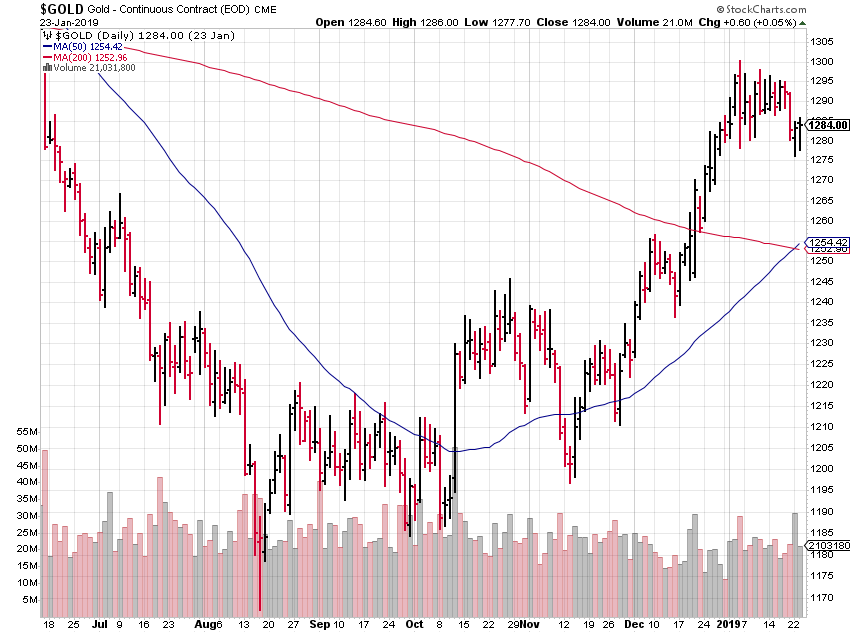

This is a gold chart from a few days back.

I guarantee you, a whole universe of traders are now watching this market.

The reason? A very simple, obvious, and potent technical signal is unfolding.

The signal is called a Golden Cross and its a very visual pattern.

It’s also a very bullish pattern that occurs when the 50 period SMA (blue line) crosses over the 200 period SMA (red line).

When a Golden Cross occurs, it signifies strength in the underlying market.

It could represent a breakout or trend reversal.

Question: What single thing is needed to validate this bullish crossover of moving averages?

Answer: A convincing move above the $1,300.00 resistance level.

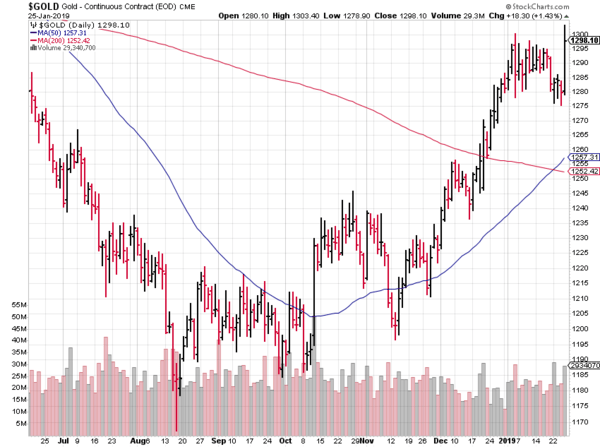

Flashing forward to yesterdays trade – Friday, Jan. 25th – gold put on a show, breaking out of its 3-week holding pattern, launching an assault of this critical $1,300 resistance zone.

The golden cross is looking pretty good all of a sudden.

When the markets on the U.S. east coast wound down trading for the week, gold closed right at resistance.

The next week will be very telling.

At the risk of sounding like a broken record, I believe this most hated of metals is about to grab the spotlight.

A solid push above $1300.00 should trigger a fair amount of buying pressure, mobilizing fat stacks of cash from the sidelines as traders both big and small vie for position.

It could signal GAME ON. It could motivate even more billionaires to dip a toe into the gold market.

Investors who have lived through one or more gold market cycles know that when the trend reverses, and the momentum kicks in, it can be a beautiful thing.

We’ve covered the positive fundamentals underpinning gold here at Equity Guru ad nauseam. We’ve even named names…

Gold: uncharted waters – the technicals, the peak of discovery, the opportunity

This is a good time to expand our search for quality companies. It’s a good time to buy dollars for dimes.

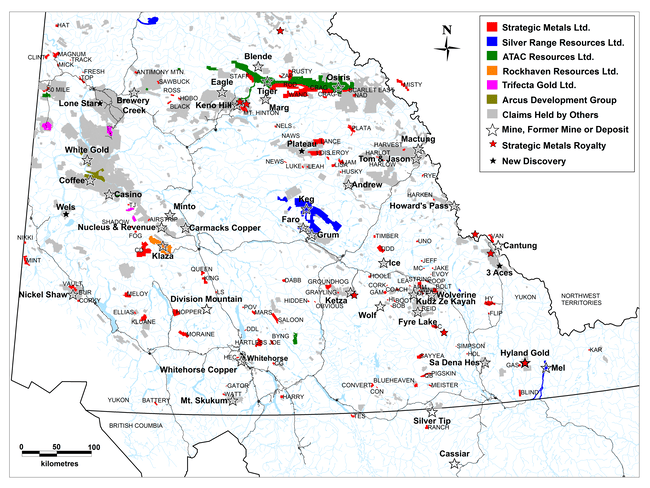

The Yukon ExplorerCo’s:

- 111.46 million shares outstanding.

- $16.16M market cap based on its recent close at $0.145

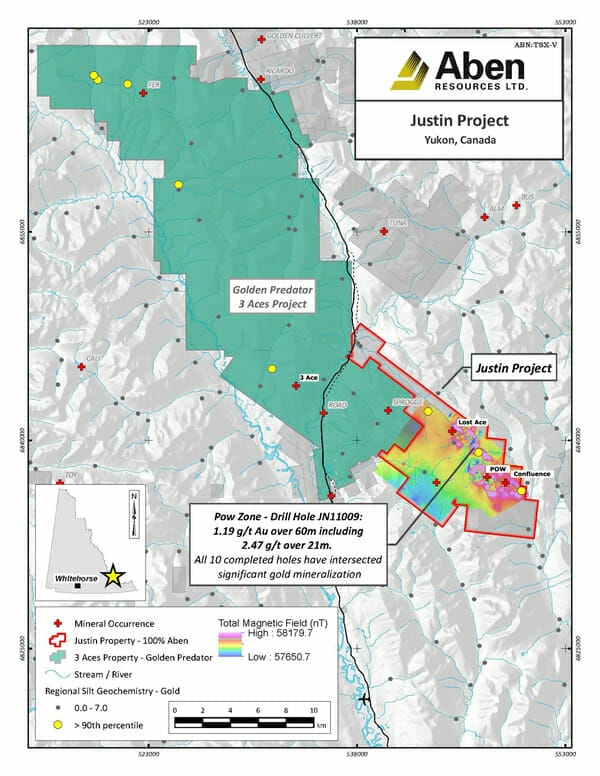

Aben has been featured prominently here at Equity Guru in recent months. Aside from its flagship Forrest Kerr project in the prolific Golden Triangle of British Columbia, the company is exploring Chico in Northern Saskatchewan, and Justin, in the Yukon Territory.

Justin is 18,314 acres of highly prospective terrain abutting Golden Predator’s 3 Aces project.

Justin’s geological setting is orogenic in nature. Some of the largest gold systems on the planet are orogenic – the California Mother Lode Belt and the Juneau Gold Belt come to mind.

The company’s 2018 field program was focused on Lost Ace, a gold-bearing zone discovered in 2017.

Lost Ace is located two kilometers west of the POW Zone where there’s excellent potential for bulk-tonnage mineralization.

Drilling highlights from previous exploration campaigns at POW include intercepts of 1.19 grams per tonne (g/t) Au over 60.0 meters and 1.49 g/t Au over 46.4 meters.

Previous exploration at Justin has successfully discovered Intrusion related sheeted veins & vein breccias along with gold bearing skarn mineralization. The new discovery at Lost Ace highlights the existence of a multi-phase hydrothermal system with the potential for overprinting mineralizing systems.

Recent trenching at the Lost Ace quartz-stockwork vein zone returned 20.8 g/t Au over 4.4 meters, including 1.0 meter of 88.2 g/t.

Field crews will be back in the Yukon as soon as weather allows.

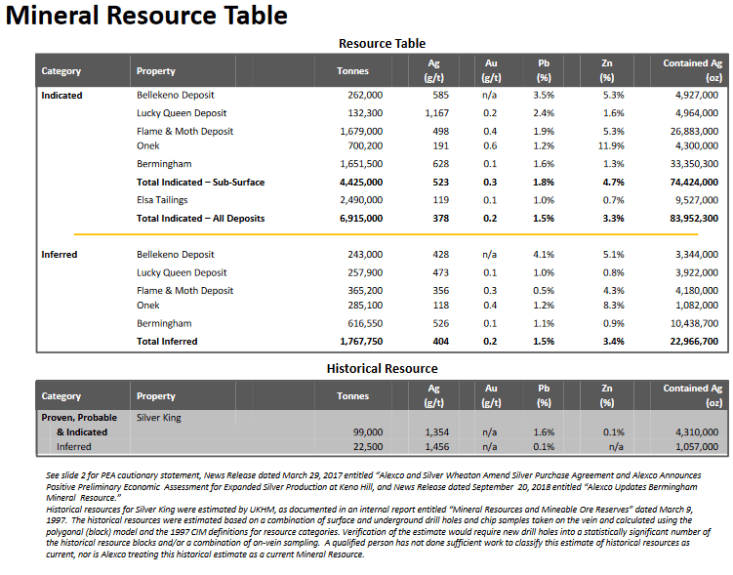

Alexco Resources Corp (AXR.TO)

- 108 million shares outstanding.

- $135M market cap based on its recent close at $1.25

Alexco operates in the Keno Hill Silver District, one of the highest grade silver destinations on the planet.

Between 1913 and 1989, the 233 square kilometer property played host to more than 35 mines where over 217 million ounces of silver was produced at an average grade of 1,149 g/t.

Alexco successfully consolidated the entire Keno Hills district back in 2006, recognizing its untapped potential. Today, the company boasts some of the highest grade silver resources in the junior arena.

There are a lot of moving parts to this high-grade story: district scale discovery potential, resource development… production.

A production decision is targeted for H1 of this year after the company tables a PFS.

Positive PFS numbers will usher in H2 production – yes, everything is in place…

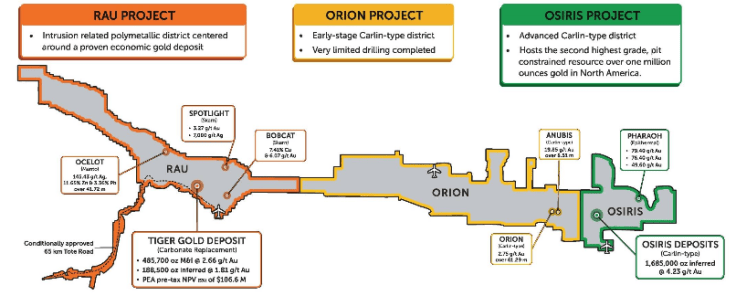

- 147.53 million shares outstanding.

- $39.83M market cap based on its recent close at $0.27

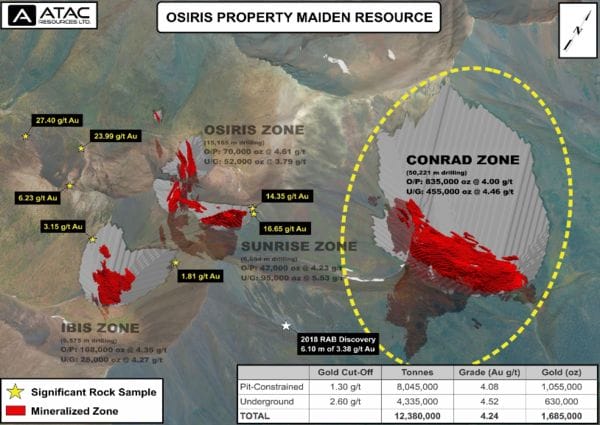

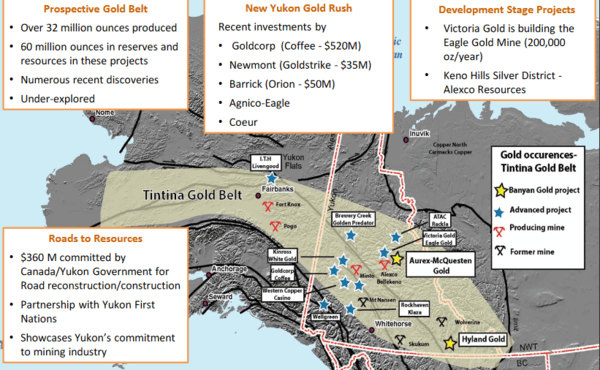

ATAC is focused on developing a Carlin-type gold district at its Rackla Gold property in the Yukon. This is the only known Carlin-type setting in Canada.

Rackla encompasses some 1,700 square kilometers and is divided into 3 separate projects: Osiris, Orion, and Rau.

The Osiris project boasts a high-grade inferred resource of 1,685,000 ounces spread out across 4 separate zones: Conrad, Osiris, Ibis, and Sunrise.

Conrad holds the bulk of the oz’s.

At the opposite end of Rackla, tucked in among the companies numerous ‘cat zones’, sits the Tiger deposit, and its positive PEA with a pre-tax NPV of $107M.

The exploration and discovery potential at Rackla has to be considered excellent. Carlin-type deposits, specifically those found in Nevada, account for roughly 9% of the world’s gold production.

There’s a lot of unexplored Carlin-type terrain at Rackla.

- 88.94 million shares outstanding.

- $4.45M market cap based on its recent close at $0.05

Banyan is exploring its 18,620 hectare, 100% owned Hyland Gold Project in the Watson Lake Mining District of the southeast Yukon.

Hyland’s ‘Main Zone’ has an indicated resource of 236,000 AuEq ounces at a grade of 0.85 g/t and an inferred resource of 288,000 AuEq oz’s at a similar grade. The Main Zone is open in all directions and at depth.

With 18 kilometers of largely unexplored strike length, the potential to grow this resource is excellent.

Banyan’s second project – the Aurex-McQuesten Property – is located between Victoria Gold’s Eagle Gold mine and Alexco’s Keno Hill Silver District.

The company recently released news highlighting a number of new gold targets on the property.

Hyland and Aurex-McQuesten are two very upscale Yukon neighborhoods, geologically speaking.

Golden Predator Mining Corp (GPY.V)

- 130.66 million shares outstanding.

- $36.58M market cap based on its recent close at $0.28

Golden Predator is focused on two Yukon projects- the past producing Brewery Creek, and 3 Aces.

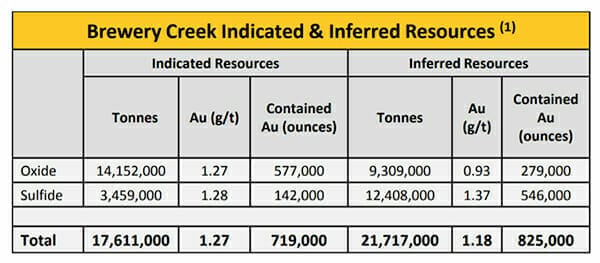

Brewery Creek was in production between 1996 and 2002. The project currently boasts a resource of over 1.5 million ounces.

A 2014 PEA on the project demonstrates good leverage to a rising gold price.

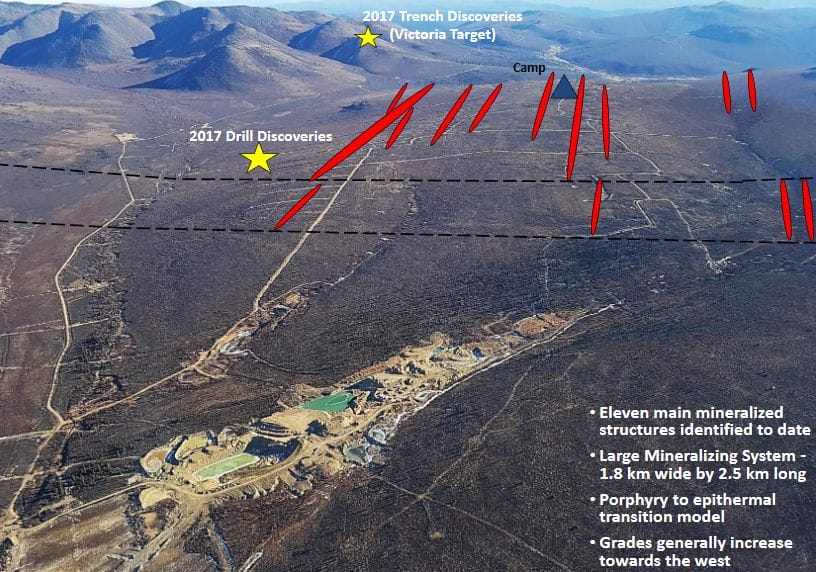

At the company’s 357 square kilometer 3 Aces project, we have an orogenic type setting with at least six mineralized zones extended over thirty-five kilometers along trend.

Approximately 300 holes have been drilled into the Central Core Area – 37% of said holes cut 5 g/t Au or better, 27% cut 8 g/t Au or better.

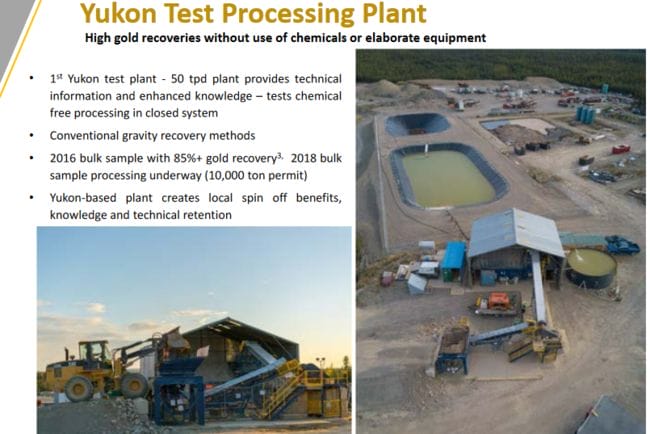

Interestingly, and wisely, the company actively bulk samples 3 Aces and processes the ore at its test plant using conventional gravity recovery methods.

In 2016, the company’s 770-tonne bulk sample recovered 953.4 troy ounces from ore that ran 46.18 g/t Au.

The costs of processing this material worked out to a modest $400.00 per oz netting the company roughly $1M.

Aside from providing company geologists with a greater understanding of the deposits geometry, structure and mineralization, the gold produced from these bulk samples drop significant cash into the company’s coffers.

This is a very creative alternative to secondary financings (raising funds in a down market).

As part of their 2018 exploration program at 3 Aces, GPY is bulk sampling 6,000 to 7,000 tonnes of high-grade surface material.

Golden Predator’s team is led by Janet Lee-Sheriff.

Luckystrike Resources Ltd (LUKY.V)

- 37.58 million shares outstanding.

- $6.01M market cap based on its recent close at $0.16

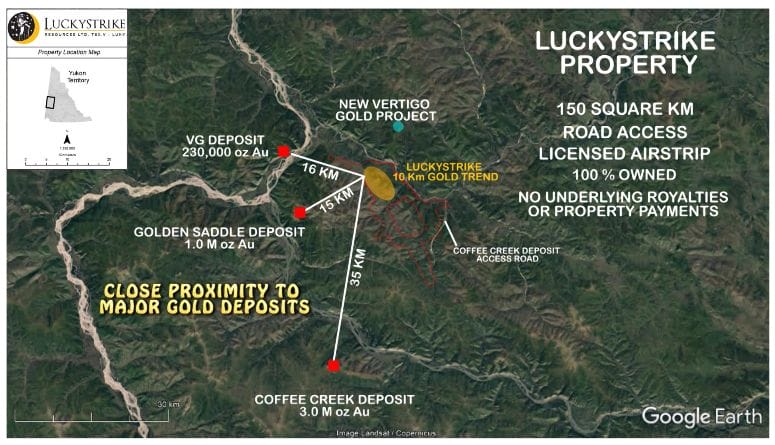

Luckystrike, a recent spinoff from Goldstrike Resources Ltd (GSR.V), is exploring for gold at its flagship Luckystrike property.

Luckystrike shares a common border with White Gold Corp’s Golden Saddle property.

Luckystrike shares (geological) similarities with both Golden Saddle and the multi-million ounce Coffee Mine Project currently being developed by Goldcorp (G.TO).

According to the company:

Five large gold-in-soil anomalies have been discovered at Lucky Strike along a 10 kilometre long gold trend delineated by soil sampling, geophysics, prospecting and bedrock trenching followed by an inaugural 1,000 metre drill program in 2017 which returned 5.36 g/t gold over 22m in hole 9 and intersected near surface gold mineralization in all 9 holes. These results are considered significant when compared to the Golden Saddle discovery hole of 4.1 g/t gold over 18m and the Coffee discovery drill hole of 17.07 g/t gold over 15.5m.

- 96.89 million shares outstanding.

- $18.41M market cap based on its recent close at $0.19

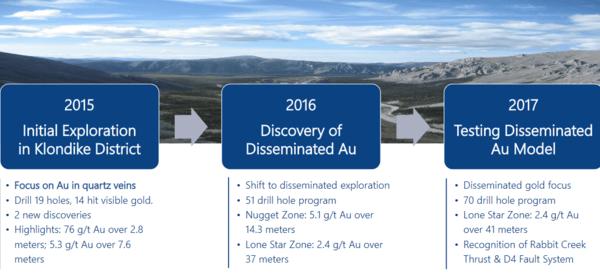

The hardrock source of the Klondike’s placer riches – some 20 million ounces – has never been found. The subject has generated much speculation and debate.

It boggles the mind to consider the scale, the numbers, the possibilities, should the source of Bonanza Creek’s alluvial riches suddenly come to light.

It’s captured the imaginations of some heavy hitters – Frank Giustra holds 14% of KG’s common, Eric Sprott holds 13%.

New theories and geological models may help KG’s Peter Tallman unravel the mystery.

On the ground, the company holds claims which cover the vast majority of the 1896-1900 Klondike gold rush area.

Multiple phases of exploration have been carried out on the property over the last few years. All have met with success.

Results from the company’s $3.5M 2018 exploration campaign continue to demonstrate the districts potential for low-grade disseminated, and high-grade vein type gold deposits.

Rockhaven Resources Ltd (RK.V)

- 157.72 million shares outstanding.

- $28.39M market cap based on its recent close at $0.18

Rockhaven’s 100% owned Klaza property, host to high-grade gold and silver in a network of quartz-sulphide veins, is located in the Mount Nansen Gold Camp of southwestern Yukon.

This 100% owned 25,000 hectare property boasts an indicated resource of 4,457,000 tonnes grading 4.8 g/t gold, 98 g/t silver, 0.7% lead and 0.9% zinc, or a gold equivalent metal content of 907,000 oz’s at an AuEq grade of 6.3 g/t.

Klaza’s inferred resource includes 5,714,000 tonnes grading 2.8 g/t gold, 76 g/t silver, 0.6% lead and 0.7% zinc. Its gold equivalent metal content is equal to 725,000 oz’s at an AuEq grade of 3.9 g/t.

Metallurgy is good.

Recovery rates? 95.0% for gold, 90.8% for silver, 91.2% for zinc and 84.6% for lead.

Numerous untested soil and geophysical targets suggest excellent exploration potential beyond the resource area.

Strategic Metals holds 41.8% of Rockhaven.

- 89.43 million shares outstanding.

- $32.19M market cap based on its recent close at $0.36

This team knows its Yukon rocks.

Strategic has called the Yukon home for decades. During this time, the company accumulated an extraordinary project portfolio of over 100 properties, most of which are 100% owned with no underlying royalties.

The company has exposure to gold, silver, lead, zinc, copper, tin, tungsten, vanadium and lithium, via an array of deposit types – porphyry, skarn, epithermal vein, orogenic gold, sedex, carbonate replacement, etc.

And the company’s business model is unique:

The Company conducts ongoing research, claim staking, and initial exploration to confirm the mineral potential of its targets. Typically, Strategic then seeks purchasers or optionees to advance the projects. The company benefits from property transactions through cash payouts, share issuances and/or royalty interests. The Company holds a number of projects which meet the requirements of a qualifying listing property.

This is what’s called the Project Generator Business Model.

Know of anyone looking for a good exploration project?

With over $30 million in cash and marketable securities, the company is in an enviable position.

- 785.97 million shares outstanding.

- $392.99M market cap based on its recent close at $0.50

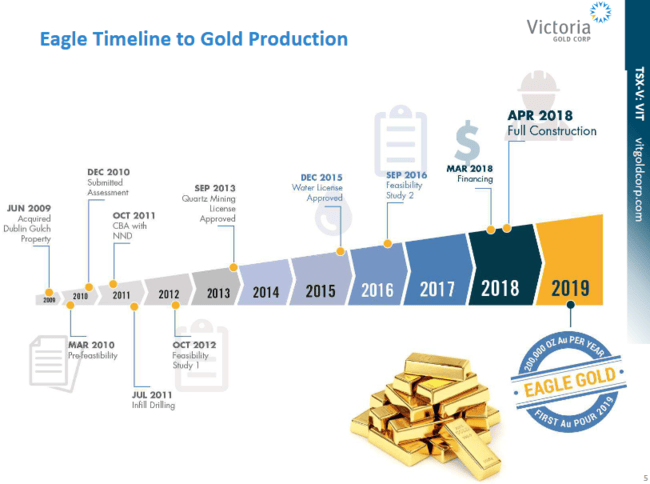

Victoria Gold’s primary focus is its Eagle Gold Project.

According to the company’s website, “the shovel ready Eagle Gold Project is the most advanced project in the region and is on track to be the largest gold mine in Yukon history.”

Eagle Gold contains a constrained in-pit measured and indicated resource of 3.6 million ounces at a grade of 0.63 g/t Au.

Significantly, the deposit boasts a very favorable stripping ratio of less than 1:1. We’re talking waste rock here – the absence of large volumes of waste enhances the project’s economics.

Eagle Gold, currently under construction and 60% complete, is expected to produce 200,000 ounces per year.

Highlights from the company’s bankable feasibility study show an after-tax NPV (5%) of $508M and an IRR of 29.5%. These are decent numbers. There’s good leverage to the metal should we enter a new bull phase in gold.

Though Eagle Gold is the main draw here, there’s exploration upside at the company’s 100%-owned Dublin Gulch and VBW claim blocks.

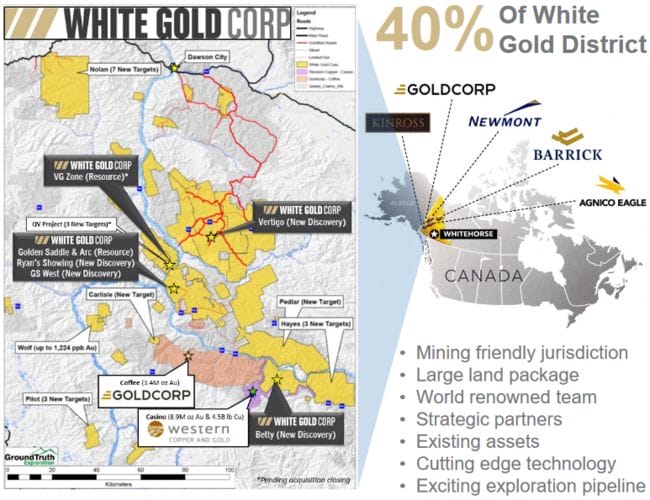

- 109.78 million shares outstanding.

- $161.37M market cap based on its recent close at $1.47

White Gold owns a portfolio of 34 properties totaling 423,000 hectares representing roughly 40% of the White Gold district – a district which has seen roughly 7 million discovery ounces since 2007.

The company’s flagship White Gold property (Golden Saddle) boasts a resource of 961k indicated and 282.5k inferred ounces of high-grade gold. Their recently acquired VG zone has a current inferred resource of 230k oz’s.

There’s room to grow ounces here – the Golden Saddle deposit is open at both ends.

The company also tagged a number of significant new property-wide discoveries in recent months.

Discovery details:

Vertigo:

- 103.9 g/t Au over 1.52 meters.

- 59.30 g/t Au over 3.5 meters.

- Open in all directions.

Ryan’s Showing:

- 2 kilometers west of the Golden Saddle resource.

- 20.64 g/t Au over 6.09 meters.

- 5.02 g/t Au over 13.17 meters.

- Open in all directions.

GS West:

- 750 meters west of the Golden Saddle resource.

- 2.97 g/t Au over 10 meters.

- 1.92 g/t Au over 24 meters.

- Open at depth.

Betty:

- Along trend with the Coffee Creek fault line.

- 1.08 g/t Au over 50.29 meters.

- Oxidized mineralization.

Wrapping things up:

As we noted in a previous offering…

Senior and mid tear gold producers are desperate to add ounces to their rapidly depleting resource bases. Years of slashed exploration budgets have choked off their pipeline to new sources of the metal.

New discoveries made in mining friendly jurisdictions will become highly coveted assets.

Companies with significant new discoveries on their books, particularly those in mining friendly jurisdictions, are sitting ducks.

Their days are numbered.

That spells opportunity for investors.

Takeover premiums are bound to push higher, even without an assist from the gold price.

If I’m right about where gold is headed? Fugget about it.

END

~ ~ Dirk Diggler

Full disclosure: of all the companies profiled above, only Aben is an Equity Guru marketing client.

Feature image courtesy of GoldBottom.com