After an already success-filled year, CUV Ventures (CUV.V) finally crossed a financial goal line with RevoluPAY.

RevoluPAY, CUV’s subsidiary, processed its first USD $25,000 worth of bookings for Expedia (EXPE.NASDAQ) and Booking Holdings (BKNG.NASDAQ) using virtual credit cards (VCC) Dec. 18. The test run netted CUV three per cent processing revenue, totaling USD $750.

According to their press release, CUV said it was pleased with the initial success of the RevoluPAY system. The added VCC transactions will continue to increase daily after the “clearance mechanism” is shared with B&Bs, small hotels, and other travel players in their network.

2018 highlights

CUV emphasised several highlights from the past year in its Dec. 20 end-of-year communique. From the jump start of its VCC payments, to other partnerships around the world, here is a smattering of other recaps:

1.) RevoluPAY processed first USD $25,000 VCC cards in a single day.

2.) RevoluPAY to receive 3 per cent fees on Expedia and Booking Holding VCC processing.

3.) Top 40 world bank executive visited RevoluPAY’s offices in Barcelona.

4.) RevoluPAY completed software updates to meet stringent two-factor ID authentication required for Central Bank license.

5.) CUV CEO met with five separate major retail consortiums for RevoluPAY app payment acceptance in: Uruguay, Colombia, Guatemala, El Salvador, and Mexico.

6.) Major restaurant chain, present in 11 countries, expressed interest in accepting RevoluPAY.

7.) CUV CEO met with NUKONDO CEO Jorge Brugo to finalize details of RevoluPAY real estate payment DA.

8.) IT team concluded incorporation of major GDS, Amadeus, into upcoming RevoluVIP travel platform.

9.) RevoluVIP to begin allowing pre-launch sign up of first numbered travel club memberships.

Bank Exec

Alfredo Manresa, CEO of CUV’s wholly-owned subsidiary RevoluPAY, met with a North American executive of one of the world’s top 40 banks at RevoluPAY’s Barcelona headquarters. RevoluPAY is currently in negotiations with the unnamed bank to partner on collection and disbursement of remittances in 16 countries throughout the Caribbean and Latin America.

Manresa and his staff also talked about another CUV platform that has yet to be rolled out: RevolUTILITY.

Two-Factor Authentication

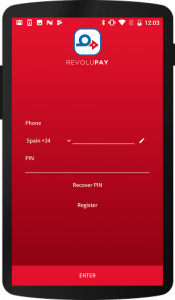

CUV also announced it added security features to RevoluPAY after a need for more security was imposed by the Central Bank. (RevoluPAY is currently awaiting a 90-day statutory approval period.)

The Central Bank requested a two-factor authentication be added to secure accounts in the app. Two-factor authentication could include anything from fingerprinting to biometrics to passwords, to SMS codes to a combination of all four. CUV says the new features will arrive next week.

RevoluPAY Retail

Steve Marshall, CUV CEO, recently met with a bunch of executives representing national retailers from Uruguay, Guatemala, El Salvador, Colombia, and Mexico. The idea is that while remittance transactions in RevoluPAY will have a small fee attached, Marshall said he wants the end user to be able to use the RevoluPAY app to buy products in stores without having to pay another fee—free to use, just like a credit card. Marshall also says his fees for the app will cost retailers a lot less than they are charged for similar credit card transactions.

Major restaurant chain

Emilio Morales, an advisor with CUV, has been talking with a major restaurant chain. The unnamed chain has more than 800 restaurants in 11 countries. The eateries extend to 280 cities in Spain, Italy, Portugal, United States, Mexico, Guatemala, Costa Rica, Dominican Republic, Paraguay, Chile, and Colombia. Here again, CUV wants customers to be able settle their bills with RevoluPAY in all the international chain’s restaurants. If things solidify, then a letter of intent will be signed and a trial run will be put in place in one of the group’s Florida restaurant locations.

RevoluVIP

CUV has also incorporated Amadeus, the largest global distribution system linked to the RevoluVIP platform, into RevoluVIP. The platform is a discount-focused travel platform and seeks to offer the lowest prices for travel-related buys.

RevoluVIP will also start to sell memberships next week in the pre-launch phase of its RevoluVIP Club. Once up and running, the Club will offer members a chance to participate in live trials of the app. These should begin before the end of December, or in early January.

Read more about RevoluVIP.

CUV Ventures in 2019

CUV Ventures has its fingers in a lot of different “tech pies” as they close out 2018 and get set to zero in on 2019. It’s focus remains on online travel, mobile apps, remittances, overseas mobile-phone top-up payments, invoice factoring, blockchain systems, and retail app payment systems.

Full Disclosure: CUV Ventures is an Equity Guru marketing client.