Renaissance Oil (ROE.V) is developing a diversified shale and mature fields portfolio in Mexico.

Mexico’s state-owned PEMEX lacked the technology and capital to unlock the value of shale. It requires modern techniques to stimulate the gas bearing zones.

Russian oil producer LUKOIL chose Renaissance as their partner to explore and develop the Amatitlán block in Mexico.

LUKOIL has a market cap of $48 billion, a million of barrels of production and 100,000 employees in 40 countries around the world.

The 1-year ROE chart has been choppy, rising from .16 on August 30, 2017 to .34 on November 7, 2017 – and now trading at .22.

On August 27, 2018 Renaissance released its Q2, 2018 results.

SECOND QUARTER 2018 HIGHLIGHTS

- Revenue reached a record of $7 million.

- Revenue increased of 40% compared with the previous quarter.

- Revenue higher by 31% compared to Q2, 2017

- Production in Q2 2018 increased to 1,656 boe/d compared to 1,249 boe (barrel of oil equivalent)/day in the previous quarter and 1,552 boe/d in the second quarter of 2017;

- Renaissance & LUKOIL drilled 6 new wells targeting the shallow Chicontepec formations at Amatitlán.

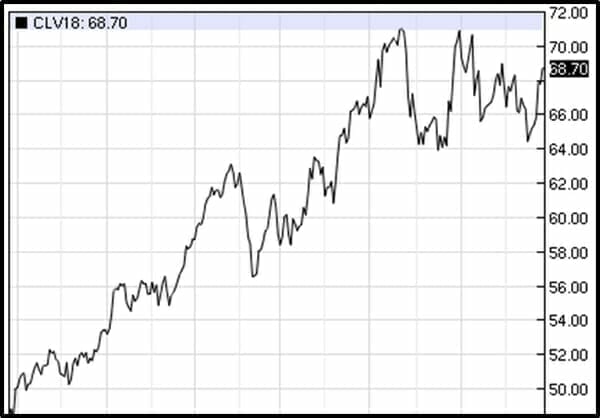

Oil prices have risen about 40% in the last year.

The recent improvement in oil and gas prices continued into Q2, as sales of crude oil averaged $80.68/bbl compared to $72.98/bbl in the previous quarter and $54.09/bbl in the second quarter of 2017, while sales of natural gas averaged $4.51/Mcf compared with $4.19/Mcf in the second quarter of 2017.

Mexico recently had a federal election that will result in a change of ruling government.

Mexico’s president-elect Andres Manuel Lopez Obrador (AMLO) was born into a family of shopkeepers in a tiny southern Mexican village.

According to the Wall Street Journal, the new leader will halt oil auctions for a couple of years.

Mexico’s oil production has been falling for a decade, declining from 1.9 million barrels per day (mb/d) recently, down from 3.4 mb/d in 2005. Mexican output is expected to fall by another 130,000 barrels per day in 2018, due to geriatric offshore oil fields.

Despite this, some political observers believe that Lopez Obrador will not hold any new oil auctions during his 6-year term.

The new Mexican president has promised to vet the 107 oil and gas contracts already awarded for corruption. He has stated that he will not retroactively interfere with ethically clean contracts.

Canada’s Corruption of Foreign Public Officials Act creates powerful disincentives for Canadian executives to line the pockets of foreign officials.

For instance, last year Nazir Karigar, an Ottawa-based businessman was sentenced to 36 months in prison for offering bribes to Indian officials on behalf of a Canadian tech company, CryptoMetrics.

Karigar was found guilty of:

- openly discussing the payment of bribes to Indian officials

- preparing a spreadsheet budgeting intended bribes

- designing a sham proposal, to create an illusion of a competitive bidding process.

Given the economic and human tragedy in Venezuela, it seems unlikely that Lopez Obrador will completely choke-off international investment in the Mexican resource sector.

If he did, it would be a double-edged sword for Renaissance shareholders.

On the one hand, political anti-investment rhetoric is seldom a positive share-price catalyst.

On the other hand, if the new supply of Mexican extraction permits falls to zero, it will drive up the value of the existing approved contracts.

“During Q2, 2018, six additional wells were drilled intersecting the shallow tertiary aged Chicontepec formations,” stated Renaissance CEO Craig Steinke, “To date 16 Chicontepec wells, of a 17-well program, have been drilled with the drilling of a 17th well now underway.”

Eleven of the new wells have undergone completion operations and been brought onto production with further completions expected to be concluded in the coming weeks. Renaissance has also completed workovers and repair operations on eight wells of the scheduled workover program.

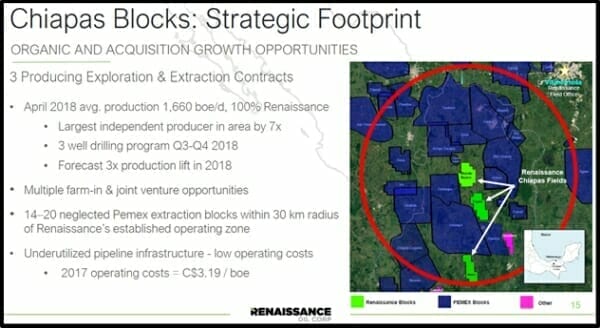

Renaissance produced 1,656 boe/d at the Mundo Nuevo, Topén and Malva blocks (the “Chiapas Blocks”).

ROE is waiting for rig certification to further advance the Chiapas development program. This drilling program of four new wells and a series of workovers to existing wells, is expected to increase the Company’s production base in Mexico.

- The Mundo Nuevo 6,845-acre block was developed by PEMEX – reaching peak production of over 15,000 barrels per day of natural gas liquids, in the early 1980s.

- The Topén 6,251 acre-block, another PEMEX property, reached peak production of over 1,500 barrels bbls/day of medium crude oil, in the mid 1980s.

- The Malva 5,239-acre block reached peak production of over 2,000 barrels bbls/day of light crude oil, in the late 2000s.

The rising prices for crude and natural gas continued into the second quarter of 2018 resulting in a record high quarterly revenue of $7 million.

Full Disclosure: Renaissance Oil is an Equity Guru marketing client, and we own stock.