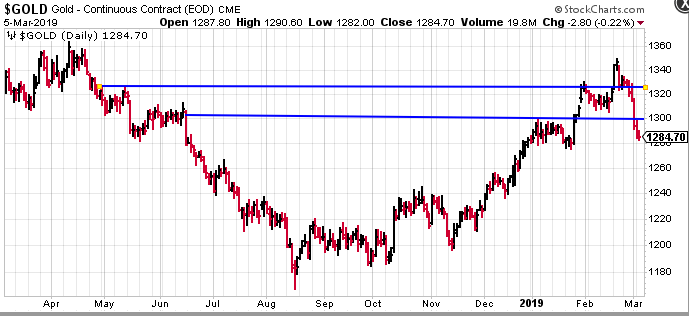

Gold: what we witnessed during the month of February – on the 19th and 20th to be specific – might best be described as a Bull Trap.

What we’re currently in the midst of – in very recent sessions – may well turn into the polar opposite – a Bear Trap.

A helpful first aid tip for those trading this volatile market: copper lined neck braces work great for severe cases of whiplash.

We’ve recently made a strong case for gold here at Equity.Guru, and in particular, the shares of the companies that search for the stuff – the ExplorerCo’s.

I suspect we’re in the early innings of a bull market in gold stocks that will rival the last one – the decade long run we witnessed beginning back in 2001.

The above chart is a historical recap of trading in the largest gold producers (note the 2001 low vs the 2011 high). The smaller companies – the junior ExplorerCo’s – went on a tear that defied description (apologies, no long term chart exists for that lot). 10-baggers were run-of-the-mill. 20-baggers were not uncommon. It was an epic ride.

Due diligence

If you’re going to speculate in the junior exploration arena, it’s essential that you hone your due diligence skills.

I cringe at the thought of people using public forums as their main source of investment advice. These investor message boards can be sink holes for loose capital in the hands of lazy, undisciplined traders.

Learn the art of due diligence. Toss out the notion that investment decisions are best left to people that talk the talk.

Way back in the day, Doug Casey published his Eight Ps of resource stock evaluation. This is how it’s done:

Nevada

Nevada, in case you don’t know, is one of the friendliest mining jurisdictions on the planet, currently ranked number three by the Fraser Institute. It’s also top shelf in terms of global production where it’s currently ranked 4th in the standings (Nevada accounts for 72% of U.S. gold production).

Between 1859 and 1994, 60 million ounces of the malleable metal was mined. Between 1995 and 2017, 150 million oz’s. Clearly, Nevada is the mother of all mining jurisdictions.

The Nevada ExplorerCo’s

The list of companies featured below is by no means comprehensive.

Some of the co’s featured here boast significant resources, some are way up on the development foodchain; some are producers, some appear to have nothing going on and trade by appointment only. I include the latter category because here is where the greatest dramas will play out.

Though I may offer an opinion or two regarding specific companies on this list, I’m not recommending outright purchases. More, this is a starting point to begin your due diligence, to begin creating a short list of potential BUY candidates.

Allegiant Gold (AUAU.V)

- 60.84 million shares outstanding.

- $11.86M market cap based on its recent trading pattern.

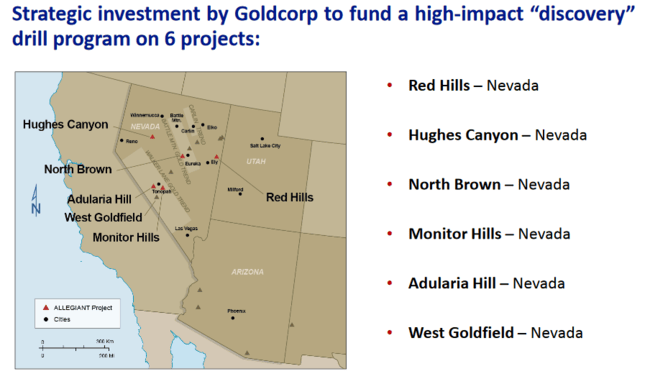

Allegiant came about after Columbus Gold (CGT.T) spun out its interests in 12 highly prospective drill-ready gold projects in the U.S., nine of which are in Nevada.

Allegiant’s flagship Eastside Project hosts a pit-constrained inferred resource totaling 721,000 gold equivalent oz. (35.78 million tonnes grading 0.63g/t gold equivalent).

Preliminary metallurgical testing indicates that both oxide and sulphide mineralization is amenable to heap leaching.

Eastside also hosts numerous exploration targets and historical resources of some 272,153 oz. gold (11,177,761 tonnes grading 0.82g/t gold).

The company is one of the most aggressive ExplorerCo’s operating in Nevada right now: Eastside, Red Hills, Hughes Canyon, North Brown, Monitor Hills, and Adularia Hill have all been probed with the drill bit over the past few months.

The company has also optioned out (three) projects in its portfolio to fellow ExplorerCo’s, one we’ll touch on below.

There are a number of compelling fundamentals underpinning the Allegiant story – management is one of them.

I’d recommend a closer look at this one.

Barrian Mining (BARI.V)

Q&A forum hosted by Equity.Guru’s Chris Parry.

- 26.83 million shares outstanding.

- Not yet trading

Barrian is new on the scene having struck a deal with Allegiant Gold on two highly prospective projects, one in New Mexico, the other in Nevada.

The company’s flagship project – Bolo – is a 3,332-acre package of claims located 90 kilometers northeast of Tonopah Nevada.

Bolo is a Carlin-type setting – its mineralization is similar to the Pinson, Lone Tree/Stonehouse, and Turquoise Ridge/Getchell gold deposits, all multimillion-ounce orebodies defined by high-angle structures.

Surface sampling has defined widespread gold mineralization along two parallel north-south trending faults – the Mine Fault and the East Fault.

Significantly, alteration along the Mine Fault has been traced for 2,750 meters – outcrop samples returned gold values of up to 8.6 g/t gold.

The East Fault has been traced for 2,200 meters and has sampled up to 4.7 g/t gold.

Widespread anomalies offer numerous zones and targets for further exploration.

This is an exciting project. Newsflow promises to be strong this year.

We covered the Barrian story recently here at Equity.Guru, in detail:

Barrian Mining (BARI.V): a new gold ExplorerCo grabs a chunk of prime Nevada real estate

Blackrock Gold (BRC.V)

- 42.99 million shares outstanding.

- $1.72M market cap based on its recent sub-nickle trading range.

Blackrock is no stranger to the pages here at Equity.Guru:

Peak Gold and a classic setup in the mother of all mining jurisdictions

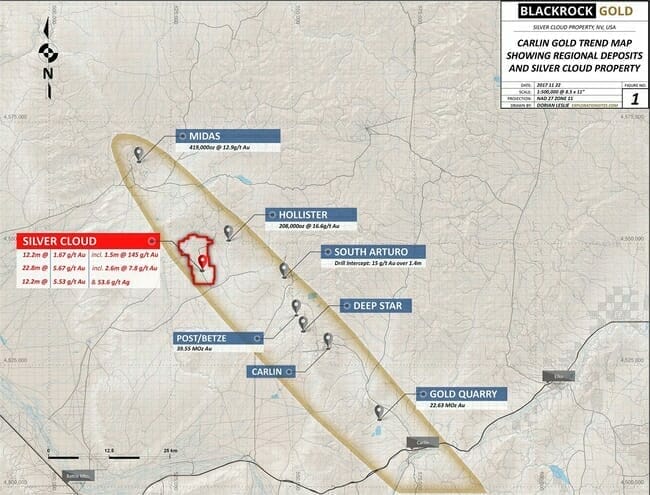

Black Rock Gold (BRC.V) holds a large, 4,537 hectare chunk of prospective terrain strategically located near the confluence of the Carlin Trend and the Northern Nevada Rift of north-central Nevada.

Blackrock’s Silver Cloud Property is located eight kilometers west of the Hollister mine which has a Measured and Indicated resource of 430K tonnes grading 16.6 g/t gold (208,000 oz’s of Au) and an Inferred resource of 180K tonnes grading 14.4 g/t gold (74,000 oz’s of Au).

The company is a classic cheap-like-borscht, high-potential proposition. It’s cheap for a reason: even though Silver Cloud represents one of the few remaining expanses of Carlin real estate that has yet to receive a proper series of pokes with the drill bit, the company has been dragging its feet.

There has been much discussion re the subject over on the BRC channel at Tommy Humphreys ceo.ca.

If company management finds the resolve to move this project forward, its sub-nickel share price should respond to the stimulus.

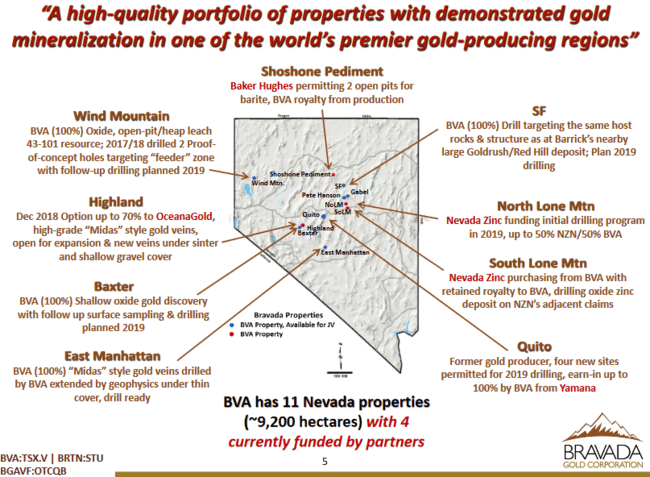

Bravada Gold (BVA.V)

- 55.12 million shares outstanding.

- $4.13M market cap based on its recent $0.075 close.

Bravada, through its wholly owned US subsidiaries, controls 11 exploration properties comprising some 9,200 hectares along several of Nevada’s more productive gold trends.

The company believes these properties offer the potential for large Carlin-type gold deposits, or rich low-sulfidation gold-silver orebodies.

The company employs the prospect generator business model.

In a recent piece of news, the company struck a deal with Oceana Gold (OGC.T) over its Highland Gold-Silver Project.

Oceana can earn up to 75% in the project by spending US$10M over nine years.

Highland, located in the Walker Lane Gold Trend north of the historic Bruner gold mine, is a low-sulfidation-type setting comprising some 1,070 hectares.

Previous drilling on the property intersected high-grade vein structures. The best hole tagged 1.5 meters of 66.9 g/t gold and 397.7 g/t silver within a 12.2 meter intercept of 9.5 g/t gold and 109.4 g/t silver. Nice hit.

This is another ExplorerCo with multiple irons in the fire.

Contact Gold (C.V)

- 50.5 million shares outstanding.

- $15.65M market cap based on its recent $0.31 close

Contact’s extensive land holdings extend across the prolific Carlin, Independence, and Northern Nevada Rift gold trends. Their 212 square kilometers of target rich terrain include projects ranging from early stage to the resource definition stage.

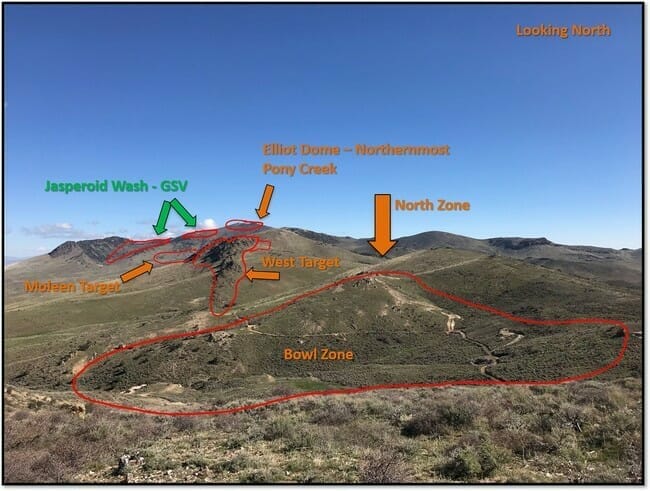

Pony Creek, the company’s 13,771-hectare flagship project, is strategically located immediately south of Gold Standard’s Railroad-Pinion project. The property hosts a Carlin-type system with a historic gold resource.

Pony Creek contains large areas of prospective rocks that have never been sampled in the world-class Carlin Trend of Nevada. Numerous historic drill holes containing long intercepts of gold mineralization remain open for expansion through offset drilling based upon proper stratigraphic and structural understanding of ore controls.

In recent news, drilling extended the company’s Bowl Zone at Pony Creek by 250 meters. The company also increased a private placement for proceeds of up to $2.85 million.

2019 newsflow should be steady.

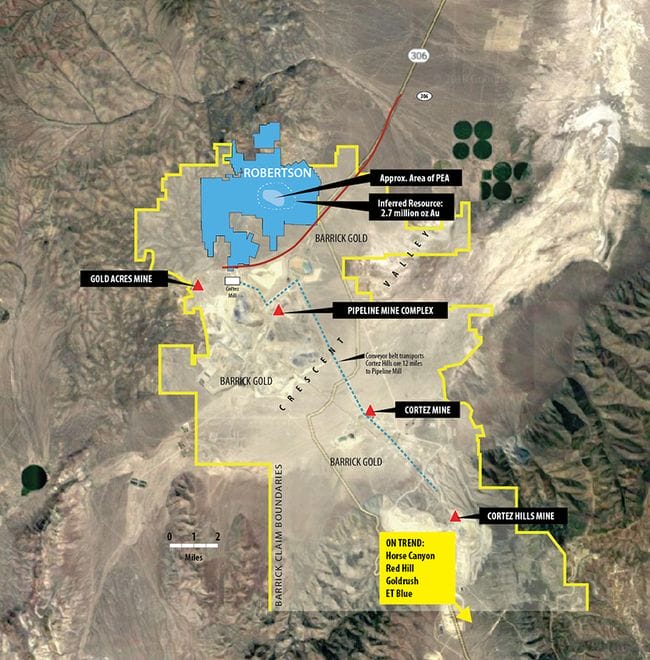

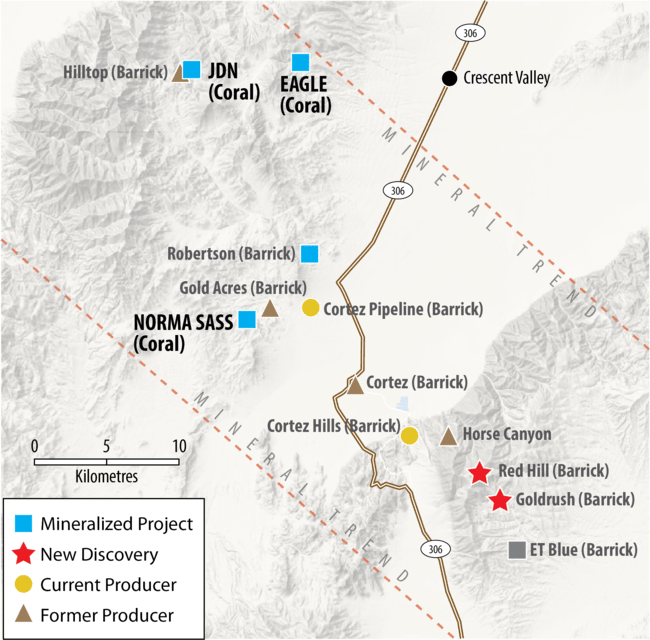

Coral Gold (CLH.V)

- 47.94 million shares outstanding.

- $16.78M market cap based on its recent trading patterns.

I began following this company back when I was still battling acne.

Coral is in an enviable position. You hear about those royalty deals O’Leary keeps harping on over at Shark Tank? Well, royalty deals also play out beautifully in the gold space.

Coral holds a sliding scale 1% to 2.25% net smelter royalty on over 2.7 million ounces at Barrick Gold’s Robertson Property located along the Cortez Gold Trend. The installments are divvied out quarterly – advance payments have already come into play.

Under the agreement, concluded in June 2017, Barrick paid US$15.75 million (approximately Cdn $21.2 million based on the exchange rate at the time) to Coral. Barrick also returned 4,150,000 common shares of Coral, representing approximately 8.7% of the Company’s basic common shares outstanding for cancellation by the Company.

Barrick recently reported that pre-feasibility work is on schedule and phase II metallurgy is in progress.

Aside from their fat sliding scale royalty, Coral controls three highly prospective projects in the vicinity of Robertson. This is a good address.

This is one of those exceptionally rare company’s in the junior exploration space that takes great pride in maintaining a tight share structure.

How many junior ExplorerCo’s can you think of that launch Normal Course Issuer Bids and actually follow through with stock purchases?

Coral Shares Acquired Under the Normal Course Issuer Bid

Pursuant to the Normal Course Issuer Bid (NCIB) announced on July 30, 2018, as of January 31, 2019 Coral had purchased 2,781,000 Coral common shares at an average cost of $0.3694. Under the NCIB, Coral may purchase up to 3,938,462 common shares, representing approximately 10% of the total current public float (being the total issued shares, less shares held by insiders, and their associates and affiliates). Purchases are made at the discretion of Coral at prevailing market prices, for a 12-month period. Coral intends to hold all shares acquired under the Bid for cancellation.

Keep an eye on this one. It has a nice royalty set-up, over $18M in cash, three prospective Cortez projects in its portfolio, and an appetite for acquisitions.

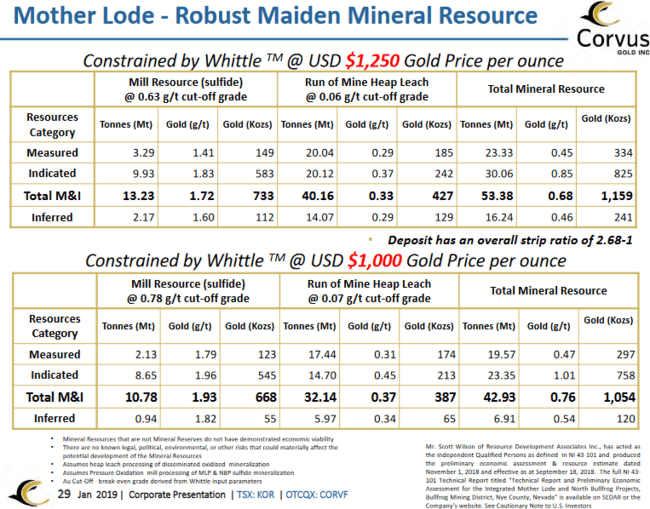

Corvus Gold (KOR.T)

- 110.85 million shares outstanding.

- $220.59M market cap based on its recent $1.99 close.

As you can probably guess by examining the company’s market cap, Corvus is further along the development curve than your average junior ExplorerCo.

The company’s primary focus is on developing its North Bullfrog and Mother Load projects.

North Bullfrog, situated eight kilometers north of the Bullfrog Mine formerly operated by Barrick, encompasses some 86.6 square kilometers of prospective terrain.

The Mother Lode project covers an area of roughly 36.5 square kilometers.

The resource:

A scoping study report, one which boasts a North Bullfrog-Mother Lode NPV (5%) of US$585.6M and an IRR of 38%, can be accessed by following the link below:

North Bullfrog – Mother Lode preliminary economic assessment

The company is also active on the exploration front:

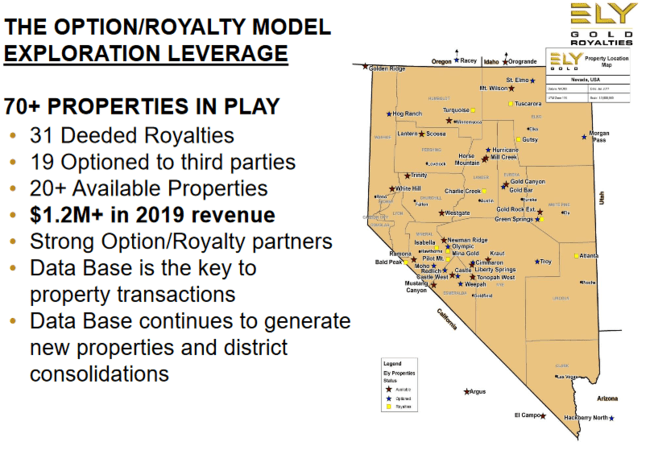

Ely Gold Royalties (ELY.V)

- 93.11 million shares outstanding.

- $15.83M market cap based on its recent $0.17 close.

Ely is a royalty company. If we are right about peak gold and the dearth of new gold deposits coming on stream, the projects ELY is positioned in will likely see more development as funds are plowed into exploration

Exploration success may lead to significant resource development. When a deposit is put into production, underlying royalty holders, like ELY, collect a check every quarter. It’s a beautiful business model, particularly when the underlying projects represent significant ounces-in-the-ground.

Ely might best be characterized as an emerging royalty company, holding development assets in Nevada and the Western U.S.

Its current portfolio includes 27 deeded royalties and 24 optioned properties. Their portfolio is already generating some revenue.

Ely Gold’s royalty portfolio includes fully permitted mines, mines under construction and development projects that are being permitted for mine construction.

Companies like ELY represent a good option for those with an aversion to traditional high-risk exploration plays.

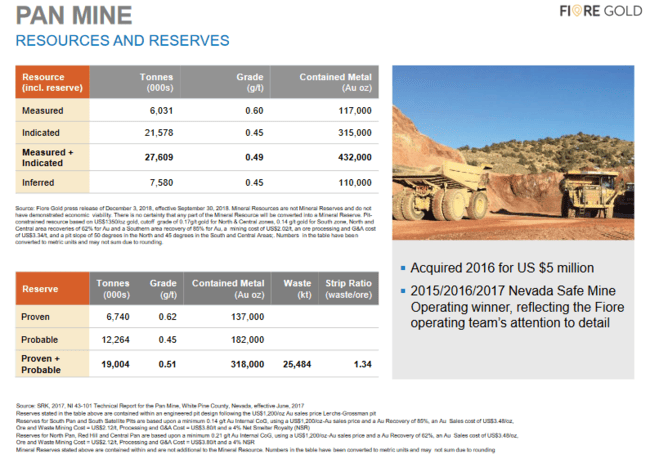

Fiore Gold (F.V)

- 97.72 million shares outstanding.

- $31.76M market cap based on its recent trading patterns.

Fiore is a new producer in the gold space. Its Pan Mine in Nevada is just the beginning of what the company hopes will evolve into a 150,000 oz-per-year production scenario.

Pan, a Carlin-style, open-pit, heap-leach mine on the prolific Battle-Mountain–Eureka Gold Tend, was acquired on the cheap when the previous operators failed to execute and bankrupted their company:

The Rise and Fall of Midway Gold and the Resurrection of the Pan Mine in Nevada

In its most recent quarter, 9,765 oz’s of the shiny metal, representing a 47% increase over Q1 of 2018, was produced at an All-In Sustaining Cost (AISC) of $995.00 per oz – that’s compared to a Q1 2018 AISC of $1,900.00 per oz. A HUGE freaking improvement, this.

As is the goal of most forward-thinking junior producers, cash flow from production will provide a non-dilutive way to fund exploration, setting-up the next mine development scenario. It doesn’t always work out that way, mining being what it is – an uber high-risk endeavor – but Fiore management appears to be highly competent.

Aside from Pan, the company holds a suite of exploration projects in Nevada, Washington, and Chile.

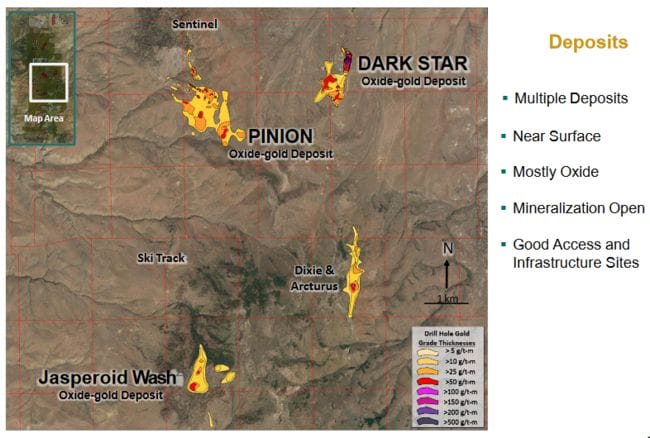

Gold Standard (GSV.T)

- 259.81 million shares outstanding.

- $392.31M market cap based on its recent $1.51 close.

Gold standard is another ExplorerCo positioned further up the food chain.

The company’s flagship Railroad Gold Project, located along the prolific Carlin Trend, covers roughly 208 square kilometers and lies adjacent to Newmont’s Rain and Emigrant mines.

The Pinion and Dark Star gold deposits offer a potential near-term development option for the company.

Pinion has an Indicated resource of 31.61 million tonnes grading 0.62 g/t Au for 630,300 ounces of gold and an Inferred resource of 61.08 million tonnes grading 0.55 g/t Au for 1,081,300 ounces of gold. This resource is due for revision to include recent success with the drill bit.

Dark Star, 2.1 kilometers to the east of Pinion, has an Indicated resource of 15.38 million tonnes grading 0.54 g/t Au for 265,100 ounces of gold and an Inferred resource of 17.05 million tonnes grading 1.31 g/t Au for 715,800 ounces of gold. This resource is also due to be revised this year to include highly favourable results from a 2018 drilling campaign.

The North Bullion deposit, seven kilometers to the north of Pinion, has an Indicated resource of 2.92 million tonnes grading 0.96 g/t Au for 90,100 ounces of gold and an Inferred resource of 10.97 million tonnes grading 2.28 g/t Au for 805,800 ounces of gold.

The geological footprint doesn’t end with the Pinion, Dark Star, and North Bullion:

These jurisdictionally superior ounces-in-the-ground justify the company’s current $400M market cap.

Institutions own roughly 24% of the company’s common.

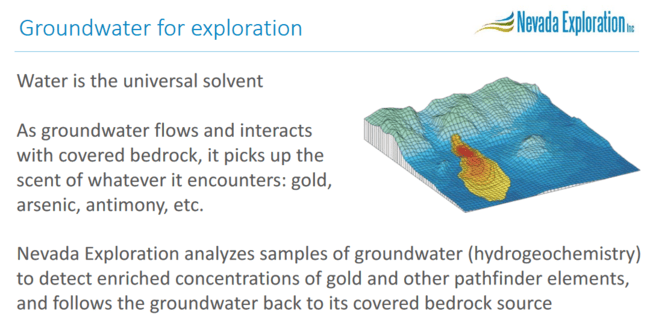

Nevada Exploration (NGE.V)

- 79.26 million shares outstanding.

- $28.53M market cap based on its recent $0.36 share price.

Nevada Gold is not your typical run-of-the-mill ExplorerCo. NGE management thinks well outside the box when it comes to grassroots exploration.

The company is advancing a portfolio of new district-scale gold exploration projects along Nevada’s Battle Mountain-Eureka Trend.

Traditional mineral exploration is a capital-intensive game. For the past decade, NGE’s team has been using hydrogeochemistry with conventional exploration tools to develop a cost-saving Nevada-specific regional-scale geochemistry approach to discovery.

Using its proprietary technology, NGE has completed the world’s largest groundwater sampling program for gold exploration collecting approximately 6,000 samples to evaluate Nevada’s covered basins for new exploration targets.

To advance follow-up targets, NGE has overcome the high drilling costs that have previously prohibited the wide-spread use of drilling as a prospecting tool by developing its Scorpion drill rig, a small-footprint, truck-mounted, small-diameter RC drill rig specifically tailored to the drilling conditions in Nevada’s basins (analogous to RAB drilling in other parts of the world).

NGE holds a large portfolio of exploration projects, three of which it defines as ‘active‘ with district-scale potential. One such project – South Grass Valley – generated the following news:

Newrange Gold (NRG.V)

- 90.29 million shares outstanding.

- $13.09M market cap based on its recent trading patterns.

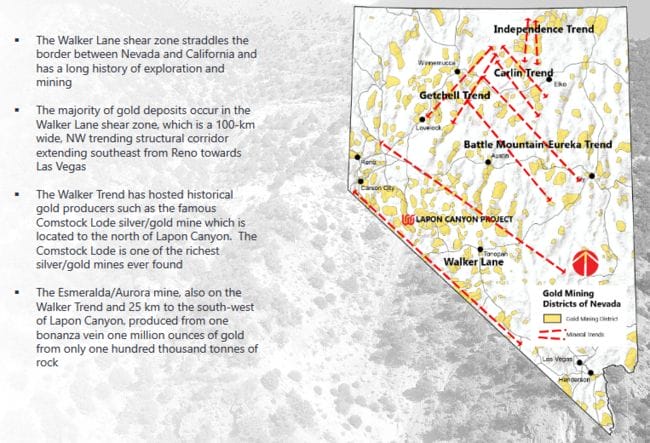

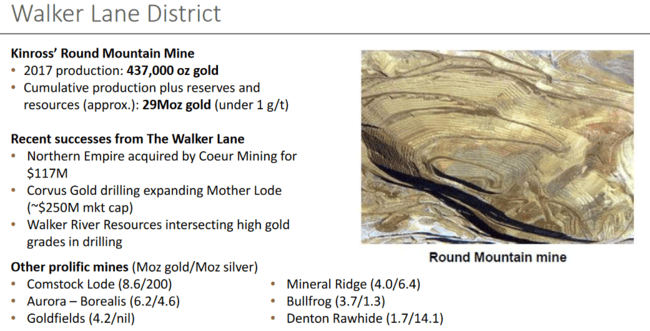

Newrange is an exploration and development company looking at near to intermediate term production opportunities.The company’s flagship Pamlico Project is a new discovery located on Nevada’s Walker Lane Trend.

Over 53 million oz’s of gold and 519 million oz’s silver have been extracted from Walker Lane historically.

Pamlico’s 1,670 hectares, held in private hands since 1896, covers the historic Pamlico group of mines, as well as the nearby Good Hope, Gold Bar, and Sunset mines.

Due to the largely untapped, under-explored nature of the project area, Newrange is taking an aggressive approach to exploration.

A maiden resource estimate is due in Q3 of this year. Drilling is ongoing.

Newrange Gold Reports Higher Gold Grades From Core Drilling at Pamlico

NuLegacy Gold (NUG.V)

- 306.82 million shares outstanding.

- $36.82M market cap based on its recent $0.12 share price.

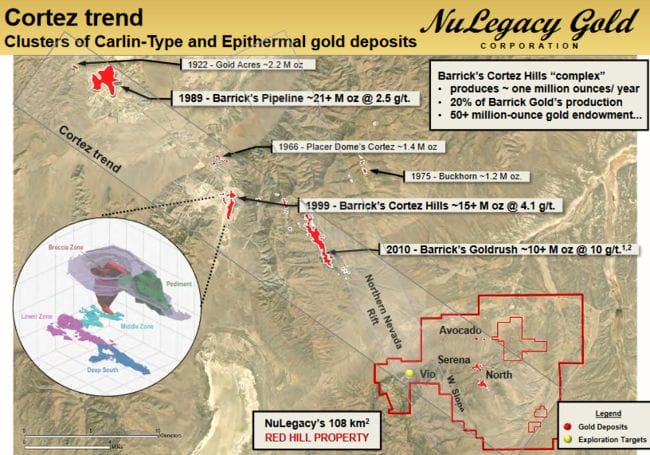

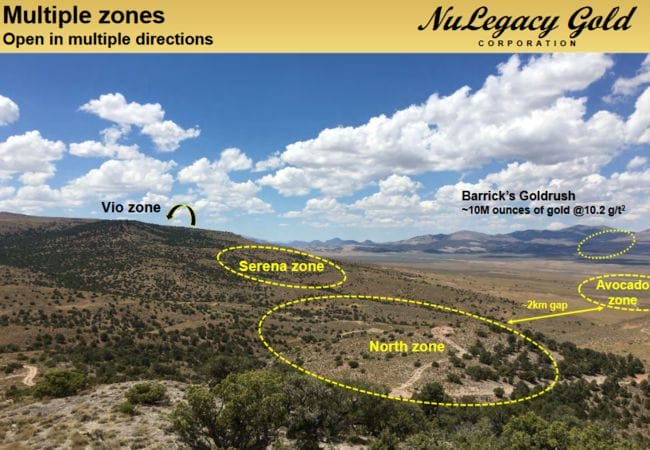

NuLegacy is focused on discovering Carlin-style gold deposits on its 108 square kilometer Red Hill Property located on the prolific Cortez Trend.

To date, the company has discovered five zones at Red Hill.

The highlight of their 2018 drilling campaign was an 8.7 meter hit grading 16.9 g/t gold which extended their Serna zone a full 100-meters to the west.

Ed Cope, NuLegacy’s director of evaluations & acquisitions…

“This is a very significant result because anytime you get ½ ounce gold over 30 feet in a Carlin system, it suggests there was a robust hydrothermal system at work capable of producing a significant Carlin-type deposit. Our job, as exploration geologists, is to find the high-grade core of this deposit — and the transformational geologic work completed at the Red Hill property in 2018 will help us to achieve that goal.”

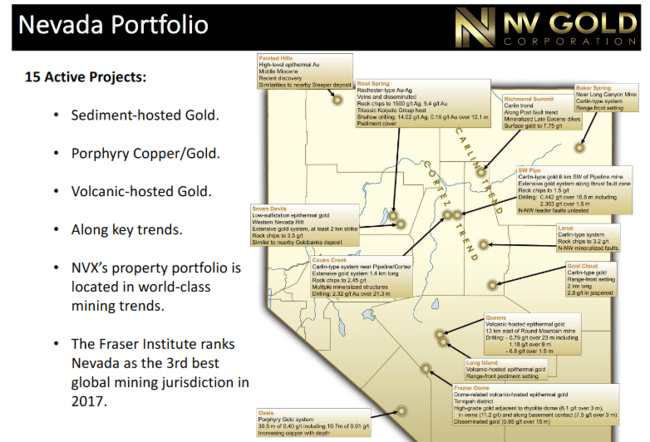

NV Gold (NVX.V)

- 37.58 million shares outstanding.

- $5.64M market cap based on its recent $0.15 close.

NV Gold is a junior ExplorerCo focused on delivering shareholder value by utilizing the prospector generator business model on its extensive portfolio of Nevada based projects.

In-house technical knowledge and a decades-in-the-making geological database of research and exploration will serve as a foundation to create opportunities for lease or joint venture.

The company promises to be active on multiple fronts this year, Frazier Dome being the subject of recent interest:

NV Gold Highlights Exploration Potential of Frazier Dome Gold Project, Nevada

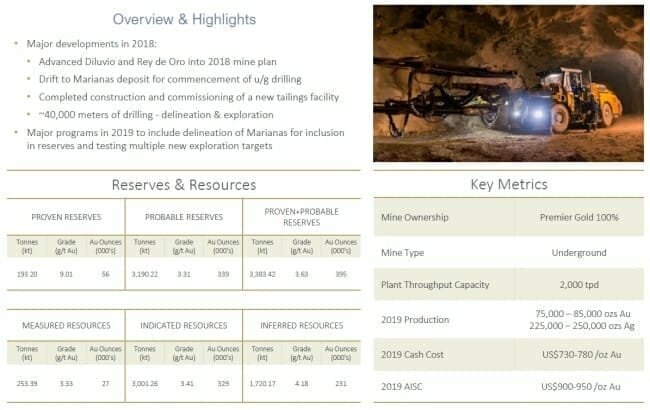

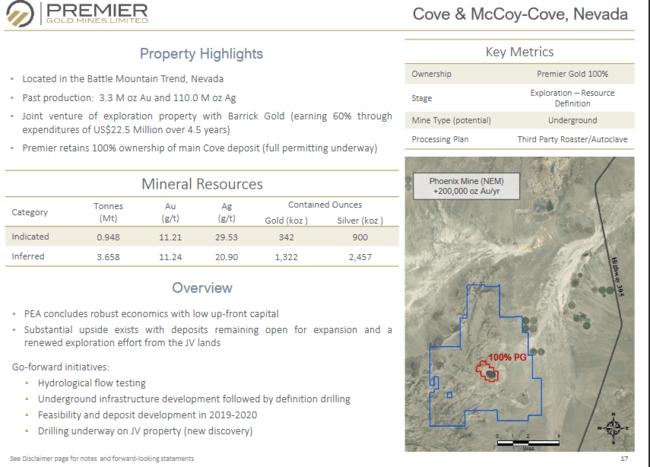

Premier Gold (PG.T)

- 210.43 million shares outstanding.

- $364.04M market cap based on its recent $1.73 closing price.

Premier is as close as you can get to a ‘blue chip’ in the junior exploration arena. Company management has a long history in the sector that began with Wolfden Resources and its High Lake base metals project in Canada’s Arctic, a project that was taken out by Australia’s Zinifex Ltd at a handsome premium (I was a happy beneficiary of that 2007 takeover transaction).

The company has a number of moving parts, far too many to flesh out with any degree of proficiency in the space allowed here.

In short, the company is a gold-producer with an enviable exploration and development pipeline of high-quality precious metal projects in Canada, the United States, and Mexico.

The Nevada assets:

The company’s 40% owned South Arturo mine is located on the prolific Carlin Trend, approximately twenty-five miles northwest of the town of Carlin Nevada. Ore from South Arturo is primarily processed at Barrick’s Goldstrike Mine.

Recent high-grade intercepts at South Arturo include 68.6 meters of 15.92 g/t Au at El Niño underground and 35.7 meters of 16.54 g/t Au at the Phase 3 Pit target. Nice hits!

Recent exploration at the project prompted the following press release:

The company’s advanced exploration-stage Cove Project is located in the Battle Mountain Trend of northern Nevada approximately 20 kilometres south of Newmont’s Phoenix Mine.

Cove represents one of the highest grade undeveloped gold deposits in the state:

South Arturo and Cove represent only two projects in the company’s formidable development pipeline.

This is one to watch.

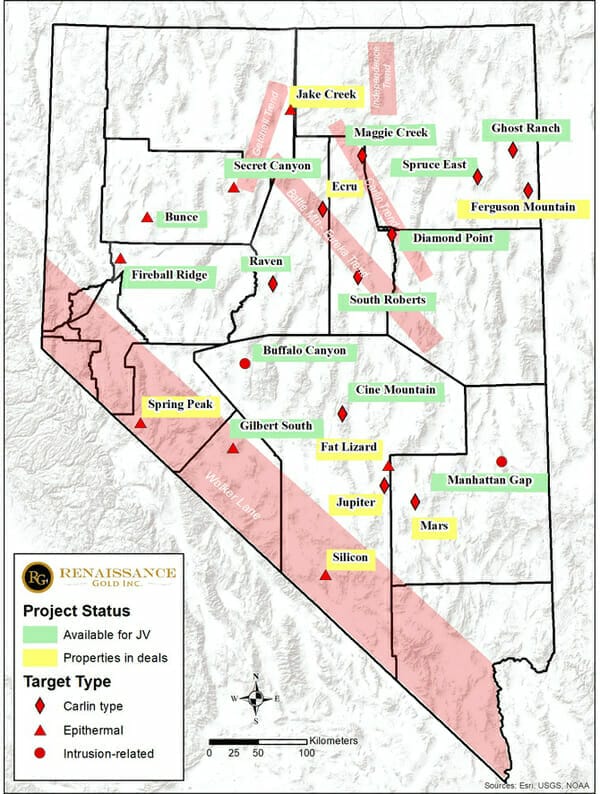

Renaissance Gold (REN.V)

- 62.74 million shares outstanding.

- $11.29M market cap based on its recent trading patterns.

Renaissance emerged as a spin-out from the 2010 acquisition of AuEx Ventures by Fronteer Gold. Frontier was subsequently taken out by mining giant Newmont. I remember these transactions all too well. I held AuEx for well over a year and dumped my entire position only hours before the FAT takeover offer was announced. Be right – sit tight… there’s a topic worthy of some discussion.

Renaissance is another Nevada based ExplorerCo utilizing the prospect generator business model.

Like the other prospect generators’ on our list, the company believes that this biz model is the secret to maintaining a tight share structure.

The company’s project portfolio consists of eleven Carlin-type projects, eight epithermal projects, and one intrusive related project.

Of interest, the company has been extremely active on the earn-in agreement front in recent weeks:

- Jan. 17th – a double earn-in with Hochschild Mining plc (LSE:HOC) on the Mars and Ferguson Mountain projects.

- Jan. 25th – an earn-in with OceanaGold (OGC.T) on the Spring Peak project.

- Feb. 20th – an earn-in with, once again, OceanaGold on the Fat Lizard project.

These are good names, and some of the joint venture terms are very agreeable (aggressive exploration plans and large cash payments to the company).

With this much activity and money sloshing around, don’t be surprised if a discovery is produced from the company’s project portfolio this year.

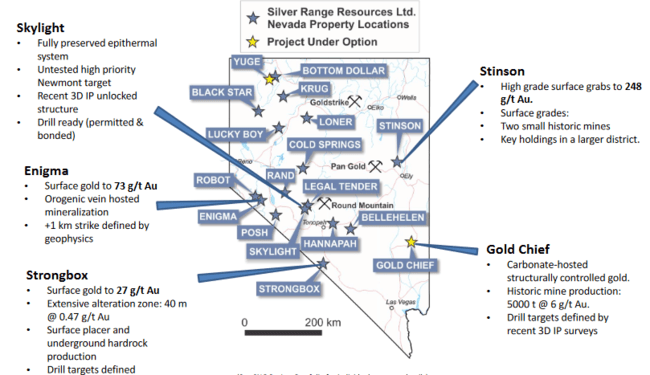

Silver Range (SNG.V)

- 72.14 million shares outstanding.

- $8.66M market cap based on its recent $0.12 close.

Silver Range is yet another Nevada ExplorerCo employing the prospect generator business model where it has eighteen active projects.

Brent Cook on why this biz model is so damn popular:

It makes so much more sense to come up with the ideas, conceptualize the ideas, and have someone else come in and spend the money testing those ideas ….That’s really why I always like to have three or four prospect generators in our portfolio.

Scanning the company’s Nevada project portfolio, I spot four that are at the drill ready stage:

- Gold Chief – joint ventured to Crocan Capital Corp

- Skylight – available for joint venture (jv)

- Strongbox – available for jv

- Cold Springs – available for jv

The remaining 14 projects are at a preliminary stage of exploration.

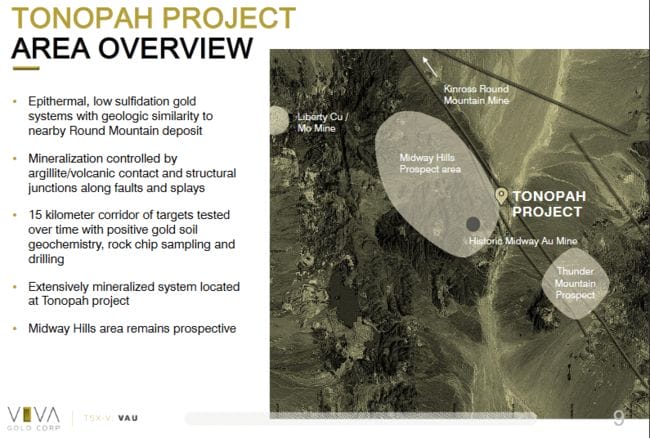

Viva Gold (VAU.V)

- 20.79 million shares outstanding.

- $6.76M market cap based on its recent trading range.

Viva’s flagship asset is its 100% owned, 4,054 acre Tonopah Gold Project located on the prolific Walker Lane Trend.

Tonopah currently sports a resource of 186,000 ounces at a grade of 0.95 g/t Au in the Measured and Indicated category, plus a further 238,000 oz’s at a grade of 0.77 g/t Au in the Inferred category.

Highlights from recent Tonopah drilling include:

- 33.5 meters at 2.6 g/t Au.

- 100.6 meters at 1.33 g/t Au.

- 45 meters at 2.2 g/t Au and 3.0 meters at 46.1 g/t Au.

Goals for 2019 include increasing the confidence in the current resource via infill drilling, stepping out with the drill rig in search of that key one million ounce number, advancing the project to the scoping level stage along with preliminary metallurgical test work, and initiating baseline water quality studies for permitting.

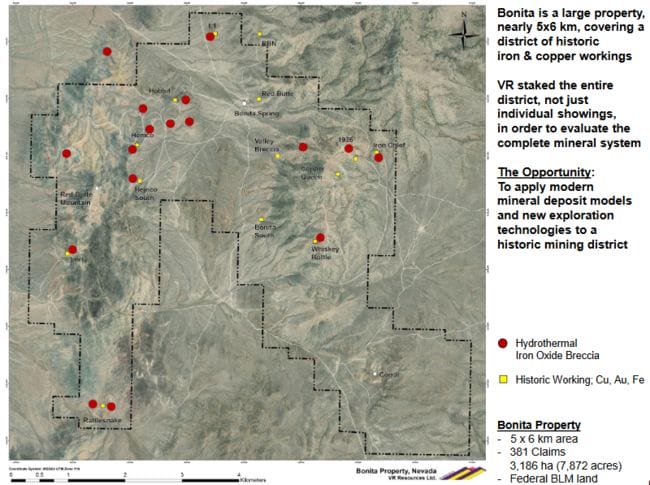

VR Resources (VRR.V)

- 47.39 million shares outstanding.

- $7.58M market cap based on its recent trading pattern.

VR is exploring its flagship 3,186 hectare Bonita Project located in Humboldt County, northwestern Nevada.

The Bonita property encompasses an area of historic copper, gold and iron workings over an area of roughly 4 x 5 kilometers. The showings occur within a district-scale hydrothermal system spanning some 5 x 7 kilometers – geological mapping, airborne magnetic and hyperspectral surveys define the geological footprint.

The company has plans for the project this year which include a first pass drilling campaign on the Copper Queen and Hemcoon target areas.

Walker River (WRR.V)

- 121.41 million shares outstanding.

- $15.18M market cap based on its recent $0.125 closing price.

If you heard a distant roar and were wondering what all the commotion was about, chances are it was coming from the house Tommy Humphreys built, over in the WRR neighborhood at CEO.CA.

The company’s Lapon Canyon Project is what all the rumpus was about.

Lapon’s 1,940 acres are located on the Walker Lane Trend and are cut by a series of steeply dipping cross fault structures.

There was some small high-grade mining on the property back in the day. Along with the construction of a two stamp mill, roughly 600 meters of drifts and raises were developed from two adits.

Highlights from a recent RC drilling campaign include:

- 31.1 g/t Au over 13.7 meters including 198 g/t over 1.5 meters and 78.1 g/t over 1.5 meters (true width approx 70%)

- 10.23 g/t Au over 19.9 meters including 78.1 g/t over 1.5 meters and 221 g/t over 1.5 meters (true width approx 80%).

- 93.5 g/t Au over 1.5 meters (true width approx 89%).

- 2.28 g/t Au over 42.7 meters and 159 g/t over 1.5 meters (true width roughly 73%).

As per the company’s Feb. 26th press release:

The information from the compilation and interpretation of the 2018 drill program on the Lapon Project will greatly aid in acceleration of drilling, geological mapping and understanding of the gold mineralization at the Lapon Project. Planning of the upcoming 2019 Exploration and Drill Programs is underway.

West Kirkland Mining (WKM.V)

- 408.47 million shares outstanding.

- $24.51M market cap based on its recent $0.06 close.

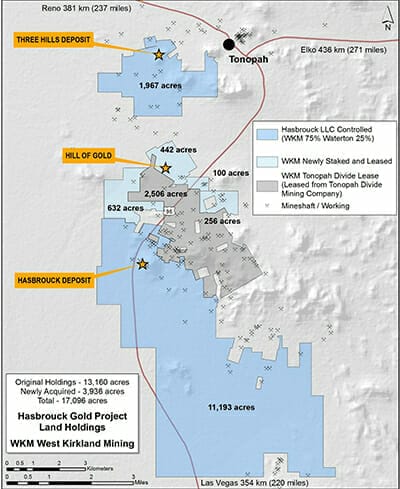

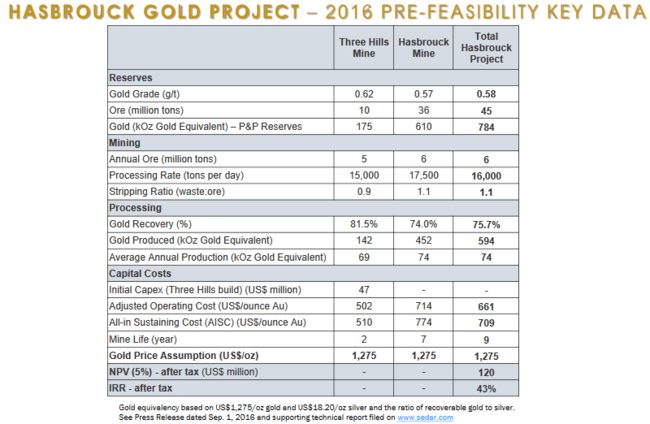

WKM is all about developing its 75% owned advanced stage Hasbrouck Gold Project in Tonopah Nevada.

Hasbrouck sports 784,000 ounces of gold in the Mineral Reserve category. The project is fully permitted.

This is a simple mining scenario, as simple as it gets.

A pre-feasibility study tabled in 2016 shows a modest Capex of US$47M, an after-tax NPV of US$120M, and an IRR (after tax) of 43%… all based on a $1275.00 gold price assumption. Not too shabby.

Exploration potential proximal to the mine development area appears to be wide open:

West Kirkland Reports 43m of 3.40 grams per tonne at surface Near Hasbrouck Project, Tonopah, Nevada

Wrapping this one up

I’m a firm believer in Peak Gold Theory, that the vast majority of our planets major deposits have already been discovered. Those that remain – those under cover – will become highly coveted assets as senior and mid tier gold producers are rapidly depleting their resource bases

If you happen to be positioned in a Nevada ExplorerCo with a significant new discovery on its books, hold on for the ride and let a resource hungry producer set your exit price.

END

~ ~ Dirk Diggler

Full disclosure: of the companies featured above, only Barrian Mining has a marketing relationship with Equity.Guru.

Feature image courtesy of BLDGBLOG.

Nevada now ranked #1 ! in new annual Fraser Mining Survey, released Feb. 28th

https://www.fraserinstitute.org/sites/default/files/annual-survey-of-mining-companies-2018.pdf