(This is part two of a three part series on Canadian marijuana e-retailer Namaste Technologies. Part 1, part 3.)

“Lifestyle marketing” is the invention of whatever real-life Don Draper figured out that people couldn’t care less about the many benefits offered by whichever product or service is paying to be advertised to them. Charts and graphs get information to sink in, but so what? Math is for squares. What people really want is the dopamine rush that comes with being able to imagine themselves as the person they deserve to be. Let ’em dream on that for a while, and they’ll buy anything in the real world that might make it come true.

Coffee Break Youtube channel, giving the people what they want.

In part one, we looked at how the people from Namaste were living their dream out loud in some kind of annoying dubstep track that’s only got one gear and never gets around to dropping the bass. The dream being sold there is the financial independence that comes with being in on the ground floor of the Amazon of pot, and who can’t get behind that?

All the finest, most personal dreams can be custom made out of the wealth dream, and that has everything to do with the company’s impressive retail investor following, many of whom are surely market neophytes who identify with CEO Sean Dollinger. This first-of-its-kind direct engagement strategy is effective because the lifestyle being showcased is that of self-styled, maverick third wave internet entrepreneurs. Nobody dreams on a stock market lifestyle, or at least nobody should. The stock market is terrible. This archetype is tolerating a brief encounter with it only for as long as it takes for their entrepreneurial genius to make them very rich through their ownership of the One True Stock.

Couldn’t fake this if you tried

Dial it up at 18:47, and witness Namaste CEO Sean Dollinger complaining about the “spoofing” of offers in the market for N.V.

I like the way he illustrates it using hand puppets.

While there are indeed IIROC rules against “spoofing” orders, Dollinger appears to be describing activity in an open market, and if that’s the case, he’s at very least got his terms wrong. Spoof orders are placed pre-market by traders trying to keep the bid in check. The offers can be called “fake” because they disappear when the market opens, and nobody has a chance to take them out. There is no way to make an offer during an open market that isn’t available to a buyer and, therefore, not “fake” by any definition.

Dollinger’s story has Namaste being manipulated by offers placed during an open market to scare off bids and drive the price down. That’s also dirty pool, of course, but I’m struck by the fact that he doesn’t mention trying to take the “fake” orders out.

Sean (I know he’s a reader), the next time you’re watching a big, scary wall line up on the ask side, consider setting an example by calling your broker instead of IIROC and the exchange. Cleaning out the offers, then going on youtube to put everyone on notice that you’ll do it again would be a baller move. Classic walking the walk. You’d have straight up taken stock from the jealous haters who are just using it as cheap ruse, trying to drag you and your shareholders down, and those sorry losers had it coming! It would come off a lot more confident than whining to and about IIROC and the TSX, but would also cost a lot more, and I don’t really know much about marketing. Maybe people identify better with whiners.

Don’t make me get my spreadsheet…

Let that video roll through 21:46 and Dollinger gets all righteous about it, telling his audience that Namaste “deserves” to be the leading company in the space.

“We deserve to be the leading company in the space. We do $30 million plus in revenue, next year we’ll do over $85 million. I can’t tell you how many companies presently do over $30 million, but I assure you, it’s not over five in the whole entire industry.”

-Namaste Technologies CEO Sean Dollinger on 420 Live, June 6th 2018

Dollinger has got one thing right: there are exactly five Canadian pot companies with more than $30 million in trailing twelve months revenue. But Namaste is not among them.

Namaste’s gross revenue in the most recent 4 quarters adds up to $17.5 million, which would have earned a top line profit of $3.5 million, and a net loss of $11.8 million.

(Author’s Note: We thought Dollinger might have been referring to the company’s last fiscal year, so we looked it up. He wasn’t, but BOY did that take a while! The original version of this post had an analysis of Namaste’s cashflow here, but various failed attempts at making their accounting add up from quarter to quarter made for enough content to fill a whole other blog post. At this time, we’ve sought comment from the company who may or may not get back to us before we publish The one and only Namaste Tech pt. 3, so stay tuned for that. (update! here it is.) For now, we’ll stick to their revenue, which is reported consistently in their statements, but doesn’t add up the way Dollinger adds it up on 420 Live.)

Namaste does not have $30 million in revenue in the trailing 12 month period. Namaste doesn’t have $30 million in revenue in any 12 month period. There has not been $30 million in revenue in the entire history of Namaste Technologies! $23,858,618 is every dime this company ever grossed and reported to date.

I thought for a second that Dollinger might have got to $30 million by forward projecting revenue based on his most recent quarter, but they did $5.6 million in Q ending Feb-18, and 4 of those would yield $22.4 million.

While he’s got the IIROC rule book out and is broadcasting to the world, Dollinger might want to see what it says about material misstatements by company executives. But don’t worry, Sean: I ain’t no snitch.

Printing money

But not for the company’s net.

You’d better believe there’s some stock being printed. Those 20 million shares in Dollinger’s SEDI filings didn’t all come out of the market.

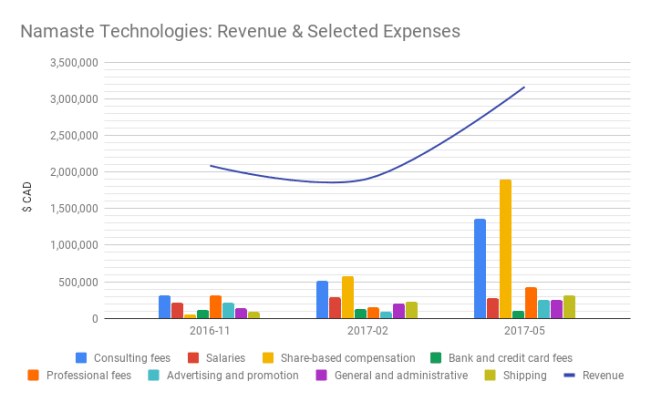

I make no apologies for this strange chart, it’s a product of Namaste’s unique type of accounting.

The chart was drawn to illustrate the rate at which stock is being printed in this company in relation to other https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.png expenses, and their gross revenue. Stock-based compensation is Namaste’ single largest https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistrative expense in the middle two quarters of fiscal 2017. Fiscal Q4 (ending in August) is when they quit reporting the line items this way, so 3 quarters of these is all we get. I’m going to reserve comment on the Aug quarter until I can make sense of it.

The nature of companies’ stock options plans are that they are authorised to issue a certain amount of options to directors, officers and employees during the year. When those options are issued and at what price remains the discretion of management. The options are booked in the quarter that they vest, at the fair market value that they vest. Shareholders ought not have a problem with hard working management being paid in stock for growing the company, and professional operators of ventrue-stage companies never miss out on a chance to print themselves some paper.

Maybe this Namaste crew are stock market people after all.

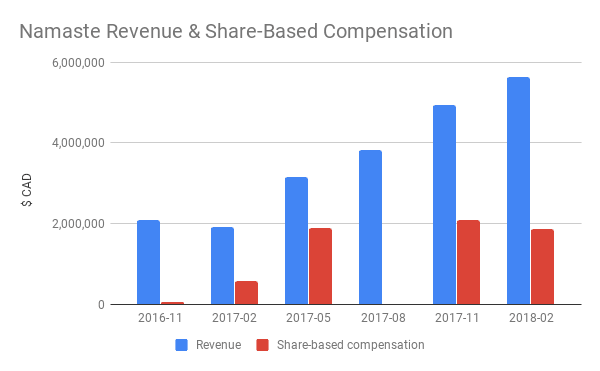

The accounting change threw us a curve ball, but we can still chart the stock-based compensation vs. revenue for all quarters except the year end quarter, and here it is:

The entitled millennial cliche is a bit on the nose here, but it sure fits. This venture-stage e-retail company whose sales of actual marijuana are still a dream has come by their portion of this out-of-control pot market by securing actual revenue from sales, and showing a gross profit from those quarters. As we look at the revenue against the company’s quarterly share compensation, one has to wonder if Namaste’s management is operating as though they deserve a healthy chunk of equity in any quarter that they can show revenue and top line profit.

It’s an interesting study in modern management psychology. To test our thesis, we’ll first have to get a handle on Namaste’s operating profit. Stay tuned for part 3.

(feature image of Don Draper surely belongs to AMC, but comes via Ross Sarcano over at complex.com, one of those guys who invented love to sell you nylons.)

You guys mad they aren’t paying you for publicity? Wanting a piece of the pie for a lower price? Good luck with your attempt at a hit piece. Don’t forget to mention all the good things Namaste has done…. I’m sure that will be left out lol

Thanks for the well wishes, Josh, and thanks for reading.

Namaste is not an EG sponsor, and it wouldn’t matter to me if they were. I’m hired by EG to write original content about smallcap companies, and that’s what I’m up to.

Lordie lawd…look at those consulting and compensation fees SKYROCKET! Looks like a circle jerk of check writing to ‘consultants and whatnots!’ Esp. considering how low their advert spending is when that should be at a heavy saturation point and I don’t see anything related to them in my lil’ town here in SoCal.

Or am I missing something here???

I’ve only got the consulting fees in there for scale on the share-based compensation, which is in there like clockwork. My original goal was to chart the equity comp to management against the top line profit, but they change their mind so often on what the gross profit/loss is that it’s hard to get a handle. Part 3 will go into those inconsistencies.

I’m on-record in part 1 that I like the way they do IR, and I’ll add here that that includes their IR spend, which is low.

I thought this was an article on Namaste Technologies, but rather it seems like a hit piece on on Sean Dollinger. Clearly you guys have some beef and are trying to push a narrative to your audience. Sentencing your article with “Sean (I know he’s a reader)” clearly tells us the intent on why this article was even created, as well signs of an inferiority complex and delusions of grandeur. The data and numbers you’re showing isn’t wrong, but the conclusions you’re drawing either tells us you’re either VERY ignorant, or VERY disingenuous.You’re cherry-picking numbers and drawing conclusions that are non sequitur.

Josh and Anson, the writer of the article states that, “Company Founders Sean Dollinger and Kory Zelickson aren’t afraid to tell anyone who will listen that they’ve got a better handle on marketing than anyone.”

The numbers suggest that Namaste is better at marketing their stock to neophyte investors, than they are marketing weed to consumers.

Warning signs? On May 15, 2018 the company issued a press release, “New Logo Symbolizes Namaste’s Evolution”.

“The color palette was modified meticulously with a tight selection of turquoise, blue, and green tones to reflect the values of trust, transparency, tranquility, and wellness,” stated the press release, “The addition of fuchsia represents the edge and technology that the Namaste team brings to the fold.”

A CEO can issue a press release announcing a successful bowel movement. Talking about the meaning of the fuchsia in your logo, isn’t far from that. Do some good companies traffic in hogwash? Probably. But it’s a red flag. Your money is important. If you are a Namaste shareholder, the numbers in this article are relevant to your investment prospects. The writer is my colleague. I disagree with him frequently. But I promise you the data is fuchsia-free.

This is proving my point. Sean has gone on record in stating they are pushing back on press releases and are only going to issue an press release when they successfully follow through with a deal or reach a goal. Again, you guys are either being dishonest, in cherry-picking data and information to push a narrative or just ignorant. The latter is fine since you have a disclaimer to CYA which states you guys aren’t licensed professionals and might not have all the necessary information.(However, one would assume you have done a lot of research since this IS an multi-part article)The former is just childish and unprofessional.

Anson, thankyou for your measured response. I suppose, loosely speaking, “Cherry picking data and information” is exactly how you construct an article. ie. you have an opinion (Namaste is style-over-substance) and you cite data points to support that. Quoting verbatim a 40-day-old press release, or financial disclosures, would seem fair play. Conversely, if you just RANDOMLY stuck data points onto your article, it wouldn’t form into a cohesive shape. Anson, you have to admit, the CEO does sound like a used-car salesman. That is some truly weak sauce he’s pouring on You Tube. Best of luck with this and all your investments.

When I say cherry picking information. Why didn’t the author add NamasteMD or Cannmart to his calculation 22.4 million by years end? Did he accidentally leave it out or have such bad research and analysis skills that he wasn’t able to find their biggest investments.

In calculating the company’s revenue, I used the consolidated financial statements of Namaste technologies, prepared and approved by the company for the respective periods. Itcs my understanding that Cannmart & NamasteMD are wholly owned subs whose revenue was consolidated into those statements & included in the figure.

If those companies were NOT Namaste subs, and their revenue was not included in the figure (not my understanding) then N shareholders would not own that revenue, and it would not count as Namaste gross sales by Sean’s definition or anyone else’s.

This is very poor and very harmful research and analysis. You projected the annual earnings of a company using data obtained 2 months ago without factoring in any of the present and future knowledge you obtained or any of the variables that affected it. A few variables you didn’t consider were

1)Their quarterly reported 1600 patients. Reason because they were still in beta phase and letting only a few people on to test stability and accuracy. Since “official” launch they gained 4400 new patients in 2 months.(no marketing done so far) They projected 5k patients by July ( reached 6k before July) and projected 50k patients by years end

2)On May 7 they signed an exclusive agreement with Ample Organics that allows them to sell vaporizers to their clientele. (Has been easily integrated in their systems)

You have access to all this new information, but instead you took a 2 month old quarterly and multiplied by 4. You either intentionally left it out, very horrible at research and analysis or you got lazy. Why are you making a multi-part article if it’s just done poorly. If you call yourself an editor or journalist, have some integrity and put in the effort and do the research and analysis properly.

Hey Anson, I’ll repeat – go eat a bag of dicks. If you have better information, go write your own report. Sitting here all day calling my people lazy because they’re not spending as much time bouncing on Namaste’s dick as you are is just a silly waste of everyone’s time.

We’ve called the future on Namaste several times and BEEN RIGHT EVERY TIME.

So long. Namaste. Good luck.

Chris Parry

1) ” they’re not spending as much time”

You’re literally PAYING people to do research for a MULTI-ARTICLE write up and having opinions that are easily being corrected by a 5 second google search.

2)”We’ve called the future on Namaste several times and BEEN RIGHT EVERY TIME.”

I seriously don’t see how you can be right about ANYTHING when during the course of our entire conversation I ANNIHILATED every single one of your arguments so hard, you DEFLECTED, resulted in NAME CALLING and plain STOPPED and GHOSTED my arguments.

You call yourself and editor and journalist but you have ABSOLUTELY no clue what you’re talking about and speaking on things WAY out of your depth. You’re so stubborn in not admitting you’re wrong you’re willing to damage the credibility of your words and business.

Alright homer, we called Namaste as being severely overvalued and the weed stock mostly to lead the sector in collapsing in mid-December. It duly got crushed and has never recovered.

We’ve said since it wasn’t going up while you Dollinger nuthuggers claimed it was going to double any day now. It never has.

If you listened to me, you got out with your profits. anyone who has listened to you has been beaten and bled out.

So use AS MANY CAPS as you want, but you’re still wrong. History has proved it.

You have such strong opinions of a company and the first thing you name to boast about on being right is a basic TA on a company consolidation after a 10x increase in sp in 1 month? As well, it’s contingent on it may or may not stay low forever for the entirety of it’s life? Do you actually have anything to boast about or are you going to keep shouting ” the sky is blue” till the sun sets when you can’t anymore?

How can you publish such filth

You mean the photos of the sexy nurses Namaste’s CEO paid for to sign people up for an illegal telemedicine medical consultation?

I know. It’s disgusting, isn’t it?

If you think I’m cherry picking data, or otherwise unfairly treating these numbers, go ahead and set me straight. You’ve got access to the same public filings, public statements as I do.

Thanks for reading, Anson.

I want to go on record here and say that Dollinger & Zelickson are currently my favorite characters in all of Canadian small-cap. This is not a hit piece.

Instead of making you read my mind: “clearly tells us the intent on why this article was even created…”, I’ll be happy to lay it out. I wrote this because Sean Dollinger went on a live stream defiantly told the world that N has “$30 million in revenue,” (they don’t), and that it “deserves to be the top company in the space.”

Those are the kinds of statements that my readers expect me to look into and write about, and I intend to continue doing it. As I mentioned, there’s more where that came from. Their financials read like the plot of Mullholland Drive, and I’m happy to do the service of sorting them out.

Assuming you’re a shareholder who’s not happy with how the company is looking, I suggest you take it up with Namaste. Nobody puts a gun to their head and makes them do a weekly livestream where they whine about the big bad offer side beating them up and feed me enough content for 3 blog posts a week.

Again, As I stated before, ” data and numbers you’re showing isn’t wrong ” however the conclusion you arrive at is wrong either because you’re intentionally cherry picking data and leaving it out or have very poor research and analysis skills. EX.”I thought for a second that Dollinger might have got to $30 million by forward projecting revenue based on his most recent quarter, but they did $5.6 million in Q ending Feb-18, and 4 of those would yield $22.4 million.” This is 100% Correct. HOWEVER, you leave out the fact that this number is from Vaporizer sales alone. The sale of cannabis and/or fees from customer acquisition through NamasteMD and Cannmart isn’t calculated in yet. NamasteMD is projected to have 50k patients by years end. As well the accuracy of Seans projection with the confirmation of 6000 patients instead of 5000 ahead of schedule with no marketing done so far.

Haaaaaahahahaa

50k patients by year end. Okay. Sure.

Hahahahahahaaaaaaaaaaaa.

Sorry, I have to go prep for my date with Charlize Theron, that I project will happen by year end.

Haaaaaaaaaaaaahahahahahaha.

Unprofessional and childish. Instead of providing facts and figures why you think they won’t make the projected patients by years end, you scream like a child.

Namaste Projected 50k patients by years end

Namaste Projected 5k patients by the beginning of July, and they already reached 6k before the projected date. All through word of mouth and no advertising which they will begin.

You want professionalism? I’ve won awards for excellence in journalism, you’re a rando on the internet.

Eat a bag of dicks.

You people who write this BS have no clue what your talking about..50 k is achievable…when they get their license to sell go on 420 as a guest and apologize to all the investors in person. Put your so called knowledge to use. I’m not hating I’m in at 30 cents.

50k is achievable?

How many LPs, which have been spending big money trying to get patients and being doing so for several years, have 50k right now?

But Namaste is going to hit 50k, during a time when it’s going full rec so patients will be able to buy it in stores, and while they’re not allowed to actually market themselves.

Okay. Sure. Good talk.

1) “How many LPs, which have been spending big money trying to get patients and being doing so for several years, have 50k right now?”

You do realize that’s because the regular process can take up to 10 weeks for an application to process. While NamasteMD can get you prescribed and ordering in a couple of days.

2)”during a time when it’s going full rec so patients will be able to buy it in stores,”

Nope, medical marijuana is TAX DEDUCTIBLE. On average, a medical patient spends about $2000 yearly

Hmm, so every other LP is going to give up their only way of getting premium pricing so Namaste can play with Shopify?

Get real.

1)”Hmm, so every other LP is going to give up their only way of getting premium pricing”

Why do farmers sell to supermarkets if they can “make more money if they sold everything themselves? ” Because they don’t. If anything your profit margins should increase. Shipping is one businesses most expensive costs. Although they may have to lower their prices, they have a competitive edge because they don’t have to handle any shipping costs and importation fees. As well, you can get access to a whole new clientele you wouldn’t have had before.

2) “so Namaste can play with Shopify?”

I don’t understand, is this implying Namaste’s competition Shopify? You do realize Shopify is just a platform … right? Namaste’s websites are also on Shopify. Shopify isn’t like amazon, you can’t just search something up and buy from it. Any business that will create an e-commerce business on Shopify doesn’t have access to any of the technologies and services Namaste offers.

It’s funny, every time you respond you do not challenge any of arguments I made and interject with something irrelevant to try deflect the conversation. And your deflection digs you a digger and digger hole that show that you’re WAY out of your depth, and you have absolutely no idea what you’re talking about.

Again, Chris Parry, AirBnB is a platform, Amazon, Alibaba .. think sir think … the internet is not the past it is the now … Google was built on selling advertising, a platform … the platform just needs traffic … hi facebook platform … smoke and mirrors …. what LP is a high ranking Googler on their board? Namaste … you really need to do some more research … Amazon pages differ from user to user based upon AI and machine learning … you seem to must be behind the times or are ignorant

Air B&B doesn’t put out a press release every time someone rents out a house. Amazon doesn’t announce “strategic partnerships” with every company who lists a widget for sale. Namaste isn’t a “Platform” business by any conventional description.

Shopify is a platform. Namaste is using that platform to sell vaporizers and grinders, but mostly to sell stock.

Cannabis sales in grams, for the period filed most recently:

Canopy Growth Corp: 2.3M grams

Aphria: 1.4m grams

Aurora Cannabis: 1.3m grams

Medreleaf: 1.3m grams

Canntrust: 982k grams

Cronos: 501k gams

Organigram: 300k grams

Hydropothecary: 131k grams

Abcann: 27k grams

Emblem 207k grams in the past 2 quarters.

Namaste: Zero grams.

TGOD: also Zero grams.

They don’t sell any dope. I don’t care if they convince a million people to fill out a form, they aren’t patients who buy weed until the company sells them weed. We don’t know if they’ll like the weed, what margin they’re going to be able to make on the weed, whether they’re going to even be allowed… etc.

You want to figure in future sales from a division that doesn’t exist, go for it. That isn’t how I do analysis.

Braden Maccke

1) “they aren’t patients who buy weed until the company sells them weed. We don’t know if they’ll like the weed,”

??? They’re able to buy weed right now from multiple LP’s through referrals? And they’re taking a commission of out of that. I’ve already told you this before, not sure why you’re defaulting in an argument that already proved and confirmed through a simple google search.

“You want to figure in future sales from a division that doesn’t exist, go for it. That isn’t how I do analysis”

I don’t know how many times we’re going to have this conversation.

You made a projection Then told everyone look they’re nowhere going to be making 30million. You made a future analysis without calculating their future sales?

Yeah, I don’t know how many times we’re going to have to go through this, either. I haven’t made any projections at all.

I’m just commenting on Dollinger’s (false) statement that Namaste has grossed $30 MM in any year, or any other period of time at all ever. Cuz they haven’t.

If N is moving product to those patients and taking a vig, it isn’t broken out in the mess that they call financial statements, so I’m not going to figure it in.

As for “I’ve told you this before!” Shut up, crybaby. I don’t do research in the comments sections of my own blog posts. If you want to make a citation, go right ahead.

I think you, Chris Parry, are behind the times and do not understand the internet or what AI and machine learning can actually do in the real world … how many websites do you manage?

One right now, but I managed the Vancouver Sun’s website for five years, ran editorial at Stockhouse’s for a few more. Go ahead and tell me about SEO like it’s 1999.

School me then, Woody.

What kind of lift can N expect from Findify and why?

Jeff,

You realise you just used the phase, “when they get their licence to sell” – referring to company with a $365 million market cap? Some publicly traded companies have a smell. Fragrant – or otherwise. This one smells rank. Listen to the CEO ramble on YouTube – replace “tranquility”, “wellness” “machine learning” “telemedicine apps” with “low mileage” “power windows” “luxury package” – and you have a used-car salesman. Why do so many of the shareholders (not you) call the CEO “Sean”? Do they think he’s a friend? Is that the pitch? “We’re all in this together”? Here’s my prediction: when Namaste implodes “Sean” is gunna be rich – and you won’t (because your money will be in his pocket). Namaste isn’t a client, I’m not a shareholder, I don’t short stocks and I didn’t write the article. For your sake, I hope my smell test is giving a faulty result.

1) I don’t get this argument. The way you a value companies is the way a person talks? If SEAN never used these words would you all of a sudden give A rating?

2) People use SEAN because it’s a discussion on Namaste. Everyone here knows who he is and it’s redundant to use anything else because it gets to the point. EVEN your co-worker the AUTHOR of this article uses SEAN. “Sean (I know he’s a reader), the next time you’re watching a big… ” Maybe he should’ve said “CEO Sean(I know he’s a reader) the next time you’re watching a big…” THAT DARN SHAREHOLDER

It seems like you’re WAY too fixated on words rather than the content of the words. Why are you even responding if all you’re going to do is dilude the conversation.

Was I not clear? I judge the CEO’s words to have little content. So “fixating” on them, reaps no dividends. You didn’t like the numbers, you don’t like arguments, but you do like “Sean” and Namaste. You are committed. I respect that. Best of luck.

You have personally given me NO arguments and I stated multiple times throughout this comment section that the author’s “number” research and analysis is done VERY poorly and lazy. He literally took a 2 month old quarterly report and multiplied it by 4 to find a projection. WITHOUT including any of the NEW knowledge he has learned that came after it. A few are an exclusive deal with Ample Organics on May 7 and more than 2x increase in patients. Is he cherry picking and intentionally leaving it out or is he making a multi-part article with such lackluster research and analysis.

I’m actually quite introspective, if you’re trying to gaslight the conversation. Make it so it isn’t text-based. As well I have broken down every argument your co-workers have provided so hard that it shows that they’re absolutely clueless and talking way out of their depth, resorting to deflections to carry on the conversation or just plain ghosting.

Do y’all read?

I didn’t discuss the license to sell, or their patient total. The article is about Dollinger making up figures as he goes, failing to understand how the stock market works.

I will go further into their financials in part 3.

I’d be happy to go on 420 live, hook a blogger up.

??? It’s a projection.

A)”I’m projecting i’ll make $100k this year

B)”But 2 months ago you only made $100 you’re actually projected to make a maximum of $400″

A)”A month ago my app on the play store finally launched and I’m getting a constant stream of new users and revenue, also next month they’re bumping my split for the revenue as well ”

B)”Your numbers are just guesses, you’re just making it up as you go!”

A)” Well yeah…It’s a projection. Projections changes as new knowledge is obtained and is introduced. If 2 months later my growth decreases or my app is removed then my projection changes.”

Man, if you want to stick around here, you’re going to need to listen for answers to your questions, comprehend them when given, and bring them aboard in your responses. This Fox News ‘muddy the waters, never admit defeat’ bullshit is boring AF.

Chris Parry

Give me one answer to my question. Cause I defeated all your questions with my answers. Don’t try to gaslight the conversation when it’s 100% text-based

Projections use the future tense. When Sean said that “next year we’re going to have $85M in revenue,” he was making a forecast.

Statements use the present tense. When Sean said “Namaste has $30 million in revenue,” he was making a statement. At the time he made it, the statement was demonstrably false. In other words, it was a lie.

I think you might be more comfortable back over on the Bullboards.

So you saying Namaste isn’t going to be making 30 million this year because quarterly x4 isn’t a forecast?

I’m saying that Sean Dollinger lied to you and everyone else when he said that “Namaste has $30M in revenue,” because, at the time, Namaste did not have $30M in revenue in any year or all of their years.

IDK what they’ll do in revenue, but it’s going to have to be a whole lot to justify a $400M market cap on 16% margins.

It “isn’t calculated yet” because it doesn’t exist! The company hasn’t published a projection of revenue from those properties, and even if they had, no serious analyst would bank on it.

It’s also worth noting that other companies who claim patients actually sell those patients medicine. Namaste does not. We have no way of knowing whether or not the not-yet-even-close-to 50,000 patients that N claims to have are going to like what they get, stick around, decide it’s less hassle to just head down to the dispensary, etc. Even social media companies count user subsets (daily active, etc.).

1) “It’s also worth noting that other companies who claim patients actually sell those patients medicine. Namaste does not.”

Namaste is already currently making revenue it’s current patients WITHOUT the need of selling through Cannmart. Through referrals to different LPs, they net 10-20% for purchases for the lifetime of that patient. With simple calculations (using Canopy as a basis) just by referring 50k patients will net them 5 – 10 million annually. You can argue they may or may not reach the projected 50k by years end, however their projected goal by the beginning of July were 5000 patients, and they already reached 6000 before that with NO marketing done so far. (Which they stated they are going to begin)

2) ” We have no way of knowing whether or not the not-yet-even-close-to 50,000 patients that N claims to have are going to like what they get”

What????????? Namaste patients has access to MULTIPLE LP’s And their Findify AI caters to the patients preferences and symptoms.

3) “decide it’s less hassle to just head down to the dispensary, etc”

That’s the point of NamasteMD. Quick and easy way to get a TAX DEDUCTIBLE prescription WITHOUT the need of PHYSICALLY going to the doctor, and sitting in a waiting list(Which could take weeks) As well every month you don’t need to PHYSICALLY renew your prescription through your doctor, you can just do it through an app on your phone. With Cannmart and Pineapple express you also get access to SAME-DAY delivery.

USUALLY when a company says they’re PROJECTED(FUTURE) to make an X amount of revenue, you ask them WHY? IF one were to make an ESTIMATE on their PROJECTED earnings, you DO NOT only use their last(PAST) quarterly earnings as the sole basis for calculation. You add all the variables AS they’re being introduced. You made a PROJECTION of their annual revenue without including their PROJECTION of 50k patients by years end. You had the OPTION to include that they had the potential to reach their projections if they met their goals and quota, However you either decided to leave it out and cherry picked only part data to push a narrative OR you have very horrible research and analysis skills. I’m actually beginning to believe it’s the latter since you seem absolutely clueless about their services and what they offer and I literally had to hold your hand and point you to the answer to your questions which is easily Google-able. At that point, why are you making a multi-part article if you don’t do the proper research.

WHY ARE YOU SHOUTING?

I don’t believe I’m shouting? I don’t recall putting any exclamation points. Putting a word in BOLD however emphases keywords and points.

COOL STORY BRO.

Nice meme from 2011 grandpa :p

I can tell you’re fun at parties.

Contrary to your assertion, my post made no projections. I tried to sort out where Sean Dolly came up with the idea that N had $30m in revenue (they don’t,) but I projected nothing. I rarely do. I just count stuff.

CEOs who aren’t full of shit don’t make revenue projections based on unknowns. Sometimes you’ll see case-based projections (imagine a slide in a REIT deck that forward projects 2 income lines, based on whether or not they close a deal on a property), but nobody just bakes in forward projections of sales divisions that don’t exist.

It’s common for established companies to give earnings guidance based on how they expect (say) a line of stores to perform over a summer season, based on how many stores are open and how they do in an average summer season, but Target (for example) doesn’t bake in revenue for stores that haven’t yet been licensed by the city or built.

We get it. You’re bullish on N. You love his passion. I like N, too. They’re fun to write about. At the moment, I’m not a shareholder.

Braden

I just looked that quote up again:

“We do $30 million plus in revenue, next year we’ll do over $85 million. I can’t tell you how many companies presently do over $30 million…”

Sean Dollinger did not project $30 million in Namaste revenue. (He projected $85!) He uses the present tense, clearly stating that Namaste *does* $30 million (plus!) in revenue. They don’t. They never have.

Braden Maccke

What? Are you actually lost? Do you not even remember what you wrote in your OWN article? Are you trying to straw-man me into an argument I never made?

“I thought for a second that Dollinger might have got to $30 million by forward projecting revenue based on his most recent quarter, but they did $5.6 million in Q ending Feb-18, and 4 of those would yield $22.4 million.”

YOU made the a projection using ONLY 2 month old data WITHOUT adding the new variables introduced. YOU made the argument he was possibly projecting his revenue. I STATED multiple times you’re either cherry picking data or LACK research and analysis skills to make such a projection. My previous analogy was to explain to you that’s not how you do a projection.

The Namaste shareholder archetype being a highschool dropout is a bit on the nose.

My positing that Dollinger’s lie might stem from a projection is not the same thing as me making a projection. When (for example) morningstar or zacks quotes an annualized earnings or dividend figure for a company, they multiply the most recent quarterly figure by 4.

I most certainly remember what I wrote. I put a lot of work into these and I’m proud of my work. I also welcome criticism from people who want to put in an equal amount of work, and cite that work. You are not one of those people. You’re just making a lot of noise, so I’m afraid I haven’t got any more time for this.

Braden Maccke

What? You tried to give him “the benefit of the doubt” by saying he could’ve projected his revenue. However in order to verify it and defeat his argument you TRIED to project his revenue by “quartlerly x 4” What is quarterly x4 if not a self projection of a company’s annual revenue.

Braden, I understand what you are saying and it is fair, but at the same time the sentiment of what Sean Dollinger was trying to say is we have high revenue and in comparison the SP is not reflecting that as compared to say CRONOS … I would like to know what you think about CRONOS valuation given they max out at 47kg … even selling every gram CRONOS cannot possibly have the valuation they have … vs. a Namaste that is actually has mutiple times that revenue in hardware alone, which is increasing steadily, a fact, not projection or hype, and Namaste has a valuation that is much lower … so I will put this out there .. Namaste will have the highest earnings per share of the LPs …..

If Dollinger wanted to compare Namaste to Cronos, that’s what he should have done. What he did do (and continues to do) is just straight make things up.

I don’t think that those companies belong side by side, because they do different things. I make no comment on Cronos’ valuation at this time. If I decide to look into it I’ll do a post.

But since you asked: The average, operating cultivator has a cost to grow a gram between $2 and $3.

Namaste’s take-or-pay deal w/ Supreme puts their cost at $6/g.

Sad that you are spending so much time bashing Sean and Namaste. Lots of negativity for no reason but to keep new shareholders away

If that’s your take, you’re not reading so well.

“Dishonest, lying smallcap media. Sad!”

Braden Maccke … so I reread your article and the comments below and to sum it up I think the problem with your article, even if researched well, shows a clear subjective intent with little objectivity …. this hurts your credibility in what you are trying to say whether reality or fiction …. it might be better received for your own benefit.

Is it at all possible you just do not understand?

I think ultimately you are wrong about Namaste not being a success and more or less bashing what they are doing. It actually has already been a successful small-cap investment for many others and me. Timing is everything right and it is all relative.

“One thing that I tell people is … if you’re going to do anything new or innovative, you have to be willing to be misunderstood,” says Bezos in an interview with Axel Springer CEO Mathias Döpfner, published by Business Insider in April.

Namaste Transparency; not normal

Namaste 420; not normal

Namaste Pledge; not normal

Namaste sales only license; not normal ..

Namaste purchase of AI company; not normal

NamasteMD; not normal

What is normal in a sector that is just being created? You should be writing about how this is such an amazing story unfolding in Canada and we are all so lucky to be able to watch it play out. If you have money to invest by all means invest it now and see what happens. Can you really be so sure which horse will win the race when we do not really know the track or more accurately the track is just being built? That this horse in the gate stomping and hissing will not win the race?

You have focused on finite negatives and run with it …. I could write a similar article about Terry Booth, Bruce Litton, Cam Battley or John Fowleer based upon their interviews and what they have said publicly. There is nothing new about CEO or employee compensation and whether it is in line with performance of a company or SP. That is low hanging fruit.

I will read Part 3 and comment on that too. I hope to read some objectivity. I will close by saying and knowing it is extremely difficult to create a business from nothing and generate $1 million a year let alone grow a business that generates $22.4 million or even $30 million in a year. Extremely difficult. Give the guy some credit.

You know they were doing $1m a quarter back when it was just a vape store with a $40m valuation, right?

Thanks for reading and all, but I’m having trouble following you here.

I don’t recall ever writing that Namaste wasn’t a success, or even that it wouldn’t be one in the future. In fact, I’ve spilled a lot of ink writing about why they’re successful.

Jeff Bezos doesn’t have anything to do with Namaste or what I think of it and, truthfully, what N is doing is hardly “not normal”. Online vaporizer stores and telemedicine portals are positively ordinary things. There are many such enterprises who make a great deal more money than Namaste does. They just don’t go on a livestream and flap their topknots about it.

I’m aggressively disinterested in what you think I should write about. What’s this nonsense about me being sure what horse is going to win a race? I didn’t make a call. You and the rest of these birdbrains are the ones who are so sure N is the second coming. If I could see the future, I wouldn’t be blogging for a living.

You could absolutely write a similar article about Battley Litton, Booth or whoever the hell you want. That’s the great thing about this country. Any yoyo with broadband can show the world the depth of his ineptitude. None of those guys are dumb enough to livestream made up horseshit about revenue they don’t have. Too big. You have to dig deeper to get to the cultivator class, like when we detailed Aurora’s outsourcing (still doesn’t make and sense, will probably get buried in LEAF’s produciton post merger). https://equitystaged.wpengine.com/2018/04/12/marijuana-datajam-extra-curious-case-aurora-cannabis-acb-t-outsourcing/

Email Chris about your guest blog post. chris@equitystaged.wpengine.com