Today I had the following conversation with a colleague.

LK: I believe the price of gold is going higher.

BM: Why?

LK: Global money printing!

BM: That’s all ya got?

LK: Ever tried living off your credit cards?

BM: No.

LK: I did.

BM: And?

LK: It ended badly.

At this point – sensing firm resistance – I pre-emptively cited the Fitch Ratings Report on Trump’s Tax Cuts and Jobs Act, which projects an additional $1.5 trillion added to the federal deficit over a decade.

Surely all those duffle bags of $100 bills fluttering like confetti from helicopters will devalue fiat currency and cause a stampede to gold equities!

My colleague sighed with paternal fatigue (despite the fact he’s barely out of his teens).

BM: We can argue about debt-to-GDP ratios until the Llamas come home. But here’s the real-time problem with gold. Nobody gives a shit. Weed, blockchain, tech, cobalt – that’s where the action is. Go look at the biggest-volume traders on the TSX today. I bet there’s no gold company in the top ten.

I did “go look”.

Yamana Gold (YRI.T) was the highest volume gold company – but only the 13th highest volume trader over-all – with 2.6 million shares changing hands.

YRI has a portfolio of mines in Brazil, Chile, Argentina, and Mexico. Yamana had 2017 revenues of $2.2 billion. The targeted 2018 gold production is 900,000 ounces.

On November 10, 2012, YRI was trading at $20.14. Since then it’s dropped to $4.13 – losing about 80% of its value.

If gold goes to $2,000 Yamana will go up like a rocket ship.

But history suggests that the junior markets will rise faster and higher.

If you’re looking for a beaten down gold company with explosive upside, Cabral Gold (CBR.V) should be on your radar.

CBR owns the Cuiú Cuiú Gold Project located in the Tapajós Region within the state of Para in northern Brazil. Cuiú Cuiú has Indicated Resources of 5.9MMt @ 0.9g/t gold (200,000 ounces of gold) – worth about $330 million CND at today’s spot price.

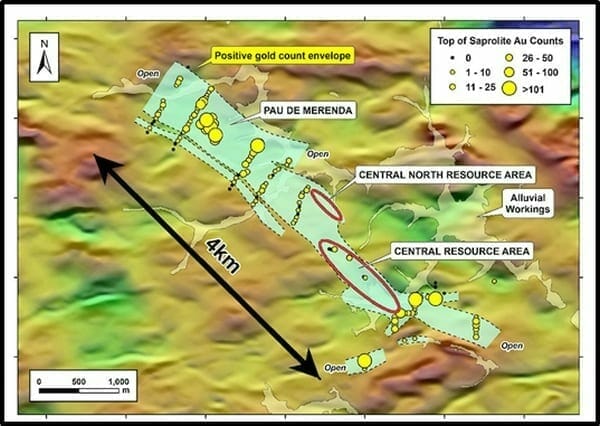

On July 5, 2018, Cabral Gold released the initial results of an ongoing auger drilling program sampling saprolite within the Central – Pau de Merenda target corridor at the Cuiú Cuiú Project.

Auger drilling is used on soft rock or soil formations that don’t need heavy machinery. Three blades, attached to a hollow tube cut into the earth. The tube is able to separate the samples from the materials.

The samples are thus not damaged and can be easily analysed. Auger drilling is useless on hard rock. But in the soft stuff, it can reach depths of 900 feet.

Cabral Gold’s Auger Drilling Highlights

- Weathered bedrock sampling returned highly anomalous gold counts

- Peak values of 18.7 g/t Au

- Gold counts in places exceeded 100 per sample

- These results define a mineralized corridor extending for a minimum of 4km in a NW-SE direction (open along strike)

- The Central deposit, which contains 485,000oz (5.9MMt @ 0.9g/t Au + Inferred resources of 8.7MMt @ 1.1g/t Au), currently occupies the southeastern 1.2km of this 4km long anomaly

This is a big deal because Cabral’s Cuiu Cuiu asset is immediately adjacent to Eldorado’s (ELD.NYSE) 2.2 million-ounce TZ project which got its construction license in April 2017. Eldorado is a $1.1 billion global gold developer with gold revenues of $84 million last quarter.

Until the current auger drilling program, the trends had not been well understood due to deep soil cover that partially masks the bedrock geochemical response.

The Pau de Merenda-Central corridor is in the central part of the Cuiú Cuiú property. In the above image, targets with established resources are shown in red. Primary target zones under evaluation for drill targeting are shown in yellow.

According to the July 5, 2018 press release, “The current program of work has involved an initial campaign of channel sampling, pitting and auger drilling in the Central – Pau de Merenda corridor, to provide a more precise framework to determine drill targets. Additional trenching and channel sampling are still in progress.”

The Cabral geo team believes the latest results “strongly suggest the presence of a wider and much longer mineralized corridor that encompasses the Central deposit and the Pau de Merenda target, than was previously envisaged.”

“The auger results from the Central – Pau de Merenda corridor area are very compelling and strongly suggest the presence of a significantly larger area of gold mineralization than is suggested by the current resource at Central,” confirmed Alan Carter, Cabral President & CEO.

My colleague was right.

Nobody gives a shit about gold.

Which makes it the perfect time to buy gold.

I realise there’s a vapour of nuttiness rising from that last statement, but at least there is hard data to support my belief – which is a more dignified form of delusion than performing a Bhujangasana before a huckster-with-a-man-bun, thinking he’s your personal wealth advisor.

A positive step for Cabral at Cuiú Cuiú is to convert the Inferred Resources of 19.5MMt @1.2g/t gold (800,000 ounces) to the indicated category.

The inferred resources are worth about $1.3 billion at today’s bullion spot price.

Note: the existence of a large indicated or inferred resource does not mean Cabral can build a profitable mine.

Cabral is currently trading at .25 with a market cap of $7.8 million.

Full Disclosure: Cabral Gold is an Equity Guru marketing client, and we own stock.