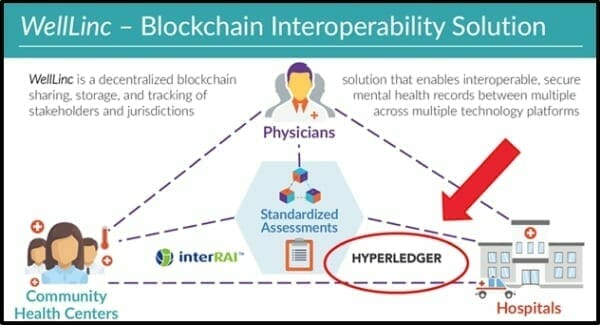

Update: on May 31, 2018 VitalHub (VHI.V) announced the first sale of WellLinc, the Company’s proprietary Blockchain Electronic Health Record (“EHR”) interoperability solution. WellLinc has been licensed by Bluewater Health and the Canadian Mental Health Association of Lambton-Kent (“CMHA LK”).

VitalHub’s WellLinc solution is built utilizing the Hyperledger Fabric technology to support full interoperability that is not limited to read-only access to data. WellLinc allows organizations that update a client record in one node to automatically record that transaction and update it across all other trusted nodes.

“We believe having a shared, interoperable mental health record system will greatly enhance our ability to provide high quality and a more cost-effective process, allowing us to reinvest existing resources in direct patient care,” stated Paula Reaume-Zimmer, VP of Mental Health & Addictions Services of Bluewater Health.

On May 29, 2018 VHI published its Q1, 2018 Consolidated Financial Statements, along with some explanatory chit-chat.

Highlights for the quarter ended March 31, 2018:

- Acquisition of H.I. Next, which has historical unaudited revenues of $2.695 million, $3.329 million and $3.572 million for 2015, 2016 and 2017.

- Acquisition of Clarity, with $200,000 in revenue in its last fiscal year.

- Royalty-free license sale to a customer of HI Next software.

- $1,613,362 of perpetual license fees and $58,015 of services revenue, with the remaining balance of $1,719,499 in deferred revenue.

- Introduction of WellLinc, a proprietary electronic health record interoperability solution powered by blockchain technology.

- 16 new customers in New York State, through the Behavioral Health Information Technology Grant Program.

- Licensed B Care Electronic Health Record software to Manitoba’s Northern Regional Hospital

- Additional contracts in the quarter including: Bluewater Health, ON, Canada; HKS Counselling Services, ON, Canada; United Chiefs and Councils of Mnidoo Mnising, ON, Canada; Alzheimer’s Society of Toronto, ON, Canada; and Stella’s Place, ON, Canada.

- Revenue of $2,923,390, representing an increase of 2172.3% over the same period last year.

The market responded positively to the Q1, 2018 financials.

Normally, these kinds of numbers will have the CEO howling at the moon, declaring his CTO a “genius” – and quoting freely from The Book of Revelations in the hope that a feeble-minded journalist will dub him “The Jesus Of Blockchain”.

VitalHub CEO Dan Matlow took a more measured approach:

“We are starting [our emphasis] to realize the impact of our strategy as we combine our acquisitions for the first time,” stated Matlow, “As a company with an M&A-based strategy, we are focused on the adjusted EBITDA number which is solid.”

Note that: “solid” – not “great”.

As we stated a couple of weeks ago, “VHI – a healthcare technology company marrying medical information networks with blockchain technology – is gobbling up other companies.”

Unlike many CEOs – who create acquisition targets the same way a 6-year-old girl chooses a cup-cake (by the density of smarties) – Matlow has established disciplined acquisition criteria.

- Breakeven or profitable

- Owner operated businesses with limited outside investment

- Large component of expense is on research and

- Development vs. sales and marketing

- Little commercialization or sales and marketing expertise

- Significant customer base with minimal retention issues

- Limited or no expansion beyond geographical boundaries

- Creating a large growth barrier

- Ability to upsell to existing install bases of target companies

- Targets bringing their product into a mobile environment

- Recurring revenue above 60% of total revenue

Ironically, the last criterion is the reason Matlow isn’t crowing about the Q1, 2018 revenue growth number.

“We experienced some one-time revenue gains through the sale of perpetual licenses,” admitted Matlow.”

VitalHub has a robust two-pronged growth strategy, targeting organic growth opportunities within its product suite, and pursuing an aggressive M&A plan.

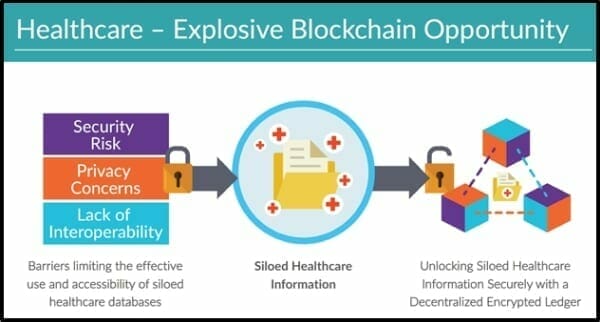

According to the Decision Research Group, “Industry projections expect the global Blockchain Healthcare market to grow to $2.3 billion by 2021, up from roughly $340 million in 2017.”

VitalHub’s potential world domination is going to hinge on Hyperledger, “an umbrella project of open source blockchains and related tools supporting the collaborative development of blockchain-based distributed ledgers.”

Hyperledger’s objective is to promote cross-industry blockchain collaboration capable of benefiting global business transactions.

“We believe the healthcare market is ready for an impactful blockchain solution,” stated Matlow.

“Ready” is an understatement.

The healthcare industry is screaming for a blockchain solution to provide national centralised medical records.

How bad has it been failing?

If the healthcare industry was a baby – and centralised medical records was a spoon – it would look like this:

According to a recent study by Johns Hopkins, in an average year, 250,000 people in the U.S. die every year because of medical mistakes, making it the 3rd leading cause of death after heart disease and cancer.

“The system of care is fragmented,” stated Dr. David Classen, a professor at the University of Utah School of Medicine, “Harnessing health information technology through the use of electronic health records of hospitalized and ambulatory patients is essential.”

Real life example courtesy US policy think tank Third Way:

Texas native, Tracie Storie (52) suffers from the chills while staying with her daughter in Boston. The Boston doctor determines she has sepsis, a potentially fatal infection in the bloodstream. Tracie states that she is allergic to certain antibiotics. Due to her medical conditions, she can’t remember which ones. The doctor freezes. Tracie goes untreated until her Texas doctor can fax over the records. She survives. Barely.

The U.S. has spent billions of dollars trying to set up centralised healthcare records. The efforts have failed because the software is proprietary (the source code is closed) therefore it doesn’t work as a global information sharing system.

There is a second more pernicious reason for the failure: centralised records make it easier for disgruntled patients to change doctors. Information is power. The medical system is reluctant to give patients more power.

Matlow has a nose for closing accretive transactions, like the acquisition of H.I. Next.

VHI is trading at $0.18 – unchanged over the last year.

If VitalHub did nothing but buy money-making companies in the Healthcare sector, a market cap of $15.3 million is too low.

The dream of centralised medical records has been cock-blocked by corporate interests.

For VitalHub – the establishment of centralised medical records is the end game. We don’t know if they’ll succeed. But the CEO’s game-face tells us VHI still has its eyes on the prize.

Full Disclosure: VitalHub is an Equity Guru marketing client and we own stock.