Located roughly halfway between Glitter Gulch and The Biggest Little City in the World, Cypress Development (CYP.V) is busily de-risking its 100%-owned Clayton Valley lithium project in Nevada.

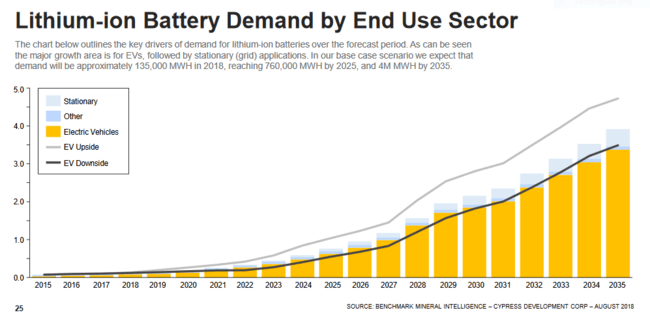

“Why lithium,” you ask?

Seriously?

You’ve been running with a pack of wolves for how long?

Clayton Valley – the company’s flagship asset – is at the dynamic pre-feasibility study (PFS) stage.

Located immediately east of Albemarle’s (ALB.NYSE) Silver Peak mine, the region has all of the infrastructure an aggressive new miner could ever want or need.

The project is located in what’s known as an Endorheic Basin. These settings are characterized by limited drainage – no outflow to rivers or other external bodies of water. Think of it as a giant bowl with water seeping into it from the sides.

Runoff from higher elevations is trapped. This standing water, in the form of seasonal lakes and swamps, equilibrate only through evaporation or seepage.

It’s the perfect setting for lithium to concentrate.

A picture is worth a thousand…

In a previous Equity Guru offering, Cypress Development – a deeply discounted lithium development story, we listed the many attributes of Clayton Valley:

- Two claim blocks, Dean and Glory, totalling 4,200 acres.

- 100% owned (a 3% NSR which can be reduced to 1% for $2 million).

- Orebody is flat lying with no overburden (can’t stress enough how hugely important this feature is to the economics of a project… any project).

- Extensive volcanic-derived geological setting.

- Lithium is contained in illite and montmorillonite soft clays to a minimum depth of 120 meters below surface.

- potential significant rare earth element (REE) values exist for Scandium, Neodymium, and Dysprosium.

- No drilling or blasting required to liberate the ore (again… hugely important).

- Region is steeped in mining history – ample access to experienced labor and contractor services.

- A mature regulatory environment.

- THE best mining jurisdiction in the U.S.A. – currently ranked 3rd globally by the Fraser Institute’s annual Survey of Mining Countries.

- Good road access through and through.

- Rail system access is 90 miles by road.

- Easy access to power – electrical connection possible via the sub-station in Silver Peak.

- Water is available via the Silver Peak municipal water supply.

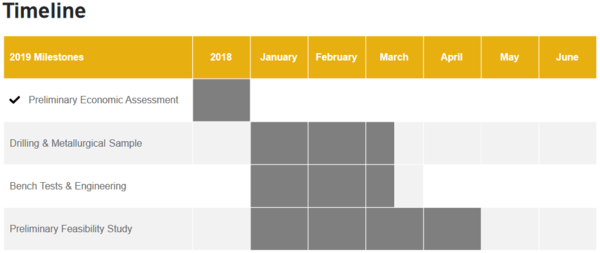

As noted earlier, this a preliminary feasibility stage project. The PFS should drop early in the 2nd quarter.

For those currently puzzling over the difference between PEA’s, PFS’s, and FS’s, this should help bring you up to speed:

A preliminary economic assessment (PEA) is a first pass economic study that probes all the basic parts of a mineral deposit – resource, scale, logistics, etc. At this stage, an inferred resource is sufficient to get the ball rolling.

A pre-feasibility study (PFS) takes a closer, more comprehensive look at the economics of a project. Infill drilling – tightening up the grid and elevating the resource to the measured and indicated categories – adds greater certainty and validity to the number crunching. The PFS also includes metallurgical test work and the commencement of baseline studies. Here, the company can begin brainstorming various development scenarios.

A feasibility study (FS) is the final document that incorporates every aspect of a project, from logistics to Capex. The study narrows down the various development scenarios to one single track. Very often you’ll see the study characterized as ‘bankable’. If a company is looking at some form of debt financing, this is what potential lenders want to see.

The Clayton Valley PFS is building on the success of last years PEA.

Highlights from the company’s 2018 PEA include:

- Net present value of $1.45 billion at 8% discount rate.

- An internal rate of return (IRR) of 32.7% (after tax).

- Average annual production of 24,042 tonnes of lithium carbonate over a 40-year mine life.

- Capex of $482 million, pre-production, and an operating cost estimate averaging $3,983 per tonne of lithium carbonate.

- An estimated 2.7 year payback period.

- Not too shabby y’all !

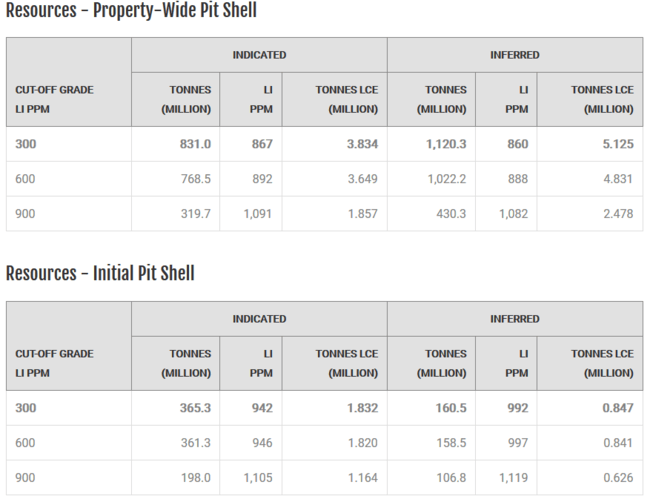

The company’s current lithium resource estimate underpins the economics:

In a nutshell, Clayton Valley boasts nearly 2 billion tonnes of claystone material.

- 3.835 million tonnes of lithium carbonate equivalent (LCE) contained in 831 million tonnes of material at an average grade of 867 ppm Li in the Indicated category.

- 5.126 million tonnes of LCE contained in 1.12 billion tonnes at an average grade of 860 ppm Li in the Inferred category.

It required only 2,000 meters of drilling to define this resource.

And most impressively, the company spent less than $1M bringing Clayton Valley to the PEA stage.

A tip of the hat to management.

While we’re looking at the resource, it’s worth noting that the deposit remains open at depth as 21 of 23 drill holes ended in lithium mineralization.

Grade continuity – the consistency with which the mineralization is distributed across the orebody – is excellent. This is an important consideration – the greater the continuity, the more robust the economics.

Due to the deposits extraordinary continuity, it won’t require a huge amount of infill drilling to upgrade this resource to the higher confidence categories – from resources to reserves.

Clayton Valley’s ore is leachable!

It was discovered early on that by raising the temperature and using a stronger leaching cocktail – sulphuric acid – Clayton Valley’s ore is leachable.

Highlights from these tests include…

- Low acid consumption at 125 kg/t.

- 2 to 8 hours agitated leach time.

- 81.5% extraction rate indicating that the dominant lithium-bearing minerals present are not hectorite, a refractory clay mineral which requires roasting to liberate the lithium.

- Standard treatment with lime adjusting pH to low impurity solution.

- Recovery to battery grade product possible on-site.

Recent news:

Cypress Development Drilling at Clayton Valley Lithium Project in Nevada

The company’s current focus is on metallurgy and optimizing the conditions of the process flowsheet.

This drilling program will facilitate three things: 1) upgrade the current resource to reserves, 2) provide material for further advanced metallurgical test work, and 3) give the company a better understanding of the underlying geological characteristics of the project.

The results from this round of met testing will be watched closely.

Last years studies consisted of single stage bench tests using 100 – 250 gram samples.

This year’s leach tests will incorporate a proprietary multi-stage leaching process using three-kilogram samples.

Recent metallurgical test work was performed on core obtained from previous drilling.

These current, more advanced studies will use the remaining core from previous campaigns as well as fresh pulps from this upcoming program.

Mobilization is underway for the next phase of drilling.

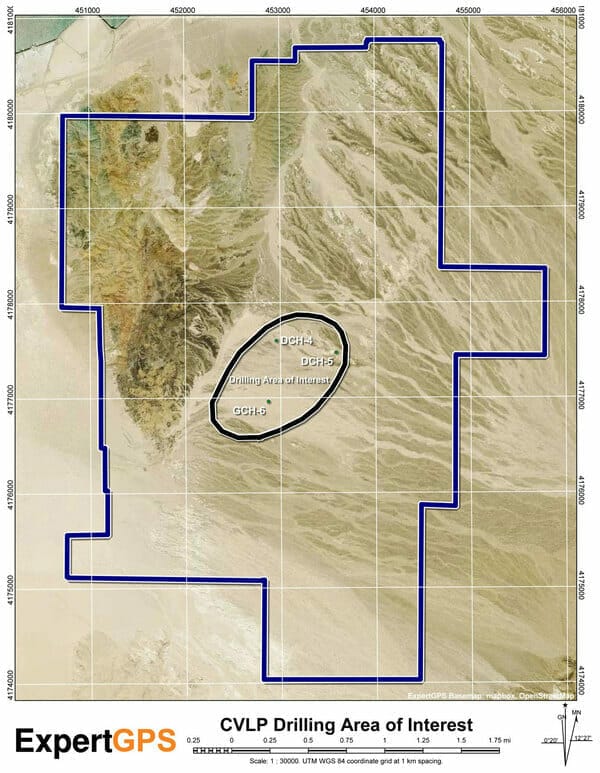

The present drill program is an important data gathering component of the ongoing prefeasibility study (PFS) and will concentrate on an area between previous drill holes GCH-06, DCH-04 and DCH-05. (See drill hole location map). The primary objectives are to upgrade and convert resources to reserves in developing the PFS mine plan and to obtain material for further metallurgical testing. Secondary objectives are to obtain geotechnical data and additional information on lithology, mineralization, and clay speciation.

Infill drilling, expected to begin in a few weeks, will consist of roughly five holes and will target the higher grade lithium clays featured in the PEA resource model.

Drilling is expected to intersect lithium-bearing units from near-surface to depths of more than 100 meters. Actual depths will vary with drilling conditions and lithological contacts. The primary targets in the drilling area are the Upper Olive and Main Blue Mudstone units. Lithium values were intersected in nearby holes are relatively higher, as seen in GCH-06 where the lithium values are up to 1609 parts per million (ppm). The drilling program is anticipated to generate 500 to 800 meters of core. Drilling is expected to be completed in March depending on weather conditions.

Near-term catalysts:

Intervals and assays will flow from of this program, but more importantly, the advanced staged metallurgical work – results from ongoing bench tests to refine production and cost parameters – will be the most watched item. It’s what institutions wanna see before they determine whether a project is real or not.

And of course, the release of the PFS itself will be a highly anticipated event.

This slide from the company’s investor deck offers a timeline for this dynamic period of activity:

Closing thoughts:

Cypress is backed by a super-solid management team. They know how to get things done, on time and on budget.

These are interesting times for the company. With an extremely modest market cap of $15.23M based on its 72.52 million outstanding shares and a recent $0.21 share price, Cypress could be due for a significant re-rating. Positive met test results and a solid PFS should seal the deal.

END

~ ~ Dirk Diggler

Full disclosure: Cypress Development is an Equity Guru marketing client.