One of these days, Gold is going to surprise everyone and push higher. It’s going to take out a number of chart levels technicians call resistance, scream higher and not look back (this author’s ardent opinion).

This bullish prophecy is shared by a number of market analysts, though that doesn’t necessarily mean very much as the vast majority of said analysts are… well…

The Peak…

I’m a firm believer that we’ve reached ‘peak gold ‘, that we’ve passed the peak of discovery and production.

Many of the mega deposits on our planet, like those in the prolific Witwatersrand Basin of South Africa, are almost spent, nearing the end of their life cycles. South Africa, once boasting annual production of over 1,000 tonnes of gold a half-century ago, produced a mere 167.1 tonnes in 2016. And get this: according to the Environmental Economic Accounts Compendium published by African Statistics Day, South Africa will completely exhaust its gold reserve base in less than four decades. That’s some trippy ass’d shit, especially considering South Africa was once one of the larger producers on the planet.

This possibility alone should keep gold lofty. At the very least it should limit its downside price risk.

Cross-Currents of Uncertainty…

Some believe the big move in gold won’t occur until after global equity markets come down like a Led (lead) Zeppelin.

Some believe that a crash, with a score of potential flashpoints scattered around the globe, is imminent. Here, a good ceo.ca buddy of mine, not to mention a gifted technical analyst, discusses that very possibility with a distinguished guest.

It’s not an easy topic to visit – this market crash scenario thing – but we as investors need to be mindful of such potential hazards. It might even be prudent to hedge ourselves against them, especially if some whack-job gains control of the White House and instigates a global trade war.

The Ultimate Hedge?

In my mind, gold is the ultimate hedge against market uncertainty. Yes, it may get sold off initially in a global liquidity crunch should one or two pivotal banks topple, triggering a domino effect that takes everything, including the major indexes with them. But such a sell-off in the metal would be short-lived IMO. I believe gold will be the one asset that investors flock to for safety in such an event. And the well-run companies that dig the yellow metal outta the ground… they’ll have a heyday.

(Note that the idea of a market crash is merely a concept, a theory… there are no certainties here one way or another).

An additional source for the role gold plays in our global economy and monetary system can be found here, for those wanting to immerse themselves deeper into its tangible qualities.

The Company:

I’ve compiled a short list of what I believe to be the best (asset) endowed, most smartly run gold stocks in the sector. Granada Gold Mine (GGM.V) occupies one of those top spots. The company’s fundamentals are compelling.

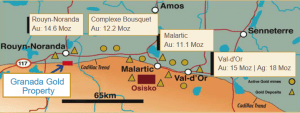

Granada’s property is located in elephant country, in mining friendly Quebec. Note the deposits in the area. Note their scale… .

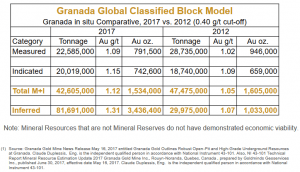

Led by the very competent Frank J. Basa – a hydrometallurgical engineer with expertise in milling, gravity concentration, flotation, leaching, and the refining of precious and base metals – Granada sports a global resource of nearly 5 million ounces.

Within that global resource lies a pit-constrained resource of 807,700 ounces measured and indicated (625,000 ounces grading 1.14 g/t measured – 182,700 ounces grading 1.26 g/t indicated). 0.39 g/t is the cut-off grade applied to these ounces.

Note the higher-grade underground component in the above resource. Obviously, the company has plans for it (more on this in a bit).

The Studies – The Plans:

On April 6th of this year, the company announced the commencement of a Feasibility Study for the development of an 80,000-to-100,000 ounce per year production scenario for its pit constrained resource.

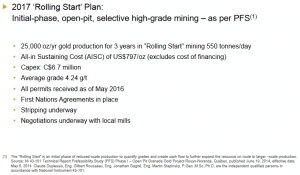

CEO Basa is not content waiting around for the results of that feasibility study, however. To get things rolling, he plans to initiate a ‘Rolling Start’ plan, a plan to process an initial 600,000 to 2,000,000 tonnes of surface material grading 4.5 g/t gold based on a 2014 Pre-Feasibility Study. Mineral reserves – high confidence ounces – have been established within this higher-grade surface material…

The mill slated to process material from this Rolling Start plan will be built just across the border, at the Castle Mine Property in Ontario by sister company Canada Cobalt Works (CCW.V), a company that is no stranger to the pages here at Equity Guru.

Granada has signed a provisional milling agreement with Canada Cobalt Works to process this higher grade material. CCW will also make very good use of this mill as it continues to develop its high-grade Cobalt-Nickel-Silver resource at its Castle Mine Project.

This is smart planning. And no, this isn’t your typical junior-gold pie-in-the-sky bullshit. Canada Cobalt Works has retained the engineering firm Wood Group to undertake the necessary studies to obtain the required permits to install this 600-tonne-per-day mill at the Castle mine. Granada has received all the necessary permits to begin mining. Stripping of the deposits overburden has already begun. My understanding is that CCW will finance the construction of the mill with debt.

Earlier, I mentioned the ‘higher-grade underground component’ of Granada’s resource (1.5 million ounces of gold averaging 4.56 g/t gold Inferred) – this initial mining phase will provide a ramp to production for these ounces located immediately north of their near-surface deposit.

Exploration Potential:

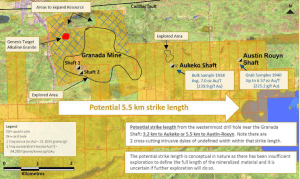

This is what intrigues me – blue-sky exploration upside. CEO Basa and his team have no shortage of targets to test along 5.5 kilometers of strike length. This strike length of prospective geology could extend even further…

The Genesis target, the area around the Granada mine itself, the Aukeko target, the Austin Rouyn target… all of these will see drilling.

Recent Exploration News…

Earlier this spring, Granada began trenching its Aukeko project. On June 4th, and then just yesterday (July 10th) the company updated us on its progress at Aukeko…

Granada Gold Mine Finds Gold with Trenching at Aukeko

This trenching program is an important step in narrowing down and prioritizing targets for an upcoming drilling campaign.

The company is very happy to announce its exploration team has completed the third trench, totaling 85 metres in length with an average width of approximately 1.5 metres located 150m to the east and south of the previous 2 trenches reported June 4, 2018. This trench extends the total trenching program to 365 metres. Channel sampling with a rock saw in all 3 trenches have been completed by Technominex of Rouyn-Noranda under the supervision of GoldMinds Geoservices. The distribution of trench samples was affected by the topography of the terrain and the presence of water. A total of 208 trench samples (including blank and standards) have been sent to ALS laboratory in Rouyn-Noranda for analysis by fire assay. Results will be disclosed once received, validated and interpreted.

CEO Basa is not just attempting to add ounces onto what is already a robust global resource for the Granada property. He wants to delineate high-grade ounces and fast-track them to production. 6,000 meters of drilling is scheduled for this first phase at Aukeko.

Commenting on this recent piece of news, CEO Basa stated…

“Again, we are very excited to expand the exploration of our extended LONG Bars zone on strike going east to test the remainder of the unexplored mineralized structures.These are highly prospective areas for production – our major focus.”

A little background on Aukeko…

The Aukeko mine was in production in the late 1930s. Several auriferous structures were identified within a five hundred metre wide, east-west trending zone with shearing, alteration, and quartz veining along with numerous porphyry intrusions.

Of significance is the “Auk Shear” zone where the Aukeko Shaft was sunk in conjunction with stripping and trenching in the same vicinity. This zone was mapped over a one-kilometre length with an average width of 50 metres. The Auk Shear zone was the location of the Bert Vein where three bulk samples were reported to have been taken in 1938 from a trench approximately 50-to-150 metres east of the Aukeko Shaft that averaged a grade of 7.0 ounces gold per ton (240.0 grams per tonne) (from public files with MERN (Ministère d’Energie et Ressources Naturelles) GM52851).

Aukeko is part of the east-west trending structure on the Granada Gold Mine property. A further 1.9 kilometres east is the Austin-Rouyn Mine.

The potential strike length on the property is 5.5 kilometres, beginning at the westernmost drill hole near the historical Granada shafts and extending eastward to the historical Austin Rouyn shaft where grab samples in 1940 showed up to 6.57 ounces of gold per short ton (225.2 grams per tonne).

Austin-Rouyn qualifies as additional blue-sky exploration upside.

Final Thoughts:

As mentioned earlier, this company is run by a very competent team. The CEO, as I suggested in a recent Equity Guru piece featuring Canada Cobalt Works, appears to be setting a new standard for how a junior exploration company should be run.

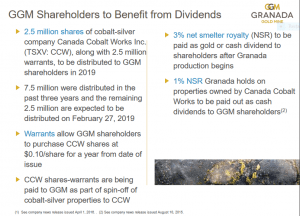

Adding validity to that positive characterization, check out this slide on Granada’s Corp Presentation… (if you’re a fan of CCW common, warrants and net smelter royalties, take heed)

The company has < 59 million shares outstanding and a market-cap of approximately $12M. With a global gold resource of nearly 5 million ounces, a number of higher-grade zones, a geologically prospective setting sporting a strike length of some 5.5 kilometers… not to mention a ‘rolling start’ plan to fast-track the company into production… I’d say that the current $12M price tag factors in a fairly hefty discount.

END

~ ~ Dirk Diggler

Full disclosure: Granada Gold Mine is not an Equity Guru client. Canada Cobalt Works is an Equity Guru client. The author does not own shares in either company but plans to initiate purchases in the near future.

Postscript: Gold was taken out behind the woodshed today. It’s sitting right near a fairly important support level. A bounce here may signal that a short-term bottom is in…

We stand to watch…

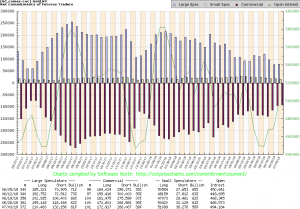

Post Postscript: One potentially bullish crosscurrent in the gold arena is the Commercial positioning as reflected in the chart below. It’s the best setup we’ve seen in nearly a year…