Anticipating a higher gold price is like waiting for your alcoholic uncle to gain sobriety.

It would be a more hopeful enterprise if he wasn’t blind drunk every day by noon.

For gold bugs, it’s been a long and frustrating wait.

But we are among the believers:

The most compelling reason to buy gold is global money printing. Since the 2008 financial crisis, central banks have printed (“quantitatively eased”) $11 trillion dollars.

The total global DEBT is $190 trillion, with 28% of it borrowed since the 2008 financial crisis.

In the mainstream financial markets, this dramatic increase in money supply has had no immediate effect.

But it will.

When that day comes there will be a stampede to gold – and in particular gold juniors – creating significant wealth for anyone who got in early.

TomaGold (LOT.V) is one junior worth looking at.

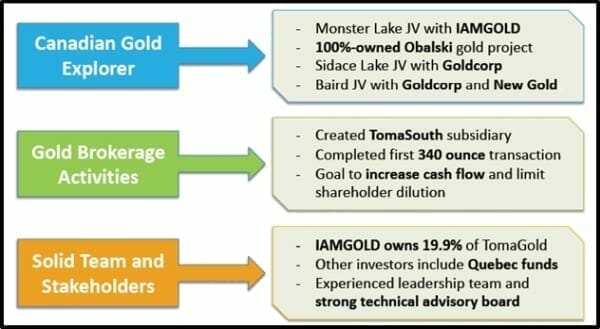

LOT is partnering with major mining companies to develop high-grade gold mineral properties.

It has strong joint venture agreements (JVs) with Goldcorp (GG.NYSE) and New Gold (NGD.TSX).

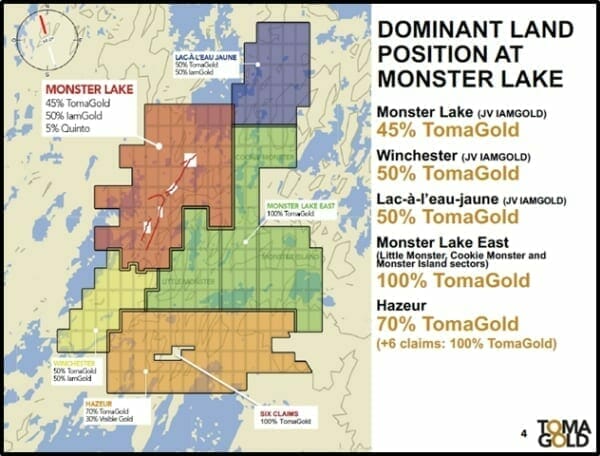

But from TomaGold’s sprawling portfolio of assets (six gold properties in northern Quebec and a couple more in Ontario) we believe the Monster Lake project JV’d with IAMGOLD (IAG.NYSE) contains the most powerful stock price catalyst.

IAMGOLD is a $2.4 billion gold miner with large stakes in the Rosebel gold mine (South America); Essakane gold mine (Burkina Faso), Westwood gold mine (Canada) and the Sadiola Gold Mine (Mali).

IAMGOLD generates over $1 billion a year in revenue and has an “operating margin” of 53%.

Operating margins measure the financial horse-power of the core business – stripping out factors like asset sales or interest payments.

By way of comparison, Apple (AAPL.NYSE) has an operating margin of 27%, while General Electric (GE. NYSE) has an operating margin of – 1.8%.

We mention this – not because it’s cool to have rich, competent friends – but because companies like IAMGOLD have no need – or desire – to participate in drill punts.

[editor’s note: a “drill punt” is micro-cap explorer that raised enough cash to stab one hole in the ground and pray it hits something shiny].

IAMGOLD’s end-game is to build mines – so they invest in projects with low political risk, good geology and favorable economics.

Which is to say, when a multi-billion company owns 50% of a project, partnered with a junior explorer trading at .06 – it’s worth trying to figure out why.

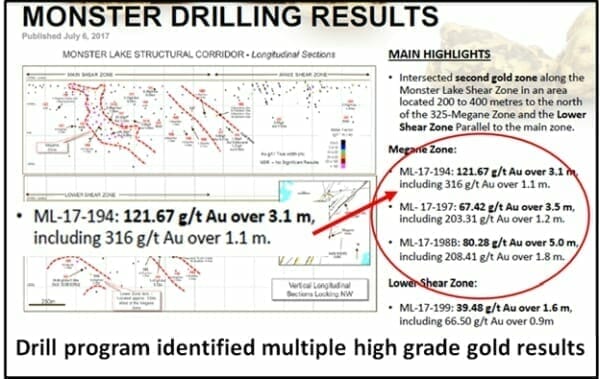

On January 22, 2018 IAMGOLD announced that it has begun a drilling program at Monster Lake and confirmed that an initial resource estimate is in progress.

Monster lake is located 50 kilometres southwest of Chibougamau, Quebec, Canada. The estimate, which will be performed in accordance with National Instrument 43-101, will be based on data from more than 80,000 metres of drilling completed by IAMGOLD, TomaGold and previous explorers, including approximately 38,000 metres from the 325-Megane zone area.

The resource estimate will be supported by a 43-101 technical report.

IAMGOLD is planning to do 7,500 metres of diamond drilling at Monster Lake – including definition drilling, testing for extensions along strike and at depth.

The company also plans to evaluate new mineralisation discoveries.

“We are delighted that IAMGOLD has initiated a first resource estimate for Monster Lake,” stated David Grondin, President and CEO of TomaGold. “This will mark a significant milestone. Together with the resource estimate, this drilling program will continue to advance the Monster Lake project significantly.”

On January 29, 2018, TomaGold announced the creation of a new subsidiary, TomaSouth to buy gold from artisanal producers in South America and transport it to refineries.

TomaSouth has already closed its first transaction, for 340 ounces of gold, after entering into a partnership with local entities that will oversee day-to-day operations.

The expertise of those local partners and their access to an extensive network of South American gold producers are key to the expansion of the Corporation’s brokerage activities.

There is a complicated revenue-sharing plan between TomaGold and the artisanal miners, involving “transaction volumes” “performance targets” and “consultant options”.

Would you like us to explain it to you?

“This new gold brokerage business will enable us to generate positive cash flow for our exploration activities without creating excessive dilution,” stated Grondin, “We’ll have access to a vast network of gold producers of all sizes. Along with our new credit facility, this initiative will enable us to increase the number and volume of our transactions and generate growing revenues for the Corporation.”

It’s good when a junior can generate cash to fund exploration as long as it doesn’t steal focus from the primary exploration objective.

Gold brokering involves a matrix of relationships with miners, truckers and South American government agencies. It’s not a turnkey business.

As Equity Guru writer Greg Nolan recently wrote:

“One would think that with the profusion of global economic and political shock-waves we’re currently experiencing – with bond yields and general equity prices all over the proverbial map – gold would be asserting itself with tremendous force and conviction.”

Indeed.

We think Monster Lake is the key to unlocking value in this micro-cap company with heavy-weight partners.

According to the terms of the JV agreement, IAMGOLD must incur $10 million in exploration work over 7 years to earn an additional 25% interest.

Full Disclosure: TomaGold is not an Equity Guru marketing client, though we had a meeting with members of the ownership group. We own stock in the company.