Out of the oil “disaster” of 2018, one junior oil company has found opportunity.

Permex Petroleum (OIL.C) says it took advantage of the tough year by making aggressive moves as the company looks to put itself in the best financial position for long-term growth and sustainability.

“Our team are firm believers of not letting a good disaster go to waste,” wrote Mehran Ehsan, Permex president and CEO. “As such, our company took advantage of the most recent downturns.”

In its annual letter to shareholders, Permex said it assembled a 41 to 100 percent working interest in 6,500 low-cost acreage positions. These are located in the San Andres, Tannehill, Grayburg, Yates, Strawn, and Caddo formations.

“Our entry cost and subsequent leasing efforts continue to be extremely attractive compared to recent public market acquisitions and valuations,” wrote Ehsan.

The letter also said Permex’s acquisition strategy allowed it to obtain “a core holding” in, what Ehsan called, the most desirable oil field in the US. This investment gave Permex a stake in the biggest, “cash-flowing asset” in its portfolio, with gross revenue of USD$160,000 per month.

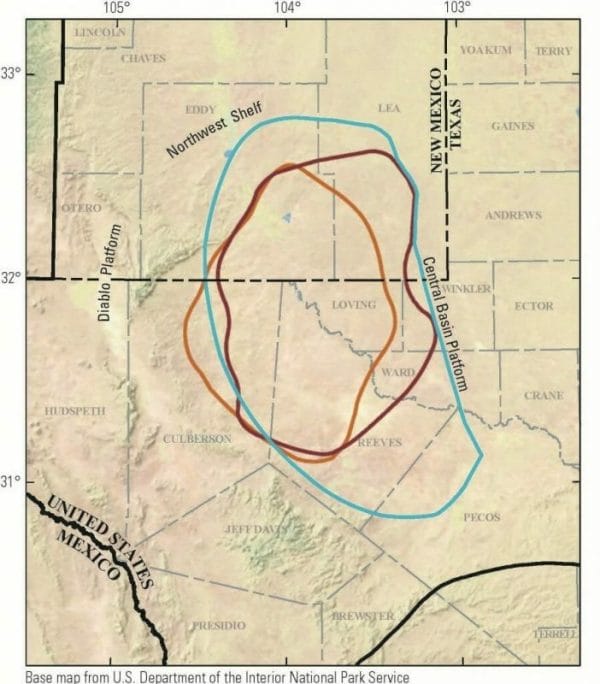

Permex, a junior oil and gas company, has assets in the Texas/New Mexico Permian Basin. The Permian Basin straddles West Texas and southeast New Mexico and includes within it the Delaware sub-basin.

In November, the United States Geological Survey (USGS) released new estimates for the Delaware sub-basin portion of the Permian Basin oil field. They indicated estimates of 46.3 billion barrels of oil, 281 trillion cubic feet of natural gas, and 20 billion barrels of natural gas liquids in the Texas and New Mexico parts of the Delaware sub-basin in the Wolfcamp Shale and Bone Spring formations.

By comparison, the US’ total proven oil reserves is only 39.2 billion barrels.

Year-Over-Year

The company also summarized some of its key numbers measured year-over-year.

- Daily gross production increased by 200% from Q4-17 to Q4-18.

- Acreage position in the Permian increased by 25% from Q4-17 to Q-18.

- Proved plus probable reserves total $142 million* or 9 million barrels of oil equivalent, a 22% increase year-over-year.

- Proved (1P) reserves total $79.5mm* or 4.32mm barrels of oil equivalent, a 72% increase year-over-year.

* All dollar amounts are the present value of future cash flows discounted at 10% before tax derived from YE2018 independent reserve report using forecast pricing in U.S. dollars.

Three priorities

Permex also said it has three priorities—all of which began in 2018—to complete in 2019.

Priority one involves maximizing production by enhancing waterfloods, bringing shut-in wells online and by starting the San Andres horizontal well drilling programs in Gaines County, Texas.

Permex’s second priority involves continuing to tweak and enhance its operational performance and to increase its marketing efforts in order to “see a strong capital market performance and growth” of their stock price.

The company’s third priority will be to increase production of its total barrels of oil equivalent per day.

(These priorities) will put Permex in an organic growth model without external dependencies even at $40 per barrel oil. It will also provide a level of security and sustainability that will benefit our business and, correspondingly, all our shareholders.

We are well positioned to achieve this target in the coming quarters, although new added production will require additional financing, so work will need to continue as it has over the past year to help us reach this goal.

— Mehran Ehsan, president & CEO

That organic growth model Ehsan talks about follows the process: identify, evaluate, and acquire oil and gas assets in North America. Then, Permex can enhance and develop them.

Permex’s stock has continued to slide since they first went public in May. After starting out at $0.60, the stock immediately dipped to $0.50 and then tumbled to $0.39 before recovering to $0.51 in June. By September it was down to $0.34 and by November it seemed to bottom out at $0.20, before rising again. On Dec. 21 it slouched to $0.16 before finally climbing to $0.19 Jan. 7, 2019.

Permex said its year could best be described as “a year of complete shock and awe.”

We had a bull cycle followed by an unpredictable 40 percent drop in oil prices and rather brutal bear cycle within weeks of each other, creating further uncertainty from geopolitics, fundamentals and, yes, our own consumer sentiment.

— Mehran Ehsan, president & CEO

Despite the downturn in oil, Permex said they were able to build some long-term shareholder value because the production costs in the Permian Basin are low. Even the San Andres Formation offers lower-cost production than its fellow Permian formations of Wolfcamps and Bonesprings.

“Thanks to advances in technology, the Permian Basin continues to impress in terms of resource potential. The results of this most recent assessment and that of the Wolfcamp Formation in the Midland Basin in 2016 are our largest continuous oil and gas assessments ever released,” said Jim Reilly, USGS’ director. “Knowing where these resources are located and how much exists is crucial to ensuring both our energy independence and energy dominance.”

State of oil

Ehsan also told stockholders to consider a few points when thinking about oil and gas in 2019.

- OPEC plus Russia has agreed to cut production by 1.2 million barrels a day, as of Jan. 1.

- Ehsan thinks the number of working rigs in the U.S. could decrease by mid-2019.

- He also said he thinks US domestic production will still produce at high levels in the Permian Basin.

- Ehsan said the pipeline capacity crunch in the Permian could disappear by end of 2019, which, in turn, will give room for production in the region to increase.

- He said natural gas prices will probably come down after moving up to more than $4.48/mmbtu recently.

Despite the shock and awe and disaster of 2018, Ehsan thinks things will pick up for Permex and the oil industry in 2019.

“Our number one goal is the long-term growth of the company,” he said. “(Permex) is not a deal, this is a real business on the path to growth as commodity prices balance, within one of the best regions of the world.”

Full Disclosure: Permex Petroleum is an Equity Guru marketing client.