Cypress Development (CYP.V) hit a huge de-risking milestone today releasing news from metallurgical test work that confirmed previous positive results.

Though the market failed to grasp the significance of this news drop, and push the company’s shares significantly higher where they belong, the stage is now set for a serious re-rating.

A refresher

Clayton Valley is the company’s flagship asset. The project boasts nearly 2 billion tonnes of claystone material.

- 3.835 million tonnes of lithium carbonate equivalent (LCE) contained in 831 million tonnes of material at an average grade of 867 ppm Li in the Indicated category.

- 5.126 million tonnes of LCE contained in 1.12 billion tonnes at an average grade of 860 ppm Li in the Inferred category.

A scoping study (PEA) tabled last summer gave us a sneak peek at Clayton Valley’s compelling economics:

- A net present value of $1.45 billion at an 8% discount rate.

- An after tax IRR of 32.7%.

- Average annual production of 24,042 tonnes of lithium carbonate over a 40-year mine life.

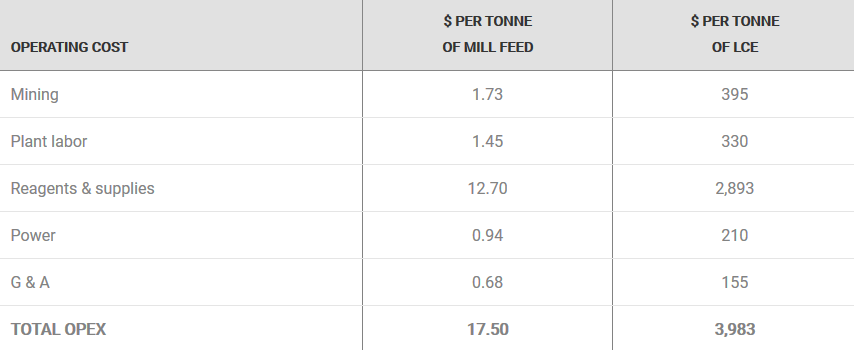

- Capex of $482 million, pre-production, and an operating cost estimate averaging $3,983 per tonne of lithium carbonate.

- An estimated 2.7 year payback period.

Building on the success of this scoping study, the company is aggressively pushing Clayton Valley further along the development curve, de-risking the project along the way.

Next stop: a pre-feasibility study (PFS) due in the second quarter of this year.

For more detail and greater insights into this extremely well run company, the following Guru offerings should satisfy…

Cypress Development (CYP.V): de-risking its Clayton Valley lithium project in Nevada

Cypress Development (CYP.V): de-risking its Clayton Valley lithium project UPDATE

The Feb. 25th news

Cypress Development Confirms Positive Metallurgy for Clayton Valley Lithium Project in Nevada

People have been waiting for this confirmation.

The results highlighted in this press release confirm the initial metallurgical assumptions and parameters presented in the previous scoping study. This is a huge positive.

By engaging a far more robust testing protocol, these numbers now take on significantly greater meaning. More on this further down.

“The testing was successful in confirming the range of parameters used in the 2018 Preliminary Economic Assessment (PEA). The results demonstrate lithium extractions of 75 to 83% and sulfuric acid consumptions ranging from 85 to 132 kg/t.”

People were wondering why these results took so long to produce. People were perhaps growing suspicious that something was wrong with the findings. Nope. Efficiency – leaving no detail unattended, no stone unturned – requires focus and time.

CMS completed over 75 individual leach tests representing more than 250 laboratory hours in leaching composite sample material from the project.

The new process CYP is developing also required numerous check assays – they needed to prove conclusively that these positive recovery rates were dead on balls accurate.

Moving along…

The real standout here is acid consumption. Bear with me…

Acid consumption is the main cost driver, as demonstrated in Clayton Valley’s PEA.

Early indications pegged acid consumption at an already low rate of 125 kg/t representing roughly 60% of the costs (‘reagents and supplies’ in the above table).

This new study shows sulfuric acid consumptions ranging from 85 to 132 kg/t. This is a much lower range. This reduction should have a very positive impact on Clayton Valley’s Opex – we’ll find out just how positive when the PFS is tabled in the second quarter of this year.

It’s important to note that even if there is no improvement in these projected $4K per tonne operating costs, Clayton Valley’s margins are exceptional, no matter what goes down in the lithium market.

The next step

The company’s focus will now shift from optimizing the leaching process to producing a saleable lithium product.

Cypress CEO, Bill Willoughby:

“We are very pleased with progress on the first phase. While it was time consuming, the information gained on the behavior of the clay during leaching is invaluable and represents a huge step forward in our understanding of the leaching process. With this as a foundation, we are confident in moving forward to the next phase of testing in the PFS.”

A key consideration

The market, sophisticated investors in particular, have been waiting for this metallurgical update.

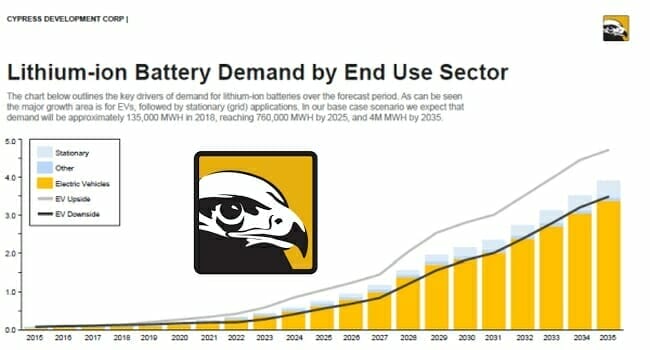

This sophisticated crowd, aka smart money, know what the future holds in store for the automotive industry. Here’s a quick reminder in case you haven’t noticed all of the electric vehicles overtaking your POS ride in the fast lane…

Without a doubt, this smart money has Cypress on its radar, but it couldn’t just step in and begin taking down large blocks of shares – not when Clayton Valley was at the scoping level stage. The market needed proof.

Now it has it.

This press release offers firm evidence that Clayton Valley is the real deal. It should go a long way toward mobilizing this smart money from the sidelines. The tabling of the PFS in the coming months will be the ultimate catalyst, but these met test results should pave the way for accumulation.

It wouldn’t surprise me in the least to see a strategic investor suddenly come on board.

With 73.18 million shares outstanding and a ridiculously low $0.18 share price, I don’t see much downside risk here. I do see extraordinary upside potential in the coming weeks and months for investors employing a disciplined buy and hold strategy. “Be right – sit tight” certainly applies here.

As stated in the intro, this news represents a huge de-risking milestone. The stage is now set for a re-rating in the company’s shares.

END

~ ~ Dirk Diggler

Feature image courtesy of the company’s i-deck.

Full disclosure: Cypress Development is an Equity Guru marketing client.