I got a document sent to me this week that I haven’t seen before, at least not in my inbox. The document was an ‘offer to rescind.’

I had placed some bets on some private blockchain deals nine months ago, and one of those had decided they were done waiting for the blockchain sector to bounce back, and were pulling the plug. To their credit, rather than just keep my money and stay private, they offered my money back.

This deal was going to be a big one, a monster in the making, but it was far too linked to crypto mining and the market forces didn’t appear good for a debut at the valuation we’d invested at, so my cash is returning to me, and just at the right time.

A quick look around the blockchain sector shows that decision is not without merit. Former high flyers are beat up and battered. Almost to a company, from the highest market cap to the lowest, from Hive Blockchain (HIVE.V) to Calyx Ventures (CYX.V), they’ve all taken it in the throat.

“Are your guys still at the wheel,” I asked one prominent Vancouver dealmaker about one such company last week. “Have they capitulated? Where’s the news? Where’s the fight?”

“They haven’t quit,” he told me, “They just don’t want to waste news on a shitty cycle. The market isn’t valuing anything blockchain right now, but they’re feverishly working behind the scenes to show they have real business, when the time is right.”

The time is right.

If everyone stays on the edge of the Dance Hall, refusing to be the first one on the floor to take a twirl, it’s going to be a long night.

Hashchain (KASH.V) keeps putting out news, but it’s crypto news and people hate crypto news. They may as well be putting out news that everyone in the office has decided to wear Crocs going forward, and that they’ve decided the tan office chairs are superior to the beige, so Phil from Accounting is headed down to Ikea to pick some up.

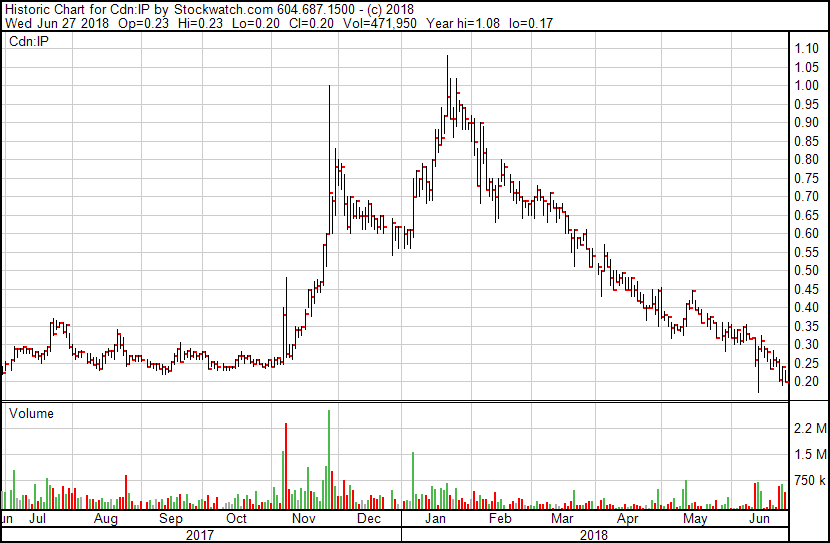

Here’s what the KASH stock price has done since inception.

Oooh, remember in April when we had hope for about eight minutes?

The news that KASH is continuing to lead the charge into crypto mining has, frankly, has not been received well, and the company doesn’t appear to have a plan as to how to fight that.

2018-06-21 – The TSX Venture Exchange has accepted for filing a purchase order dated Jan. 3, 2018, between the company and BitRig Technology Inc., whereby, pursuant to a purchase and exclusive supply agreement dated Nov. 18, 2017, the company has agreed to purchase mining rigs exclusively through BitRig. The company has purchased and received delivery of 3,000 cryptocurrency mining rigs for total consideration of $12,985,076 (U.S.), consisting of cash consideration of $10,485,076 (U.S.) and the issuance of 15 million common shares of the company at a deemed value of $2.5-million (U.S.).

Yawn.

2018-06-25 – Hashchain Technology Inc. expects to receive its shipment of 6,000 rigs later this week and to be deployed by end of July, 2018. Hashchain currently runs 3,495 rigs in its mining facilities in Canada and the United States and, upon deployment of these latest rigs, will have 9,495 in operation for 14 megawatts of computing power. In all, 9,395 rigs will be mining Bitcoin and 100 will be mining Dash.

I remember when CEO Pat Gray told me he was only mining because the market expected it and that his plans were for something more once that buzz had gone, but now it appears to be the primary focus.

And that sucks because the revs they’re making aren’t great.

With the current 3,495 rigs deployed, the company has mined 39.3 Bitcoin and 15.9 Dash over the 16-day period of June 9 to June 24, 2018. Based on the CoinMarketCap website, prices for both digital currencies on June 24, 2018 ($7,701 and $301 for Bitcoin and Dash, respectively), Hashchain accumulated a value of $302,649 from Bitcoin and $4,786 from Dash.

By the most recent pricing they’ve put out on the purchase of new rigs, they paid around $12m for a setup that is making about $600k in revenues per month, before costs.

On what their costs are, they’re not saying.

Hashchain notes there are material costs associated with mining, and it will need to complete its next quarterly financial statements to have complete details.

That’s some bullshit right there, and I say that as a stock holder in the company, and a consultant on the marketing side.

They know the costs. They know what their power is costing because they’ve locked in prices in advance and because they get a utility bill every month. If they’re not saying, it’s because their margin isn’t ideal and they’d rather not talk about it, which may be a result of parking your rigs on someone else’s property.

Here’s the thing about the $36 million I’m estimating it has cost to get their 9000 rigs to date (that number is back of a cocktail napkin, admittedly), and the roughly $12m in profits annually that should bring (again, many assumptions on that number but they come from what’s being earned currently and my assumption of a 50% margin) – Hashchain has only a $16m market cap.

The market is SO SOUR on blockchain deals that they’ll value you at a level almost level with your annual profit.

Hashchain has other things in play that aren’t crypto mining, and actually have some good business potential on those, but none of that matters because the market is valuing them at around zero, and crypto mining operations at a 50% discount on capex.

$36m in rigs is worth $16m market cap? Wow, that’s some good money after bad.

To be fair, maybe the market is pissed because they’re buying fucking Antminers.

Hashchain Technology Inc. has entered into definitive share purchase agreements to complete the previously disclosed acquisition of 5,000 new Antminer S9 rigs through the acquisition of two cryptocurrency mining companies.

Here’s a list of potential uses for an Antminer rig:

- Crypto mining.

- Boat anchor.

- There is no #3.

If crypto doesn’t kick on, those Antminers are worthless, and Hashchain is sunk. At least GPUs can be reused for other purposes, but S9’s are a big bowl of ‘all or nothing.’

Block One (BLOK.C) was so entranced with the potential of its Antminer S9 rigs in May of this year that they flipped 1000 of them to KASH for $3m in stock at $0.35 per share.

That may have seemed like good business. It wasn’t.

KASH stock is now worth $0.12, or 2/3 less, just two months later.

I’ll say it publicly and in front of any audience: I hate KASH’s crypto play. It’s trash. It’s dumb. It’s last year’s hotness slapped on this year’s sadness in the belief that, if they can just get enough of these things to be able to talk megawatts instead of kilowatts, it’s going to go huge.

That ship has sailed, friend, and it sailed long enough ago that you should probably stop trying to board it.

HIVE, which is already the biggest crypto deal in town, has sold off down to $0.64 today, which is a 90% discount to where it was at its high. Nobody has a bigger mining operation than HIVE, and they’re making similar revenue numbers to KASH on a per rig basis. They’re also sitting pat, reasoning that the money they raised (at $3+) was for mining, and that’s what they do, and if the market isn’t valuing that right now, that’s on the market.

I can dig the integrity of that. What I can’t dig is the inaction in the meantime.

HIVE’s hashpower capacity is some 4 times what KASH is projecting they’ll have in operation at the end of the year, and they’re piling on more every month, but nobody cares.

Exeblock (XBLK.C) hasn’t put out news since they traded in their CEO, and the stock reflects that. Block X (BLOX.C) made a $250k investment in a company in May but nothing since. Atlas Cloud (AKE.C) came down 2/3 recently after a months long ‘business change’ trade halt that stopped it from doing pretty much anything positive. We’re yet to hear what their plan is going forward.

Remember when Kodak (KDAK) announced they were going blockchain, and the billions that were added to their value overnight? Look now. No recent news and 2/3 down from the high.

Imagination Park (IP.C), which tried to sling blockchain into its ailing and mildly fraudulent VR business with ‘Xeno Tokens‘ when the sector was hot, but has now become a directorial carousel as it feeds its execs free stock and warrants on the reg, has the sort of stock fall off that you can only get with consistent failure and non delivery on promises.

NOTE TO IP BAGHOLDERS: We were right, weren’t we?

Global Blockchain (BLOC.C) has been adding megawatts of crypto mining power – like, really large amounts of crypto mining power – and the market has this to say in response:

What the hell are we doing here?

Why is everyone down?

Why is wealth being dissolved across the board?

Because:

Right.

And what can pull us out of this nose dive?

The market doesn’t hate blockchain, it hates crypto mining.

The market fucking LOVES blockchain because it’s a great tool for just about every single sector out there. But just being a ‘blockchain company’ isn’t a business plan. It’s like saying companies that have a Facebook account are a social media company. It’s a thing you use, not a thing you are.

Want an example?

Here’s one of our clients, VitalHub (VHI.V), which is using blockchain tech in the medical records and telemedicine business:

Look at that increase in volume!

Sure, there have been dips, but the resistance is on the way up, not in coming down. It’s as if people who are doubling their money on this stock can barely believe it and are cashing out before it all reverts to sector expectations, and yet it just keeps climbing.

Why?

Two reasons: value, and business.

The market cap on VHI is just $17m, which is far easier to defend than the $100m+ fat crypto plays out there.

Then there’s the actual business they’re generating; here’s a list of their news this year, while the rest of the sector was capitulating or crypto mining:

- Vitalhub licenses VH LTC to two long-term care homes

- Vitalhub licenses WellLinc to Bluewater, CMHA LK

- Vitalhub introduces opioid harm reduction module

- Vitalhub, Ernst & Young sign marketing agreement

- Vitalhub licenses B Care software to Northern Regional

- Vitalhub garners 16 new customers in New York State

- Vitalhub releases blockchain health record software

- Vitalhub’s B Care to be sold by Telus Health in Canada

- Vitalhub acquires Clarity Healthcare for $353,883

REAL BUSINESS.

The key here is, VitalHub is less an example of blockchain at work, and more an example of the potential of telemedicine, as it applies to blockchain.

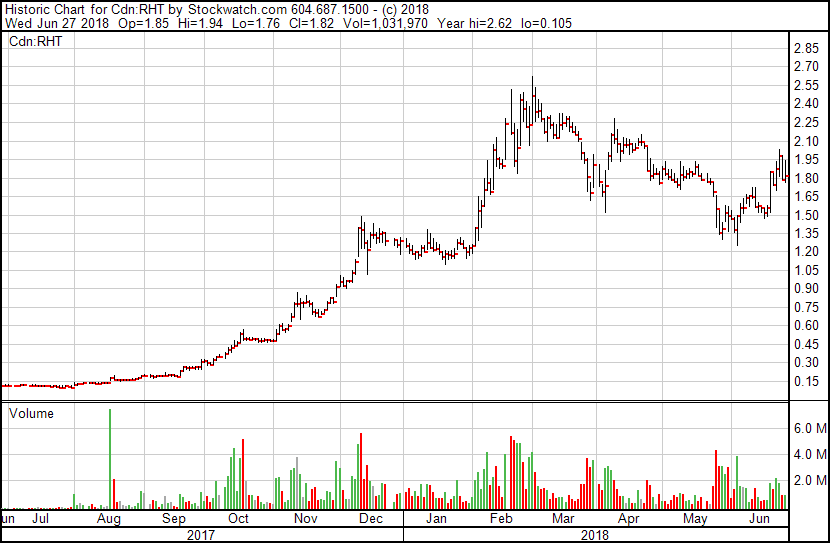

Here’s Reliq Health Technologies (RHT.C), which we told you about for a couple of years, and who have delivered real business on that front, with a similar model/customers/trajectory:

That’s a $202 million market cap, which shows where VHI can roll to (a 10x) as it keeps adding assets, pilot programs, and new clients.

https://equity.guru/2018/04/11/vitalhub-vhi-v-undervalued-health-tech-player-following-rhts-well-worn-path/

Here’s the Enterprise Group (E.T), a resource sector services company that rents generators and heat trucks to drill operations and has managed to detach itself from the fortunes of oil and gas and mining by falling ass backwards into blockchain when it acquired a company using the tech to monitor equipment in the field.

While all of your ‘blockchain aggregator’ companies have eaten shit, Enterprise has destroyed.

Because it’s using blockchain to streamline its real business.

Development on the StarChain technology continues. Enterprise’s technology development group is currently performing infield testing with success. Management expects to offer its customers specialized equipment capable of several remote controllable features in second half of 2018.

The company’s equipment offerings will enable its customers to automate and/or schedule the performance of the equipment which optimizes usage, delivering several benefits such as reduced fuel expenses, lowering on-site maintenance costs, real-time reporting among many others.

So we’ve laid out the case that there are three types of blockchain deals:

- The crypto guys, who are getting their asses kicked

- The ‘gone fishin’ guys, who are getting their asses kicked

- The business operators, who are doing just fine

But there is a fourth type, and that’s the hard working but largely ignored guys who will seriously fuck with your understanding of what’s possible and will be the people who drive blockchain to the next wave:

Guy #1: Dr Danny Yang, genius at DMGI.

DMG Blockchain Solutions (DMGI.V) is pretty easy to shit on right now, because their stock is right where everyone else’s is. But while a lot of their competitors have been mentioned above as either running hard in the old direction, not noticing the cliff drop they’re headed over, or are hiding from the scornful gaze of the market, DMG has been slashing its broadsword with fury, knocking down some decent deals, and wondering what they have to do to get some respect.

“Nobody’s moving,” said CEO Dan Reitzik when I chatted to him last week, adding, “We look around and it’s like, what are you all doing to change this? Why are you all just getting smacked upside the head and not fighting back?”

Part of DMG’s fight back is a guy named Dr Danny Yang.

I could tell you all about what the company has planned with this project and that project, but what it all comes down to is this guy. They acquired a company because it came with this guy.

A guy who did his BA at Harvard and his Ph.D in computer science at Stanford. 93 of his LinkedIn friends have recommended him as an authority on machine learning. He’s an entrepreneur with several startups in his wake, but for the last two years he’s been working on Blockseer.

The pitch on that is fine:

BlockSeer’s mission is to make blockchain data and applications accessible to everyone by providing valuable analysis of patterns, useful metrics, clear visualizations, and actionable intelligence. Blockchains (such as Bitcoin and Ethereum) are a new platform that enable transactions and applications (or smart contracts) in a decentralized setting. Blockseer provides the analytics tools for these transactions and applications on the blockchain.

That pitch above is complicated and non-obvious to the layman, so here’s the layman’s version:

Dr Yang is creating the Bloomberg of crypto.

You want to look up who has the most Dash? Blockseer is going to let you. Want to track the Ethereum you’re getting from its origins? Blockseer. Want to see whether that dude who is promising to buy your bike actually sent the money for the last three he bought? Blockseer.

Exchange transactions: Blockseer.

Dark web transactions: Blockseer.

Accounting forensics: Blockseer.

Real time trade data: Blockseer.

Bitscore, the world’s second largest e-wallet, is using Blockseer.

Hell, if you want to create a Forex-like crypto exchange market, where currencies can be cross-traded in seconds, Blockseer is geared to make it happen.

If you can’t see the value in that, you’re eating too much ranch dressing late at night.

But the real pitch is in spending ten minutes talking to this cat.

He’s not going to wow you with stories of his spring break at Maui. He’s not going to talk sports. He’s not going to be your wingman and likely has no opinion on that thing you’re binge watching on Netflix. The stock price? No idea.

He’s singularly focused on building this big hairy audacious beast. And the more he talks to you about what it will do (not what it ‘can’ do), the more it becomes clear that DMG is employing a serious operations god.

Yang is quiet. He’s unassuming. But if you said to him, ‘Danny, I could really use technology that does X and transforms it into Y and I know that doesn’t exist yet but if it did, that would be great,’ he’d get real quiet for a minute, then he’d jot some notes, then he’d get quiet again, and then he’d disappear to a desk and start pounding out code. Then his team would follow his lead.

You could then go away for a week and get obliterated on rum drinks with umbrellas, and when you emerge from your hangover you’ll set eyes on the next great fintech app.

He’s one of those guys. Other guys who want to be him take a pay cut to work for him.

These guys I’m all over, and DMG, for mine, is a value buy at this level because, whatever you think of their crypto rigs, you’re really buying a guy who will be one of the tech world’s great visionaries, and DMG is going to arm him with the weapons he needs.

GUY #2: Hamed Shabazi, CEO of Wellness Lifestyles (WELL.V)

If you’re running a TED Talk event in Canada and this guy isn’t invited, someone’s getting fired.

You may recall him as the guy who ran Tio Networks, which helped folks with no bank accounts pay their bills online through a series of kiosks, and sold that operation to Paypal for $300 million.

That deal shook the whole of the Canadian market scene, because it proved Canada’s pubco tech scene, which is generally considered a distant and inferior cousin to the US tech scene, could still bring down a big exit.

Hamed, who is genuinely one the nicest guys you’ll meet, doesn’t come into a room with a Tio t-shirt, and doesn’t luxuriate in this success. He has the feel of a startup entrepreneur looking for his first $50k.

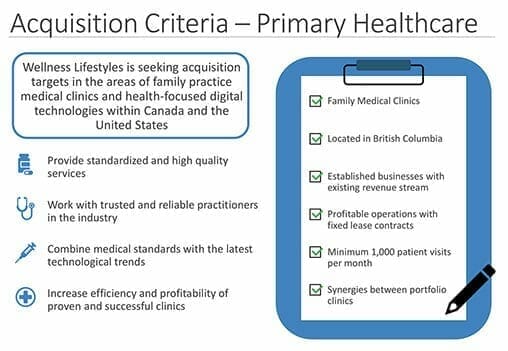

His new deal is a pretty simple one: He’s buying medical clinics and bringing them into the 21st century.

A clinic roll up isn’t a brand new idea out of left field, but Shahbazi is applying blockchain to the deal by taking tired old clinics run by doctors who, realistically, hate running clinics and would love a chance to cash out, and updating them with new tech.

That makes them streamlined, more profitable, it helps the doctors involved focus on their patients, and it employs telemedicine to expand their reach. the blockchain element? You’ve got to earn Hamed’s trust before he’ll even talk about it, because he doesn’t want this to be a blockchain deal.

“I’d be happy to never mention the term, to be honest,” he tells me during an afternoon drink by the water in downtown Vancouver. It’s a short drink – he has meetings stacked back to back to back, even at 6pm on a Wednesday, because there are far more clinics that want to talk to him about becoming part of Wellness Lifestyle’s operation than he has time to handle.

“The medical industry is the biggest of all industries,” he says, “but here we are getting a note from the health authorities advising that ‘all clinics should secure their fax machines’ to keep patient records secure.”

“What the hell are we doing in this day and age, still using fax machines to transfer patient records?”

Fair question. So, rather than wait for the archaic healthcare system to catch up to the tech world, he’s gearing the tech world toward running his clinics in a way that’s more secure, has better data, cost savings, and time savings – allowing his doctors to increase their revenues by seeing more patients.

“People look at the business and think, you’ve got one customer – the government – so you can only get paid what they’ll pay. How are you going to make money? But they’re missing that my customer pays their bills on time, without question. In the US, there you’re dealing with health insurers that want to argue every invoice. I’ll take this system, thanks. If we streamline the operations of these clinics and let doctors focus on their primary task – seeing patients – then the revenues increase accordingly.”

The Company and its management are focused on executing the priorities of the Company, which include: (1) acquiring additional healthcare clinics to establish improved scale for synergies, (2) establishing best in class shared services to create a scalable growth model for the Company, (3) modernizing its operation with the use of technology to benefit doctors and patients and (4) executing on a disciplined and highly accretive capital allocation program.

If this pitch was coming from a green CEO who had never run a company before, that would be the only risk I see associated with it. Money is being made, cash is in hand, the sector is hot and they’re acquiring hard.

But this pitch isn’t coming from a green CEO, it’s coming from one of Canada’s great tech success stories, and one of its few big exiters on the public exchange. It’s a gimme.

GUY #3: GLOBALIVE (LIVE.V) head honcho Anthony Lacazera.

Don’t you just hate him already?

Don’t you just hate him already?

Lacavera is no shrinking violet. He’s the guy who decided it would be a cool summer gig to start a new telecommunications provider, and began what would become Canada’s fourth largest wireless communications company, Wind Mobile.

His first exit, right before that, was selling a teleconferencing startup for $30 million.

He sold Wind to Shaw Communications for $1.3 billion, and in 2010 the Globe and Mail named him CEO of the year.

Also, he’d rather I don’t mention any of that, because Globalive isn’t a vanity vehicle, and he doesn’t want it to be about ‘what Lacavera is doing next.’

Sorry Anthony, you’re a mega success, you’re just going to have to endure the fact that people want to know what you’re doing.

So here’s the pitch:

Globalive Technology is a next generation software company that is designing, building and commercializing software platforms that leverage the latest artificial intelligence and blockchain technologies.

Globalive Technology is forming operational joint ventures with strategic partners that drive cost and speed-to-market advantages while developing technology stacks for longer term licensing, token and transaction revenues.

And yes, it’s not just you – that sounds like a load of bullshit to me too.

Words, phrases, words, jargon.

But I sat with Lacavera and heard his pitch in person, and I’m quite sure if you did the same, you’d follow him around all day and hold his dick for him as he peed. The man is an android. He’s an executive ninja. If he runs for Prime Minister, the gig is his. If he showed up to pick up your sister for a date, you’d high five her on the way out.

Anthony Lacavera is not ‘running a blockchain deal’, he’s setting up his next billion dollar exit.

This is important, because a man with his track record, his ability to pitch, and his higher plain executive existence, can get into any boardroom, anywhere.

And that’s what you want if you’re selling artificial intelligence and blockchain solutions; the ability to get into real Fortune 500 boardrooms and convince them you can actually create the next generation framework that they don’t know they need yet, and come away with not just a deal, but also coin.

The company has a dozen investments and partnerships in the space already, including:

- VIDL: Transformational news platform utilizing blockchain and artificial intelligence technologies to report accurate global news events and incidents in an automated real-time manner. Run by former President of CNN.

- MANTLE: Building software solutions to assist companies in expediting the process of adopting and integrating blockchain technology. They are helping companies fast track blockchain adoption through a user friendly “Wordpress”-like web application.

- HYPERBLOCK: A 20 MW crypto mining facility in the North West United States, which has expansion capacity to 80 MW. The existing facility is powered by hydro-electric energy that represents some of the lowest power consumption rates in North America at under USD$0.04 per kWh. Operates across multiple revenue channels including Mining-as-a-Service (MAAS), self-mining, server hosting, and server hardware sales.

- COINSQUARE: One of Canada’s fastest-growing digital asset trading platforms, with a 100,000 person userbase and a $400m valuation, providing a safe and secure destination to access a range of digital assets. Globalive Technology is working with Coinsquare to expand into the UK followed by Europe, signaling the start of Coinsquare’s international expansion.

- FLEXITI: A Canadian financial technology lender with a $300 million loan portfolio and 1.1 million customers, offering technology-enabled instant credit approvals for prime customers at the point of sale for big-ticket retailers. Flexiti’s retail partners include name brands such as Birks, Spence Diamonds, Bad Boy, Ben Moss, Peoples, Bombay, Ethan Allen, La-Z-Boy, Cartier and EQ3. Globalive Technology plans to utilize blockchain and artificial intelligence to provide accurate real-time credit adjudication, improve reduction of bad debts and leverage POS interactions to generate further revenues through loyalty programs and services.

- CIVIC CONNECT: Software company that enables municipalities to create their own smart city applications and develop blockchain technology solutions. Currently serves more than 58 million constituents in key markets including; New York, Los Angeles, San Francisco and Seattle. Partners include Amazon and Microsoft.

- ACORN: One of the world’s first non-invasive, in home, live cell collection kits enabling whole genome preservation for testing, analysis and future regenerative IPSC stem-cell therapies. Developing a blockchain application for Acorn to store genomic data, and allow permissioned access to genomic information for the purpose of research and collaboration.

- FUTUREVAULT: Developed a secure, intelligent and collaborative management platform to facilitate the digitization of highly sensitive personal information.

- CRYPTOSTAR: Mining operator with locations in the U.S., Canada and Iceland.

And when you look at some of the companies Globalive has worked with/started before going public, it’s a really substantial list of Canadian tech winners:

Globallive isn’t a client of mine, and there’s nothing in it for me if you don’t share my fanboy belief in the outfit and it’s captain, but if you bet on people, this is the type of people you bet on.

And if Lacavera makes a go of it in the ‘financing blockchain and AI tech for corporate clients’ game, any one of these projects has the potential to pop ten figures deep.

I put a little crap on Kodak up top of this story for their entry into the blockchain market, which I viewed at the time as being a cynical sector play, but that entry brought billions in added value to the stock, so it’s not like there’s nothing there. And it’s Kodak, one of the world’s most famous names.

So who is going to make their plan work? Who did Kodak hire to complete the project?

GLOBALIVE, bitches.

[Globalive Big Dev is] currently building the digital image infringement blockchain on which KodakOne will operate. This will allow for photographers and agencies to store and transact their image assets and associated metadata to users globally.

Kodak made one of the biggest announcements in the blockchain space earlier this year, and of all the companies out there bullshitting that they’re providing blockchain solutions to multinationals, here’s Globalive actually putting their project together.

Massive.

Some of these partnerships may go to nothing. But each of them may also launch hard into the valuation stratosphere. At the current $124m market cap, there’s ridiculous room for upward price movement and, when it goes on a serious run, it’s going to drag the entire blockchain sector up in its wake.

Dudes need to quit hiding their work from the market. Time to get loud and bring the investors back. but to really make that happen, you need actual work being done, with actual corporate clients that will incorporate your code into their business processes because THEY TRUST YOU.

Dr. Danny Yang. Hamed Shahbazi. Anthony Lacazera.

These are guys you bet on.

— Chris Parry

FULL DISCLOSURE: Hashchain, despite our booting it around, is an Equity.Guru marketing client. We don’t like talking shit about a client, but we want it to do better, especially since I own stock in it. DMG is also a client, as is VitalHub and Calyx, and ExeBlock just completed its contract with us. The author may buy or sell stock in any of the companies mentioned, but currently holds Calyx, Atlas Cloud, Hashchain, and Block X.

Hi. You make a strong case for DMG & Globalive, yet in your disclosure you don’t own any. Why not? Thanks.

I do own DMG – that’s an oversight. Don’t own Globalive because only found out about them after they’d gone public and am not sure if they’re doing any marketing.

Thanks for the info. btw, I like reading your articles and your humour. The lines you come up with are pretty funny. I bought into Zinc One, DMG, TGOD (buying soon – waiting for pullback), Hive, Invictus, AbCann, and waiting for pullback in Globalive before buying. I think they all have huge potential. From your comment I guess you do mostly private placements?

Seems like you were wrong on KASH today and the Namaste pieces and all the laughable “professional” comments and arguments in the comment threads. Is that what you guys usually do? Say something and expect the opposite to happen? Lol I’m just ball breaking here and thought I would fan the flames on the namaste comment section lol.

Good talk. Tell me, are all Namaste homers this boring?

Nope. Just had a good laugh at your Charlize Theron comment about Namaste’s 50k patient projection. You gonna be hitting that or what?

If there’s a god.

Calyx – your thoughts, going somewhere?

If so, good time to load up for the future, your opinion.

So Chris, how about a comment reply on Calyx?

My complaint about Calyx remains the same – they’re doing the work but not talking about it enough. Need to see clients.