SHOP drops in the face of Adobe deal with arch nemesis Magento

Cannabis Wheaton announces $100M+ bought deal… is it harvest time?

Here’s what happened May 22nd

Ever-resilient Shopify gets smacked around again

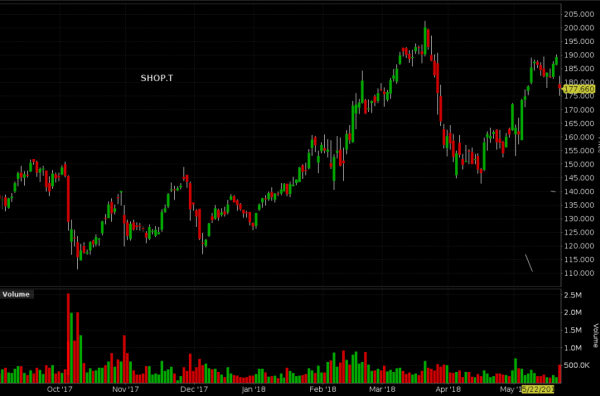

The May 1st HWH mentioned a high-profile miss by Canadian e-commerce giant Shopify (SHOP.T). We noted at the time that the company had failed to turn a profit on more than $200 million in revenue partially thanks to advertising costs, and that perhaps the street had figured that $14 billion was about saturation level for the Ottawa-based plug-and-play e-retailer.

The market didn’t agree with us in the short term, sending SHOP marching up to a $17 billion market cap in the past three weeks, then taking back a billion today to close SHOP down $11.59 at $177.66 (-6.12%) in a crisis of faith.

Today, OG software company Adobe Systems (they of the hundred and seventeen billion dollar market cap), payed $1.68 billion in cash for web based CRM Magento. Magento had US$150 million in revenue in the same period, making SHOP look pretty expensive on an earnings basis. More to the point, where Shopify appears to cater mostly to the small and medium sized businesses keen on buying up enough podcast ads to disrupt the mattress industry or whatever, Magento boasts name brand clients like Burger King and Coke.

Syndication being the better part of scalability, one can infer that the small army of self-styled, powermac-toting entrepreneurs who make up SHOP’s core group of customers will be ready to listen to a pitch from Adobe, who already sells them the stock images and software that they use to make pastel-coloured, feel-good images to sell whatever. We expect SHOP to do an agonizing re-appraisal of the situation, least the market do it for them, but we’ve been wrong about Shopify’s staying power before.

To Everything There Is A Season

And right now is prime season to shear the sheep

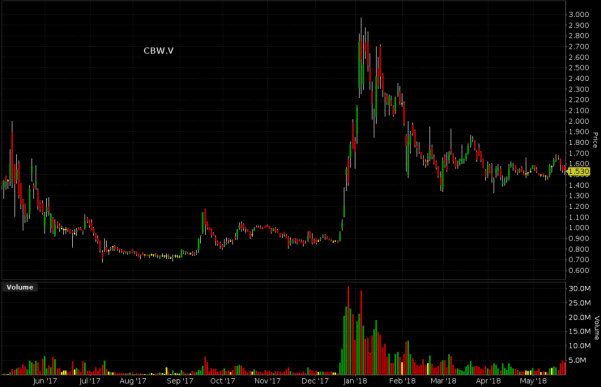

We’re inclined to see today’s after-market bulletin that Cannabis Wheaton Corp. (CBW.V) is doing a $100M bought deal as further evidence that this it’s harvest season in the Canadian cannabis market. The BMO led offering prints 71.5 million units consisting of a share and a half warrant, and provides for a 15% over-allotment to the brokers to raise a total of $172 million in the event that CBW can convincingly hang out above $1.85/share some time in the next 2 years and make those warrants count. CBW closed at $1.53 today (before the $1.40 raise was announced), down a penny (-0.65%).

Somehow, CBW is the most unique company that we’ve seen emerge in this weed boom and the one with the least imagination. The Chuck Rifici brainchild borrows its name and its business concept from fabled Canadian metals “streaming” company Wheaton Precious Metals (formerly known as Silver Wheaton). Cannabis Wheaton is meant to be the Canadian cannabis industry’s investment bank. A CBW shareholder is offered exposure to this emerging Cannabis market through the filter of industry-connected operators who know more than they do. In the tradition of the great Canadian mining companies who invented the royalty and streaming model, Cannabis Wheaton is to identify the companies that have the opportunity to become the very best cultivators, wholesalers and retailers in this exploding industry, and bring home the value.

And who better to make sense out of this wild wild west market than a crew hand-picked by Canopy Growth founder, Liberal government connected, pot biz shark Chuck Rifici? It’s not only one of the best pubco investment pitches in the cannabis business, it’s one of the best in any business. CBW has been able wrap it around an assets package that is essentially a bill of goods, and make a company with a $674 million market cap.

More interested in outcome than income

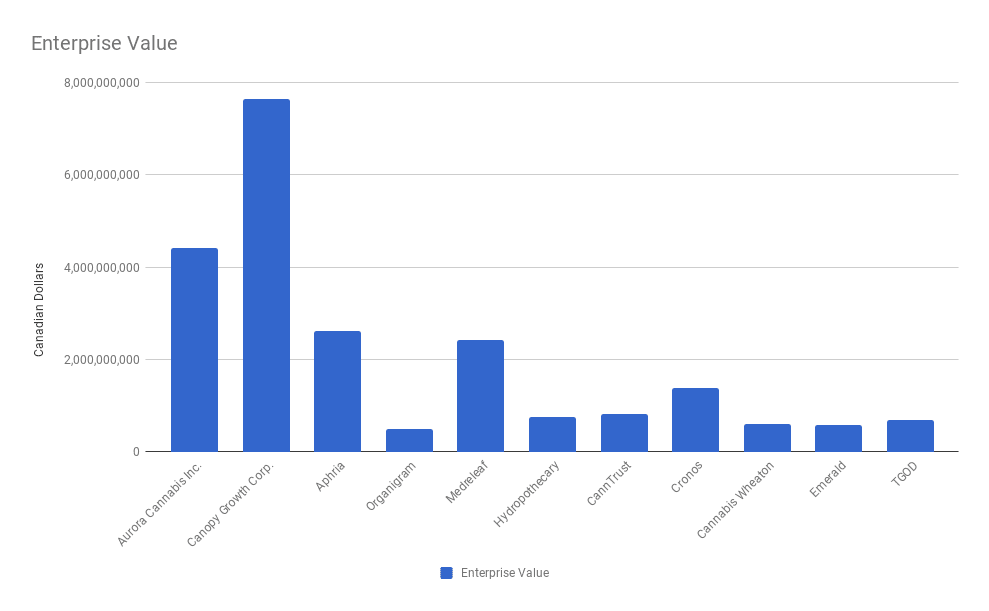

It would be unfair to evaluate CBW in the terms of brand name roylatycos. The more mature resource royalty companies are all built around income producing assets. The Franco Nevadas and Wheaton Precious Metals of the world invest in exploration-stage assets to create royalties further down the road, but they all have core income assets that keep the stock tight. CBW may well have bought one of those if it existed, but they don’t. There is ONE cash-positive Canadian cannabis company (Aphria), and the revenue champ is currently $7.6 billion market cap Canopy (WEED.T) with $21 million last quarter. Wheaton’s promise to its shareholders is that it’s identified the companies who will be producing revenue, and will be able to get theirs first.

To get an idea about what the market might think of CBW once its cannabiz investments are a bit more mature, we took a look at a couple other companies who style themselves as gunslinger investment bankers who can bring you both growth and yield.

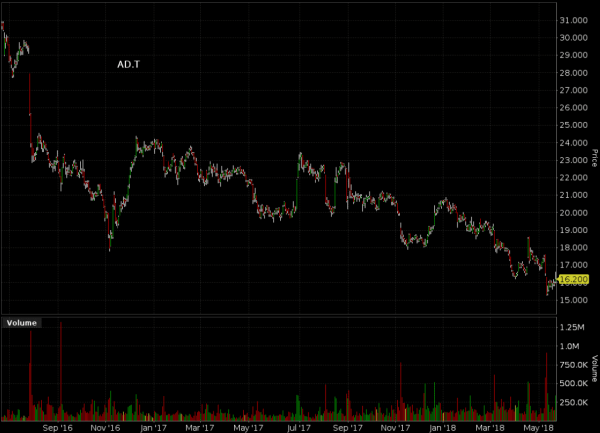

Alaris Royalty (AD.T) trades at a $591 million market cap. This company is sector ambivalent, financing various types of service companies, industrials, consumer products, etc. They had a rough quarter, losing nine cents behind a charge they had to take over some debt that looks like it might go bad. Alaris produces 20+ million in revenue per quarter like clockwork. It pays a quarterly dividend that, at current price, amounts to an annualized yield of 10%, because Alaris is trading at book value. It’s price:book ratio is 1. AD was up $0.28 to $16.20 today (+1.8%) on 500k shares.

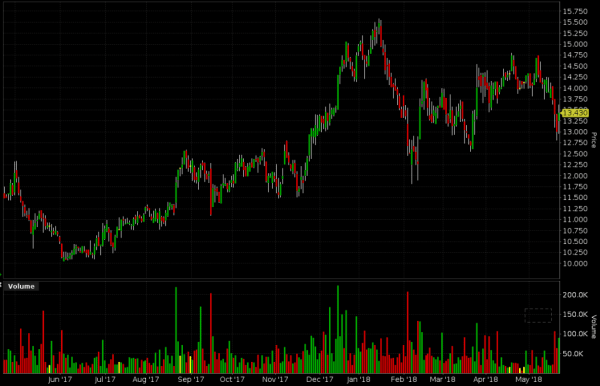

It isn’t to be confused with mining royalty company Altius Minerals (ALS.T), who started out by consolidating various royalty interests in Newfoundland’s Voisey’s Bay deposit, and added the royalty from Manitoba’s 777 mine, forward bought a copper stream from Yamana Gold’s Chapada mine in Brazil, various sundry coal and potash royalties, and are now pulling in $15 million a quarter on the regular, and paying a $0.04 dividend (annualized yield of 1.1%). The company is up to their eyeballs in 2 revolving credit facilities ( $127M total) and cut a deal to break off $100 million in preferred stock to hedge fund Fairfax in $25 million tranches, just in case. For their trouble, the market has given Altius a $580M market cap, and a price to book ratio of 1.7.

Cannabis Wheaton has no revenue, regular or otherwise, and a price to book ratio of 6.4, which is about right for a name brand pot company right now. Cronos (CRON.V) has a 9.9 price book, and sector bellwether Canopy Growth (WEED.T) weighs in at a 7.7 p/b.

And now, in May of 2018, as cultivation star Medreleaf asks for and gets an all-stock deal from paper-factory Aurora, as Canntrust does an $87 million dollar bought deal of their own, we get the distinct feeling that both CBW and the brokerage business that has inflated this bubble is feeling the wind get a little bit colder. We don’t know what metrics CBW uses to gauge market maturity, but we can get a good idea of where they think the cycle’s at by the fact that they’re printing about a quarter of their market cap to cash up.

(feature image of harvest moon courtesy flickr user Yoshikazu Takada)