There’s a common misconception – a few actually – that this site is one of the following:

- A pump and dump tool

- A short seller’s tool

- Both

We even made a page about it where we outline investigative stories we’ve written about clients that our clients might not have enjoyed.

This may be one of those, though in my belief it serves as vindication for those currently running said company.

Every public company that promotes itself is, at least to varying degrees, a ‘pump.’ And when the price starts to decline a little, as happens, even if only because the early guys have made enough money to cash in, you might look at that as a ‘dump.’ Often, whether a company fits the description is down to where you got in – and out.

But a real pump and dump is easier to spot. Here’s one:

That’s Graphite Energy (GRE.C). Earlier this year,a series of misleading articles (that’s being generous – they were straight up lying) were put out by the company, and third parties who bought in early for pennies, on a network of bullshit stock pumping websites.

Then, when it got too tall, they all bailed. On the same day. No elegance, no opportunity for investors to get out, just slammed to hell.

The CEO resigned days later which, in a neat loophole the regulators should close, meant he didn’t have to file inside trading documents showing what he disposed of during that fall.

We’ve identified another pump and dump, in the technical sense, although with a twist in that part of the dump was coming from the CEO, hidden from his board, his fellow executives, and the investing public until he was clear of the building.

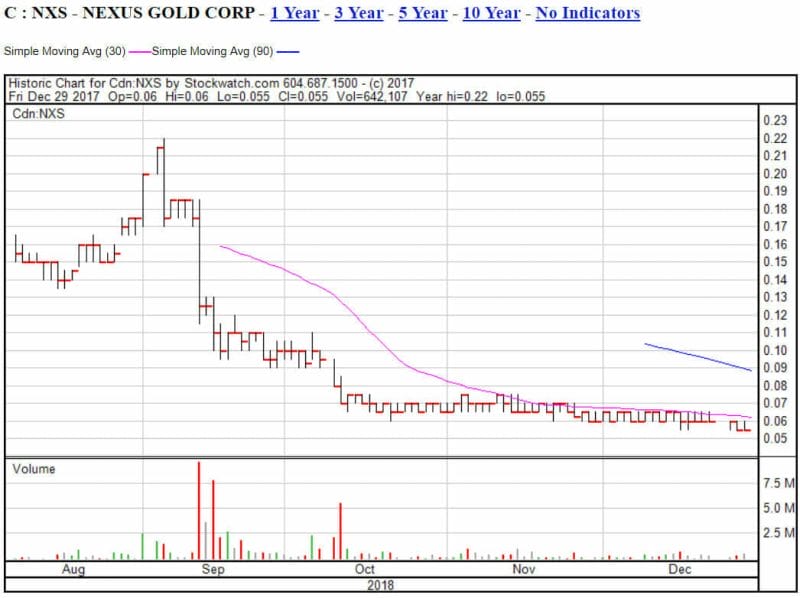

Nexus Gold (NXS.V), a long time client of ours, was ravaged last year when, in the midst of a nice run, a newsletter writer reportedly contacted them and asked to be place on the board. Upon refusal, said newsletter writer allegedly intimated something along the lines of, ‘that’s sure a nice stock you have there, be a shame if something happened to it.’

Something duly happened to it.

We reported on this, on how dark money sometimes runs ahead of the market in ways you and I can never understand or predict, and how some big drops and rises are the result of a handful of guys in a backroom deciding that something, be it the US dollar or a Peru-based lithium explorer or the cost of will be big tomorrow. Or much smaller tomorrow.

In the case of Nexus Gold, we thought we’d had things figured out: Guy with big following and large position in small company pulls the plug on company to beat them down and maybe get them to say ‘uncle’, whereupon the buy-back would recommence.

It turns out, it was a little more than that. Or more gross, anyway.

As the company bled and tried to fight its way back, the CEO was actively selling shares – and not reporting the fact to regulators and shareholders, or his board.

This is Peter Berdusco. Today, Berdusco is the boss at Guayana Goldstrike (GYA.V), but before he took that role, he helmed Nexus as it toiled away in Burkina Faso on a property that, to this day, we think is pretty decent.

This is Peter Berdusco. Today, Berdusco is the boss at Guayana Goldstrike (GYA.V), but before he took that role, he helmed Nexus as it toiled away in Burkina Faso on a property that, to this day, we think is pretty decent.

People who know Berdusco say he’s an amiable enough guy, with a deep knowledge of the resource world. He’s been around for a good long while so he most definitely knows that his duties as a CEO, from a regulatory standpoint, involve announcing publicly if he buys or sells his stock within ten days of doing so.

On June 29 2017, as his company had drifted in share price from $0.24 down to $0.18 over the previous few weeks, the company put out this news release, in his name:

Nexus Gold Corp. wishes to confirm that the Company’s management is unaware of any material change in the Company’s operations which would account for the recent increase in market activity.

24 hours later, on June 30 2017, Berdusco sold 100,000 shares of his company at $0.18, good for a haul of $18,000.

This is not a crime – CEO stock sales happen all the time. Sometimes a guy wants to buy warrants and sells some stock to finance that, sometimes he has stock options he wants to make use of, sometimes his girlfriend wants a diamond to make up for that thing she saw on his text messages, and cash must be had – stat.

A CEO generally wouldn’t sell his own stock the day after sending out a regulatory shrug, because the optics of that would be fucking horrible, and probably contribute to more investors selling their own stake.

The proper thing to do in any instance – the LEGAL thing to do – is to file insider documentation that shows a trade happened. This is what that information looks like.

Maybe Berdusco didn’t want to see his company suffer, maybe he just forgot, or maybe he was getting out and didn’t want anyone to know, but in any event, Berdusco didn’t file his insider paperwork until September 10, 2018 – over a year after his first trade, and two days before he left the company.

To be abundantly clear: He sold his stock in secret.

We asked existing execs and directors at Nexus if they knew about this, and we’re told they had no idea, that it appeared to them that all hands were rowing in the same direction.

We’re also told, though nobody wanted to go on record, that the people currently running the company are furious about this revelation.

We’ve also placed a call to the British Columbia Securities Commission which has not, to this point, been returned.

If Berdusco had been honest when he was selling his stock, there may have been some hard questions to answer, and the answers to those questions, though not a positive for his stock price, may have helped investors exit before mid-September of that year, when the NXS stock price dove again, this time in a single day, from $0.18 to $0.12, on no news.

Nexus Gold Corp. wishes to confirm that the Company’s management is unaware of any material change in the Company’s operations which would account for the recent increase in market activity.

Yep, the news release that emerged in response from the CEO was word for word what it had been six weeks earlier.

Berdusco’s remaining shares took a beating that day, and the company went into damage control mode. Lots of calls to answer from angry investors, lots of confusion on the markets, and in the middle of it all, Berdusco reassuring people the company was good, the property was good, and that there was no inherent problem at the helm.

Meanwhile, there was a problem: The CEO wasn’t done selling.

On October 13 2017, Berdusco sold another 605,000 shares into the market at $0.07, good for $42,350. And once again, Berdusco didn’t file insider trade documentation for this within the permitted guideline.

He sold another load of stock, this time 295,000 shares, three days later on October 16, 2017. That was worth $20,650. The paperwork on this, again, apparently had to wait until he got around to it almost a year later.

Berdusco’s three trades, in total, brought him $81,000. That’s a lot of girlfriend apologies. Or warrants. Or boats.

Nexus replaced Berdusco as CEO in May of this year, moving him to across to the temporary role of President. A month later, Berdusco was taken out of the President role, leaving him as a director. He resigned that director position on September 12 of this year, a mere 48 hours after he finally caught up with his insider trade paperwork.

The company also announces that Peter Berdusco has resigned as a director to focus on other ventures. The board of directors thanks Mr. Berdusco for his many years of service to the company.

Investors in those ‘other ventures’ – namely Guyana Goldstrike, of which he’s now President, CEO and Director, and Canada One Mining (CONE.V), which he joined as director this year, should ask some probing questions.

Nexus, in the time since, has rolled back it’s stock and done a lot of work to rebuild its reputation and standing, but with issues like this emerging so late in the day, that battle has taken on an extra burdensome weight.

Meanwhile, Mr Berdusco does not list his time helming Nexus Gold on his Guyana Goldstrike CEO bio.

There may be a perfectly reasonable explanation as to why someone would take so long to fulfill their regulatory duty as CEO, but we’re baffled as to what that might be.

Regardless, we at Equity.Guru attempted to contact Berdusco regarding these matters, but was told by a Guyana Goldstrike rep that he was out of town and unreachable until next Tuesday.

If Nexus investors would like to ask those questions for themselves, we’re told info@guyanagoldstrike.com will get to him.

— Chris Parry

FULL DISCLOSURE: Nexus Gold is an Equity.Guru marketing client, but this story was not directed by them, approved by them, nor paid for by them.