During the last U.S. election cycle, Candidate Trump promised the American people lower gas prices by deregulating the local Oil & Gas industry and lowering environmental standards.

U.S. gas prices recently hit a 4-year high of $2.97.

According to President Trump it’s OPEC’s fault, though oil pundits have pointed out the Trump’s proposed sanctions on Iran will remove about 2.4 million barrels of oil production per day – creating upward pressure on oil prices.

Renaissance Oil (ROE.V) is developing a high quality, diversified shale and mature fields portfolio in Mexico.

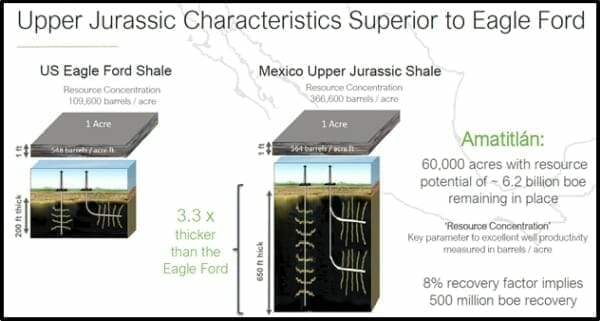

Shale gas is natural gas found in fine-grained sedimentary rock. Mexico’s state-owned PEMEX lacked the technology and capital to unlock the value of shale. It requires modern techniques to stimulate the gas bearing zones.

In January 2017, Russian oil producer LUKOIL, chose Renaissance as their partner to explore and develop the Amatitlán block in Mexico.

LUKOIL is the 2nd largest company in Russia, with million of barrels of production and 100,000 employees in 40 countries around the world.

Naturally, the Amatitlán block has been hogging the limelight.

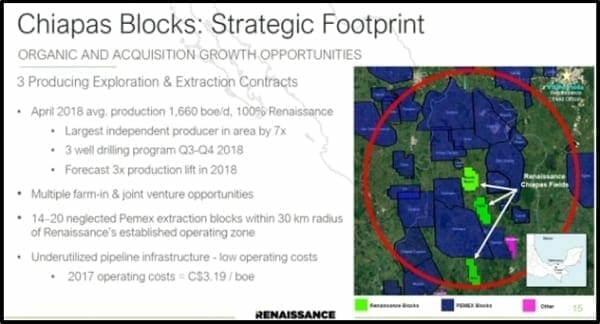

But ROE has three other projects in Chiapas, Mexico, that just got green lit for development.

- The Mundo Nuevo 6,845-acre block was developed by PEMEX – reaching peak production of over 15,000 barrels per day of natural gas liquids, in the early 1980s.

- The Topén 6,251 acre-block, another PEMEX property, reached peak production of over 1,500 barrels bbls/day of medium crude oil, in the mid 1980s.

- The Malva 5,239-acre block reached peak production of over 2,000 barrels bbls/day of light crude oil, in the late 2000s.

Renaissance sees significant opportunity at Chiapas for additional value creation in new well locations as well as application of innovative re-completion technologies.

According to the July 9, 2018 press release, ROE has received the go-ahead from Mexican authorities to develop the three producing properties in the Chiapas Blocks.

This development program is designed to enhance current production and explore new formations.

Key development highlights:

- Major work-overs on three existing wells, one at Malva and two at Topén;

- Drilling up to four Cretaceous wells, two at Malva, one Mundo Nuevo and one at Topén

- Extensive coring in new zones of interest across the Chiapas Blocks.

The work is scheduled to begin in August 2018.

“The wells are tied into the existing pipeline infrastructure, allowing for immediate increases in production from the average of 1,643 boe/d for the month of May 2018.

The first of the four new wells is scheduled to spud in Q4, 2018.”

“All three of the Chiapas Blocks have infrastructure in place with significant excess capacity to Pemex facilities,” ROE confirmed, “allowing for cost effective tie-ins and short cycle time to first production.”

Renaissance also recently signed a Right of First Refusal (ROFR) for the Pitepec block, adjacent to the north of the Amatitlán block.

The 61,300- acre Pitepec property is currently producing 1,487 barrels per day of light oil from shallow formations.

Renaissance’s log and core analysis from previous wells testing the unconventional Upper Jurassic shale formations indicate these deeper source rocks are high potential reservoirs for commercial development. The ROFR expires on May 31, 2019.

“We have been picking the low-hanging fruit by improving production at existing wells with the focus of producing the first ever commercial Mexican shale oil,” stated Craig Steinke, Renaissance’s CEO in a recent interview, “It’s certainly not hyperbole to say that this is a once-in-a-lifetime opportunity.”

The Trump https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistration wants all countries to stop importing oil from Iran by November, 2018.

It’s anticipated that the Chinese may demur and chose to buy the Iranian oil at a discount.

That won’t stop oil and gas prices rising in North America.

Full Disclosure: Renaissance Oil is an Equity Guru marketing client, and we own stock.