There’s been a bit of a charge in the air where zinc is concerned in recent days.

To paraphrase a significant piece of zinc-related June 17th news…

‘South32 and Arizona Mining announced today that they have entered into an agreement for South32 to acquire the remaining 83 percent of issued and outstanding shares of Arizona Mining via a plan of arrangement, representing a fully funded, all cash offer of US$1.3 billion (C$1.8 billion). The offer price of C$6.20 per share represents a 50 percent premium to the closing price on 15 June and implies a total equity value for Arizona Mining of US$1.6 billion (C$2.1 billion).’

Most of the acquisitions we see in this space are all-paper deals: the acquiring company using its stock as currency, swapping its own shares for the shares of the company it wants to pin down.

This acquisition is different. It’s not just a deal worth C$1.8 billion… it’s an ALL CASH deal worth C$1.8 billion.

This might be the strongest signal yet that the junior sector is turning the corner and is on the verge of a sustainable push higher.

Companies in this sector generally abhor parting with their cash. Zinc supplies must be crazy-tight in order to prompt South32 to cough up that much dough on a single deal. It speaks volumes.

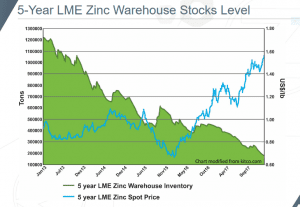

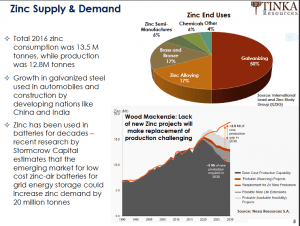

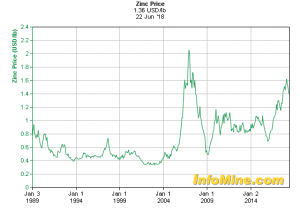

A snapshot of zinc supply/demand…

Commenting on the lean supply picture, Equity Guru’s Lukas Kane recently affirmed…

There’s a shortage of zinc because two of the world’s largest zinc mines have run out of ore (Australia’s Century mine, and the Lisheen mine in Ireland) and China has shut down 26 archaic zinc mines in Hunan province, which were poisonous.

A pic is worth a thousand words. I find this next chart particularly persuasive…

… tight Tight TIGHT ya’ll.

The Company:

Zinc One (Z.V) is in the business of exploring for and building a potentially significant high-grade zinc resource.

The company has two key assets under its wing: the past producing Bongará Mine Project, and the Charlotte Bongará Project. Both are located in north-central Peru.

The Bongará Mine Project will be our primary focus here.

Lukas Kane has been following Bongará and the Zinc One story closely. Some of his recent insights can be found here, and here.

First, The Price Chart…

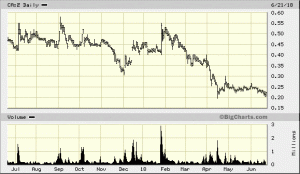

I must confess, when I first studied the Zinc One chart, I wondered if there was something seriously out of whack; some fatal flaw that we’re not aware of causing this relentless price pressure. Then I looked at the price charts of other quality zinc explorers – co’s like Vendetta (VTT.V) and Tinka (TK.V)… they’re not exactly giving investors high altitude nosebleeds either.

There are a few notable exceptions to this current malaise: Fireweed Zinc (FWZ.V) comes to mind.

If the above price action is merely a symptom of an apathetic market, this could be an opportunity for small zinc exploration companies, particularly those growing significant high-grade resources.

The Project:

The Bongará Mine was in production from 2007 to 2008 but was mothballed shortly after it began producing (the zinc market went waaaay soft during the turmoil that was 2008)….

Bongará’s mineralization is close to the surface. It’s also very high-grade. Some of the outcrops in the area graded over 50% zinc – that’s uber-rich rock.

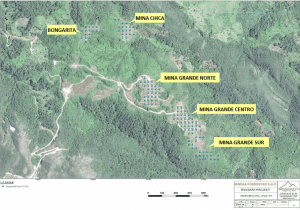

As you can see in the above map, the project plays host to a number of zones: Mina Grande (Sur, Centro, Norte), Mina Chica, Bongarita, Campo Cielo and Crista.

The Geology:

The Bongará Zinc Mine Project is classified as a Mississippi Valley-type deposit. These are generally high-grade lead-zinc deposits hosted in soft sedimentary host rocks such as limestone and dolostone. The name is derived from historic deposits discovered along the Mississippi River in the United States.

The zinc mineralization at the Bongará Zinc Mine project is classified as a Mississippi Valley-type deposit and is mostly hosted by strongly dolomitized brecciated limestones that are stratabound. The mineralization can also occur as tabular bodies with irregular boundaries, which is a characteristic of that mineralization encountered along the periphery of breccias. Hydrozincite (a zinc oxide mineral), smithsonite (a zinc carbonate mineral), hemimorphite (a zinc silicate mineral), and a zinc-aluminum-iron silicate are the primary zinc minerals that are hosted by soils, dolomitized breccias, heavily-weathered fractured and vuggy dolomitized limestones, and fine- to coarse-grained dolomitized limestones. At Mina Chica, the mineralization is typically zoned as either predominantly hydrozincite or predominantly smithsonite and hemimorphite, both zones with apparent variable amounts of iron.

The Drilling Campaign:

A drilling program which began in January was focused on the projects three main mineralized zones: Mina Grande Sur, Bongarita, and Mina Chica.

When assays results began hitting the wires, I was immediately struck by two things: Bongará’s depth and grade. A number of the high-grade intervals reported in the March 29th news release began at 0.0 meters… right at the freaking surface. You don’t need to be a geologist or mining engineer to understand how significant that little detail is.

Right from the get-go, the truth machine (drill rig) tagged high-grade mineralization.

Highlights from the Mina Grande Sur zone included:

- MGS18001 – 5.5 metres of 26.1% zinc, starting at 3.0 metres drill depth

- MGS18003 – 4 metres of 32.5% zinc, starting at surface

- MGS18003 – 15 metres of 21.5% zinc, starting at 15.0 metres drill depth

- MGS18004 – 9.1 metres of 43.6% zinc, starting at surface

- MGS18006 – 14.1 metres of 32.8% zinc, starting at surface

In the same release, further to the northwest at the Bongarita zone, notable intercepts included:

- BO18005 – 11.5 metres of 16.0% zinc, starting at surface

- BO18005 – 5.7 metres of 29.2% zinc, starting at 5.8 metres drill depth

- BO18007 – 7.0 metres of 25.3% zinc, starting at surface

There were a total of nine news releases, spread out over three months, all of which included shallow high-grade hits across all three zones.

Leafing through the pages of drilling data, several intercepts caught my eye, forcing me to double check the digits. I was expecting to find typos. There were none…

Mina Chica zone:

- MCH18004 – 16.5 metres of 35.6% zinc, from 15.0 metres drill depth

- MCH18005 – 18.0 metres of 31.0% zinc, from 20.8 metres drill depth

Bongarita zone:

- BO18022 – 2.4 metres of 38.1% zinc, from 1.5 metres drill depth

- BO18033 – 2.4 metres of 42.8% zinc, from 7.9 metres drill depth

Mina Grande Sur zone:

- MGS18017 – 8.2 metres of 42.7% zinc, from 7.5 metres drill depth

- MGS18020 – 20.5 metres of 34.3% zinc, from surface

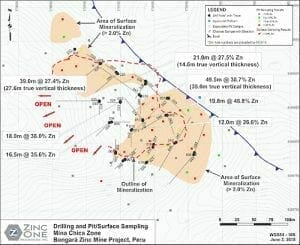

The highlight of the campaign came with the discovery of a new zone in the vicinity of Mina Chica. Results from this new orebody were extraordinary. They included:

- MCH18010 – 12.0 metres of 26.6% zinc, from 1.5 metres drill depth

- MCH18013 – 19.8 metres of 46.8% zinc, from 1.9 metres drill depth

- MCH18014 – 49.5 metres of 38.7% zinc, from 7.3 metres drill depth

(note, true thickness of the above 49.5 meter interval is 35.0 metres from a vertical depth of 5.1 metres)

This new zone is shown on the map below. Significantly, the deposit is open for expansion to the west and southwest.

The Talk…

In chatting with others who follow these zinc stories closely, I’ve heard some concern expressed over Bongará’s size and metallurgy. It’s worth mentioning.

The concern is that the project lacks scale, that the original operator of the property sold it to Zinc One for that very reason. Some feel that the deposit(s) would need to grow substantially in order for Bongará to make sense economically.

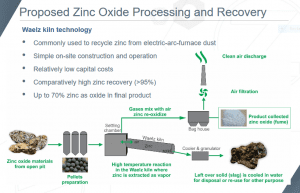

Some also feel that metallurgy is an issue with Bongará’s oxide ore. Under normal circumstances – with gold and copper for example – oxide material can be a distinct advantage, one which results in good recovery rates and low processing costs. With zinc, oxide ore is more challenging to process and can result in higher costs.

Fair enough. It’s important to be opened minded when you enter this arena. It’s important to examine things from every angle.

Regarding size: My take is that these smaller higher-grade deposits are where you should be parking your money, if the value is there. Humongous, high Capex mega projects are very difficult to finance this day and age. Smaller, higher-grade projects, those with a lower Capex, shorter payback periods, and higher IRR’s, are what mining financiers are looking to support.

(note: Capex or ‘capital expenditures’ refer to the cost of building a project – the lower the Capex the better. IRR or ‘internal rate of return’ refers to the profitability of a project – the higher the IRR the better)

The high-grade core coming outta the ground at Bongará suggest that even modest tonnage will be sufficient to make this project work. Some of the rock at Bongará boasts > 500lbs of zinc per tonne. The theme here is higher concentrations / higher margins (Zinc currently trades at approx US $1.30 per lb – you do the math).

Also, the near surface nature of this high-grade rock should make for a fairly simple operation. Waste rock should be minimal. They won’t need a large fleet of diesel guzzling trucks to move massive volumes of rock around. Opex (operating expenses) should be modest.

Moving along…

Metallurgy: I’m not a metallurgist. But the company believes it has a simple, low Capex, low Opex solution, as demonstrated below…

Final Thoughts:

I believe there’s an opportunity here for companies like Zinc One.

With South32 Ltd’s very recent takeover of Arizona Mining, companies growing zinc resources, particularly those sporting high-grades and compelling economics, should begin gaining traction as the market recognizes how undervalued many of these resources are, and what other larger companies might be willing to pay for them.

Zinc One is unique in that it sports extremely high-grade rock at or near surface. It’s also situated in a mining friendly jurisdiction.

I look forward to watching the company stepout from known mineralized zones as it attempts to expand its resource base. I also look forward to a resource estimate scheduled for Q3 of this year. It may come as a surprise to some.

We stand to watch.

END

~ ~ Dirk Diggler

Full disclosure: Zinc One is an Equity Guru marketing client however the author does not own shares in Zinc One at the time of writing.