E3 Metals (ETMC.V) plans to test its new lithium concentration technology at a soon-to-be built pilot plant in Alberta, the company announced today.

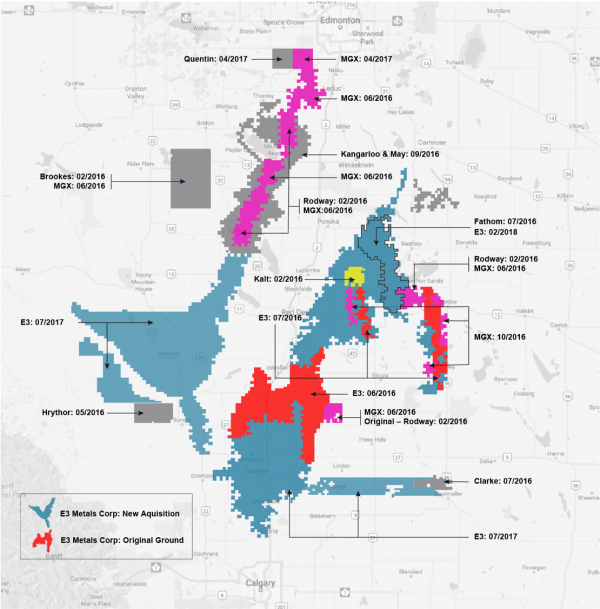

If successful, the technology could extract additional revenues from the company’s resource in Alberta’s Leduc reservoir, a sizable claim approaching 600,000 hectares with an inferred 6.7 million tonnes of lithium carbonate equivalent (LCE).

The nearly seven million tonnes of inferred LCE only accounts for 34 percent of the company’s claims on the reservoir.

Continued development of E3 Metals’ lithium production technology will continue with the assistance of engineering, procurement and construction (EPC) firms.

The company has also partnered with GreenCentre Canada (GCC) and the National Research Council of Canada (NRC) to continue research into lithium production.

GCC is a not-for-profit based in Ontario “with a mandate to assist in the commercialization of chemical technology from both industry and academia,” through its research facilities.

The NRC is an arm of the Canadian government meant to foster tech-innovation nationally. The organization granted E3 Metals $100,000 in August for this project’s development.

“These partnerships are to advance E3’s ion-exchange technology developed by the Alessi Lab at the University of Alberta to commercial readiness,” according to the company.

Additional objectives for the company are the development of a commercial chemical sorbent and design parameters for the construction of its pilot plant.

E3 Metals six month development plan

The company has outlined its schedule for the net six months of the project’s development:

- Demonstrating repeatability of the University of Alberta’s extraction technology development at commercial facilities (GCC — AI and NRC — IRAP);

- Increasing the performance efficiencies of the ion-exchange process by increasing recovery, concentration factor and lithium uptake;

- Developing a commercially scalable ion-exchange sorbent material;

- Constructing ion-exchange equipment in a lab environment to refine the mass balance and generate volumes of concentrate;

- Producing lithium hydroxide at the lab scale;

- Finalizing the lithium production process flow sheet;

- Finalizing the design of the pilot plant.

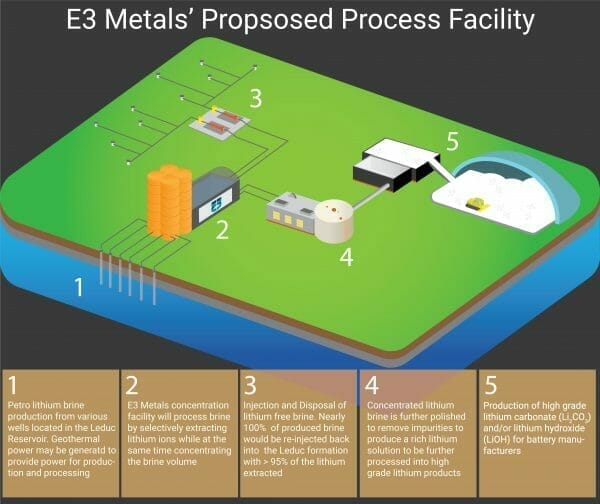

E3 Metals proposed flowsheet has identified a three step process for extracting their LCE resource:

The first step involves pumping the lithium-enriched brine from the Leduc reservoir to the surface. The second step is creating a higher-grade lithium concentrate that utilizes E3’s proprietary ion-exchange process. The third step generates the final lithium product (lithium hydroxide or carbonate) by further purification, electrolysis and crystallization.

The company believes the Leduc reservoir stands apart from other resources due to its ability to produce vast quantities of lithium-enriched brine: “a single well could produce more than 10,000 cubic metres per day (116 litres per second).”

‘Step one’ involves harnessing the lithium-enriched brine for the pilot project. This brine is a waste product of oil and gas production and is available at surface, removing the need for E3 Metals to drill a new well.

During ‘step two,’ E3 Metals will use its lithium extraction technology to chemically filter and concentrate lithium brine. Ion exchange is used to remove adulterants and the water is reintroduced into the reservoir.

This process can be completed “in about three hours, as opposed to 18 to 24 months for conventional evaporative solars.”

The final step requires the assistance of E3 Metals’ EPC firm partners and the use of commercial facilities to generate a product from the lithium concentrate through electrolysis and crystallization.

The company claims to be able to create both lithium hydroxide and lithium carbonate, though it aims to give preference to the former due to its value to battery manufacturers.

The spot price for lithium carbonate is between $12,100 (U.S.) and $13,000 (U.S.) and for lithium hydroxide between $18,100 (U.S.) and $18,800 (U.S.)

-E3 Metals

Additional goals for the company include updating its inferred resource to NI 43-101 compliant status and “complete a full cycle project economics analysis to prefeasibility study (PFS) level.”

Trajectory and comparables

E3 Metals’ share performance over the past year resembles a plot diagram.

In bedtime stories, where all the loose ends are nicely tied by the end, the plot comes to a resolution after settling conflict. Naturally, E3 Metals’ ride off into the sun moment would involve the successful demonstration of their concentration technology’s capabilities on a large scale.

Until then, everything else is conjecture. What we do know is the company’s size, its resources, its technological endeavours, and those of its competitors.

Neo Lithium, with a market cap of $135 million, has a high-grade resource estimated at 400 mg/l. For comparison, E3 Metals’ resource is measured at up to 84.8 mg/l.

The company has a measured and indicated resource estimate of over four million tonnes LCE and nearly three million tonnes LCE in inferred resources at its project in Argentina’s ‘ Lithium Triangle.’

Though Neo Lithium currently trades at CAD$1.17, compared to E3 Metals’ $0.39, the company uses traditional solar evaporation methods to concentrate their lithium brine.

Given their resource’s relative size, and E3 Metals’ theorized production methods, E3 Metals presents notable value at nearly a third of Neo Lithium’s price. That is, if the process works at the scale it was designed for.

Full Disclosure: E3 Metals is an Equity Guru client, and we own stock.