Bobby Burleson, analyst for Canaccord Genuity, rated Plus Products (PLUS.C) as a speculative buy in The Globe and Mail today.

Plus Products is a company that manufactures THC and CBD-infused candy for the California edibles market. California represents a large wedge of the U.S. edibles market, which pulled in $1 billion in sales in 2018, according to Arcview Market Research.

Burleson said he anticipates that Plus will be expanding into states that have already legalized recreational cannabis next, and into Canada when edibles are legalized in October.

What is a speculative stock?

A speculative stock is a stock that carries a high degree of risk. Penny stocks and emerging market stocks are thought of as speculative buys because of the volatility in their price fluctuations.

Plus Products is no different.

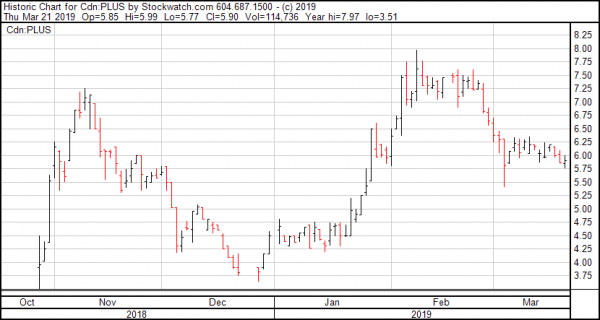

Tomorrow is always a question mark with a chart like this. If you bought one thousand shares when Plus Products was at $4 in the middle of October, you would have doubled your investment by February and still be in the money today.

Speculative stocks are vulnerable to messy rises and falls. It’s where the doubles and triples in stock price live, but it’s also a graveyard of lost savings and bad investments.

If starting companies can grow out of this stage then stock price fluctuations will show less volatility.

Plus Products is still young yet, but they’re doing the right things towards finding the kind of stabilization that attracts long term investors.

“Through its popular line of gummies, Plus has attained leading share of the legal edibles market in California (10 per cent in the second half of 2018), arguably the world’s most competitive,” Burleson said.

Plus Products is also looking to diversify their products beyond gummies with their $2 million acquisition of the Oakland-based Good CO-OP in December.

Baked goods account for roughly 10% of the edibles sales in California and that’s a plus for Plus.

Good is a California-based baker specializing in THC-infused brownies. Right now that’s all they make, but they’re getting into mints and hard candies.

Also, Plus Products secured eligibility by the Depository Trust Company (DTC) for its shares on the OTC board.

The Depository Trust Company was founded in 1973 and is one of the largest securities depositories. The DTC acts as a record keeper and clearing house for broker-to-broker trading of corporate and municipal securities.

You don’t need to be DTC eligible to trade, but there are certain efficiencies and cost benefits that DTC offers and many stock exchanges require DTC-eligibility prior to listing of a security.

DTC eligibility permits Plus Products shares to be distributed, settled and serviced through DTC’s automated processes.

“This eligibility offers our U.S. institutional and retail investors an expedient and trustworthy platform on which to trade our stock and increases share liquidity in all public markets in which we trade,” said Jake Heimark, co-founder and CEO of Plus Products.

Plus Products is only five months old as a company and it’s perfectly normal to have some volatility in the early stages. But Plus has a lot of good things going for it such as a stable market strategy, a solid product and sales.

Shares rose CAD$0.04 to end the day at $5.90 per share.

Currently Plus Products has 24,330,799 issued and outstanding shares with a market cap of $143.5 million.

Sometimes speculative bets can be good bets. This might be one.

–Joseph Morton

Full disclosure: Plus Products (PLUS.C) is an Equity.Guru marketing client.