Hydrocarbon Hullabaloo: Trump Tosses Deal With Tehran, Does It Matter?

Shell Says “Sayonara,” Sells Sands To CNQ, Scotford Still Making Sour Into Sweet

Nevsun Laughs at Lundin’s Yard-Sale of an Offer

There’s an Airline Trading on the Venture Now, and

A Canadian Gold Producer On The Quiet Grind

Here’s What Happened May 8th

(Feature photo by Flickr user Amy Lloyd is a RCAF Avro Anson, with support.)

President Deals Just Can’t Deal, Tears Up Iran Nuke Agreement

We try to stay away from politics in these daily wraps, but the degree to which Trump tearing up the US nuclear deal with Iran has shaped these markets makes it relevant. Staying on-message to his brand as the anti-Obama, the US president turned around and undid the agreement that his predecessor had negotiated to curb the development of Iran’s nuclear program. US sanctions that were lifted in the previous deal will be put back, and the twin threat of decreased Iranian outputs and increased Middle East tensions put upward pressure on the oil price. Trump couldn’t keep a secret if he had control of the entire national security apparatus, so this was well expected and totally baked in by the time it was announced. Oil prices remained near their 14 year highs Tuesday. It remains unclear what the effect of this move will be on future (and current) international accords, or the US’ ability to enter into them with any with sincerity.

Oil led Toronto again as the top two companies by dollar weighted volume were Suncor (SU.T), up $0.24 to $49.70 (+0.48%), and market leader Canadian Natural Resources (CNQ.T), down $0.87 (-1.92%) to $44.43. CNQ just finished a deal to purchase Royal Dutch Shell’s bitumen interests in Northern Alberta. The Financial Post reports that the Dutch oil giant sold its sake to CNQ for $7.7 billion to pay down some acquisition related debt and put Shell in a position to survive in a future that penalises carbon emissions, or one with low oil prices that put low-margin projects out of the money. Shell is keeping its Ft. Saskatchewan, AB Scotford Upgrader, which converts bitumen into synthetic crude oil.

Diluted-bitumen-heavy petrol export product Western Canadian Select went for $52.73/bbl Tuesday. Syncrude Sweet Premium traded for $66.73/bbl. Benchmark WTI was $70.15/bbl.

Meanwhile, In Mining

Vancouver based gold and copper producer Nevsun Resources (NSU.T) took to the pages of the Globe and Mail to tell Lundin Mining (LUN.T) what they could do with their off-brand offer. Lundin had offered to buy $1.4B market cap Nevsun for $5/share, consisting of $2 in LUN stock, $2 in cash, and (if they act now!) $1 worth of shares in $81 million market cap Euro Sun Mining (ESM.T), which kind of smells like something that they found on an old balance sheet. You could practically hear Nevsun CEO Peter Kukielski rolling his eyes. NSU said that if Lundin wants to get serious and make it cash and shares of $5.8B market cap LUN.T, they might have time for that. Making non-binding lowball private offer public didn’t hurt Nevsun’s cause. They did 4.5 million shares of volume Tuesday and gained $0.44 to close at $3.41 (+14.81%).

The Globe says Lundin’s plan was to put Nevsun’s Bisha project – a high grade VMS copper-gold project in Eritrea – into Euro Sun, and keep the Serbian Timok copper gold project, a high-grade joint venture with Freeport-McMoRan. There may have been a method to Lundin’s madness. The highly profitable Bisha property has Nevsun named as the subject of a of a lawsuit by Eritrean mine workers (who have since left Eritrea) who allege that they were effectively enslaved and tortured at the project. A BC Court of appeals ruled in November 2017 that the case could proceed in Canada, and Nevsun appealed back in January of this year, asking the Supreme Court of Canada to find that what happens in Eritrea should really stay in Eritrea, and they might have a point. Imagine the burden to Canadian courts if they suddenly had to sort out all of the messes Canadian mining companies create in countries we can’t even pronounce. (Air-i-tree-ah). Nevsun isn’t going to mount a defense in court until the jurisdiction issue is settled. The only statements they’ve made about the matter effectively blamed any mistreatment of workers on the type of local contractors that foreign governments force companies to “joint venture” with for concessions.

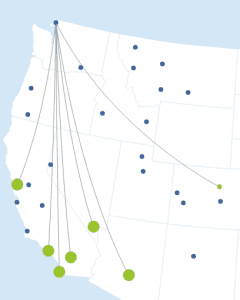

The Future Is A Direct Flight to Moose Jaw

Canada Jetlines (JET.V) has got the attention of the Venture exchange, doing 3.4 million shares yesterday and another 5.2 million shares today to close up $0.16 (+17.7%) over the two days. The company plans to become the first “ultra-low-cost” commercial airline in Canada. $63 million market cap JET had $2 million in cash at the end of last year, and just promised $876k of it to Airbus today as a down payment for a lease on a pair of Airbus A320s. A previous deal having fallen through for a pair of Boeings was cited as the reason for the upstart carrier delaying their launch, previously scheduled for June, so this might put them back on track.

People familiar with the situation have told Equity.guru that the company is cautiously optimistic that the Canadian Transportation Agency will approve their carrier’s license before the end of Q2, 2018.

Ultra Low Cost Carriers are popular among Canadians, despite not existing in Canada. Las Vegas based US$2B market cap Allegiant Travel Company (ALGT.Q) reported yesterday having moved 1.1 million passengers in April at an 85% load factor to create a billion dollars in revenue. No word on how many of those passengers drove down from the Lower Mainland to fly to Vegas out of Bellingham, but we have it on good authority that saving money is only half of the draw. The border lineup is worth putting up with just to avoid having to deal with Air Canada.

Canada’s sprawling geography and multiple regional markets may be a good fit for an ultra-low-cost carrier. Keeping costs low by flying out of regional airports like Abbotsford and Hamilton, JET may be able to use the nimble profile of an upstart company to find a niche outside of Westjet and Air Canada’s cost and route sphere.

Atlantic Gold Finds A Steady Groove

No space today for a full gold wrap, but we note that Nova Scotia based Atlantic Gold Corp. (AGB.V) did 2 million shares of volume after announcing that they produced 7,775 oz of gold in March and sold it for $12.9 million. The company is producing that kind of volume on the steady, boasts good recovery rates and is talking up expansion exploration. They just soft-forced conversion on some $0.60 convertible debentures (making them eligible for conversion into shares by paying off the interest), with expert timing ahead of another big production month. AGB was up a penny to close at $1.88 (+0.01%), on action that looked like the debtholders-come-shareholders wanted to hang around for a while yet. AGB is going to want to keep up that production. The company owes their project financing facility $18.6 million this year, $54.4 million next year, and another $37.9 million in 2020. But after that they’re in the clear. Today’s close makes Atlantic’s market cap $384.3 million, a price to book ratio of 4.

Led Zeppelin’s 1971 gold single for Black Dog: not for sale.

CORRECTION: A previous version of this post stated that JET hoped to be licenced “by Q2 2018,” which is obviously already here.