PLUS Products (PLUS.C) has produced a 2018 revenue estimate of USD$8.4M despite a challenging legal cannabis market, the company announced today.

The company’s unaudited revenue represents 684% growth over 2017 when revenues reached $1.1M.

The company says Q4 revenue is expected to reach $3.4M, a 32% increase over Q3 revenues and a 776% increase from Q4 2017.

PLUS Products credits the double-digit growth in revenue to their brand portfolio of SKUs. The company has four full-time SKUs and one rotating and seasonal product.

“We are proud that in a year where the greater legal California cannabis market shrank and underperformed expectations, PLUS had significant growth in both revenue and market share.”

–Jake Heimark, co-founder & CEO of PLUS Products.

The company’s unaudited cash balanced climbed to $22.9M by year’s end. This figure represents an increase of $0.3M compared to Q4 2017 and an increase of $11.1M when compared to Sept. 30, 2018, just before PLUS’ October IPO.

From Q3 and Q4, preliminary unaudited operating expenses rose 67%. PLUS says this is due to professional fees stemming from the IPO, additional costs from market research and brand development, increased wages and shared based compensation for management personnel hired during Q4.

California loves Plus

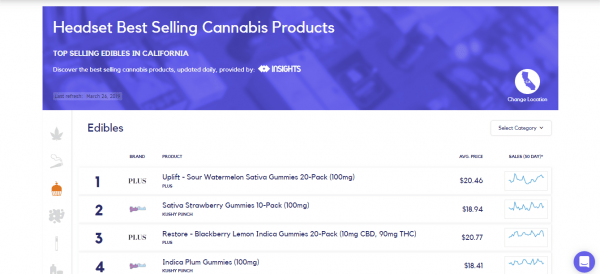

Headset, a retail analytics firm, said the PLUS “Uplift Sour Watermelon” gummy outperformed the more than 20,000 branded cannabis products for sale in California dispensaries in 2018.

Market research firm BDS Analytics said the PLUS “Uplift” and “Restore” edibles were the top two best-selling edible products in California. BDS Analytics also projects PLUS’ retail sales to have exceeded $10M in Q4.

Furthermore, BDS Analytics also tracked a 17% decline of legal cannabis sales in 2018. The company believes this had to do with new licensing challenges, packaging requirements and testing regimens instituted by the State.

Despite this downturn, PLUS has managed to ascend to the top of the heap with its assortment of branded products.

“When the legal market shrinks in its first year of enforcement, the most likely culprit is an increase in underground market sales as some businesses struggle to figure out how to adapt to the new legal landscape.”

–Jake Heimark.

PLUS has always demonstrated its willingness to comply with state regulations. As just one example, the company began using child-resistant tins one year before the final regulatory deadline.

Read: Plus Products (PLUS.C) gets serious about safety as sales numbers soar

The call to child-proof cannabis product tins stems from an increasing number of cannabis-related health scares among children.

The Los Angeles Times reports the number of calls to poison control centers from young people age 19 and below increased to 588 in 2018 from 347 in 2017.

PLUS’ new tins are made of recyclable tinplate steel with a polypropylene insert. Similar to a prescription pill bottle, the tins require a press and twist technique before opening.

The company also participated in the National Cannabis Roundtable with former House Speaker John Boehner acting as honorary chairman last month to change U.S. cannabis laws and allow for freer legal commerce.

PLUS says the audited financials will be available before April 30, 2019, and that its consolidated financials for Q1 2019 will be made available prior to May 31, 2019.

The company is up $0.11 today, representing a 2% increase in SP. PLUS Products has 24.3M issued and outstanding shares and a market cap of $134.5M.

Full disclosure: PLUS Products is an equity.guru marketing client.