After all the kicks cryptocurrency, and Bitcoin in particular, has taken in the past year, some might find it hard to believe there are companies out there willing to double-down on the shared ledger dream of 2017, 12 months later.

There have most definitely been bodies floating down the Crypto Grande over the past year, and more than a few of those are former public market stars.

Let’s look at some companies in the sphere and see how they’re doing.

Hive Blockchain: losses, amended agreements and an absurd lack of fear

While crypto was being hammered and investors and companies alike were looking at strategic alternatives, Hive Blockchain (HIVE.V) doubled-down on mining crypto in 2018 with upgrades and installations of both new ASIC and GPU computers.

Hive Blockchain Technologies Ltd. has added 100 petahashes (PH) of cloud-based ASIC mining capacity, bringing total capacity to 300 PH, at a cost of $6-million (U.S.), payable as $2.5-million (U.S.) in cash or Ethereum and an additional $3.5-million in the form of 8,317,490 common shares, valued at approximately 55 Canadian cents per share, a significant premium to Hive’s current trading price.

The biggest problem here is with the ASIC computers, which can only be used for one particular purpose and cannot be scaled-back and retooled. This means, when Bitcoin and altcoin mining becomes unprofitable, the ASICs become large, unwieldy, power-sucking paperweights.

HIVE lost $28.25m in Q2, which was never part of Frank Holmes’ investor deck when he paraded HIVE as a straight up gimme late last year.

That’s fine – getting it wrong isn’t something only he is guilty of. But refusing to pivot in any way while your stock drops 95 percent? That shows either incredibly large balls, or an ego-driven business that is entirely reckless.

DMG Blockchain Solutions: A lot of good ideas and people inexplicably still doing the wrong thing

Rather than look at the price of Bitcoin and decide on which direction they should move to give shareholders the best value for their investment dollar, DMG Blockchain (DMGI.V) has remained determined to plow straight ahead with the stuff nobody is making money on right now, signing a contract with a major blockchain industry company to perform mining-as-a-service.

This means they’re charging other companies a fee to do their mining for them, which was a lucrative idea back in the halcyon days of 2017 when we were all dreaming of getting fat and rich on invisible money that would always be in demand.

But 2018 provided a cold, hard wake-up call that crypto’s growth relies on a whole load of people believing in crypto’s growth–and those people don’t appear to be there anymore–DMG’s client notwithstanding.

DMG’s chief executive officer, Dan Reitzik, stated: “We are pleased that, just as we energized our new substation, we added a significant new client and we are now filling our capacity in accordance with DMG’s MaaS growth strategy. We have been very careful to preserve capital in our first year as a public company by focusing on our MaaS hosting model. Given our solid position, we are thus prepared to fill the remainder of our capacity with new-generation mining equipment in the new year, which should result in additional cash flow generation for both DMG and our clients.”

I mean, sure, but we have some concerns over the three-month contract terms, which could see DMG stuck with a lot of hardware in early 2019, if their client doesn’t make money quickly.

Here’ some history on Bitcoin.

| All-Time High | CA$25,303 |

|---|---|

| Since All-Time High | -82.1% |

| All-Time High Date | Dec 16, 2017 (13 months) |

Note the all time high. That’s a huge drop, and it’s showing no signs of stopping. By the time you read this, you might be able to use Bitcoin order a pizza again, assuming your local pizzeria even takes it as currency. Like Hive above, DMG investors are going to be left with a lot of paper investments in hefty, large inefficient baseboard heaters if the currencies don’t kick.

There are lots of good things happening at DMG, which was previously an Equity.Guru marketing client, and they’re probably far more interesting as a long term investment, but we don’t necessarily like to hear about more server purchases.

Hashchain: I can’t even.

Hashchain (KASH.C) now sports a $9 million market cap, down from an all time peak of $440 million in 2017.

And their plan?

Keep adding rigs and keep mining crypto. Cool story. Can’t fail.

Neptune Dash: Could the last guy out leave a key for us?

Neptune Dash (DASH.V) was once the darling of the market, a deal so hot we couldn’t get them to talk to us. Now? We were recently negotiating to take over their office space and haggling over whether we’d give them something for their office furniture.

Looking good, Billy Ray.

RIOT Blockchain: What goes up, must come down

Originally a biotech company Riot Blockchain (RIOT.Q) felt the way the wind was blowing and put Blockchain in their name, and enjoyed a good spike in price.

But what comes up must come down, especially when weighted by ASIC rigs.

During their Q3 they pulled in $2.3 million in mining revenue, and lost $6.2 million.

“The Company expects to continue to incur losses from operations for the near-term and these losses could be significant. The Company expects the need to raise additional capital to expand our operations and pursue our growth strategies,” according to Riot’s last quarterly report.

You almost have to admire their tenacity. Their perverse dedication to their continued, sustained failure would almost be admirable if it weren’t so sad.

The cost of crypto: Is the end actually nigh?

Here’s a video to give the basics for crypto-mining.

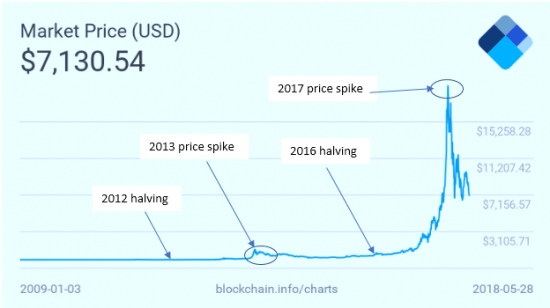

There are three core problems with Bitcoin mining on an industrial level. The first involves a function of the chain itself, and specifically that Bitcoin’s creator, Satoshi Nakamoto, coded a mechanism for artificial scarcity directly into the program, by which it effectively halves supply of available coins every four years with the next halving being in 2020.

The theory is that when the supply of new Bitcoin is less than the demand for it, the price should go up. But even if demand doesn’t increase, the supply will decrease, and the price will also go up. For those few remaining holdouts clinging to their Bitcoin for dear life, this is good news. But for miners, a reduction in the reward miners get for solving the puzzle would mean a decrease in revenue, especially if the difficulty of mining remains constant.

Historically, the effect on Bitcoin’s price has been generally felt a year after the halving. For investors, that means it’s time to stock up on existing Bitcoins, but for miners it translates to substantially less revenue. Now they will be spending more in terms of capital costs and kilowatt hours to compete for a drastically reduced yield in total coins earned per kilowatt hour as the price gradually rises.

As an answer to this, there are many companies that have moved away from Bitcoin mining, or never engaged in it in the first place, but instead use blockchain to perform different, more lucrative functions. It’s really something of a mixed bet, and there are some companies here that are doing better than others.

BTCS: The Ghost of Blockchain Yet-to-Come?

BTCS’s (BTCS.Q) story is what happens when a company holds onto dear life when the market has moved on. They bought in as a bitcoin mining and digital asset company at 2015, focusing on products that are peripheral to the blockchain ecosystem including an e-commerce site and a cryptocoin wallet, both of which never got out of beta.

An attempted merger in October 2017 fell through and then someone broke in and stole all of their mining rigs. Their share price suffered some considerable shocks, hitting the skids at two cents after opening at $0.30 cents in 2015. Now tumbleweeds bounce through their offices and neighbourhood children tell ghost stories and dare each other to spend 10 minutes in their lunch-room.

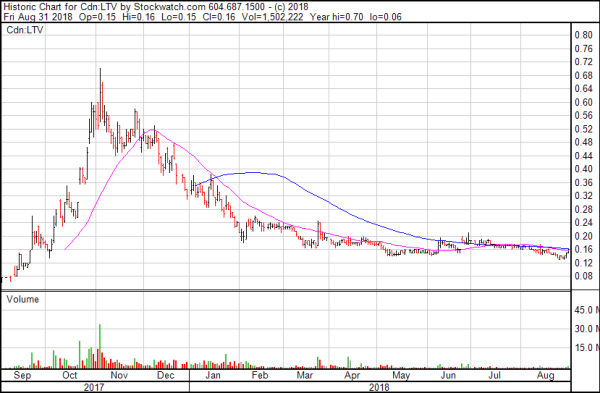

CUV Ventures: The evolution of the revolution brings a stock price de-evolution

CUV Ventures (CUV.V) is hard to pin down because the scope of their business plan has evolved several times, and grown a little hard for Johnny Public to categorize. They’re a global remittances company, a bank, they’re into international finance, and have recently gotten into the vacation market. In terms of remittances, their low price and user-friendly interface makes Western Union (WU:Z), their primary competitor, look like a highway robber, which of course it absolutely is.

There was a time when it appeared likely they’d join the crypto train (heck, who wasn’t thinking about it for at least a second), but it was a brief flirtation and they’ve instead moved into big data, and global finance/marketing/factoring loans and more.

Their primary product is RevoluPay, a crypto-backed, blockchain-enabled, multi-purpose platform that lends itself to the tourism, lending and remittance industries. It uses a permissioned blockchain to convert fiat currency into their own proprietary cryptocurrency, which can be then sent via their own channels anywhere in the world and converted back to cash.

That idea remains one with absurd potential, but investors are impatient.

ExeBlock Technology: Lights are on; nobody’s home

We used to write about this company a fair amount when blockchain companies were all the rage. ExeBlock Technology (XBLK.C) main contribution was as creators of distributed apps (DAPPS) to be used on their peerplay system. Then they hit a serious slump, dumped their CEO and haven’t recovered. Back in Feburary of 2018, we were less than polite with them as we tend to be when we see people are asleep at the wheel.

Here’s where they are now:

They weren’t mining crypto, but they do stand as an object lesson for those interested in the crypto-sphere that even the right moves can be foiled by the wrong people.

Now we have the hesitant adopters. A handful of companies that have adopted blockchain technology, or at least expressed interest, but have yet to do anything with it.

Millennial Esports: Waiting for something to happen

Around January of 2018, Millennial Esports (GAME.V) took up space on the investment sheets of Global Blockchain (BLOC.U). They were intending on creating a cross-platform game using blockchain technology that would have made use of in-game tokens, and then for months nothing happened.

It’s hard to tell just what could have happened to this deal, but smart money says that GAME waited and waited and waited for something to happen to unlock blockchain’s supposedly infinite promise, and then got tired of waiting and went on pumping out well-regarded games and seeking out other lucrative partnerships.

Kodak: Yes, that Kodak

The camera giant has had better years, it’s true.

Back in May they threw money into a blockchain company expecting dividends, created a subsidiary with blockchain in the name and then danced around as their price went up. The SEC got involved, and they backpedaled when they realized it was a bust.

Jeff Clarke, Kodak’s (KODK.Z) CEO, apparently had notions that blockchain technology could help track down copyright violators and get paid. Given that they haven’t entirely parted ways with their Kodak Blockchain subsidiary, maybe he still does.

They even tried out a small stake in mining, which went horribly wrong and blew up in their faces. Searching around for information on KodakOne quickly gives the impression that this company is firmly in Kodak’s back pocket while the company figures out how to make money off of it. It looks like they may have figured out how, so this will be an interesting play to watch in the coming year.

Lastly, the pure blockchain plays. Those few companies that have decided that while crypto-mining may be a dead end, there is still some life in blockchain. These are the companies that will stick with their game-plan, and to hell with what the market says.

Leonovus: staying the course

Leonovus (LVNS.Q) uses blockchain technologies and cloud computing to provide data storage and security. They have built their entire business model around blockchain and likely won’t be changing course regardless of what the markets may have to say. Towards that end, they’ve recently signed into an agreement with Sherritt International (S.T) to strengthen their data security, with the pilot beginning in January, 2019.

This company’s steep drop in the dying months of 2018 followed by gradual uptick in price should make it an interesting one to watch, if only as a barometer of how pure blockchain companies play out in 2019.

Graph Blockchain: No really, you’re still using the word ‘blockchain’?

Graph Blockchain (GBLC.C) is a blockchain-based logistics company offering supply chain management solutions using blockchain technologies, including but not exclusive to, order processing logistics, inventory management, transportation and warehousing.

This is a market which, according to Transparency Market Research, is expected to be worth around USD$15.5 trillion by 2023. Their most recent moves have included patents with the Korean intellectual property office, partnerships with Samsung (SSNLF) and LG (066570:KS), and discussions about how to get Canadian beef to a hungry East-Asian marketplace.

And all of that in their first month of existence.

Yes, THAT Samsung and LG. And IBM (IBM.Z) is a partner. And they got a contract with Hyundai (HYMTF.Z).

And yet, the market HATES their stock.

If even a mover like Graph is taking hits to their bottom line, then it should be obvious that the market’s love affair with the fancy math that will save the world and replace fiat currency has come and gone. Now what remains to be seen are whether or not Satoshi Nakamoto’s technology has any staying power, and in what form.

Bitcoin miners are going to have an uphill climb if they decide to stay the course, but there may be room for blockchain companies to make some steep profit, if only the market comes around and recognizes its inherent value in 2019.

One thing is for certain: the free lunch is over, and if there are any winners in the blockchain space in 2019, they’re going to have to work for it.

–Joseph Morton

Full Disclosure: CUV Ventures and Graph Blockchain are Equity.Guru marketing clients.