Yah, I know.

Truck phones.

You probably don’t give a fo’.

But maybe you should.

Here’s why: There are currently 12 million commercial and first responder vehicles on the road in the United States.

Most of them still use 70-year-old two-way radio technology to communicate with dispatch, eroding efficiency and driver safety.

Siyata Mobile (SIM.V) is replacing this antiquated status quo with an IoT smartphone that incorporates voice, data and fleet management apps.

What is it? – a business plan scrawled on a napkin?

Not exactly.

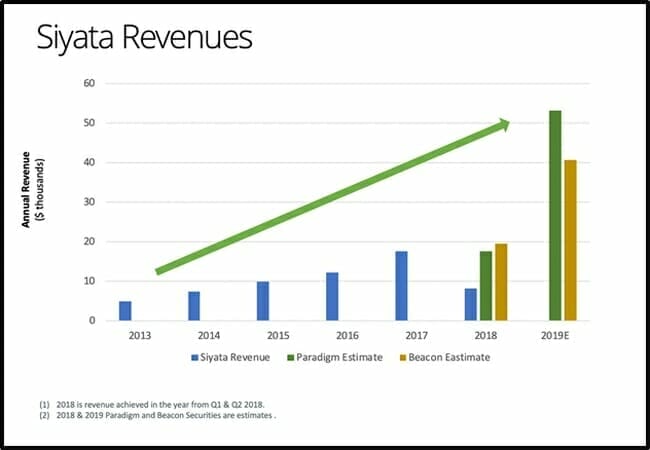

Siyata sold $17 million worth of commercial phones last year in a market a fraction of the size of the U.S market.

SIM announced a deal with Bell Canada three weeks ago, a deal with Motorola last week ago, and US Tier 1 Operator Supply Agreement today for its flagship product, the Uniden UV350.

Siyata is at a tipping point, I’ll explain why in a minute.

But first you need to understand this: operating a fleet of vehicles without commercial-grade communications hardware is like barking group instructions into a wind-storm.

Some of the information gets lost. That can be expensive (for commercial fleets) – or deadly (for first responders).

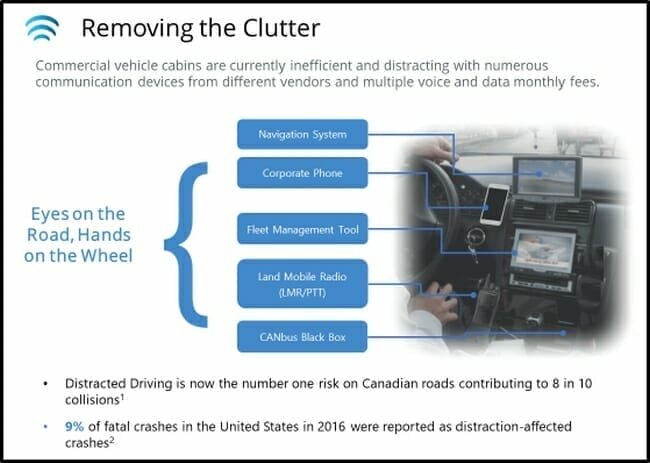

Today, commercial vehicles have personal cell phones, a GPS, 2-way radios, business cell phones, keyboards and multiple SIM cards for dispatch logistics and communication.

In the same way that the consumer flip-phone market was destroyed by smartphones, conventional two-way radio is about to be obliterated by 4G/LTE Push-to-Talk Over Cellular (“PTT”) hardware.

According to a report by Frost & Sullivan, the number of commercial vehicles with dedicated communications technology will double in the next 2-3 years – with most of the growth coming from North America.

Of the 14 million North American commercial vehicles – 80% belong to small fleets with less than 500 vehicles.

Siyata sells an all-in-one ‘connected-vehicle’ IoT smartphones for vehicles targeting the $9.8 billion professional fleet and first responder market.

Siyata’s Uniden UV350 is the first 4G/LTE all-in-one fleet communications device with crystal clear cellular voice calls, Push-to-Talk (PTT) Over Cellular, data applications and more.

Learn more about the UV350 here:

Siyata’s hardware comes with noise-cancelling software designed to perform inside a semi-trailer, crane a 16-wheeler or a police vehicle with sirens running at 120dbs.

The Uniden UV350 was designed specifically for commercial vehicles.

Technology Milestones:

April 2018 – Achieved all major certifications from global partners;

April 2018 – Approvals from Google, FCC, and Industry Canada;

March 2018 – Software integration with North American PTT software partner;

September 2018 – Completed Supply Agreement with Tier 1 Canadian Operator

October 2018 – Completed Logistics and Distribution for Canadian Sales

Pending – Network Approval from Canadian Tier 1 Operator

Pending – Network Approval from two Tier 1 U.S Operators

Siyata’s revenue has increased 300% over the last 5 years.

Revenue:

Beacon Securities projects Siyata’ 2019 revenue increase of 108%. Paradigm Capital projects a 2019 revenue increase of 199%.

Take it with a grain of salt.

Siyata is a micro-cap stock. Inherently volatile. Inherently risky. Don’t play with your rent money.

SIM’s 5-year chart suggests a company that is growing in value.

But let’s not kid ourselves: any micro-cap stock can be obliterated by a force much bigger than itself.

Here’s the skinny: the Push-to-Talk Over Cellular market “was valued at US$ 2.7 billion in 2017,” according to Research Reports, “and is projected to grow to US$ 5.6 billion by 2026.”

Buried in Siyata’s June 30, 2018 Management Discussion and Analysis (MD&A), is the following statement.

“A Tier 1 Cellular Operator in the United States has commenced network certification for the Uniden® UV350, all-in-one 4G/LTE dedicated in-vehicle cellular device.”

Googling “Tier 1 Cellular Operator” – I get the following 4 names: “AT&T, Verizon, Sprint and T-Mobile.”

Network Certification from any Tier 1 Cellular Operators would radically expand the distribution channels for the UV35O.

No shit.

Verizon, for instance, has about 150 million subscribers, and 2,300 retail outlets.

Why would a Tier 1 operator want to carry Siyata’s hardware?

Because it allows them to generate revenue from the inside of a vehicle, something they are not doing efficiently now.

Presumably, the Tier 1 “network certification process” could end negatively – leaving SIM with its current 43% revenue growth rate.

But SIM has a track record of delivering on its promises. Deals with Bill Canada and Motorola were announced – and then consummated. Given this history, today’s Tier 1 Cellular Operator news should be taken very seriously.

“This operator agreement in the U.S. covers all the terms and conditions related to the distribution, pricing, logistics, warranty, legal terms and more.”

We think it’s a game-changer.

Siyata has a current market cap of $44 million – about 2.5X its 2017 revenues.

For reference, Apple (APPL.NASDAQ) booked 2017 revenue of $265 billion – about 4X its market cap of $918 billion.

Truck phones – now you know.

Full Disclosure: Neither Equity Guru nor the writer have any financial relationship with Siyata. In the past, the writer has provided corporate communications services to Siyata’s IR firm. The writer owns Siyata stock.