Good morning from my underground lair where, surrounded by glowing monitors, keyboards, and a slightly fey servant named Beauregard watch the news both analog and digital on our client companies and the broader market for you, our consumers of sweet sweet information.

Today I have a thrilling trifecta of news about Equity Guru clients – all of which are of interest to you if you operate in the Weed, Crypto and Mining areas. It’s like an EG Royal Flush.

HIKU completes presales inspection ready to grow

(Yes the headline is a haiku)

Today HIKU (HIKU.C) announced it’s subsidary DOJA (‘member when?) has completed its pre-sales license inspection for it’s west Kelowna ACMPR facility. Sigh. I’d link to it, but as of this AM it’s not on their site yet. C’mon guys – day and date with the wire. It’s not hard.

Back to the matter at hand. This announcement is good news because HIKU is going to need this production capacity to funnel product into Manitoba as one of it’s master licensees to sell legal cannabis. With the West Kelowna site up and running, HIKU is building a nice vertically integrated stack.

Every ton they grow themselves is one less they have to buy on the open market for distribution in Winnipeg. The facility called ‘FUTURELAB’ (rolls eyes) will produce 4,500 kg of product a year when fully operational. The building itself is 22,076 sq. ft of hydroponic goodness.

This is the second facility in HIKU’s pocket, it already operates one that is producing in the same area.

Put together, this is a good sign that HIKU will be able to service it’s retail markets while keeping margins nice and fat.

As always though, let’s go to the big board.

HIKU.C took a hit during the weedpocalypse, bounced back and slid again. Now it’s on its way back up – this news should help.

I have a big ol’ crush on vertical monopolies. Henry Ford owned a herd of cattle just to have leather for his car seats. I think HIKU is a something that if you are holding onto because it’s a long play, you is smart. (I’m not just saying that to suck up to my boss who owns stock).

With control of their production and distribution chains, the profit potential is enormous. Just ask the movie studios about the good ol’ days when they owned the theatre chains at the same time as their production houses.

eXe dOwnloads a bUsiness uPdate

eXe released a long and detailed update to it’s business plan. I would link to it, but they don’t have a media page on their website. Sigh. Please refer to the dozens of times I’ve said the little things like this matter. No typos. Have up to date links on your site. Don’t make me fish around looking for public facing information. It looks bad – for you. (NB – I didn’t find any typos on the eXe site- examples are for illustration purposes only)

Public shaming over. Now here’s the scoop

The core of the update is to reassure everyone the company isn’t peddling vaporware, and is really gearing up to make what it hopes will be very disruptive moves in the small-scale transaction areas. (e.g. your office 50/50 draw could be run by eXe’s dApp one day soon)

To that effect, they are hiring heavy tech hitters at a frenetic pace, and getting ready to launch some blockchain backed public facing apps. This has huge potential. From a marketing perspective, having a simple easy-to-use app to set up chartity auctions that can be sold as secure, with the buzzword ‘blockchain’ – damn, that’s a nice market advantage.

Plus no one else is doing it right now.

The last paragraph touts the new website. Yes. it’s gorgeous. No it doesn’t have a media section. See my first paragraph.

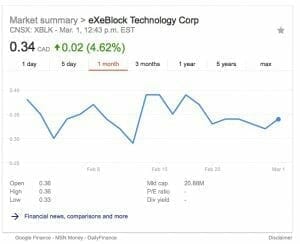

The stock is hovering around midpoint between high and low. With the incipient release of the 50/50 dApp now might be a good time to look at this one. If it takes off post-launch remember me in your dreams.

BLUUUUEE SKIEEEEES … smiling at meeeeee, Uranium placement closes for thee.

(Trust me, if you get this reference it’s HI-larious)

So my esteemed colleague Kane knocked it out of the park with his analysis of Blue Sky Uranium (BSK.C). It would seem he was not the only one watching this bad boy. According to their news release this AM, BSK has now closed it’s private placement due to over-subscription.

That was fast.

The placement was for 7,258,500 units – raising $1,451,700. Here’s the deets:

“Each unit will consist of one common share and one transferrable common share purchase warrant. Each warrant will entitle the holder thereof to purchase one additional common share in the capital of the Company at $0.35 per share for two years from the date of issue, expiring on February 28, 2020. If the volume weighted average price for the Company’s shares is $0.75 or greater for a period of 5 consecutive trading days, then the Company may deliver a notice (the “Notice”) to the warrantholder that the Warrants must be exercised within twenty (20) days from the date of delivery of such Notice, otherwise the Warrants will expire at 4:30 p.m. (Vancouver time) on the twenty-first (21st) day after the date of delivery of the Notice. The accelerated exercise shall not apply until the expiration of the four-month hold period required under Exchange policies and rules, and securities laws that are applicable to the Company, being June 28, 2018.”

Didja ever wish you could find out about these kinds of opportunities before they happen for once?

So, if Lukas is right about the potential of the Amarillo Grande project, then these early investors will be very happy. For everyone else, be aware this is could be sitting like a ticking share-bomb.

That being said – I think there’s enough glowing miracle nuke-rock for everyone here. but if you feel squirelly, you only have extra profit to lose by waiting. (this assumes you want to invest in uranium. As always, pick your own poison. I like polonium, if it’s good enough for the KGB, it’s good enough for me.)

FULL DISCLOSURE: I don’t own stock in any of these, but they are all EG clients, and some of us do own stock.