If you want CBD, which is the stuff in cannabis that makes you healthier but that doesn’t get you stoned, hemp has as much of the stuff as commercial cannabis does. But hemp doesn’t attract mind boggling valuations on the public markets.

On the TSX, 20k sq ft of licensed cannabis in a greenhouse in Edmonton is worth a multiple of what 100k sq ft of outdoor hemp is just outside Edmonton, even though the costs of keeping a field in business are a lot lower than what it costs to keep an indoor pharmaceutical grade grow facility in business.

Hemp gets no respect, at least it hasn’t over the last few years. But hemp is about to have a moment.

THE CASE FOR HEMP, PART 1: PEOPLE WANT IT

My grandmother is in her 90’s, everything hurts, and she uses hemp CBD oil to change that. Couple of drops behind the tongue and she’s good to go. And the old dears at the bingo hall, they’re all taking it now, because she won’t shut up about it and, like, she’s able to walk again.

In my office, I take hemp CBD oil to deal with a host of hard living complaints. So does our Equity.Guru CEO, Daria Grave, and all her family, here and abroad. Our sales director takes it and that’s no small thing, because market guys are usually associated with other forms of self medication. Our writers take it, though mostly if we give it to them for free, because writers are poor.

Wanna know how many of us are buying weed to smoke from a government distributor’s online store?

Wanna know how many of us are buying weed to smoke from an LP directly?

Wanna know how many of us are buying weed to smoke from dispensaries?

Wanna know how many of us are buying weed to smoke from a dude behind the dumpster behind the pub?

We, the people, the majority of the people, the older, kid-having, not-wanting-to-trigger-a-drug-test folk, the thinking about our RRSPs crowd, the sweatpants at 11pm in the frozen food aisle at Safeway types, we don’t want to blow our minds when we get home from work.

Bongs make us roll our eyes, dates who need to smoke a bowl before they get out of bed make us skeezy, guys with ‘legalize it’ t-shirts make us cross the street to avoid a conversation, and Jodie Emery banging on about how she should be able to own the industry while her husband dabs himself into oblivion makes us go inverted in the pants.

Weed, as a smokable product, is ass. It’s not the best way to get healthy, or even high. It’s stanky, skanky, it doesn’t keep, it’s work to prep, it’s messy, and it doesn’t get us laid anymore because we’re a long time out of college.

CBD, on the other hand, makes us sleep better. It helps us deal with blood sugar. It lowers stress and triggers bodily systems that we want triggered. CBD is great, because we can ingest it, drink it, eat it, pop it, and go on being adults without finding ourselves buying four flavours of Doritos at 7/11 at 4am on a Tuesday.

CBD is THE FUTURE.

And the evidence of that is, the first things that sold out of Canada’s government weed stores online on Weed Wednesday were EVERYTHING THAT IS HIGH CBD.

We’ve found something else in the early data, and it’s something the LPs have clearly not seen coming: High CBD products, which number about one in every fifteen strains listed, are almost entirely sold out, across the country.

The BC provincial online store is just about out of CBD-dominant strains, while their 1:1 blends are also selling out more quickly than anyone expected. The Government of Canada specifically advises consumers to smoke 1:1 blends, but they almost certainly never thought we would actually listen.

In Ontario, the only CBD-dominant strains that ARE in stock start at $13.85 per gram – showing that nobody wants to get ripped off AND listen to what the Government says. The price-competitive options are either sold out or will be by the end of today.

Now, let’s be clear, before the enthusiasts start throwing rocks at us, that high CBD products are more effective if they have some THC to trigger the proper bodily reactions to it. There’s no doubt that’s a thing. It’s science, and I’m not saying that ironically.

But grandma? She doesn’t want the THC because she’s already uneasy on her feet, so she’ll take 85% good and clear-headed over a bowl of tasty nugs and a stack of rolling papers.

I don’t want it because I don’t want to trip a drug test. My mom doesn’t want it because it makes the act of buying it a lot more complex than ‘have Amazon deliver it’ (NOTE: If you want to try CBD products extracted from hemp oil right now, Amazon sells the stuff legally. You don’t need to wait for epic legislative change, you just need to deal with your understandable concern over spending $100+ on products that look hand labeled).

THE CASE FOR HEMP, PART 2: IT OPENS UP THE PLAYING FIELD

If all there was in the world to make people happy and healthy was weed, I’d be buying Canopy Growth Corp (WEED.T) and Tilray (TLRY.Q) stock at a heavy rate, because they have lots of money and a head start on that sector. But their continued mega-success is only assured in a closed loop, where competitors have to spend tens of millions to get licenses and build massive grow facilities and raise hundreds of millions to catch up.

In an open field – literally, an open field, perhaps in sunny central Alberta, any old farmer can go grow him or herself some industrial hemp and get into the game.

59-year-old Alberta hemp farmer Brian] Rozmahel said he expects more conventional farmers in Alberta will embrace hemp, because it has a good economical return, is resilient and is resistant to diseases such as clubroot.

“Someone just dropped gold in the Klondike and word got out … there’s all sorts of people rushing thinking they’re going to make millions,” he said.

It’s not as easy as just sticking some seeds in the ground and letting the sun do it’s thing. Though hemp is easy on the soil and grows in low water situations and keeps pests down and has multiple uses, for a while there, the government refused to let farmers use everything they grew.

The Regina Leader Post:

Prior to the Cannabis Act, there had been no focus in industrial hemp on producing strains with higher levels of CBD, which creates a stickiness in the plant that is not favourable for harvest by combine.

As of August 10, 2018, though, “farmers were allowed to harvest the flowering head material and store it on their farms,” [Canadian Hemp Alliance Executive Producer Bill] Haney says. Effective October 17, the Canadian market for hemp fractions opens its doors, allowing hemp farmers “to sell [these plant materials] to licensed marijuana producers,” he says.

“Now, as an industry, the seed breeders are looking at adjusting the genetic capabilities of strains to produce more resin that contain higher levels of CBD, without the accompanying THC,” Haney reports. For hemp producers to extract the CBD from the plants themselves, though, they must undertake the rigorous process of becoming a licensed marijuana producer. Already, the country is witnessing commercial partnerships forming between hemp producers and marijuana producers in a bid to realize mutual benefits.

After years of Canadian hemp farmers being only allowed to sell part of the plant to those who wanted it for products, now things have opened things up markedly. That’s a good thing for a local population that had been raised on oil development and exploration, and needs a new industry to embrace.

The Toronto Star:

“The first field of hemp that I grew, because it does look like marijuana, there was sort of a rebellious streak to me that went, ‘Wow, look what I’m doing!’” Rozmahel said from his farm in Viking, where he grows almost 400 acres of hemp plants. “People still stop on the highway and take a selfie.”

But new federal laws mean Rozmahel doesn’t have to situate his fields one kilometre away from schools and churches, and he also has a new revenue stream because he can sell the plants and leaves to cannabis producers.

Like?

Aurora Cannabis (ACB.T) is leading the way with its 800,000-square-foot facility near Edmonton International Airport, but there’s another cannabis-related venture that hasn’t been made public that county officials say will create 300 jobs. In the last year alone, Leduc County has approved four development permits for cannabis-related uses — two for production facilities and two for retail facilities. Three of those permits involved property purchases.

Other cannabis-related companies operating in Leduc County include: Inkubate Packaging, which makes packaging from hemp; Radient Technologies (RTI.V), which extracts CBD from raw plant matter; and HempCo (HEMP.V), which is currently building a 56,000-square-foot production facility. It will be the largest such facility in the country.

No, it won’t. The competition for ‘biggest hemp production facility in the country’ is heating up.

But we’ll get into that in a second.

This shift toward treating hemp like the upside-abundant product that it is, is already being seen in the increase in the number of companies using it in other products:

ST. JOHN’S, NL – Newfoundland’s Storm Brewing has announced the return of a long-gone beer that is back thanks in part to the recent legalization of cannabis. Hemp Ale (4.5% abv) – known locally as “Weed Beer” – was a flagship brand for the brewery in the late 1990s, until it was discontinued in the early 2000s due to the difficulty in sourcing good quality hemp seeds to use in the brew.

But with availability of that key ingredient now much improved, the brewery decided to bring it back for a limited time.

The rush right now, as far as it pertains to hemp, is not to grow a lot of it outdoors (that’s truly an agriculture play, and will commoditize quickly as imports become a thing).

And it’s not to breed seeds: That field is set:

Canada’s current hemp industry consists of “about half a dozen major certified seed producers, all required to be members of the Canadian Pedigreed Seed Growers Association,” Haney says. The bulk of commercial hemp growers are in Alberta, Saskatchewan and Manitoba, including Fresh Hemp Foods in Winnipeg, Naturally Splendid (NSP.V) in Pitt Meadows, BC, Hempco, which has already attracted investment from Aurora Cannabis, and Hemp Production Services in Saskatoon.

And it’s not in hemp research: Though Canopy slapped down crazy money recently on that front:

Canopy Growth Corp. has signed a deal to buy Ebbu Inc., a Colorado-based hemp researcher, in a stock-and-cash deal worth more than $425 million.

Under the agreement, Canopy will pay $25 million in cash and issue 6,221,210 shares to Ebbu.

The company will also pay up to an additional $100 million if certain scientific-related milestones are achieved within two years of the deal closing.

And it’s not even to process the hemp into usable products; any LP with extraction equipment, or a partnership with someone else who has extraction equipment, can get in that business.

Emerald Health (EMH.V) has been at that.

A B.C. company recently announced the purchase of just over 200 hectares (500 acres) of harvested hemp flowers and leaves (chaff) from P.E.I. Chris Wagner, CEO of Emerald Health Therapeutics, says the transaction was possible because of forward-thinking farmers.

Until recently, it was only legal to harvest, store and sell the seed, fibre and stalk of the hemp plant. The flowers and leaves were not permitted to be harvested or sold, and would go to waste.

“What these farmers did was say ‘We’re going to take a risk,'” Wagner said. “The farmers said, ‘We’re going to set up our equipment and set up our facilities so we can harvest and store the flowers.'”

No, the big opportunity right now, and it’s a SERIOUS opportunity, because there’s not enough hemp out there, and that which is out there is largely not CBD-ready, is supply deals.

That is, finding the seriously great high CBD stuff from producers who can grow a ton of it, and getting an agreement to have it supplied in large numbers, exclusively, going forward.

If you want to match an LP in terms of potential sales, and you don’t want to put $120m into building a building, go buy up all the good hemp and start a-sellin’ it to my grandma.

How does one become the Canopy Growth of hemp?

First, you need the hemp:

LIVEWELL CANADA INC. has secured 1,000 acres of Canadian industrial hemp biomass for the purpose of extracting and producing cannabinoid-based products for distribution in Canada. Using current extraction technology licensed to Livewell, the company anticipates extracting approximately 25,000 kilograms of CBD for sale under the Access to Cannabis for Medical Purpose Regulations. It is expected to be harvested in mid-August, 2018, and brought to market in 2019.

Then you need the ability to turn it into health products:

Livewell Canada Inc. has signed a binding letter of intent (LOI) to acquire 100 per cent of Acenzia Inc., a leading developer and manufacturer of next-generation natural health products located strategically near the Canada-United States border near Windsor, Ont.

Then you need someone to sell those products to:

Livewell Canada Inc. has signed its first cannabidiol (CBD) supply agreement for a minimum annual purchase commitment of 5,000 kilograms of CBD isolate at a price of $7,000 (U.S.) per kilogram over the next 12 months. This minimum volume represents approximately 20 per cent of the initial expected CBD supply to be extracted from the industrial hemp biomass secured by Livewell as announced in an earlier release dated Aug. 13, 2018.

Then you need the ability to sell it on a wide scale:

Livewell Canada Inc. has partnered with Vitality CBD Natural Health Products Inc., a Canadian CBD (cannabidiol) company, to sign a binding term sheet with Global Wellness Distributors LLC, a Nevada entity controlled by a U.S. private equity firm, for the supply of cannabidiol (CBD) wholesale products in North America.

Under the term sheet dated Oct. 27, 2018, which covers a period of 15 months with an option for four renewable one-year terms, Global Wellness commits to distribute CBD isolate, distillate and full spectrum CBD oil. At closing, Global Wellness will pay a $3-million (U.S.) deposit to the suppliers for the initial CBD supply. Commencing in January, 2019, Global Wellness will distribute a minimum quantity of 1,000 kilograms per month.

Now, it’s true that others out there are buying up hemp and turning it into CBD products, but there’s hemp and there’s hemp. The good CBD hemp, the stuff you want because CBD is the point of the exercise and not making paper products, that’s a sticky, resinous plant and farmers hate it because it gums up their combine harvesters.

That’s why some of the deals you’re seeing, of LPs buying up hemp, involve heavy wording around hemp flower, as opposed to the whole plant. Because scything the tops off your hemp plants is easy. Using the rest of the hemp plant, which is where you’ll make your money – that’s hard.

Livewell knows this, and so it’s plan is to grow a boatload of hemp indoors.

That’s a good plan. Heck, it’s a great plan. And it’s why Canopy Growth Corp, with its multi billion dollar valuation, bought into Livewell through its Canopy Rivers venture arm.

LiveWell Canada Inc. has completed the initial phase of the Artiva facility in Ottawa for licensing. In co-operation with its partners, Canopy Growth and Canopy Rivers, the company has prepared its confirmation-of-readiness package for submission to Health Canada to demonstrate its compliance with the Access to Cannabis for Medical Purposes Regulation (ACMPR) security requirements, for the purposes of obtaining a production licence.

[..] The Artiva facility is strategically located in the nation’s capital in Ottawa, Ont. The property sits on 100 acres of land with 540,000 square feet of existing greenhouses and 200,000 square feet of hot houses.

How into hemp is Canopy right now? Really kinda a lot.

Canopy Growth Corp. has entered into an agreement to acquire the assets of ebbu Inc., a hemp research leader based in Evergreen, Colo. The transaction will complement and accelerate multiple core verticals operating under Canopy Growth’s group of companies.

Intellectual property (IP) and research and development advancements achieved by ebbu’s team apply directly to Canopy Growth’s hemp and THC-(tetrahydrocannabinol)-rich cannabis genetic breeding program and its cannabis-infused beverage capabilities. In addition, ebbu’s IP portfolio will contribute to the clinical formulations program being executed by Canopy Health Innovations, a wholly owned subsidiary of the company. Canopy Growth operates a rapidly emerging, field-scale hemp operation based in Saskatchewan and by applying ebbu’s IP, the company has the potential to vastly reduce the cost of CBD production, a sought-after cannabinoid in both the wellness and medical spaces.

Canopy will pay $25m in cash and issue 6.2m shares (good for CAN $396m today) to ebbu for their assets. That’s a MASSIVE commitment, and if you like putting two and two together, would indicate that Livewell, as it nails milestones, will be a potential takeout target for the big mega-weed player.

LVWL’s market cap is $123m. After it just closed its $4-$5 billion investment by Constellation Brands, we think WEED.T could take LVWL out with its catering budget.

https://equity.guru/2018/10/29/livewell-lvwl-v-bets-cbd-not-avocado-toast/

ENTER HERITAGE CANNABIS (CANN.C):

Heritage Cannabis gets no love from the market because, for a while, it didn’t do much to tell its story to the retail investor.

That’s changing, and it’s about time, as they’re starting to look real good. They just acquired a second ACMPR license and facility (Cannacure Corp, it also has 75% of PhyeinMed Inc.), and then there’s this; their hemp plans are not small.

Heritage Cannabis Holdings Corp. targeted subsidiary Purefarma Solutions Inc.’s Saskatchewan-based joint venture partner, has completed harvesting over 1,000 acres of hemp and is on schedule for the full 1,600 acres planned for this year. Once the full harvest and quality checks are complete, Purefarma expects to take delivery of 1,100 acres of x-59 and 500 acres of Canda strains.

Purefarma, based in Kelowna, BC, is a manufacturer and wholesale processor of premium CBD oils with $2m in revenues last year.

Heritage isn’t messing around. They’ve quickly amassed some genuine assets but their market cap is STUPID.

For $47m, you get two LPs and an oil processor that was valued at $150m just nine months ago.

In 2015, that’d be a half price deal. Today? It’s 75% off where it should be. And if it doesn’t experience an adjustment on the market soon, through increased buying, someone is going to acquire it FAST.

Ascent has expanded hard into the US and just announced a hemp strategy that comes with a supply deal out of Kentucky.

Under the terms of the supply agreement, AgTech will supply up to 25 per cent of its hemp biomass production containing greater than 10 per cent CBD to [Ascent subsidiary] Thirty Eight Hemp, either in the form of biomass or extracted CBD, with no minimum amounts required to purchase. In addition, the company will increase its ownership interest in AgTech to approximately 10 per cent, subject to appropriate approvals being received, by investing $500,000 (U.S.) in AgTech.

Furthermore, AgTech and Thirty Eight Hemp plan to enter an arrangement whereby AgTech will assist Thirty Eight Hemp with the distribution of various CBD and other hemp-derived products in approved jurisdictions in the United States, while Ascent will provide certain expertise and intellectual property to help AgTech with building its next hemp processing facility in Kentucky.

AgTech plans to grow 4m+ hemp plants next year by adding more farmers to the AgTech supply chain, and through its 30k sq ft facility. The processing facility Ascent will be helping with is going to come in at 50k sq ft.

As The Hemp Act works through US lawmakers, Kentucky is going to be VERY important. Having had decades of tobacco farming dominate the region, there’s a definite desire to transition to hemp, and a lot of work has been done in the state to ensure it’s front of the line when the laws allow them to go full speed ahead.

But there’s another wrinkle in the industry that makes Kentucky a potential hub of the US hemp industry: Other states don’t want it.

Ascent COO Reid Parr tells me, in places like Colorado and Oregon, cannabis growers lobbied lawmakers to run hemp growers out of town.

“Traditonal hemp farmers grow for seed protein, and so just plant seed in the ground and, in time, males and females grow together,” says Parr. “The males fertilize the females which produce seed instead of flower. They give off a small amount of CBD and there are small amounts on the male plant.”

That growing style isn’t like cannabis, for which growers keep male plants out of the process entirely. In fact, Ascent sells a kit to growers to help them ‘sex’ their plants, so males can be removed before they spoil the females.

When hemp got legalized in 2014 in the US to be produced and sold for research, that saw a few new states come online in Colorado, Kentucky, and Oregon.

Says Parr: “We’re in Oregon and could apply to buy from hemp farmers for our processing needs, but the regulations were very in favour of cannabis farmers who grow outdoors and restrictive of hemp, because the cannabis lobby wanted hemp farmers far away so they wouldn’t inadvertently fertilize their cannabis fields, which want flower above all else.”

In Colorado too, lawmakers were averse to letting the hemp business spoil their burgeoning cannabis business.

“They basically moved the hemp business into greenhouses,” says Parr. “Kentucky is interesting because it’s the tobacco belt and before the 1930’s, it was all hemp production. So you have a well respected agriculture research program at the University of Kentucky, a huge equine industry, decades of tobacco cultivation, so everyone’s a farmer out there. There was a lot of conversion from tobacco to hemp when the laws allowed it, and lots of resources to help those farmers grow CBD rich flower. Genetics have been developed, regulations have been developed – and there’s no legal cannabis industry. In Kentucky, you get the highest quality genetics and the best growing environment naturally in fields.”

How good are those genetics?

“We’re talking 15-20% CBD while still keeping the THC levels below the legal threshold.”

Ascent’s deal will bring them the best hemp available in the US, and in exactly the strains that they’re looking for. No garbage, no pretendsy CBD, no vape filler. They’re looking for pharma-ready feedstock, and they’re going to get it.

“Whether those deals you’re seeing floating around for hemp purchases in Canada are good or not, really relates to where you want to sell your end product,” says Parr. “If you’re exporting to Europe and it has to be GMP certified, you need to be buying input material from a GMP certfiied supplier of CBD input material. If you have a GMP certified facility, you can certify your product and sell it into the pharmacy distribution networks of Europe and/or Canada.”

“Our deal opens us up from just selling to dispensaries to selling across the USA, online, and producing on a larger scale into, say, a Whole Foods or Walgreens.”

Locking up Kentucky, and ensuring they have the sort of hemp, at a large scale, that can actually be turned into quality CBD products in the US and Europe – and for a ridiculously lower production price than is seen in Canada – is a gamechanger.

And if you think Ascent is a blow-in on the hemp scene, that they all of a sudden decided it’s hot and glommed on like a Kardashian to an NBA tour bus, guess again:

The company’s wholly owned operating subsidiaries in Oregon and Nevada are legally permitted to handle hemp and are presently selling CBD-based products in those jurisdictions. When the Hemp Farming Act has been passed into law, Thirty Eight Hemp plans to produce and distribute CBD and other hemp-derived products throughout the United States and abroad, which will significantly expand the company’s hemp distribution.

Understand what you’re seeing here: We’ve watched Canopy hit the billions range in market cap, almost entirely based on the Canadian market and their ability to be the boss at the table.

But hemp, and hemp in the US? That’s a reset. We’re all starting from scratch there.

While Emerald Health is bragging about buying some flower that Vancouver Island hemp farmers have been saving for a rainy day, Ascent is bulldozing into the US and locking up a major supply deal in a major agri state, with a group that is leading the pack and helping that state write its new hemp laws.

Right now, there is a lot of hemp around, but most of it is rubbish when it comes to CBD needs. It’ll make paper, bricks, clothing, you can sprinkle the seeds on your Corn Flakes and get a nice vitamin boost, but it’s not oil ready.

As an example, if you go on Amazon to find the hemp oil products available now, they’re pretty amateur hour – and notably absent of the letters C-B-D.

So this landscape is far from set in stone, and while the cash Canopy has at hand can buy its way in pretty much anywhere, it’s still really limited in what it can acquire and hold in the US, by virtue of TSX rules that Canadian weed companies listed on that exchange can’t hold assets in the US that aren’t abiding by current federal law.

Admittedly, Canopy is pushing up against that. Ditto TGOD, which used a venture arm to take a piece of the just public California edibles play Plus Products (PLUS.C) that it has since spun off.

One company has pioneered the CBD products business earlier that most, and though it doesn’t come without issues, it’s just about the only global brand out there.

When I asked Ascent’s Parr if he thought any of his competitors were getting it right in the hemp/CBD business, the only name that sprang to mind for him was Isodiol.

Ascent has a supply deal with Isodiol, which has a long roster of products and acquisitions from around the world and has done serious revenues as a result.

“Isodiol has really figured out how to build good revenues and done some good deals,” says Parr. “They’ve had some struggles as a public company [Editor’s note: Yes they have] but acquiring BSPG Labs in the UK was a good move. We’ve been buying CBD crystalline from them for a while and they can’t produce enough to satisfy demand. They’ve got a deal in California as well, and the new farming act will allow them to provide more material. that makes them better positioned to get into Europe and producing GMP certified product.”

For Parr, that puts them in a very unique place when it comes to what happens when big pharma finally enters the market.

“There are a number of non hemp companies, very large agricultural companies, starting to look at hemp, and companies like ourselves and Agtech, and Isodiol, are definitely having conversations with those sorts of companies because they’ll be the ones to help us get to the next stage quickly.”

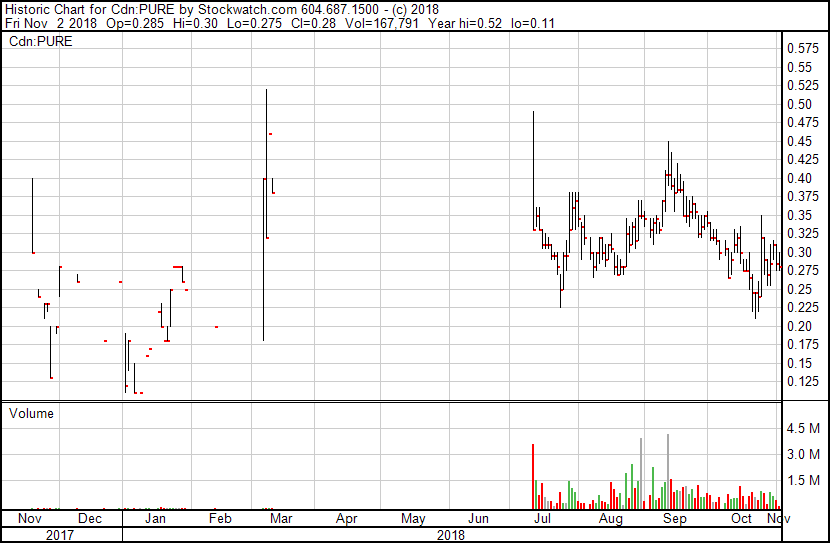

Isodiol is a rehab project on the public markets right now, having blown large amounts of money on consultants and having been at one time suspended by the CSE (not an easy thing to do) as they struggled to restate financials.

A year ago, the stock traded at ten times it current value and was a frequent rock thrown at me by long holders, yelling at me for not covering it more.

But sometimes a company continues to find a higher altitude, even though its engines have been cut. When Isodiol started to be asked hard questions, the answers weren’t good and it crashed hard.

Around a month ago, they came to us and asked if we’d work with them to get the word out on their rebuild.

We said no. We wanted to see improvements. A long term business plan. A lift in the stock. New deals that moved away from snapping up brands willy nilly and towards deals with other LPs, that would give them a piece of everyone else’s deal.

They delivered.

“Given the growing global awareness of CBD and the company’s belief that the 2018 Farm Bill is bound to pass in the United States, which will also bring clarity to the legality of hemp-derived CBD, we believe the expansion of our Florida bottling facility positions the company to further capitalize on this emerging segment of the beverage industry,” commented Marcos Agramont, Isodiol International’s chief executive officer. “This expansion will increase our bottling capabilities and expand our product offerings to our sales channel partners.”

There’s more:

Isodiol intends to import CBD isolate to the following companies:

- Up to 30kg per month to Nuuvera Holdings Limited.

- Up to 5kg per month to Agrima Botanicals Corp. (Ascent Industries)

- A minimum of 3kg per month to Zenabis Ltd.

- An undisclosed amount to Sundial Growers Inc.

- An undisclosed amount to Pure Global Cannabis Inc.

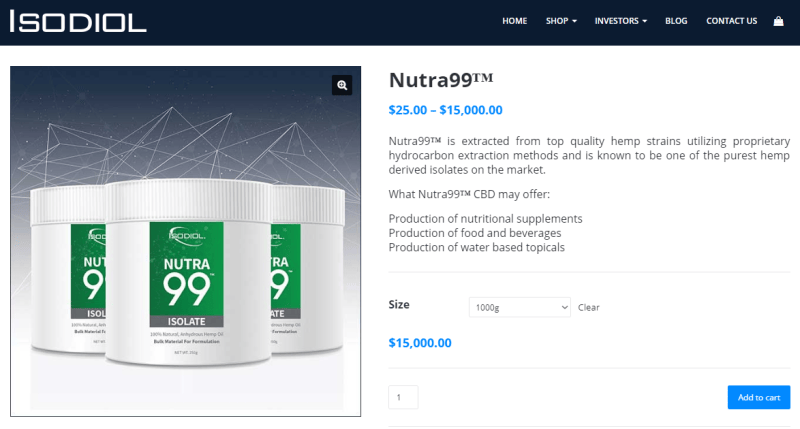

You can buy some of that isolate for yourself, if you want.

The company isn’t out of the woods chart-wise just yet, but I like today’s market cap of $84m, on $9.2m revenues in the last quarter. If management have heard the huon cry over how they spend their money and are focused on making the next quarter a consultant fee-free affair, there may be coiled spring to come.

https://equity.guru/2018/10/23/isodiol-isol-c-selling-hemp-like-going-style/

What is Pure going to do with the CBD isolate it buys from Isodiol? Well, it’s going to turn it into medical products designed for the pharma industry.

Right from the front page of their website:

The foundation for all pharmaceutical applications and adult-use products are cannabis concentrates. Our 18,000 sq. ft. facility is equipped with GMP standard clean rooms to produce innovative and proprietary extraction formulations.

That’s right, they’re GMP ready, with similar plans to what you see out of Ascent. Forget vape cartridges as a growth plan, look to the potential of selling pharmaceutical and natural health products to the other 95%.

Those wellness products at the end of the line? That’s where Pure wants to start, because it’s where the planet becomes a customer. Their Isodiol deal helps them start on that route, but the market still doesn’t see them.

$41m market cap? Bargain.

ENTER GREEN ORGANIC DUTCHMAN (TGOD.T):

I’m tired. This has been a lot of research and writing. TGOD bought a massive European hemp player. It’s also trading at a bargain 1/3 of its price from a few months ago, because a bunch of free trading paper just came available. I took advantage of that and bought more.

Here’s a video.

— Chris Parry

FULL DISCLOSURE: TGOD, LVWL, ISOL, CANN, ASNT are all Equity.guru marketing clients. We own stock in some. Pure Global is not a client but the author has acquired stock in the company.

No mention of Crop?

Ascent is not a client or any stock held by EG staff? Maybe you missed that one in your disclaimer or just a pro-bono pump?

right you are.