This week the 3-month U.S. Treasuries are yielding more than 10-year notes.

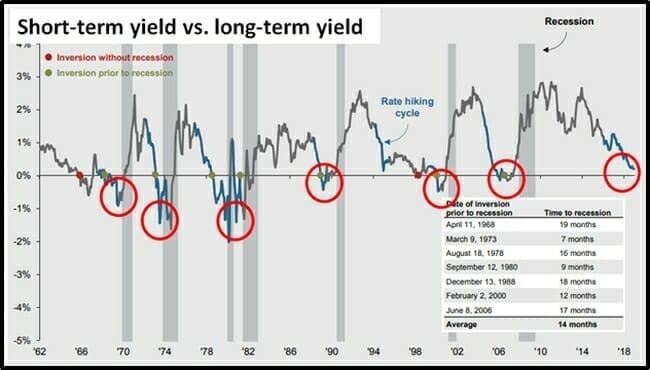

For the last 50 years, a yield curve inversion, has been an infallible predictor of recessions.

The spread between 3-month bills and 10-year Treasuries has inverted before each of the past seven recessions.

Bianco Research determined that historically, a recession arrives 12-18 months after an inversion.

Treasuries are considered low-risk because they are backed by the U.S. government. The rate of return (or yield) is determined by supply and demand.

If the demand for treasuries is low, the treasury yield increases to compensate for the lower demand. This makes it more expensive for the government to borrow money.

An investment in gold is counter-bet against the U.S. economy, so there was considerable celebration in the gold investment community.

Normally investors want a higher rate of return for locking up cash for longer periods.

When the curve inverts, investors can get a higher rate of return for locking up their cash for a shorter period.

Here’s a primer:

If the “Yield Curve” concept still seems wonkish, let’s break it down further.

You are the U.S. Treasury looking to raising money to cover the 2018 $891 billion budget deficit.

I am an investor with $100,000 cash – looking for a return.

Two possible scenarios:

Scenario#1: Hand over $100,000 to you for 10 years, you’ll pay me 2.42% per year interest – paid quarterly. After 3 months, I’ll receive a cheque for $605. I gotta wait another 9 years and 9 months – to get my $100,000 back.

Scenario#2: Hand over $100,000 to you for 3 months, you’ll pay me 2.46% per year interest. After 3 months, I’ll receive a cheque for $615 – and immediately get my $100,000 back.

The only reason to chose scenario#1 is if you think 2.42%-a-year return is the best you get for the next decade, and the 10-year rate will be even lower 3 months from now.

The Efficient-Market Hypothesis (EMH) states that asset prices “fully reflect all available information.”

The available information signals lower interest rates and slower or negative economic growth.

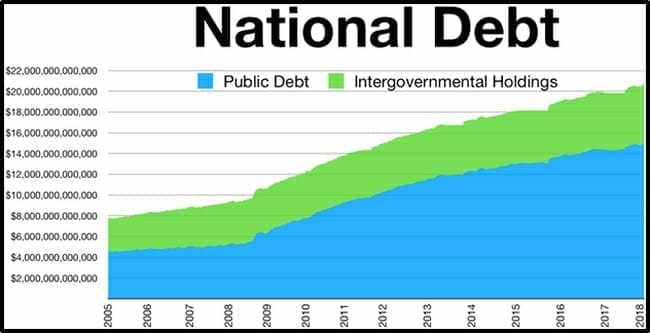

The total U.S. government debt load is now about $21.8 trillion – climbing $100,000 every five seconds.

In 2018, the U.S. debt-to-GDP ratio was 105%. In comparison Canada’s debt-to-GDP is 80%, Sweden’s is 41%.

According to The Wall Street Journal, “The Trump https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistration expects annual budget deficits totaling $7.1 trillion over 10 years.”

The debt virus isn’t just a government disease.

In the last 10 years, corporate bonds outstanding nearly doubled to $9 trillion, from $5.5 trillion.

In 2009, General Electric (GE.NYSE) had had a AAA credit rating. GE now has a staggering $115 billion of outstanding debt – with a $20 billion payment due this year. GE’s credit rating is now BBB+, moving it from “Prime” to “Lower medium”.

Many financial pundits are busy explaining why this inverted yield does not predict a recession:

Goldman Joins Chorus Warning Against Yield Curve Panic (Bloomberg)

Don’t sweat the inverted yield curve (CNN)

Mizuho Bank Not Worried About Yield Curve Inversion (Bloomberg)

For sure – maybe it’s “different this time”.

But it’s not just the U.S. government and corporate America that is bloated with debt.

Although Americans collectively carry $870 billion in credit card debt, they still spend $70 billion a year on domestic pets, including must-own products like “Poop Freeze”.

According to Bloomberg, “Global debt hit a record $184 trillion last year, equivalent to more than $86,000 per person — more than double the average per-capita income.”

This is scary because 100% of the debt is based on fiat currency (paper money), and it is easy to manipulate supply.

The inverted yield curve suggests that lending money to the U.S. government for a short term (3 months) is riskier than lending money to the U.S. government for a long term.

Gold bugs luxuriate in this kind of fiscal counter-intuitiveness.

Let’s suck back a couple of martinis, and see how it plays out.