Man has walked on the moon. The earth is round. Vaccines don’t give you autism. 9/11 was not an inside job. Chemtrails are not poison.

You wanna know how I know all this?

Because, and President Trump is just figuring this out now, in every conspiracy, eventually, someone talks.

It appears that it only took a shredding of the market caps of just about every weed company out there for some of the worst deals around to show their true colours in public, and for regulators and boards of directors to finally get off their asses and show some strength.

MedMen’s (MMEN.C) former CFO is suing that company for breach of contract and, boy howdy, does the filing document read like a laundry list of shitty things an executive should never do, from rampant racism, sexism and homophobia, to putting his therapist on the payroll for $300k per year, to wasting money on white Escalades, upgrades to his mansion, a 24 hour security detail. opposition research work on enemies (what’d you find on me, bois?), private jets, and a $160k board room table.

Chairman of the Board, Ben Rose, met with Plaintiff and announced as a fait accompli “I understand you are moving into a more strategic role and I am very supportive”.

Subsequently, when Plaintiff protested to CEO Bierman that Plaintiff had not agreed to any such move, CEO Bierman replied “Fuck Ben Rose. He someone’s bitch. Why do you care about him? The only thing that matters is our super-voting shares.”

Meden’s three founders, on top of dealing themselves tens of millions in bonuses and millions in salaries, also managed to receive 99.3% of all voting power by virtue of ‘super voting shares’ that they got as part of the go public deal.

At the time, we objected to that hard, because it means they can do just about anything they want and receive no punishment – as long as the gang stuck together.

So when two of those founders allegedly pushed out the third, for supposedly being too strict about playing by the rules, they also managed to save the company millions in bonuses – while pissing off their boy enough for him to spill publicly about how they run their show.

Namaste Technologies (N.V) CEO Sean Dollinger, the mayor of Man-Bun City, he of the recently deleted Youtube livestreams, and the closest thing we have to an Artful Dodger of weed pubcos, had no such super voting power to save his ass.

Dollinger, who has long been loudly, proudly, and enthusiastically bad at following the rules of his business, has been a target of ours for some time because, well, he’s just really bad at his job.

Today, following what the board calls a ‘recent expression of interest in the company,’ Dollinger was shown the door by his own directors for alleged ‘self-dealing.’

Namaste also announced that following an investigation by a special committee of the board of directors, the board has terminated the employment of Sean Dollinger as chief executive officer of the company for cause and removed him from his position as director, effective immediately. Meni Morim has been appointed interim chief executive officer of the company. To help strengthen its strategic partnerships, the company has also appointed Darren Gill as chief strategy officer.

That’s the way you clean it up, N board.

Namaste remains in a strong financial position, with cash balances intact, and will continue to execute on its unique and effective business strategy. The company will provide an update regarding the outcome of the strategic review process once it has concluded.

The details of the situation bear a deep read, because I can GUARANTEE you Namaste’s CEO was not alone in this kind of thing. In fact, it appears what cost Namaste it’s CEO is what also cost Aphria (APHA.T) it’s own head honcho a few weeks back.

Only Namaste’s board appears less conflicted about how to repair the damage.

The special committee’s thorough investigation examined all material allegations against the company. The only one that was substantiated and required action, as recommended by the special committee, related to the sale of Namaste’s U.S. subsidiary, Dollinger Enterprises U.S. Inc., in 2017, and subsequent transactions involving its assets and companies in which Mr. Dollinger and Namaste’s head of marketing, David Hughes, have a beneficial interest, as well as breaches of fiduciary duty by Mr. Dollinger and evidence of self-dealing. In light of these findings and the special committee recommendations, the board concluded that it is in the best interest of Namaste that Mr. Dollinger be terminated from his role as chief executive officer for cause and removed as director of the company. In connection with the findings of the investigation, the company is commencing legal action against Mr. Dollinger for damages and disgorgement.

This is bad ass. Namaste directors coming at their boy like brrrrap, brrrrrap.

In Meni Morim, they’ve chosen the right guy to lead things forward. When Dollinger was buying, well, everything he could get his hands on to pump his market cap, he acquired Morim’s company Findify AB, which was an actually interesting asset, if not necessarily necessary for Namaste’s business needs.

That’s the bright side. But the dark side is pretty damn dark.

Last month, we talked about how Dollinger had suddenly deleted all of his weekly Youtube livestreams in which he talked off the cuff, sometimes getting himself into regulatory trouble and making promises he couldn’t keep, about whatever seemed to pop into his head.

“Let’s look at our accomplishment of being accepted to one of the largest stock exchanges in the world, and not only entering on the lowest tier, we’ve been accepted on the second tier due to our requirements. Don’t think that the Nasdaq just takes an application and takes a payment and they’re happy at the end of the day. They went through our books, they went absolutely everything for 6 weeks.”

—Sean Dollinger, Namaste 420 Weekly Update July 25, 2018

So that never happened.

https://equity.guru/2018/07/26/namaste-technologies-nasdaq-consolidation/

Excerpt:

The company wishes to respond to these claims and inform shareholders that its Nasdaq application is progressing but has not yet been accepted or approved; that the company’s sale of its U.S. assets was not to a related party and was not a related party transaction as defined under applicable Canadian securities laws; and that other assertions made by Citron are equally inaccurate and misleading.

Then there was this, noted by short-sellers Citron Research, which appears, in the light of today’s news, to have been correct:

With the hope of obtaining the NASDAQ listing on Nov 28, 2017, Namaste announced that it divested of its US assets, Dollinger Enterprises US Inc.

“With our LP sales license knocking on our doorstep, Namaste management has decided that it would be best for our shareholders to divest the company of our US assets. With the US federal government stance on marijuana and the current federal legislation in the US, Namaste management believes this is a strategic decision which will allow the company to explore new opportunities.” — Sean Dollinger, Nov 28, 2017 call

Citron asks, “Who in the world would want to buy a money hemorrhaging online vape

business from Namaste?”In a direct response to that simple question, Sean Dollinger replied:

[Question:] and the buyers are arm’s length, are they?

[Sean]: absolutely! It’s a group out of Europe.

It wasn’t. It was a group consisting of Namaste’s marketing guy, and their HR guy.

From Citron again:

Namaste allegedly sold these assets for US$400k to ESC Hughes Holding Limited. The terms were $100k down and $25k a month (which we [don’t] have any record of being paid).

A simple corporate search will illustrate that the purchaser out of Ireland is not a third party, but rather none other than Namaste executive David Hughes. [..] Namaste has lied to its shareholders, Canadian Regulators, US Regulators; and most of all has attempted to hide US assets from the Justice Department in an attempt to obtain a US listing.

This did not go unnoticed by the ambulance chasers:

Rosen Law Firm, a global investor rights law firm, announces it is investigating potential securities claims on behalf of shareholders of Namaste Technologies Inc. (OTC: NXTTF) resulting from allegations that Namaste may have issued materially misleading business information to the investing public.

While Rosen Law chases every pubco with a rattling skeleton within reach of a closet, generally to no avail, the prospect of a class action suit in which they may well be exposed personally likely kicked the Namaste board into protective mode, and in not only tossing Dollinger overboard, but also taking legal aim at him personally, they’re doing their fiduciary duty, if a little later than they should have.

Frankly, Namaste has been screwing up under Dollinger again and again.

https://equity.guru/2018/01/08/oops-namaste-n-c-trading-halted-due-late-financials/

https://equity.guru/2018/05/18/namaste-technologies-n-v-will-buy-beer-dont-sell-stock-blown/

https://equity.guru/2018/09/14/sexy-nurse-bagholder-party-causes-breakup-namaste-n-v-tilray-tlry-q/

So when we caught Dollinger selling millions of shares this past December, into the lowest stock price the company had suffered in years, something his followers excused but which appeared to be poorly timed for his own sake, his company’s sake, and for shareholders watching the value of their portfolio drop, it raised more than a few eyebrows.

Turns out, when the company actually posted information related to it’s stock buyback, that the company bought back a bunch of shares THE DAY BEFORE THE CEO SOLD HIS.

From New Cannabis Ventures:

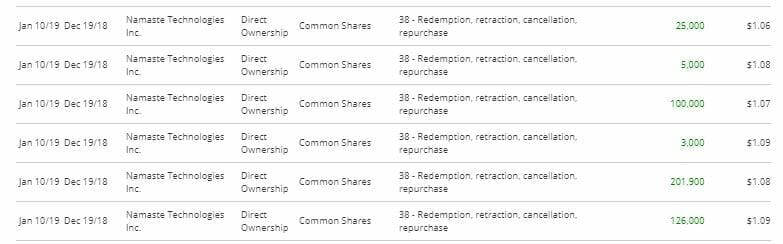

Compounding the perception that these sales were troubling is that the company revealed on January 10th that it had repurchased 460,900 shares just the day before Dollinger sold, paying an average of C$1.08, about 24% higher than where Dollinger sold :

It’s not clear why the company took so long to report this repurchase, nor why Dollinger sold shares. The company never released any information about Dollinger’s sales or its repurchase. It certainly seems improper to have the company buy back shares one day before the CEO sold 11% of his holdings.

The time lapse from the date when the company bought those shares and the date it announced the purchase is troubling indeed, as is the 24 hour gap between when Dollinger had his company prop up his share price and the moment he shredded it by selling his own stock.

But it goes a long way to showing what the board meant when it referred to ‘self dealing,’ if Dollinger’s non-arm’s length ‘arm’s length’ deal wasn’t enough to prove it.

It also explains why he’s been on a personal media blitz the last month, looking for any media outlet globally that will call him a trailblazer.

Here’s how this guy has built one of the world’s billion dollar cannabis companies

Sean Dollinger has been innovating for years, challenging the business landscape with disruptive models across a range of different sectors. Whilst his tenure hasn’t always been smooth, this shrewd entrepreneur has manoeuvred his career to a profitable path in the face of adversity. [link]

Another:

How Sean Dollinger built a billion-dollar business in three years in a quest to become the ‘Amazon’ of cannabis

Founder of Namaste Technologies Sean Dollinger always made it his business to find success in niche markets. First, it was with a mobile phone reception company, then a coal-fired pizza business. Now it’s with a billion-dollar soon-to-be-NASDAQ-listed online vaporiser and cannabis retailer. [link]

Here he is talking about how he’s selling vapes in places he shouldn’t:

Will this company become the ‘Amazon of cannabis’?

Australia is the largest market by “well over 100 per cent [over] any other country,” Dollinger said. Australians are buying the vaporisers for a range of purposes.

“We market them for aromatherapy purposes. People can use them for chamomile, dandelion root, peppermint. There’s a bunch of different products that you can use on these.” [link]

What appears to have really kicked the board along is the prospect that someone wanted to come in and buy Namaste, but felt there was too much dirt in the deal.

We’ve no idea who that may have been, but right now, with Ascent Industries (ASNT.C) fielding some 20+ offers for their assets last I heard, and with Emblem Cannabis (EMC.V) taking a beyond cheap deal to be bought out as it struggles with the markets, and with Aphria (APHA.T) playing pretend that it has a takeover offer (that nobody appears to be falling for), combined with Namaste’s board looking like it wants out, it would appear the era of short term deal making and bullshit asset collecting is over. The adults are taking back control of the marijuana market.

This might be a good time to wave a hand to Namaste shareholders, who have long claimed we at Equity.Guru were just attacking Namaste for personal reasons (that’d be justified, but no), or because we’re short sellers (nope), or because we just don’t know what we’re talking about (arguable, but I think the board has ratified our stories), and say one thing, very clear, that we seem to say again and again in these situations:

— Chris Parry

FULL DISCLOSURE: Got ya.