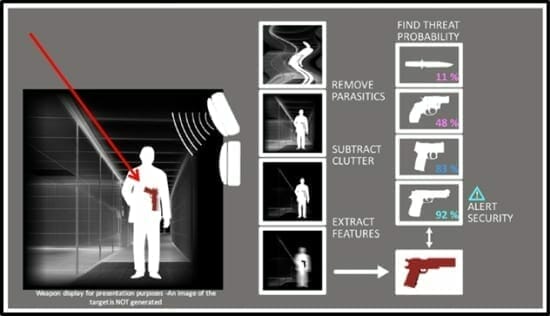

Patriot One’s (PAT.V) technology is “Designed for cost-effective deployment in weapon-restricted buildings and facilities. The hardware can be installed in hallways and doorways to covertly identify weapons and to alert security of an active threat entering the premises.”

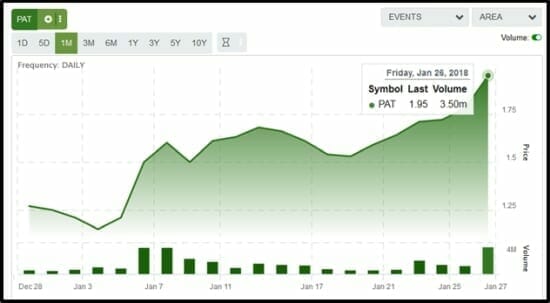

We first wrote about PAT on November 22, 2016 when it was trading for $1.35.

On January 26, 2018 PAT stock hit an all-time high of $1.97 – up 44% since our first article.

“One area we know will do well from any Republican ascendancy, and especially this one, is defense and security,” stated our initial report, “Which is probably why Patriot One Technologies has debuted on the Venture Exchange with a pop and a roar.”

Currently, if I wanted to slip through into a stadium or subway station with a weapon, I’d only have to ensure there were no metal detectors present and away we go.

The elevator pitch is that the Patriot One hardware can be installed in airports, subways, stadiums, and schools, on a street corner, or virtually anywhere crowds of people might need protecting, without giving itself away or inconveniencing people as happens at an airport security lineup.”

The reason for the bullish chart pattern?

Americans are to guns – as mice are to cheese.

They love, love, love ’em – all day long.

This isn’t a new trend.

Since 1968, there have been 1.5 million recorded U.S. gun-related civilian deaths.

Since 1776, 1.4 million American have died in wars. That figure includes the Revolutionary War, the Mexican War, the Civil War, the First World War, the Second World War, the Korean War, the Vietnam War, the Gulf War, the War in Afghanistan, the Iraq War etc.

“Shooting incidents” are on the rise.

The numbers speak for themselves: : 51,862 (2014), 53,772 (2015), 58,836 (2016), 61,444 (2017)

For the numerically-challenged – that line slopes up from left-to-right on a graph.

The need for discreet weapons-detection technology is obvious. It’s the reason we’ve been hammering you over the head with Patriot One news.

Examples: on December 20, 2016 PAT signs on Homeland Security Boss, on February 22, 2017 PAT expands its proprietary database of weapons “signatures”, on March 15, 2017 PAT signs a deal with University of North Dakota for a real-world pilot study of its NForce CMR1000 – then over the next 10 months we updated you ten more times.

As you see from the above chart, most of the time we were talking about PAT – the stock drifted. The above chart proves nothing except that we are not “bull market buddies”.

If we think we’re right – we don’t shut up.

It took a tragedy in Las Vegas to catalyze the breakout. After the massacre, we actually stopped writing about PAT for a while, out of respect for the victims [the company brass also laid low].

On January 25, 2018, Patriot One CEO and President Martin Cronin published a Letter to Shareholders with the following Q3 highlights:

2018 LAS VEGAS SECURITY FORUM: January 2018 saw Patriot One co-host a full day security forum at the Westgate Las Vegas Resort & Casino. About 50 attendees with purchasing authority. Feedback was unanimously positive. We expect to develop significant opportunities from this successful event.

ENGINEERING & REGULATORY ADVANCEMENTS: Engineering team has increased its ability to support additional client feature requests, including algorithms to make use of neural networks Additionally, PATSCAN is now certified by the European Telecommunications Standards Institute (ETSI), making PATSCAN saleable in 66 countries across Europe, the Middle East and Asia.

SALES & MARKETING: PATSCAN was recently featured prominently in coverage by Fox News, Security Today, and WIRED Magazine. We currently have agreements with 13 large clients and distributors, with a backorder of 453 units committed for scheduled delivery over the next 12 months.

FINANCING TO FUND ONGOING DEVELOPMENT: Successful closing of a significant financing round, which has enabled us to accelerate PATSCAN solution deployment to core verticals originally targeted in 2017.

On January 22, 2018, PAT announced a slew of new hires including: Mr. Robert Lex as Vice President of Operations, Dr. Paul Rice, Ph.D. as Vice President of Research. Also, Mr. Dinesh Kandanchatha, transitioning from his roles as Chief Technology Officer and Company President.

Nobody like reading bios of people they aren’t related to – but believe me these dudes are heavy-weights.

“With the speed-to-market we have to achieve in 2018, we need to act decisively to ensure we can manage our projected business growth, product rollout and corporate alliances with key partners,” stated Cronin, “2018 will see remarkable advancements, as we continue our efforts to rid the world of tragic and random acts of violence.”

Drunken monkey syndrome meets survivorship bias.

It goes like this: if you buy tuxedoes for 1,000 monkeys, ply them with single malt Scotch, stick ‘em in front of 1,000 roulette wheels – at the end of the night three of them are rich and totally convinced that they are talented roulette players.

At Equity Guru, we do not have “Drunken Monkey Syndrome” although we do enjoy a good single malt occaisionally.

Patriot One’s stock price isn’t rising because of Equity Guru.

It’s not rising because of a single mass shooting.

Last week there was gunfire at a high school in small-town Kentucky. Before that, a school bus in Iowa , a college campus in Southern California, a high school in Seattle .

The Kentucky school shooting was the worse so far in 2018: two 15-year-old students were killed and 18 more people were injured – many of them critically. It was the 11th school shooting of this still young year.

Patriot One’s stock price is rising because it has created a powerful solution to a growing deadly problem.

If you dig into the complexity of the hardware, and the matrix of federal and international licensing that governs it – you’ll see there is a moat around the business.

Full Disclosure: Patriot One is an Equity Guru marketing client, and we own stock.