceed $100 million.

CLSH has invested substantial funds into the medical dispensary, which has allowed for its expansion and improved development. Both sites represent exponential revenue potential, especially given their location in Massachusetts.

On April 10, 2019 CLSH’s Oasis Cannabis’ 24-hour dispensary in Las Vegas, had its grand reopening weekend, servicing 2,000 visitors, processing 1,750 orders in the 3 days, with an average sale of USD $50.00 and a gross margin of 46%.

CLSH has also developed a proprietary method of extracting cannabinoids from cannabis plants and converting the resulting cannabinoid extracts into concentrates such as oils, waxes, edibles and shatter.

Key Tech Features:

- High consistency.

- Cleaner and safer products

- Reduce growing costs

- Provide 2 X Delta-9 THC compared to competitors.

- Higher Delta-9 THC creates higher

Delta-9-tetrahydrocannabinol (delta-9-THC), is one of 60 cannabinoid molecules in the cannabis plant, and it is recognized as the main psychoactive ingredient

The technology has the potential to provide “one-stop, multi-state services to companies wishing to build private label brands”, by extracting and converting cannabinoids in a greater yield than methods currently used in the industry”

“I’m seeing around $190 million in value in the CLSH operations,” summarized Parry, “without even adding the extraction and processing patents and technology that could plug directly into EVERY. SINGLE. FACILITY.”

Canaccord Genuity agrees with Parry, giving CLSH a $1.50 Speculative Buy rating.

CLSH is currently trading at .39 with a market cap of $49 million.

Full Disclosure: CLSH is an Equity Guru marketing client, and we own the stock.