Welcome to our semi-regular column on the short selling activity in the various sectors we cover. This week I want to go over how the weed meltdown this week is impacting the big players in the short markets.

As my colleague aptly covered in his Friday Fail column, cannabis took a few punches this week. The upshot is some seriously needed air was let out of the gasbag, and it stings everyone.

You know who’s likely very happy about this? Short sellers. Anyone who bought in and was riding the wave and timed it right is cashing in right now.

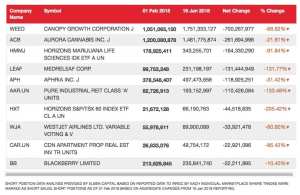

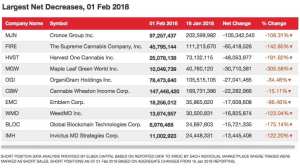

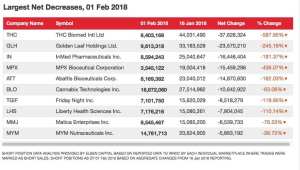

Let’s go to the Big Board

TSX

The top five losers are all cannabis stocks. Canopy saw 700 million shares sold.

TSXV

Nine out of ten – Cannabis stocks.

CSE

Ten out of ten, we have a winner.

Although the big movers and losers are all Cannabis stocks, there isn’t very much that’s actually anomalous in what’s happening. This selloff is following the general market movement, and the winners and losers will be solely based on who was lucky to time their positions.

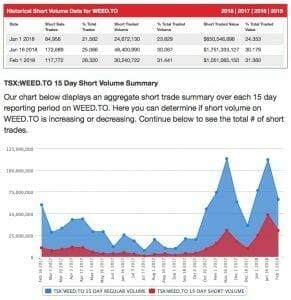

Ze Canopy, it Does NOTHINK!

Last time I talked about looking for asymmetry – it will help identify ‘the squeeze’. This week is a good example of why short selling, like most market strategies is about luck and timing the market.

Let’s zoom in on Canopy, I can’t resist volume like that.

What you can see here is interesting, because I think it shows a good example of mistiming. The volumes in the mid-month look to me to be the sign of short sellers buying to cover their positions. The last two weeks show a much softer pullback, as the stock starts to drop, the players who timed it right are able to cover their positions and grab the profits, as the market melts down.

In a regular sort of market correction, the short volume tracks with the overall volume. That’s what it looks like today.

When something is weird, like when crypto or weed took off with insane valuations etc, the bubble can grow past the best projections, and you see squeezes and other opportunities crop up.

In this case this all looks horrible for those who lost money overall in the cannabis sector, but the short-sellers who survived the bubble are likely breathing a sigh of relief as their models and projections retreat closer to sanity.

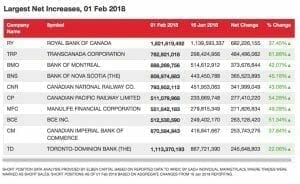

Where did the smart money go?

So all the short activity moved its money out of weed (and a little bit out of crypto – stay tuned) and ran like the dickens over to old-economy financial and infrastructure stocks.

Why? Because when the new money starts to go south, the rest of the economy is going to be a casualty of war. A rising tide raises all ships, but a drought will also beach everyone. By picking up these stocks now, the short sellers are betting they’ll take a performance hit when the ripples from the weed/crypto/next big thing hits. Once the next gasbag inflates, they’ll move their cash back again.

Of course, thats how i would play it. If I could short-sell the hell out of TO and Van real estate I would. (Heresy, I know)

In the end, whether or not this market correction is an opportunity or not will hinge on the broader cannabis market.

TIN FOIL HAT WARNING

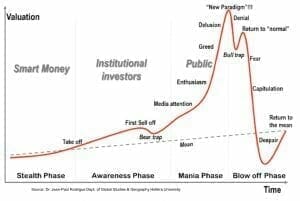

I’m sure you all know this graph.

SO if we just hit denial, the short-sellers are waiting for ‘return to normal’ to pile in, and make some money.

I could be wrong. It could be different this time.

Fundamentally, this sector will continue to grow. It will be as big as beverages, tobacco and other sin-type products. There are billions to be made. Right now this market is an excited puppy whizzing all over itself. Make sure you are careful not to get any on your leg.

All data provided by shortdata.ca

FULL DISCLOSURE: Many of our clients are listed in these tables, and we own stock in many of them.

This is your brain on the long-short asymmetry trade.