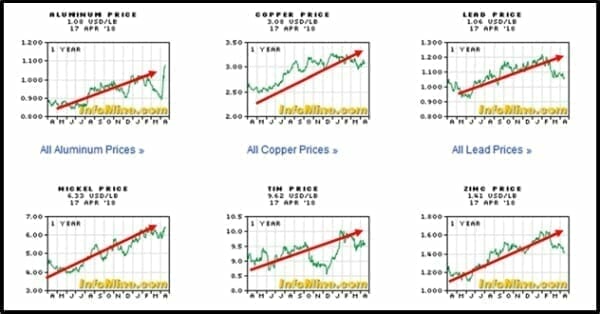

Resources stocks surged in Australia and China on Thursday. Aluminium prices reached their highest since 2011, nickel jumped the most in 6-1/2 years.

Base metals like aluminum, copper, lead, nickel, tin and zinc – have been rallying for a year [see chart below],

U.S. steel prices have also risen sharply since Trump’s decision to apply tariffs.

The Federal Reserve admitted on Wednesday that there were widespread reports in March “that steel prices rose dramatically, due to the new tariff.”

Meet Vanadium – an obscure metal on an absolute tear

Vanadium is a steel-blue metal used in the manufacturing industry owing to its malleable, tensile and corrosion-resistant qualities.

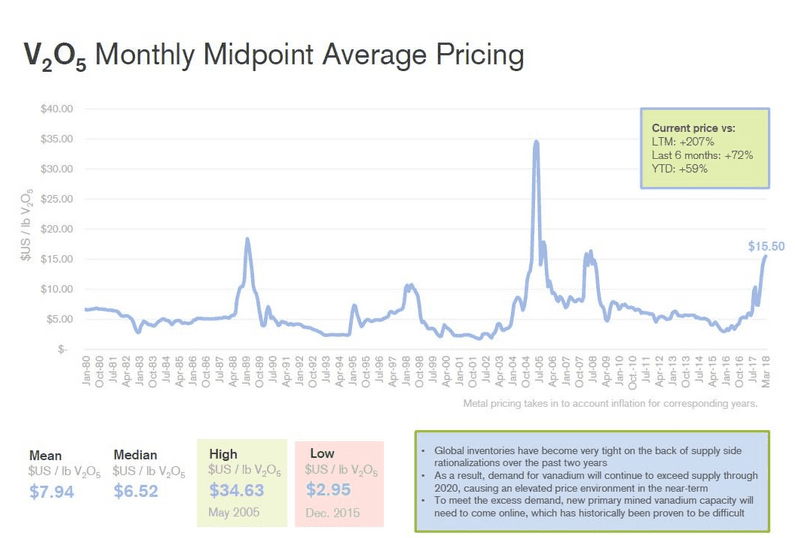

Recently vanadium has been outperforming gold, silver, copper, lithium, steel and aluminum.

Vanadium is traded in two forms:

- Vanadium pentoxide (V2O5)

- Ferro-vanadium (FeV) – An alloy produced by combining iron with vanadium.

Ferro vanadium rose $13.20 per kilogram to $35.20/kg in the 12 months prior to 31 January 2017 – rising 60% in that time.This year the price has almost doubled with the metal now trading around USD 68 per kilo.

With prices like that, it no longer ends up in the tailings pond.

Blue Sky Uranium (BSK.V) appears to have stumbled on a significant amount of Vanadium in Argentina.

Blue Sky is focusing on the newly delineated Amarillo Grande Project.

We are not suggesting that the company will be renamed “Blue Sky Vanadium” – or change its primary business model (developing a uranium deposit).

The Vanadium discovery is a bit like finding a BitCoin in the pocket of your favorite jacket in 2014. Every day it’s worth more than it was the day before.

It’s distracting – in a good way.

In fact, the uranium and vanadium are chemically tied together in the deposit – so it’s not going to be one or the other – it’s going to be both.

On April 18, 2018 BSK announced that is has filed the NI 43-101 Technical Report to support an independent mineral resource estimate for the Ivana Deposit at the Company’s 100% owned Amarillo Grande Uranium-Vanadium Project in Rio Negro Province, Argentina.

Highlights

- Inferred mineral resource estimate containing 19.1 million pounds of U3O8 and 10.2 million pounds of V2O5, (Vanadium) at a 100 ppm uranium cut-off.

- The Ivana uranium-vanadium includes an upper zone, comprised mainly of oxidized mineralization, and a lower zone, containing predominantly primary-style mineralization.

- Mineralization is hosted by loosely consolidated sediments potentially amenable to physical beneficiation by simple scrubbing and wet screening

- Preliminary alkaline leaching results of the surficial oxidized mineralization returned recoveries of over 95% for uranium and 60% for vanadium in 3 hours.

- Beneficiation test work for both mineralization types in progress, and leach test work for primary mineralization is in progress.

- The Ivana deposit remains open for “brownfield” expansion for surficial uranium – vanadium mineralization and sandstone-type uranium primary mineralization.

- The Ivana deposit is the southernmost expression of a regional mineralization front that may continue along the Amarillo Grande Project trend.

- Additional uranium and/or vanadium targets exist throughout the 140-km long trend covered by the 100% controlled BSK properties.

“Our initial view of the size of the Ivana deposit was surpassed with this resource estimate,” stated Nikolaos Cacos, Blue Sky President & CEO.

The Ivana mineral resource estimate is the first for the Amarillo Grande Project.

The deposit eats up about 7,000 hectares, in the southern portion of the 14- kilometer uranium-vanadium exploration trend.

Blue Sky Uranium controls over 280,000 hectares of mineral exploration rights.

The Ivana Deposit is only about 2.5% of the total property area.

Once the current metallurgical work is completed in H2, 2018, BSK plans to commission a Preliminary Economic Assessment (PEA) for the Ivana deposit.

There was a recently an obscure piece of news out of China that could catalyze further increases in the spot price of vanadium.

After a series of deadly building collapses, the Standardization Administration for the People’s Republic of China, recently announced a new rebar standard – requiring the use of vanadium.

“Rebar” is used to give internal structure to poured concrete.

China produces about 200 million metric tons of rebar each year. Argentina is one of China’s main trading partners in South America. $13 billion of goods move between the two countries.

Like we said, the vanadium is distracting.

But the uranium remains the A-plot.

You see, the Argentine government has expressed public support for the development of a domestic uranium supply to service its expanding nuclear energy program.

Argentina Uranium Drivers:

- Argentina has three nuclear reactors generating 10% of its electricity.

- The construction of two additional reactors is planned.

- Nuclear Energy output is expected to increase by 250% by 2025

- All uranium for the nuclear industry is currently imported.

Blue Sky’s uranium projects are being developed with Dr. Jorge Berizzo – a former mine manager with the Argentinean National Atomic Energy Commission.

“In Argentina, we have first mover advantage,” confirmed Cacos in a previous Equity Guru interview. “We have 25 years of Argentina mining experience. All levels of government have been great. Never had a problem. We share the wealth with the locals, and we’ve never had issues getting permits.”

Blue Sky is trading at .18 with a market cap of $15 million.

Full Disclosure: Blue Sky is an Equity Guru marketing client, and we own stock.