The footy season has wrapped up in Oz and things ended the way they should according to the laws of the Animal Kingdom. The Eagles beat the Magpies and the Roosters took care of the Bunnies.

Investors, however, are likely to be focusing on another type of mauling with world markets painted bright red over the past 48 hours.

On Thursday 11th October, the Aussie market got a proper ass-kicking, the XJO down 166 points or 2.74%. To be expected after US markets imploded the night before. As the saying goes, when the US sneezes, we (the Aussies) catch a cold.

As we go to press, further falls on US markets mean more pain for ASX bulls come Friday’s open.

Just a matter of weeks ago we told you here on The Fumble to take care during what is often a tricky part of the calendar – those eight or so weeks between the start of September and the end of October.

Yep, turned out that mini tech-wreck was the proverbial ‘shot across the bow‘.

It’s easy to make a call after the S&P has shed 100+ points – much harder to look for the signs that it is likely to happen beforehand.

While the world’s richest man gave his employees a pay rise, anyone who’s still holding Amazon (AMZN:NASDAQ) stock after it hit USD 2,000 a share has taken close to a 15% hit. 😮

Part of ‘protect ya neck’ – is getting out of the way of trouble and having some cash in the coffers so you can take advantage of market ‘fire-sale’ prices when they come along.

If your portfolio is showing some nice profits thru 2018 I’d suggest this is as good a time as any to think about taking some dollars off the table.

Turns out we were ahead of the curve, noticing things others had missed, and sharing those nuggets with our readers.

This theme has played out a few times recently – let’s take a closer look, eh.

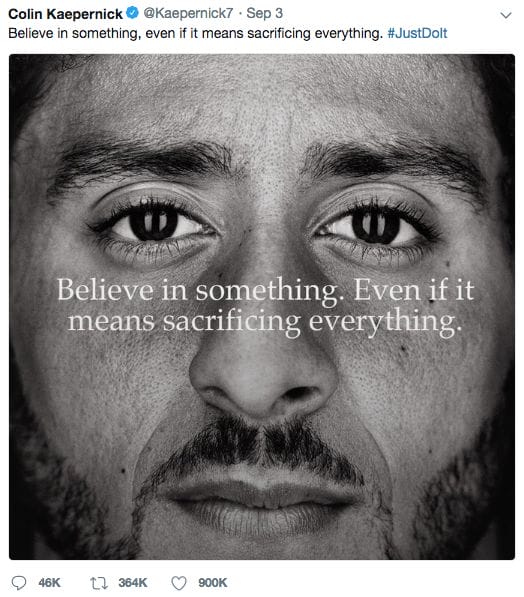

Nike hits new highs after Kaepernick tells us to believe

Nike (NKE:NYSE) seem to have mastered the knack of marketing to Millenials if the recent press is anything to go by.

While Colin Kaepernick (ex 49-er, activist and architect of “taking a knee”) is a divisive figure that didn’t stop NIKE from recently roping him in to spearhead the “Believe in something” advertising campaign.

Trump was quick to fire out a tweet against the company, causing a mere down blip before Robinhooders stampeded the stock, adding it to their portfolios in droves.

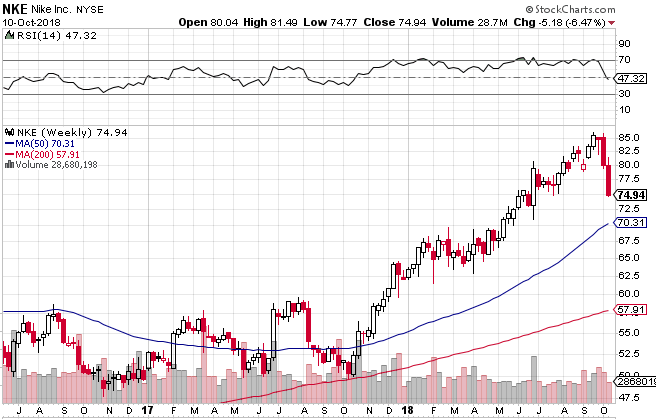

The chart tells the story, with the stock running from the low 50’s to the low 80’s over the past 12 months, peaking at 85 bucks and change (an all-time high) before the recent market swoon.

As is the case these days, 1000 memes would quickly follow.

We hear ya dude! Time for a White Russian.

We’ve just lost the Scientologists. Oh well.

Hey Tom, when is the Top Gun sequel coming out? #justfilmit

On Branding

Equity Guru’s Chris Parry has been banging on about branding, especially in the weed space, for a few years now.

Brands, brands, brands: You want ’em, we got ’em, but some aren’t what you think

He’s pointed out the parallels between weed and brewing, saying “Nobody became a billionaire growing barley and hops for Anheuser Busch after prohibition, but that company sure did okay by buying commoditized barley and hops and developing their brand and selling distributorships and dominating the retail space.”

While you might not own a pair of Nike’s (I’m a New Balance guy myself, mainly due to having a wide foot and a lot of trouble finding a decent fitting pair of sneakers), if someone asks you to name a footwear company you’re highly likely to blurt out Nike because no-one knows what happened to Reebok and Bata isn’t cool.

Crude powers ahead in 2018

It’s been a good few years for black gold.

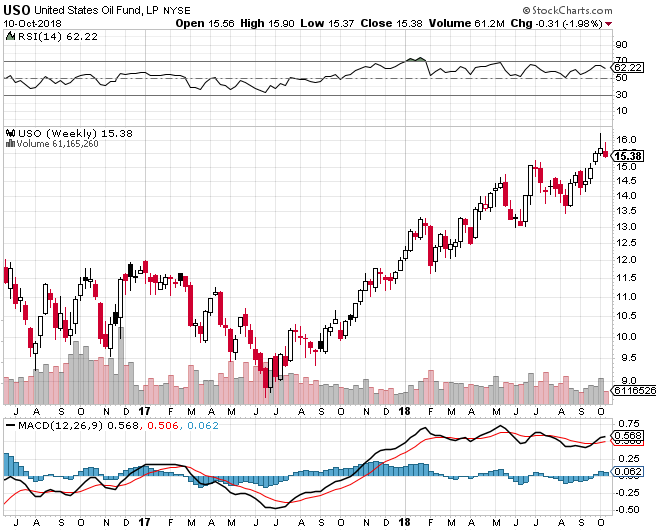

Take a look at the chart below – it’s USO, one of the big oil ETF’s which tracks the price of various oil futures contracts

Nice uptrend, which has converted many disbelievers, your scribe included.

Again, here at Equity Guru we were quick to catch the change in trend and the subsequent opportunity.

What’s next? Don’t laugh, but oil and gas… I said, don’t laugh!

StocksDigital not happy

Seems StocksDigital are crying foul that some of their competitors aren’t playing nicely.

We called them out in late February 2018 exposing the labyrinthian connections between StocksDigital, Finfeed and S3 Consortium Pty Ltd.

The Australian Financial Review ran a piece on 21 September 2018 about small-cap companies paying to be spruiked. To some degree, they were playing catch-up to us here at Equity Guru.

The article named a number of conspirators, amongst them StocksDigital, a Melbourne-based outfit who, according to their website will help clients to “Effortlessly attract, grow and engage a long-term investor audience.”

According to the AFR, StocksDigital went as far as writing a letter to Scott Morrison (now Australian PM), in an attempt to sic the corporate regulator ASIC on competitors, stating:

Businesses such as ours who are disadvantaged in the marketplace by the same unauthorised and unlicensed persons. These persons continue to offer and promise ‘Riches’ to investors with seeming impunity,” wrote StocksDigital in the letter.

Phew, that’s not us! We don’t promise anyone riches, just try and help investors to better navigate the stormy seas of the small-cap space.

These days anyone can spin up a $30 website and try to charge thousands of dollars to promote a stock with little accountability to either investors or the companies.”

Thirty bucks, eh. We’ve spent a little more than that here at Equity Guru and hope it shows.

We challenge anyone to stop by the StocksDigital website, imagine yourself being a prospective client and work out where your articles will actually appear.

And finally

Those looking for a Friday funny last week weren’t disappointed.

Cops have often used Twitter to name and shame offenders but when WA based Bruce Rock Police fired off this Tweet the public was quick to point out that the contents of crime seemed to be actual grass clippings which we believe are still perfectly legal in Australia.

–// Craig Amos

FULL DISCLOSURE: None of the companies listed here are Equity Guru marketing clients.

(feature image courtesy of giphy.com)

.