EDITOR’S NOTE: We believe, this year, resources will make a pretty hard move, just as cannabis and blockchain did in 2017, and because many of our investor readers are new to the mining space, we decided to bring aboard a writer who can dig deep into the details and explain what matters and why.

Greg Nolan, AKA Dirk Diggler, is a fount of mining knowledge. His brief: Take a look at mining and oil and gas explorers and producers, and tell us what he feels, positive or negative, with no fear nor favour.

We encourage readers, if they come across a phrase or concept that they don’t understand, to let us know in the comments, as we’re putting together a series of pieces that will explain terminology in greater detail. See more of Greg’s work here.

—

The old adage, ‘a once-in-a-lifetime opportunity’ has really worn itself thin in the small-cap resource arena; so has the expression ‘game changer’. Words that make veteran market participants cringe as every CEO and their dog seem to make the same damn claim… with a straight face even.

Two notable (recent) quotes from Renaissance Oil (ROE.V) company insiders:

“We have been picking the low-hanging fruit by improving production at existing wells with the focus of producing the first ever commercial Mexican shale oil,” stated Craig Steinke, Renaissance’s CEO in a recent interview, “It’s certainly not hyperbole to say that this is a once-in-a-lifetime opportunity.”

and:

..regarding a recent deal, Renaissance’s Director, Ian Telfer, stated that the project “is huge, very exciting and a complete game changer for the company.”

Yep. There it is again. Of course, there’s always the possibility that such ardor and avidity are warranted, that it’s not completely misplaced. This is particularly true when the likes of Steinke and Telfer utter such enthusiasms (more on company management later).

All hyperbole aside, Renaissance appears to me to be the real deal. You can almost sense the pressure building under this one – it’s like there’s a charge in the air, a glow on the horizon. At the very least, the market is watching ROE with keen interest.

A bit of history:

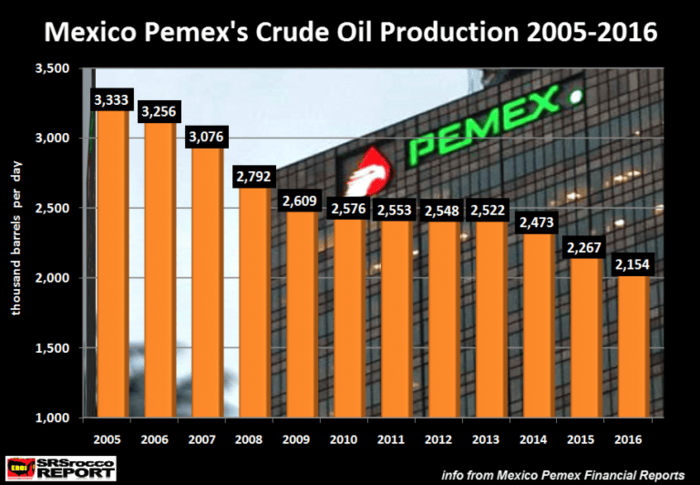

It all started 5 years ago when the government of President Enrique Pena Nieto pushed through reforms that put an end to Pemex, the 76 year state-run monopoly in Mexico’s energy sector. The reason for abandoning the monopoly, aside from a massive reservoir of offshore oil that is nearing the end of its cycle – a pic is worth a thousand words:

(chart poached from Steve St. Angelo’s excellent report ‘Pemex is on the verge of bankruptcy‘)

Plummeting production and paralyzing debt have stripped this once powerful behemoth of its sovereignty. Mexico has opened its borders to competition. Foreign companies have been let in to help tap into some of the world’s largest onshore oil and gas resources – resources that require a very particular set of skills to tap.

Different skills, Liam.

The Tampico Misantla ‘Super Basin’:

The TM Super Basin… it’s got a certain ring to it.

With partners, LUKOIL, the Russian oil giant, and Pemex, the once stately state-run oil monopoly, Renaissance has secured the Amatitlán project, a massive 60,000-hectare block of ground located on what’s widely considered the ‘sweet spot’ of the Tampica Misantla Super Basin. This was the first, the very first shale oil play to be pursued and acquired by a foreign company in Mexico.

What’s that old saying about the ‘Early Bird’?

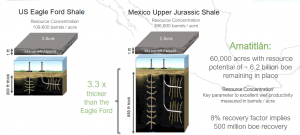

Holding multiple zones of extraction potential, the real ‘game changer’ / ‘once-in-a-lifetime’ opportunity lies in its Upper Jurassic Shales. This is a robust formation. Amatitlán shales are super thick. Over the years, Pemex drilled the area extensively. They took core samples and mapped the formation seismically. Amatitlán’s potential is perhaps best demonstrated via this tidy comparison with the US Eagle Ford Shales, a prolific formation located in the great state of Texas.

6.2 billion boe (barrels of oil equivalent) is FAT – there’s no other way to look at it. The metrics on a resource this size – even if one factors in only a small fraction of recoverable oil – are quite formidable, ‘game changers’, if you will.

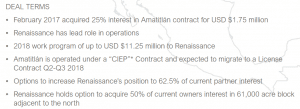

The deal:

You might be thinking, “that Renaissance sure has some sack… demanding options in their contract with LUKOIL… options which could see their ownership in Amatitlán swell to 62.5%”. This might be a good time to trot out a little more detail regarding the heft of this management team.

This, courtesy of Equity.Guru’s Chris Parry:

The management team is a who’s who of resource guys with big wins behind them, the lead director is Ian Telfer, Mining Hall-of-Famer, and Founder, Chairman of the Board, and past President of Goldcorp (you may have heard of them, Goldcorp went from pennies to $11 billion in value under his guidance gold mining in Mexico). You’ve also got Gord Keep, who is CEO of Fiore Management and Advisory Corp, AKA ‘the pipeline to Frank Giustra’ (who you may also have heard of).

Parry also stated:

“Craig Steinke, Renaissance’s CEO is coming off a prior success with co-founder Telfer at Realm Energy International Corp., a company formed to develop shale plays in Europe. After collaborating with Halliburton (NYSE: HAL) in acquiring properties across Europe and partnering with ConocoPhillips (NYSE: COP) to develop the potential flagship property, Realm was acquired by another European shale player for a tidy profit for shareholders.”

It’s important to note that the technical team behind Renaissance were pioneers in the development of hydraulic fracturing technology, aka ‘fracking’. They were the first to bring this innovative tack to the US and Canada. When LUKOIL went looking for a partner to help develop its Amatitlán shale – a project that will require heaps of fracking know how – it was a no-brainer. They settled firmly on Renaissance. That speaks volumes.

The potential:

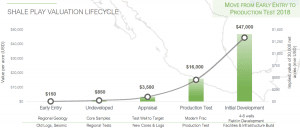

As the company moves the Amatitlán project forward, the value creation potential looks superb:

CEO Steinke recently stated:

“The Company is diligently working to obtain the permit to spud a deeper unconventional well on Amatitlán targeting the Upper Jurassic shale formations. Renaissance plans to drill an initial vertical hole to evaluate the entire Upper Jurassic section, followed by a horizontal well within a specifically targeted Upper Jurassic interval and complete the well with a high energy stimulation. Based on proprietary geochemical evaluation, Renaissance believes the Upper Jurassic section throughout the Amatitlán block is a high potential reservoir. Based on the success of the first well, the 60,000 acre block has the potential for an aggressive unconventional development program. Renaissance has taken the lead role in operations and holds options to increase its interest in Amatitlán to 62.5% of current partner’s interest, upon successful development of the property.”

Renaissance is targeting this first horizontal well in the Upper Jurassic shales for H1 of this year. Is that a drum-roll I hear? Never mind. Moving along…

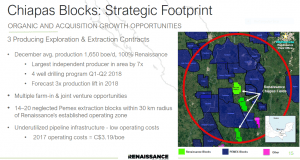

Elsewhere in Mexico:

Renaissance is already the 2nd largest oil producer in Mexico, after Pemex. By virtue of their control of three producing blocks in the state of Chiapas, the company churned out $5.4 million in oil and gas revenue in Q3 of 2017. Currently producing roughly 1,650 boe per day, they plan on drilling up these ‘mature fields’, increasing production three-fold in H1 of this year. Not too shabby for a C$70 million market-cap oil producer.

For all three of these blocks in Chiapas state, the company sees real value creation opportunity in new well locations, as well as the application of innovative re-completion technologies.

Closing thoughts:

Oil has been on a bit of a tear since the lows registered in 2015.

If this trend continues, it could usher in the mother of all tailwinds for asset developers like Renaissance. Even if oil prices flatline around current levels, Renaissance appears destined to prosper. One of the benefits of operating in Mexico is that the company enjoys significantly lower costs – lower than they might otherwise experience operating in the US, or Alberta for that matter.

With any large resource development play there’s always the question, “Sure the company has great assets, but can management execute?”

Here, the short answer is, “Damn straight!”. This team can execute. It’s what they do. I don’t mind echoing the fact that Renaissance was singled out by a mighty oil giant to operate this project.

As a demonstration of internal confidence, management has skin in the game; they’ve put their own hard earned money to work here. A recent example of this commitment – this alignment with shareholder interests – came on Dec 4th 2017 when the company completed a non-brokered private placement with certain members of its technical team for gross proceeds of C$1 million. That aint chump change. This is the kind of news makes my ears perk right up.

It’s going to be an interesting year for Renaissance Oil and its shareholders. Expect strong news flow in the coming months, from multiple fronts.

Final thoughts courtesy of Chris Parry:

“If you’re going to take a dive into a sector that is new to you, at a time when it looks like that sector is finding new energy (no pun intended), step 1 in ‘how to not lose your nest egg’ is to go in with people who have done it before and have big wins in their history.”

END.

~ ~ Dirk Diggler

FULL DISCLOSURE: Renaissance Oil is an Equity.Guru marketing client, and we have purchased stock in their most recent financing.

I was wondering if I can get Equity.Guru’s take on the following ROE news:

“The Company further announces that, pursuant to the Company’s stock option plan, it has granted to directors, officers, consultants and employees of the Company options to purchase an aggregate of 7,500,000 common shares of the Company at a price of CDN $0.31 per share for a period of up to ten years, subject to regulatory approval.”

I’m relatively new when it comes to this stuff. Will this put a ceiling on the stock price? It has dropped something like 15% (so far) since the news came out and I’m concerned my chance to escape with something decent has passed.

Thank you for your time and for the well-written (and entertaining) articles!

Those kinds of deals are fairly standard. What it means is the directors have every incentive to get the share price up over a buck so they can make those deals work for them.