CUV Ventures’ (CUV.V) wholly-owned subsidiary, RevoluPay, has secured temporary approval for a PSD2 License to begin full financial operations Europe.

According to the news release, the exemption, granted on Dec. 21, 2018, arrived on RevoluPay’s doorstep on Jan. 4, 2019, allowing for an interim monthly remittance total of up to €3 million (approximately CAD$4.5 million) pending final license approval which is projected to be in Feb 2018.

RevoluPay formally applied for a proprietary PSD2 Electronic Money Institution banking license at the end of November and, is in the midst of a statutory 90-day approval period.

The company’s interim consent came on the heels of the blockchain-driven payment provider complying with the European PSD2 Banking two-factor authentication standard.

Why should we care?

The announcement is an important milestone in becoming a fully-licensed proprietary banking entity in the EU. This designation would allow RevoluPAY to act autonomously in the following capacities:

- Operating a payment account and enabling cash to be placed on and, withdrawn, from a payment account

- Executing payment transactions

- Issuing payment instruments or acquiring payment transactions

- Money remittance

- Payment initiation services

- Account information services

- Proprietary SEPA and Swift Codes

- RevoluPAY e-Wallet Linked Prepaid Visa card

The release also noted RevoluPay’s prepaid Visa card received final official approval from Visa (V.Z) on Jan. 4, 2019.

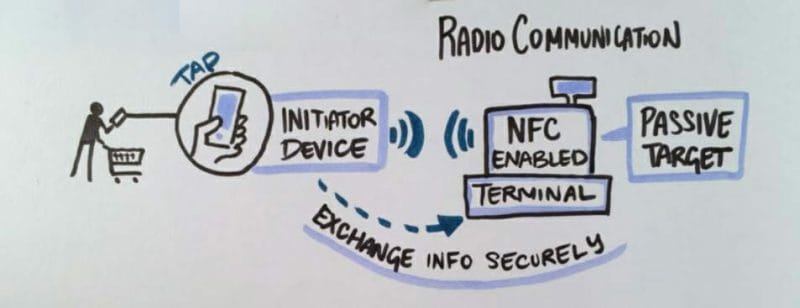

This bodes well for RevoluPAY users as the app sits on your phone and communicates with POS devices and ATMs through NFC or Near Field Communication. (see below)

Even though contactless payments are on the rise, Berg Insight, a market research firm based in Sweden, estimated there were 54.5 million NFC-ready POS terminals worldwide in 2017 – approximately 50 percent of the global POS market. And many of those NFC-ready units had not been activated.

The RevoluPAY international visa card will allow users to sidestep this technological speed bump and do business where NFC enabled POS devices and ATMs are not yet operational.

Company executives have been informed that the first batch of cards should be available within four to five weeks.

Innovating tourism from start to finish

The RevoluPAY blockchain-powered remittance and leisure payment app is part of a full service travel solution with RevoluVIP.

RevoluVIP is an innovative travel retailer which allows club members to book travel services in 134 countries around the world on the company’s main website and country-specific sites.

So instead of rooting through oodles of web pages to find that awesome vacation deal, RevoluVIP aggregates travel offers for you in a single location.

Typically travel agencies have no involvement with your trip after you land, but RevoluVIP seeks to change all that by developing specific agreements with local businesses, both private and corporate, to set up reduced rates and exclusive offers for RevoluVIP members once they arrive at their destination.

What’s the potential?

Considering domestic and international travelers in the US spent USD$716.7 billion while on vacation in 2017–that’s $32,800 every minute–it’s clear CUV is dedicated to user experience, both online and off.

And that’s just the US: there was an estimated 1.32 billion international tourist arrivals worldwide in 2017.

In other news, RevoluPAY announced on Dec 20, 2018, that it had processed its first USD $25,000 worth of bookings for Expedia (EXPE.Q) and Booking Holdings (BKNG.Q) using virtual credit cards on Dec. 18.

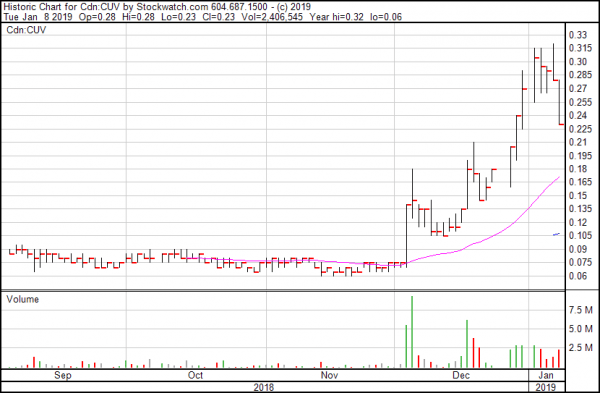

The year ended well for CUV Ventures as the multi-asset pubco saw its share price jump from $0.075 on Dec. 3, 2018 to $0.29 in afternoon trading today for a market cap of CAD$36.39 million.

If RevoluPay receives its full proprietary banking license in the next month or so, it will be on track to grab a piece of the global $595 billion family remittance market.

As such, CUV Venture’s year-end market cap climb just may continue for the rest of 2019.

–Gaalen Engen

Full Disclosure: CUV Ventures is an Equity.Guru marketing client.