Looks like pot is the new crypto.

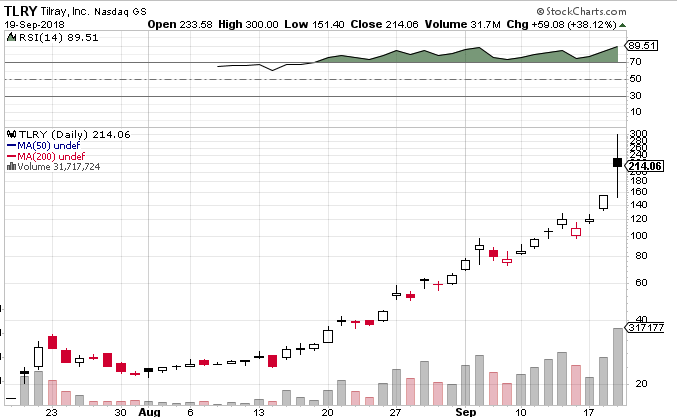

In what can only be described as a wild day of trading, cannabis newcomer Tilray (TLRY.NASDAQ) traded within a 149 dollar range on Wednesday September 19th, printing a high of an even $300 in a mid-afternoon surge before falling as low as $151 when the music stopped and chairs were found to be in short supply.

Quite the ride for a stock which only debuted at USD 23.05 some eight or so weeks ago. Anyone who picked up the stock at that price was sitting on a 10-bagger when it opened 😎

Within hours of the opening bell, news outlets were pumping out stories that Tilray’s market-cap had exceeded that of American Airlines (AAL.NASDAQ) and CBS (CBS.NYSE).

Come late afternoon, the headlines weren’t as glowing 🙄

Those market-cap ‘facts’ would only prove true for a short period of time, with the newly minted market darling only allowed to breathe the rarified air above $230 for a brief few hours before multiple trading halts forced MOMO traders to all head for the exits at once.

The stock tacked-on a lazy $59.08 (+38%) during the session but continued to leak in after-hours trade, falling over 6% to $199.60

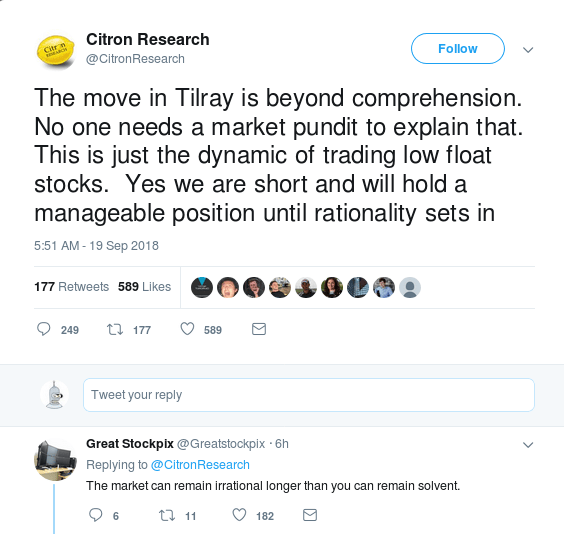

Citron caught short

The crew over at Citron seem to have forgotten the old market adage “The market can remain irrational longer than you can remain solvent.” – a message which was reinforced by one savvy Twitter user.

Citron is short? Let’s hope it’s nothing more than a 100 share position, for their sake 🙂

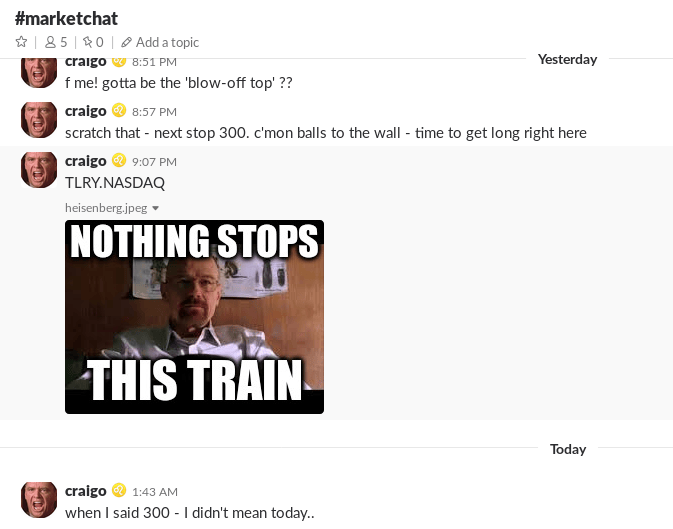

Even balls to the wall bulls who picked up the opening print looked like geniuses for most of the trading session until some sense of reality engulfed the late afternoon sell-off.

Back on August 29, 2018, Forbes called the stock overvalued and suggested “its current bull run is unsustainable.”

They laid out a solid case for a 43 buck valuation but forgot one thing – the madness of crowds.

The euphoria surrounding the legalization of recreational marijuana in Canada, the potential of tie-ups with alcohol giants for producing cannabis-infused drinks, and inking a supply agreement with Nova Scotia Liquor Corporation are a few of the factors responsible for the mammoth rise in the share price. – Forbes

They’re not alone.

Our own Chris Parry highlighted the recent dip in Tilray shares when it was trading around the $100 mark

This is not smart trading, for the average guy. It suggests everyone is chasing rather than buying on credibility and prospect.

Daytraders may have the balls to gamble in this red or black scenario, but it’s less investing than gambling and, frankly, even the big players that helped move the stock up are abandoning ship.

Parry was right, but a few weeks too early.

Here’s the tip – when a stock 10-bags in 2 months you sell first and ask questions later.

Can’t or won’t?

Then at least take advantage of the fact the stock is optionable. There were zero cost collars floating around yesterday. You could have bought the Oct monthly 140 put and simultaneously sold the 300 call for next to little outlay when the stock was trading at $235.

Best case scenario – you sell your TLRY shares for 300 bucks a piece. If the shit hits the fan, you’ve locked in $140.

While that strategy might have seemed crazy at the time, you would have looked pretty smart just a few hours later.

When stock prices detach from reality you need to keep a clear head and be nimble.

Easier said than done.

–// Craig Amos

(feature image via giphy.com)

FULL DISCLOSURE: Tilray are not an Equity Guru marketing client.