Jesus crap on a pogo stick, you people never learn.

So last week, right when we said it would, the weed market began to prolapse. And on social media all I heard was, “This is a great time to buy on dips.”

Early this week, it kept rolling downhill, and on social media all I heard was, “Why is this happening? These companies have so much potential. HODL!”

Yesterday, the drops became hard drops, and yet I still saw people saying, “Great time for value buys.”

STOP IT. Let the stock promoters do the pumping. Just because you bought a stock does not mean you have to wear the t-shirt. It doesn’t mean you’re “ACB 4 LIFE!” It’s just a thing you bought that is worth less today than it was yesterday, and even if you love it, if it’s going to be worth less tomorrow, sell the fucking thing already.

Look, I love the weed space. There’s going to be SO MUCH MONEY made there. But I’ve maintained since 2014 that the fat money won’t be in farming, because it NEVER IS, it’ll be in branding and value-added product development and retail.

Nobody became a billionaire growing barley and hops for Anheuser Busch after prohibition, but that company sure did okay by buying commoditized barley and hops and developing their brand and selling distributorships and dominating the retail space.

Who will be the Budweiser of weed? Who will develop the sales network that infiltrates Loblaws and who will develop the CBD capsule that becomes the equivalent of ColdFX?

If you HAVE to be in weed right now (and you don’t, but let’s say you do for the true believers), there are places to be that aren’t bleeding deep red. They’re down a little, but they’re reasonable.

CannaRoyalty (CRZ.C) has been on a decent run and has their mitts in all sorts of nice verticals. If one of the 25 or so pops, that story has a nice ending.

Organigram (OGI.V), which I’ve long had a hate on for and has done so many things wrong, didn’t have nearly the run of other LPs in December and, with a sell off over the last week or so, sits at a very reasonable (in acquisition terms) $450m market cap.

Nevada-based Friday Night Inc (TGIF.C) came late to the party and this didn’t get quite the lift of other deals, but has had all the sell-off. Brutalized would be the word I’d use. That makes for a sensible entry.

You’ll note we don’t have marketing deals with any of those companies and I haven’t put forward any of our marijuana clients as ‘must buys’, and that’s because we’re not a pump house.

DOJA/Tokyo Smoke AKA Hiku (HIKU.C) had a great run and is being a little torn up in the sector drop. I still hold some and would love it if you all bought it so I can retire, but that’s not your best option this week. To that end, I’ve sold most of my stake over the past week, as I said I would. I’ll buy back, but not today, friends. Love Team Kitsch, but if they’re smart they will have taken some of their own stock off the table last week because it’s been an amazing run and recalibration is needed.

Invictus MD strategies (IMH.V) is also a great company, and a client like Hiku, and I like its chances of generating profits going forward. But if you bought it today you’re gambling, because the market is scared and it may drop further next week. Again, good company, bad time to snatch at falling knives.

Abcann (ABCN.V) is a great company and also a client doing great things, and if you followed our call that it was undervalued, as was IMH, and DOJA, when we said they looked like outperformers (a day before they all shot up), you did outstanding. If you sold it last week when we said it and the others were nearing their top, you’ll love the drop it has had since.

I know that company would love us to talk it up right now, as would every company on the client list, but now isn’t the time. Let the dust settle. See who has a lot more falling to do and, when the trend is to grow again, the quality deals will be big targets.

You see, it’s possible to be a supporter of the industry, and a fan of individual players within it, and to even take money from those companies for marketing programs, and still be sensible.

I mean, I’d rather track Abcann from $2 to $4, then sell it (as we did), and then get back in at $2.30 a week later (where it is now) as it tracks back to $4 (we hope), than to HODL all the way believing it was going to $12.

That’s what literally thousands of Aurora Cannabis (ACB.T) baggies have been doing this past week and it hurts to watch because they’re not learning from their timing mistakes, they’re telling themselves, “This is good, I can average down, all those people selling are dumber than I am.”

If that’s true, godspeed, brother.

Only it’s not. We know it’s not because you’re looking at red in your portfolio today and those other people are looking at cash.

When you bought at $9.75 and it went to $15, you were like the grandma who won $100 on the slots ten minutes after she landed in Vegas. You’ve convinced yourself that you and you alone are the holder of insight. So it doesn’t matter that your asset ran back down to $10.50, because it went back to $15 again a few days later, thus proving your wisdom!

Only, a few days later still? It’s down to $8.50. And you’re still pumping coins into the slot machine because, “It has to pay up sooner or later.”

Don’t be grandma. Grandmas who play the slots eventually learn which flavour of Purina goes best with Wonderbread.

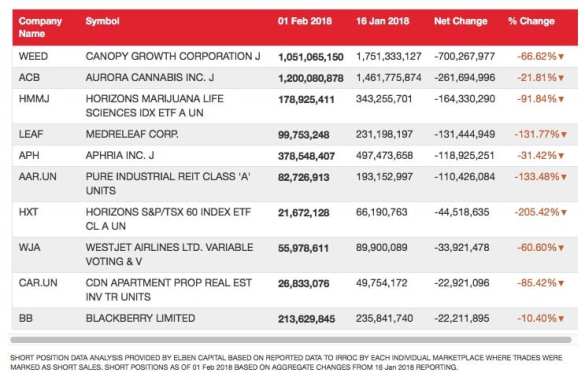

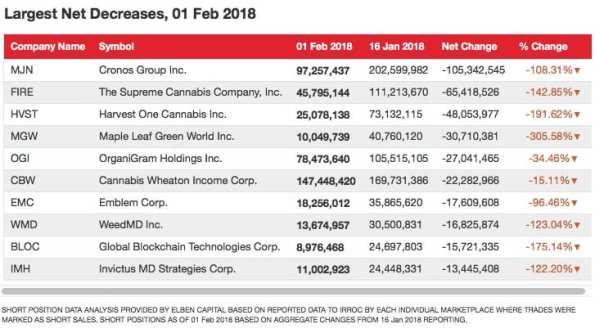

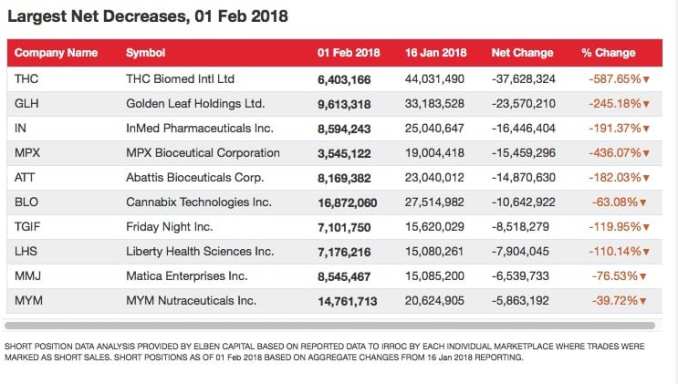

Our colleague Stephan Herman took a dig through the short seller data today and learned many things, all of which begin with “this weed company” and end with “got shorted the shit out of.”

TSX

The top five losers are all cannabis stocks. Canopy saw 700 million shares sold.TSXV

Nine out of ten – Cannabis stocks.CSE

Ten out of ten, we have a winner.

Of all that data, the one line that sticks out strongest for me is that the third most shorted ticker on the whole list is the Horizons Weed ETF (HMMJ).

It’s no shock to see people shorting the big three, Aphria (APH.T), Aurora, and Canopy (WEED.T) because they’re way overinflated and anyone who says otherwise is a damned Communist.

But that ETF represents all companies. It’s a bet of large proportions that the entire freaking industry is going to get rolled. And, so far, those shorters have no good reason to cover.

The next week will see carnage. We will all be less wealthy if we are in the market and not cash during this time. Some of our holdings, if we have trade holds for example, will be stuck in the deathspiral and we’ll just need to deal with it.

But if you heard me speak at Cambridge House’s VRIC 2018 show ten days back, I said very clearly, “Be in the cash sector now. Take out your profits. Understand what it’s like to actually have your money in your hands. Then when the crash comes, you’ll be ready to take advantage.”

The crash is upon us. This is where the smart money starts to execute.

PS: This weed market crash? It’s happened this time every year since 2014. History is your friend.

— Chris Parry

FULL DISCLOSURE: Invictus MD Strategies, Hiku/DOJA, and Abcann are Equity.Guru client companies.

Hi Chris and team.I have been seeing the bloodbath across the board and was hoping to see fair valued cannabis stocks weather the storm better.

As an example for Abcann having an average stock purchase price of say 1$,and shareholder already took profit off the The table at around these prices on a the way up, can we safely assume the stock may neutralize for normal growth from here or is there selling pressure?

In the example the average purchase price is $1 and financings are at considerably higher levels.

Would said purchaser be smart in

Opting out and revisiting at a slightly higher average purchase price?

Curious as to how much more bloodshed is in this?

Other examples are goldleaf, MPX,Invictus.some bought on the way down..

Regards,

Mike

Sent from my iPhone

hey, mike – just a quick comment on what the chart is telling me. As always, DYOR and make your own investment decisions.

Friday’s daily candle on ABCN had quite a long wick and the $2 level was rejected with buyers found at that level. The stock went on to rally, closing at $2.42. There is also evidence of previous support in the $2 area.

Friday’s action, in general, was a case of throwing the baby out with the bathwater – sell first and ask questions later. Not many names escaped unscathed. As one of my colleagues stated, “It’s carnage out there!”

Looking at the VIX chart I wouldn’t be surprised to see further downside in the near-term as these downdrafts often culminate in a spike in the VIX (fear-gauge) and there is still some room on the upside there.

My crystal ball is often wrong, that’s just how I see things at the moment.

Others may have further insights into your question.

I

m a little confused when the article title says to "back away from the keyboard"and the final words are," The crash is upon us. This is where the smart money starts to execute."I think youre telling the readers not to add any further to losing positions but be ready to scoop up some bargain basement bargains in the aftermath of the current crash.Is this correct ?Absolutely.

With the advantage of hindsight, the next trading day after your artical was a Great time to buy.

When selling to avoid a crash, I’d rather be a day early than a day late.

Hi Chris, the next time it is applicable can you please reiterate your statement from a January post in bold letters “IF YOU HAVEN”T TAKEN PROFITS BY NOW I DON”T KNOW HOW TO HELP YOU” for those of us who are a little slow (me) and maybe we’ll (I’ll) listen then.

thanks!