In part one of our ongoing look at Namaste Technologies, we watched former company insider Kory Zelickson have trouble answering a simple question about margin. In part 2 of this never-ending series on the Canadian pot-sector e-retailer, CEO Sean Dollinger was upset about traders who were lining up on the offer side to scare away bids.

“If this were the United States, these people would be going to jail!”

-Namaste CEO Sean Dollinger

We suggested that, instead of whining on a livestream and insisting that the exchange and IIROC solve his problems, Dollinger reach into his pocket and take those offers out LIKE A BOSS; mostly because it would make for better live-streaming than the snivel-job we were getting (not that I’m complaining. This is still the best show in smallcap).

In a release that followed that post, Namaste announced their intention to do just that… almost. The company will use the treasury to defend the share price in a normal course issuer bid that sees them buying up to 10% of the outstanding float. Such a purchase would cost $38M at yesterday’s $1.53 closing price, around 75% of Namaste’s cash balance last February.

That Feb balance came right after they sold 15 million shares to raise $40 million at $2.55 in a private placement that, if they go through with this buyback, would represent a wicked sharp short trade. So I’m sorry I inferred that they didn’t know anything about the stock market.

The real headline in the release, though, is the departure of former CFO Philip Van den Berg, who is starting to look like the smartest guy in the room. Van den Berg blew off 600,000 shares on the beginning of the down-slope in January at $3.15, then peppered off 200,000 shares worth of $0.13 stock on his way out (he got the last 100,000 shares off on the day we posted part 2) and had his name mis-spelled in the exit release as a thank-you.

We’re hoping that incoming CFO Kenneth Ngo is a bit more thorough, because sorting this out caused us no small amount of eyestrain-related headaches.

Making it all add up

In Canada, public companies are required to file quarterly interim financial statements that are approved by management. Only the annual financial statements of TSX Venture companies are required to be audited, and approved by the auditors. The quarterlies are management prepared.

The net effect of this setup is that investors get transparent, audited financials for TSX Venture pubcos once every 12 months. If the management-prepared financials for the three quarters that precede those annual statements aren’t exactly, y’know… right, it isn’t the auditor’s problem. The auditor never reviewed those statements, didn’t have anything to do with them. The auditor’s job is the end-of-year financials. The interim statements, the ‘tweeners, are management’s problem and the reason we keep saying that is because Namaste’s are tough to follow.

Early on in Namaste’s epic rip on the pot wave, the company leaned into their natural instinct to declare their management-prepared quarterly financials an epic victory, and to broadcast them far and wide. Here’s a release from Jan of 2017 explaining that in the first quarter of their fiscal 2017 (period ending November, 2016), Namaste earned a gross profit of $686k on $2M in revenue. That isn’t bad at all. They should be proud of a 32% sales margin. An operation generating that kind of cream can be scaled up handsomely.

(Brief aside: it’s hard to state just how important gross profit is to a burgeoning retail operation. Top line profit – total revenue lest cost of goods sold – is the spine upon which the venture is built. A growth-stage company is bound to report a bottom line loss for any given period, because operating costs are what scaling up is all about, but the ability to sell things for more than they’re bought for on aggregate top line profit, is the reason those ops costs are worth incurring. The less margin, the less it’s worth doing. Negative margin, and the company is paying to scale a losing bet.)

In 2017, Namaste posted gross profit in all of their management-prepared quarterly financials. They quit crowing about it in press releases after that first one, opting instead to issue monthly updates on their revenue, and adding in metrics like traffic rates and conversions from their various subsidiary properties. These metrics are relateable to a shareholder-base familiar with e-retail, but leave traditionalists guessing when it comes to details like margin. We still got three quarterly updates on the top line profit from Namaste in the form of management-prepared, unaudited financial statements. And here’s what they were (all figures CAD):

| Period ending: | 2016-11 | 2017-02 | 2017-05 |

| Revenue | 2,087,188 | 1,907,106 | 3,164,232 |

| Cost of revenue | 1,404,172 | 1,080,502 | 2,632,202 |

| Gross profit | 683,016 | 826,604 | 532,030 |

| Gross margin | 32.72% | 43.34% | 16.81% |

Nothing wrong with that at all. Revenue increasing from period to period, and wide margins to build with. This is great stuff.

But when the auditors got a hold of these these finances in the 4th quarter to prepare the statements for the year end, they had a different interpretation.

| Period ending: | 2016-11 | 2017-02 | 2017-05 | 2017-08 |

| Revenue | 2,087,188 | 1,907,106 | 3,164,232 | 3,822,888 |

| Audited cost of revenue | 1,500,348 | 1,309,072 | 2,943,875 | 3,849,991 |

| Audited gross profit | 586,840 | 598,034 | 220,357 | -27,103 |

| Audited gross margin | 28.12% | 31.36% | 6.96% | -0.71% |

That flat margin in the final quarter doesn’t look very good, but it’s important to give everyone working on this file credit for getting there, because when you do the straight math to calculate that quarter by subtracting the previous 3 from the 12 month period totals, Namaste ends up with a gross LOSS of $541k in the August quarter, for a margin of -14.15%.

If you’re keeping score at home, it looks like around a million dollars in costs had to get shuffled about, and $100k in costs had to get re-classified as operating expenses of one kind or another. This isn’t exactly high treason, it’s mostly just a pain in the ass, and I suspect the company doesn’t realize just how much it’s hurting them.

Morningstar and Stockhouse still show a Namaste $600k gross loss in Q4, because Namaste never bothered to re-state any of the interim financials that had to be changed, and the algorithm that does the arithmetic to figure out the 4th quarter numbers doesn’t bother to go through SEDAR and de-tangle it, because it’s very tedious and time consuming (trust me). Mistakes happen, of course, and companies who make them generally re-state their financials so that research analysts and data aggregators can keep up to date, and not have to wonder a year later how the hell they got there. For a company to be taken seriously by serious analysts in serious markets, basic reporting can’t be sloppy.

The management-prepared quarterlies for the two quarters that followed this mess reported gross profits of 32% and 64% on $1.3 million and $2.4 million in revenue, respectively, and we’re looking forward to checking them against the year-end audit. To be fair and clear: while Namaste has had its trouble allocating costs and calculating margins, they never mis-stated their revenue in any of these periods.

Now, I don’t want to come down too heavy on these guys. Non-audited interim financials are the law of the land in Canada. I gather it’s done to save on audit costs but, in some countries, where quarterlies must be audited, mis-stating quarterly financial information is a serious offense.

In other words:

“If this were the United States, these people would be going to jail!”

-Equity.guru Contributing Editor Braden Maccke

Sorting this sort of thing out is a thankless hassle, and the company didn’t bother to respond to my inquiry about it, so: in the words of Larry David:

“I’m not really a Namaste guy.”

But, despite what the comments section might have you believe, I’m not writing these to grind an axe. Readers don’t come to read about what I love and hate. At least, they shouldn’t. My posts are about equities analysis, so here it is:

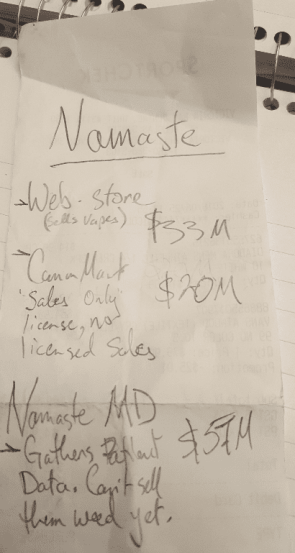

A back-of-the-receipt tally of Namaste’s value

A back-of-the-receipt tally of Namaste’s value

The bedrock operation

At it’s core, Namaste is a Shopify store that sells vaporizers. That business made a gross profit of $1.4 million on $11 million in revenue last year; 13%.

The average e-retail pubco price to sales multiple is 0.32, but it should be noted that this metric varies widely. At ten times the national average, Namaste’s existing operations are worth $36 million.

The potential for vertical growth

Management has built this vaporizer-selling Shopify store because it is the closest thing to a weed-selling Shopify store that one can build at the moment. They’ve gone to great lengths to build and acquire stakes in infrastructure that could help them become a weed-selling Shopify store.

Their Cannmart property is a Health Canada licensed “packager, labeler, and associated product tester” that may one day be licensed to sell weed either to or through the provinces. Adorably, the company consistently refers to this HC license as a “sales-only” license, despite the fact that selling weed is the one thing apart from growing it that they are not yet licensed to do.

That has to be worth something but, since it’s the only one of its kind, it’s hard to value. By the sound of it, the property is a high-security warehouse in Etobicoke with a valid HC inspection sticker. That sounds like it’s worth a couple million bucks, so let’s give them ten times that:

Running valuation total: $58 million.

NamasteMD is a web property upon which users can give up all manners of personal information in exchange for a tele-consultation with a Licensed Nurse Practitioner that might culminate in a prescription for cannabis-based medicine that neither Namaste or anyone else with a Shopify store is yet allowed to sell them. Namaste is obsessed with acquiring 50,000 patients in this manner, have acquired 6,000 so far, make their acquisition cost at <$50 per patient in the latest episode (which is down from the $60/patient they had it at last time) and most recently make the EBITDA of those patients at ~$360/patient, but it’s unclear how that figure was arrived at, considering the fact that they’ve never sold a single gram to a single patient.

Assuming the invented $360/patient is an annualized figure, and assuming N ends up with 50,000 patients who actually buy weed from them instead of heading down to the corner shop like the rest of us, that’s $18 million/yr in revenue.

Applying the same very generous price to sales formula that we used for their existing sales (10x the national average of 0.32) to this sales figure that the company made up, we arrive at $57.6 million. That’s around $1100 in market cap per patient, so let’s go with it.

Running valuation total: $115.6 million.

The noise

I’ve been complimentary towards their promotion and I continue to mean every word. The direct-to-investor approach really isn’t used often enough and I hope it catches on. Too often, great venture stage companies are under followed for lack of information. Namaste doesn’t have that problem.

Instead, Namaste’s endless torrent of information suffers from a consistent lack of material relevance. Removing the news releases that are updates and corporate necessities, the deals Namaste announces break themselves down into two categories: service agreements of questionable value and equity transactions with no present value.

All of this stuff is too noisy to be rated. It amounts to un-value-able partnership agreements and ventures that could become sunk costs just as easily as they could become integral pieces.

I’m going to list them just the same, because value is in the eye of the beholder.

Service agreements / partnerships

N has service agreements with Indigenous Canadian Medical Dispensary (allowing for the linking of dispensary clients with nurse consultations), some sort of Australian authenticity token called YPB (shows whether or not a vape is the genuine article), a distribution agreement with Cali smoke brand Lowell Herb, similar agreements with vape Co.’s, including Shatterizer, the right to commercialize needle-free cannabis injection (say goodbye to the hassle that comes with cannabis injectables!), an agreement to supply a Tetra Natural brand, and for good measure they’re doing an observational study about the effect of weed on anxiety, because how hard could medical research be anyhow?

There’s a take or pay with Supreme for 1000kg at $6000/kg through the end of the year, and my personal favourite is a supply/research agreement with Emerald Theraputics Inc. (EMH.V) that has EMH and N “colaborating on strategic business opportunities worldwide,” including EMH providing “proprietary strains of medical cannabis” to N for sale over its platform. We’ve previously pointed out that there is no evidence that EMH grows any weed at all.

I’m not giving these service agreements any value, because they don’t deserve any. Apart from Supreme fronting them $6 million worth of weight with the clock ticking, none of them are binding and none of them are exclusive.

Equity deals

We’re going to take these in order of nominal value:

Findify.io

Namaste paid $12 million cash and stock for this “machine learning / AI” company that, as near as I can tell, is some version of the Amazon algorithm that decides what “you may also like.”

Sean and Kory loved it so much they bough the company (with their shareholders’ money), but I’m having trouble seeing the value here. Web-archives indicate that Findify came out of beta in 2015, and has been a front-end plugin offering improved conversions to e-commerce stores ever since. 1000+ of them, by Namaste’s count.

Findify is a sofware-as-a-service company with going on three years of active business in the spot where the ever buzz-worthy AI sector meets the future-of-retail e-commerce sector… and they got taken out by a client for $12 million Canadian, 84% of it stock.

We’re looking forward to learning what this revolutionary SaaS platform does in client revenue.

Namaste first reported using machine learning when it bought and integrated their everyonedoesit.com property that sells vapes in the UK. At the time (January 2018), they were pleased with a 15% increase in conversions and a 11% increase in purchase price achieved by the integration and some streamlining.

Their latest rundown has EDIT.com achieving a 1.23% conversion rate, and a $62 basket price in the month of March, 2018 to gross $152,042. It’s unclear what kind of a conversion rate or basket price is considered good.

Pineapple Express Delivery Inc.

A cash-heavy (85-15) $1M investment for a 15% stake in a private cannabis delivery platform.

There isn’t much out there on Pineapple Express, and all the presser says is that they have a service agreement with Ample Organics. No mention of them having a license or a license being required to deliver cannabis, or exclusivity on their deal with Ample. PE’s website is pretty thin.

Cannbit Ltd.

Cash and stock deal for an Israeli-based cannabis producer.

This company is completing a deal to do a reverse takeover and trade on the Tel Aviv stock exchange. Namaste got a 10% stake for $908k cash and stock, and the press release makes it sound like they bought it for a trade.

Infinite Labz

This yet-to-be-built concentrate factory is under construction thanks to a first-priority $750k shareholder loan from Namaste. Namaste has struck a deal to buy a 51% interest in the company building the (notional) Etobicoke facility, but nobody is saying how the purchase price is to be determined. IL does not have a website, and appear to have adopted their edgy name in the month between the LOI and the deal closing.

Namaste seems pretty confident that the eventual facility will “increase their margin,” which it surely will, because their margin on concentrates is currently zero on account of the fact that they don’t sell any concentrates.

This list isn’t exhaustive, but it’s about as much of this as I can handle. Ring me up.

Checkout

If we give the company’s venture capital arm a valuation equal to their patient portal, we end up at a total valuation of $172.6 million, and that doesn’t even seem unreasonable, but it’s hard to find a corollary because, in the pot world, there’s nobody quite like Namaste.

Maricann (MARI.C), whose public disclosures are every bit as inept and have a well-earned reputation among investors for being evasive and shady trades for $225 million.

Newstrike (HIP.V), who can hype with the best of ’em, is going for $300 million.

Namaste currently trades at a market cap of $420 million, which is spot on, because it seems pretty high.

(ED’s note: Special shout out to EG research team member Jayden who was integral in sorting through the birdsnest of N’s financials. We’re still reporting on Namaste, and hope to bring you an analysis of the practicality of a Shopify cannabis store when it’s ready. See you in the comments.) (Feature image is PE IN FULL EFFECT!, courtesy CBS Recrods/Glen E. Friedman)

Thanks for the props. You will eat your words soon enough. You must have a HUGE hard on for the management group. All that time you took to write that was a waste. What a loser

Thanks for reading! We appreciate your support!

Thanks for the insight. I am watching them closely since the whole – shareholder pledge party business and the officer trades going on during this time. I have quite a lot of Namaste shares – I got in right at the bottom so it will be disappointing if this company ends up being not what we had hoped for. We now know as of recent (can’t quote the date) that they did get the sell only license. I do think there is reason to feel that this team of officers might be suspect. :/ We shall see I’m sure. Thanks you, I felt your series was well done.

Dear Melinda, Was your comment auto-translated from Burmese? You state that you are a Namaste share-holder. Yet you express no vitriol, outrage or indignation at the Equity Guru writing staff. Your lucidity, calmness and warmth has caused a sharp mental disconnect. Anyway – assuming we’re not being “punked” – congratulations for “getting in at the bottom”. Don’t forget the other half of the equation: sell higher! Thanksgiving indeed. God bless you and all your kin Melinda.