Whenever a publicly traded company sees a heightened level of volume and price action in its common stock – whether it’s up or down – said company often puts out a news release, one which addresses the unusual trading action. Sometimes, the regulatory authorities compel the company to comment on such activity.

First Cobalt Corp (FCC.V) has seen its stock get bullied from the buck-fiddy level down to a price low registered today at $0.35. That’s a huge range in the company’s fifty-two week high and low, one wide enough to drive a semi truck through.

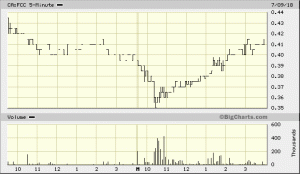

The above daily chart goes back one full year. The chart below is ‘intraday‘ – it reflects only the last two days of trading action. Each bar represents a five-minute interval…

When there’s a climax in selling pressure, I like to take a close look at the trading action via these intraday charts, like the one above. As you can clearly see, the flurry of activity around the $0.35 level involved the selling (and buying) of approximately two million shares. As a trader/investor, you need to ask yourself, what does it all mean…?

There can be a number of explanations for this whirlwind of activity. It could be something as simple as basic supply/demand dynamics – more sellers than buyers. FCC is not alone in this apparent imbalance. Cobalt Power Corp is another cobalt company with a beaten down price chart, one which looks very similar to First Cobalt’s.

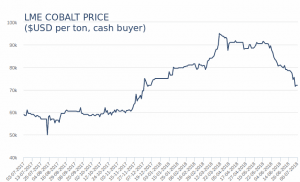

There’s also this not-so-minor detail…

The price of cobalt hasn’t exactly been on a tear of late. It’s come off quite steeply from levels witnessed only a few short weeks ago.

Of course, no market that has had the kind of move cobalt has had over the past two years can continue its Mount Everest like trajectory without resting at a camp or two along the way.

A Refresher…

As a quick refresher, cobalt is an essential metal in the production of EV (electric car) and electronic device batteries. It’s used as a binder. It lends strength, enhancing the battery’s capacity to endure high concentrations of power in a confined space.

The demand for cobalt is huge. Supplies are limited. Most of the worlds cobalt production comes from the DRC where child labor is widely used to extract it from the subsurface. Cognizant of these abhorrent children’s rights violations, a growing number of large companies are attempting to source their Co directly from ethical miners.

This is where First Cobalt comes in. FCC’s projects are located in the mining and child-friendly regions of Ontario and Idaho.

Getting back to the ‘Unusual Market Activity’ in First Cobalt’s common stock…

The Company’s Take…

First Cobalt Comments on Unusual Market Activity

First Cobalt Corp reports that while it does not normally comment on market activity or market rumours, the Company feels it is appropriate to issue the following remarks in light of the unusual activity related to its common shares.

First Cobalt reiterates that the fundamentals of its business have not deteriorated but rather, since completing the acquisition of US Cobalt, it believes they have improved. The Company is aware of no material events that would contribute to the unusual trading activity.

“We continue to execute our growth strategy, and our business is progressing as expected,” commented Trent Mell, President and CEO. “We are fully funded to complete the work program underway at the permitted First Cobalt Refinery complex, as well as our ongoing drill programs in both Ontario and Idaho. We remain encouraged by the results we have achieved to date as we continue to build a vertically integrated North American cobalt company.”

The Company also states that certain officers and directors have been buying shares in the market over the past several weeks.

Fair enough.The company does indeed hold an impressive portfolio of cobalt assets. FCC’s fundamentals have been well covered here at Equity Guru. The company’s recent acquisition of the Iron Creek Cobalt Project in Idaho is a standout IMO.

The Iron Creek Project boasts a significant cobalt resource – historic tonnage and grade estimates (non-compliant with NI 43-101) indicate that Iron Creek contains 1,279,000 tons grading 0.59% cobalt and .3% copper. That’s a nice grade. Anything > 0.5% is considered rich in this sector.

The Insiders…

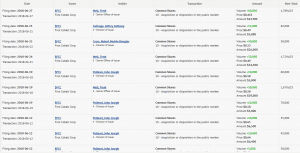

I find it interesting that insiders have been accumulating shares during this protracted period of price weakness.

Here’s a snapshot of this recent activity…

Significant insider buying is perhaps the best indication that the company’s positive fundamentals remain intact.

The What-Ifs…

Above, I used the word ‘bullied’ to describe the recent price action in FCC’s common. What if there’s more to it than simple supply/demand dynamics at work? What if there’s something else lurking below the surface? With if… and this may only be the author’s overactive imagination at work… but what if there’s some duplicitous entity out there, one orchestrating this grind lower. Why would such an entity want to drive FCC into the ground? To capitalize on the price weakness via a future unsolicited takeover bid perhaps? Dunno. It’s possible, I suppose. Don’t read into that one too much. I’m merely thinking out loud here.

The Reality:

First Cobalt is a well-managed company with a number of moving parts in a sector that has some of the most compelling dynamics I’ve ever seen.

First Cobalt is a bellweather name, a leader. I suspect the price lows registered recently offer an outstanding entry point in a sector that may see its previous highs retested and restored in the weeks and months to come.

We stand to watch…

END ~ ~ Dirk Diggler

Full disclosure: First Cobalt is an Equity Guru client. The author does not own shares in the company though others here at Equity Guru do.

Feature image courtesy of Reuters.