Rockridge Resources’ (ROCK.V) investor deck bears the title, “A Fresh Look at Historical Districts: One of Canada’s Newest Copper Exploration Companies.” Aside from a highly prospective copper asset, this company has a lot of depth, and a lot of upside potential.

Copper – the base/battery metal

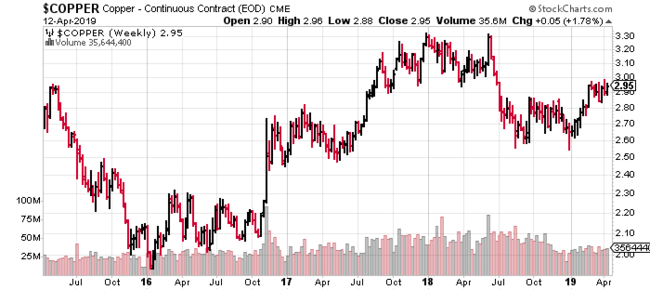

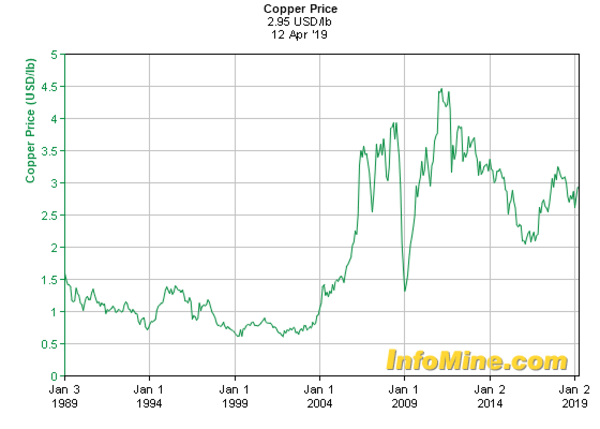

The above chart shows copper bouncing nicely off the lows registered in late 2018, taking out minor resistance in the $2.80 to $2.85 area, now consolidating recent gains just shy of $3.00.

Zeroing in on the price action from the beginning of this year (far right on the same chart), we have one of my favorite price patterns in play – a bull flag.

The bull flag is a favorite of mine due to its simplicity, logic, and its tendency to resolve itself with a very satisfying upward trajectory.

Of course, there’s a myriad of fundamentals begging for higher copper prices going forward.

Last week at the Cesco conference in Santiago Chile, one of the bigger expos in the copper arena (they’re already selling tix for next years event), analysts and executives point to the tightest market they’ve seen in more than five years.

CRU analyst Charlie Durant, in a recent Reuters article, stated, “Copper is going to be central to the green revolution.”

Electric vehicles (EVs) are seeing a global surge in interest. Manufacturers can’t keep up with demand. According to Driving Electric, it might take up 12 weeks for a new gas-powered car to be delivered, but lead times for EVs can be up to six months. “Order now” is their best advice.

Aside from EVs, which can use three times as much copper as internal combustion engines, the demand is increasing wherever energy transmission and distribution are required – solar panels and wind turbines are also good examples.

Regarding new technologies, this according to Reuters:

So-called smart-home systems – such as Alphabet Inc’s Nest thermostat and Amazon.com Inc’s Alexa personal assistant – will consume about 1.5 million tonnes of copper by 2030, up from 38,000 tonnes today, according to data from consultancy BSRIA.

The supply gap

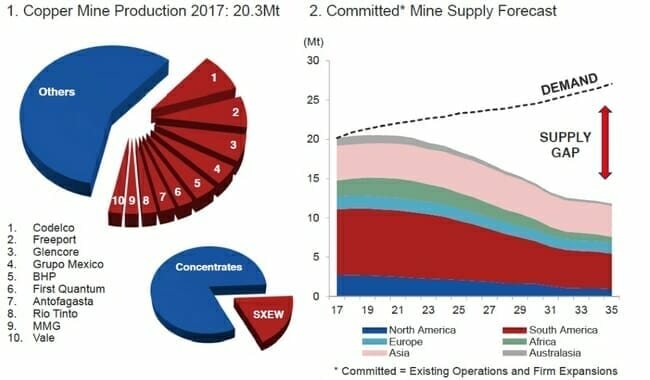

- Since 1900, usage for refined copper has increased from less than 500 thousand tonnes to 23.8 million metric tonnes in 2017, a compound annual growth rate of 3.4% per year.

- Over 200 copper mines currently in operation will reach the end of their productive life before 2035.

With this burgeoning demand, can new production keep pace?

A Million Tons of Copper Is on the Way: It May Not Be Enough

It seems to me the copper price has only one direction to travel, long term – UP.

Canada’s newest copper exploration company

Rockridge’s focus is the acquisition of copper assets, but it’s limiting its search to historical districts, those that have yet to see a contemporary approach to exploration.

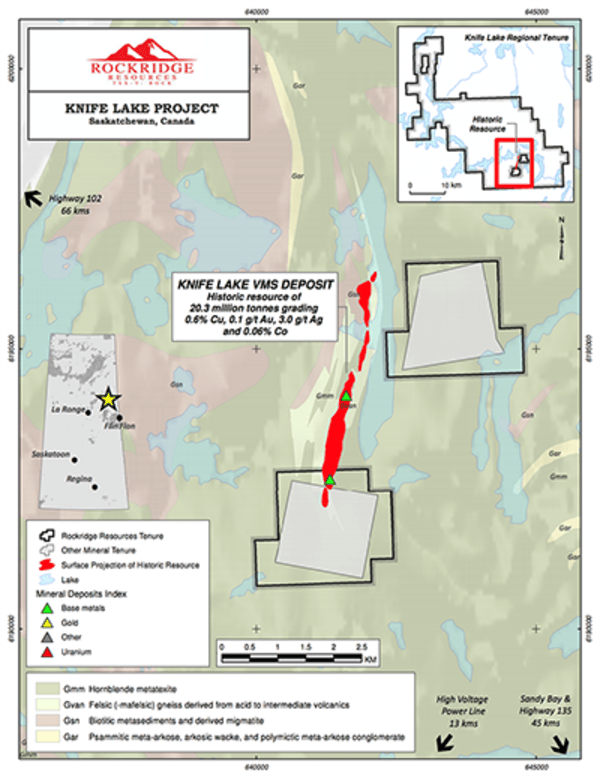

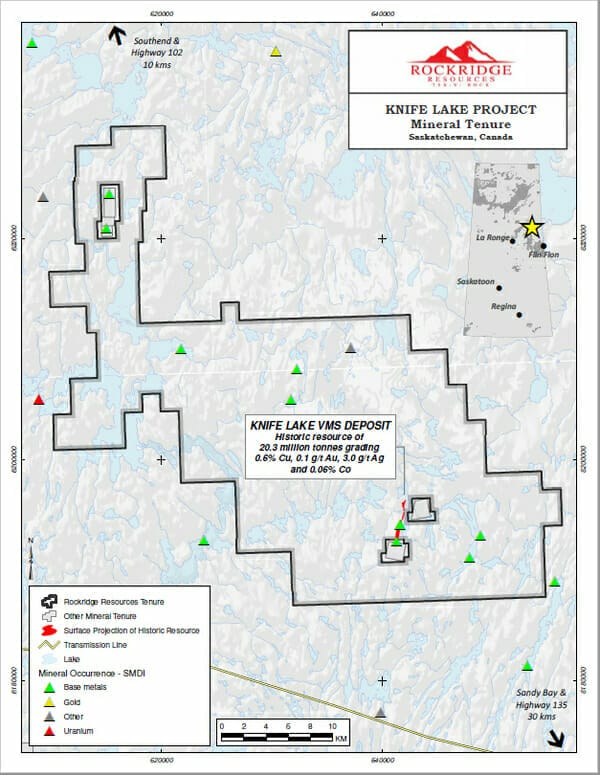

Rockridge’s 85,000-hectare flagship project – Knife Lake – resides in Saskatchewan, a Canadian province ranked in the top three of the Fraser Institute’s annual mining survey of mining jurisdictions. Eliminating jurisdictional risk should be at the very top of every investor due diligence list, right up there with the quality-of-company-management (more on this further down).

In Nov. 2018, ROCK entered into an option to acquire a 100% interest in Knife Lake from Eagle Plains Resources (EPL.V). There’s a story behind how Eagle Plains came to acquire this project – it was a seriously deft, heads-up kinda move.

The price of admission – the cost of acquisition – was less than one penny per lb of copper. Nice shooting there Tex!

Favorably positioned in the Flin Flon-Snow Lake mining district, one of the more prolific greenstone belts in the country, Knife Lake saw extensive exploration from the late 1960s to the 1990s with the last documented work program completed in 2001.

The geology

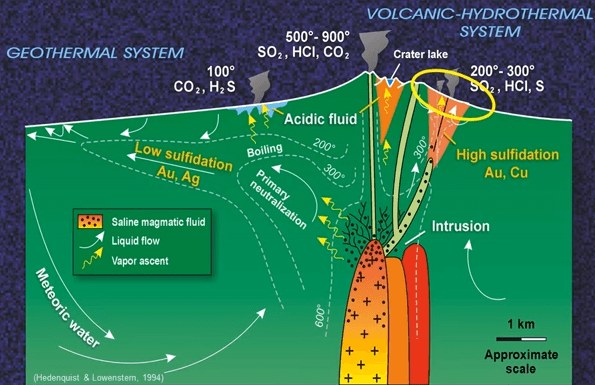

Knife Lake is a Volcanogenic Massive Sulphide (VMS) type setting.

We love VMS type settings here at Equity Guru. These deposits commonly occur in clusters: where there’s one deposit, there are likely others. A highly desirable geological characteristic, this.

A great VMS primer can be found by tapping the link below:

Historic results

Of the more noteworthy historical drill results at Knife Lake, these two stand out:

- 1.37% copper, 5.07 g/t silver, 115 ppm cobalt, 1182 ppm zinc over 60.13 meters beginning at a depth of 2.37 meters.

- 0.99% copper, 4.73 g/t silver, 103 ppm cobalt over 38.83 meters, beginning at a depth of 6.11 meters.

In late 1998, out of some 315 diamond drill holes, Leader Mining International tabled a historical resource estimate of 20.3 million tonnes grading 0.6% copper, 0.1 g/t gold, 3.0 g/t silver, 0.06% cobalt and 0.11% zinc for the Knife Lake project.

Within this resource, the company delineated a higher grade zone containing 11 million tonnes grading 0.75% copper.

Note: the above resource is “historical” and does not comply with NI 43-101 standards.

You might be wondering, “why did Leader Mining walk away from the project after such a great start?” Good question. This long-term copper price chart tells the tale:

After trading well north of $1.00 in the early to mid-1990s, copper went into a downward spiral as the decade wound down, to < $0.70 per lb.

Sub $1.00 copper slammed the door shut on Knife Lake. But Leader’s loss is ROCK’s gain.

A fresh look at Knife Lake in a $3.00 copper environment

The Knife Lake deposit itself is open along strike and at depth. Most of the historic drilling quit at 100 meters.

Knife Lake’s 85K hectares are ripe for new discoveries. The property has yet to see a real state-of-the-art exploration campaign.

There are a good number of high-priority regional targets – Pistol, Gilbert, Red Hill – that require follow-up exploration.

Bottom line: Knife Lake’s surface has barely been scratched.

ROCK’s targeting strategy will focus on identifying buried deposits using modern geophysics – high-resolution, deep penetrating EM – and drone mag surveys over large swaths of prospective terrain. The projects latent potential should much become clearer via this approach.

Groundwork and sampling – analyzing rock geochemistry to identify prospective VMS style hydrothermal systems – will be conducted property wide; as will following up on historic conductors, alteration and mineralization at regional targets.

Do you find yourself lost with some of these esoteric terms? I got yer back…

Drilling began one month ago – results imminent

Rockridge’s president and CEO, Jordan Trimble:

“The commencement of drilling is a significant milestone for Rockridge as we look to position the Company as a go-to copper and base metal exploration and development company in Canada. The historical Knife Lake Deposit returned some notable drill results and there is still robust discovery potential around it and regionally. This inaugural drill program represents the first meaningful exploration carried out on the project in over sixteen years as we execute on our strategy of going back into overlooked projects in favourable jurisdictions with modern exploration techniques and methodologies to make new discoveries.”

This initial program, the first real work conducted on the property in nearly two decades, will consist of roughly 1,000 meters in eight to ten diamond drill holes. The objectives: confirm the tenor of mineralization reported by previous operators and expand the known zones of mineralization.

Current drilling is targeting the historic higher-grade zone outlined above (11 million tonnes grading 0.75% copper).

As noted earlier, the majority of the historic drilling was relatively shallow, up to 100 meters below surface. Future programs will test the mineralization at depth.

The goal is to produce a NI 43-101 compliant resource estimate by year-end.

News will begin to flow out of Knife Lake within the next few weeks. Assays will be released in batches.

These are exciting times for the company and its shareholders. We may have some high-grade Flin Flon-Snow Lake copper on deck here.

ROCK’s management team is stacked with talent

I could write an entire chapter on this crew and still not do them justice.

This is the same camp as Aben Resources (ABN.V), Cypress Development (CYP.V), and Skyharbour Resources (SYH.V). That alone should be enough to pique your interest.

Looking over the lineup, I immediately homed in on Ron Netolitzky, ROCK’s strategic advisor. Knife, as we stated above, is a VMS deposit. Ron was one of the key players behind Eskay Creek, a famously rich VMS deposit in BC’s Golden Triangle.

Netolitzky, in a Jan 16th press release:

“I am excited to work with management and the geological team at the newly formed and well-structured Rockridge Resources. I have worked in the area around the Knife Lake Project and believe there is robust discovery potential there which the Company plans to test with its upcoming drill program.”

Joseph Gallucci, a recent hire, is another name that jumps out:

Rockridge Resources Announces Joseph Gallucci Joins Board of Directors

“Mr. Gallucci is a capital markets executive with over 15 years of experience in investment banking and equity research focused on mining, base metals, precious metals and bulk commodities on a global scale. His career has spanned across various firms including BMO Capital Markets, GMP Securities, Dundee Securities, and he was a founding principal of Eight Capital where he recently led their Mining Investment Banking Team.”

CEO Trimble again:

Mr. Gallucci has years of experience as an investment banker and research analyst with a focus on Canadian base metal companies. His expertise in corporate finance, mergers and acquisitions, and capital raising will be invaluable to the company as we look to create shareholder value through new mineral discoveries and the advancement of projects in geopolitically favourable jurisdictions like Canada.”

With a talent pool this deep, you gotta know management has their eye on further acquisitions, perhaps along the same greenstone belt.

With Gallucci’s contacts in the industry – Trevali, Osisko, Hudbay – ROCK stands a good chance of acquiring advanced-stage projects on similar terms as Knife Lake (< $0.01 per lb Cu) by tapping into the non-core asset portfolios of these larger mining companies.

Closing thoughts

ROCK sports a tight share structure of some 25.3 million shares outstanding (management, insiders and close associates hold roughly 10 million).

The company coffers are stoked to the tune of $2M – a tidy sum.

The current market cap, based on the company’s recent close at $0.24, is a modest $6.11M.

Knife Lake is on the verge of delivering its first set of assays. Additional acquisitions may be in the offing.

I like this setup.

END

~ ~ Dirk Diggler

Feature image courtesy of Bloomberg.

Full disclosure: Rockridge is an Equity Guru client. We may own the stock at any given time.