Invictus MD Strategies (IMH.V) announced today that it has delivered 120kg of cannabis to Canopy Growth Corp (WEED.T), its first B2B delivery of flower, to be sold through that company’s CraftGrow line alongside PEI’s Island Garden.

“On behalf of the Canopy Growth team, I want to congratulate the AB Labs team for achieving this milestone,” said Mark Zekulin, president, Canopy Growth. “AB Labs is now the second CraftGrow partner to successfully transfer cannabis products to be sold through our Tweed Main Street e-commerce platform. We hope to have AB Labs cannabis available to our customers this quarter and look forward to many more successful transfers in the future.”

It’s a big day for Invictus, with a clear new revenue stream, a big name reselling partner, and progress shown on its journey from applicant to producer to seller.

But if that isn’t enough, the company also announced it has increased its stake in its second licensed subsidiary from 33.3% to 50%, for $10m which will be used to expand the facility – thereby making that investment worth more.

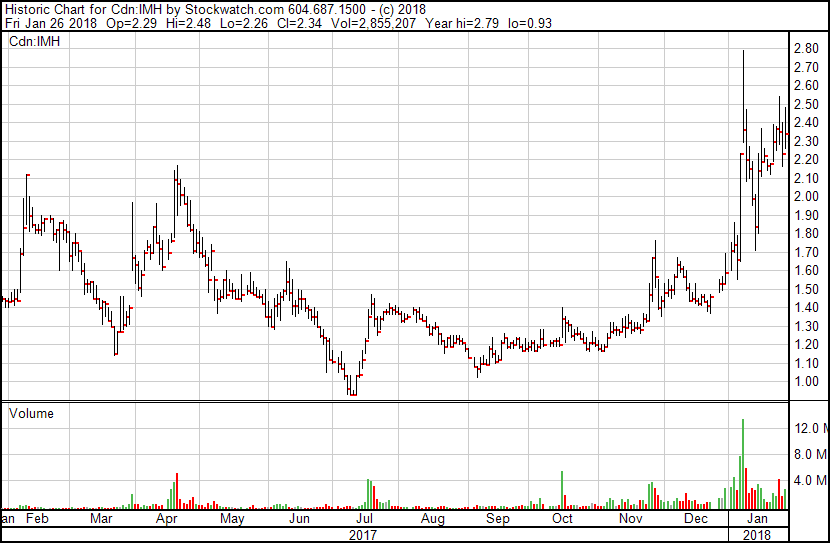

IMH is up 6% on the news. Again.

But then, none of this is really news to our readers, because we kept on telling you IMH was undervalued, that it would defy the market eventually, and that news was coming for the first weedco to pay a dividend to investors.

- In December of 2016, we told you that Invictus MD Strategies (IMH.V) might be a good time. It was trading at $0.75.

- We told you a year later that you were nuts if you didn’t give it a look. It was trading at $1.20.

- We tapped you on the shoulder again when it was $1.65, in December, when everything else had flown to unreasonable places, that it had yet to lift.

- And in early January, when I said it might be a good time to pull your weed profits and look to value picks like IMH, which was $1.75 at the time, others called us crazy, insisting the weed space would double again and again.

They have a fully owned LP in west central Alberta, they own a third of AB Laboratories in Ontario, and a third of a license applicant. They also own 82.5% of Future Harvest, a hydroponics and fertilizer specialty retail storefront, from which they already made a substantial profit from selling off one of their product lines.

Here’s the catch: Everyone has forgotten.

Canadian weed market cap values [as of Jan 3]:

- Namaste: $792m

- Cannabix Technologies: $257m

- Golden Leaf: $233m

- Abcann Global: $220m

- DOJA: $163m

- INVICTUS MD STRATEGIES: $140m

- Matica Enterprises: $139m

- Tinley: $137m

- LDS: $119m

Well I hope you got some.

In fact, I know many of you did, because the share price of Invictus stock has been rolling upwards since we made the above call, including a spell where it turned that ‘third of a license applicant’ into a ‘third of a license holder.’

As it happens, our other predictions also came true; that Abcann (ABCN.V) and DOJA (DOJA.C) were also good value picks, and that the high end of the market was going to fall off.

Abcann is the company Organigram wants to be. Abcann is the company Organigram should have been. Abcann is up this past month, but not nearly where it should be.

You know what to do.

DOJA’s crew were too young, too pretty, too small, and yet here they are, banging out a new deal with Tokyo Smoke, Canada’s most renowned vape store, creating a cross pollinated lifestyle brand that threatens to punch way above its weight class.

Abcann duly announced entry into the Australian market and picked up a clinic chain, leading to big wins that were matched in the market only by merger-attacked Cannimed (CMED.V), and DOJA, which has absolutely rocketed.

Meanwhile, consider Aurora (ACB.T), Canopy (FIRE.T), Aphria (APH.V), Cronos (MJN.C), and Supreme (FIRE.V) are all either level with where they were in early January, or lower than that point as their extreme valuations have begun to attract short sellers and repel value investors.

I’m not going to say “hate to say I told you so,” because I absolutely LOVE that we told you so.

We have accurately picked ups and downs on the weed market consistently since this site has been in existence, and every time we have, we hear the same old chorus accusing us of either being short sellers or pumpers or clueless noobs.

The runs are on the board. We nailed it TO THE DAY. We told you Invictus was a gimme, and it had a new license within 48 hrs. We told you DOJA’s crew knew what they were doing, and they belted it out of the park. We told you Abcann was the company Organigram should have been if it hadn’t gone crap, and it is killing it.

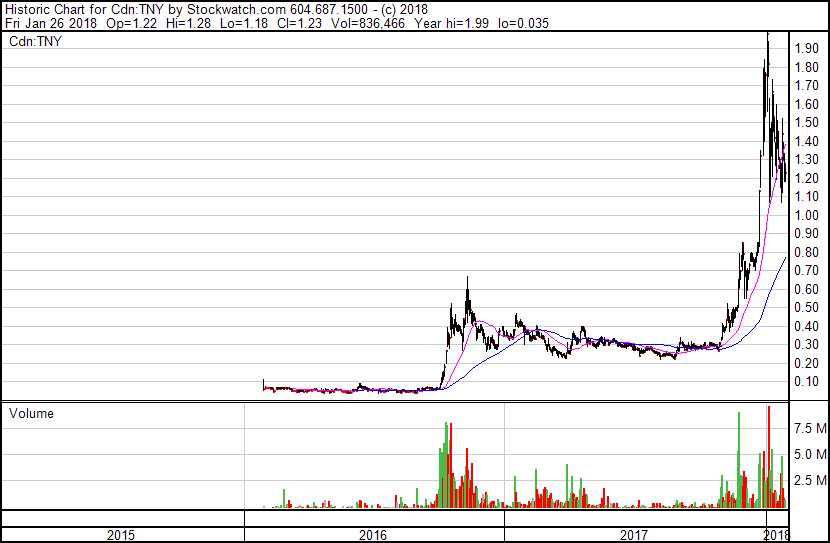

To be fair, we also told you to take some of Tinley profits at $0.90 or so, though we love the company, and it briefly touched $2 since, so we’re not going to claim a 100% hit rate.

But, daaamn Daniel!

The companies above are defying the gravity of the market but, here’s the thing – the market is WEIGHING THEM DOWN. For them to continue booming, they’ll need to put out more good news.

I’ve sold some DOJA, and will sell more – partly because I have a lot and am a bit overweight on them, but also because they’ve done the job we hoped they would, and that’s when you take your profits (or much of them) off the table.

Can IMH double from here? Sure, as could ABCN and DOJA. And I’d venture they’re far more likely to double in value than Canopy and Aurora, which would have to raise their market caps by around $7b to deliver the same percentage return IMH will bring from adding $200m.

But here’s something to consider, and it’s part of what I told folks in my keynote at the Cambridge House VRIC 2018 show this week:

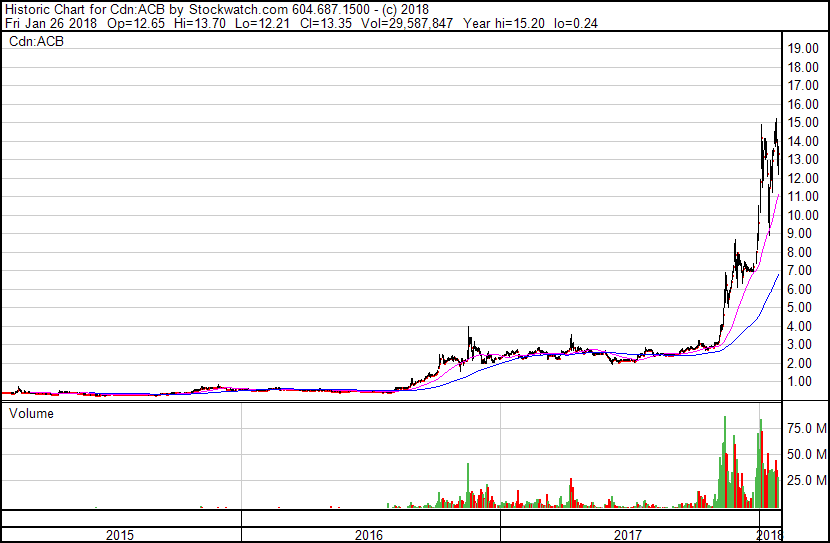

This is ACB’s 3 year chart. You’ll notice every year since 2015 (actually 2014 too, but it doesn’t show on the chart because the numbers were so far smaller), at the end of the year, ACB goes on a big run, and for the rest of the year it tapers off. Happens in 2015, 2016 and 2017.

This is ACB’s 3 year chart. You’ll notice every year since 2015 (actually 2014 too, but it doesn’t show on the chart because the numbers were so far smaller), at the end of the year, ACB goes on a big run, and for the rest of the year it tapers off. Happens in 2015, 2016 and 2017.

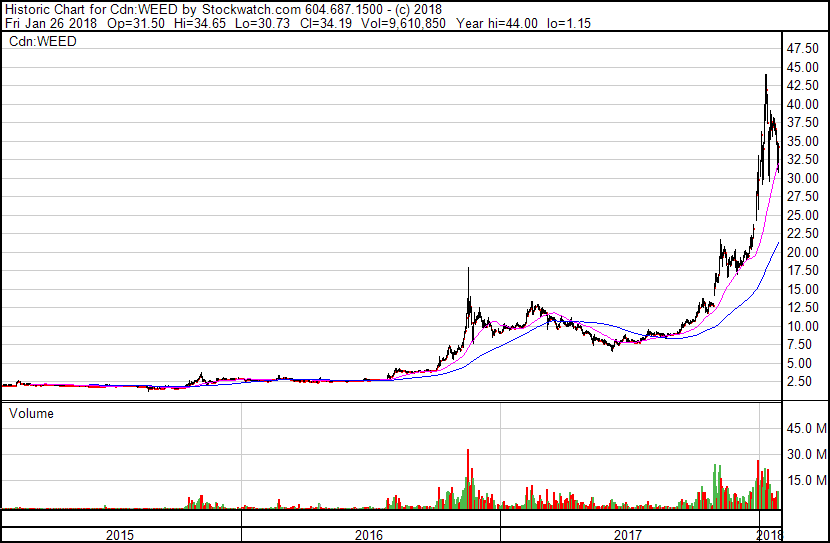

This isn’t an ACB anomaly. Here’s Canopy.

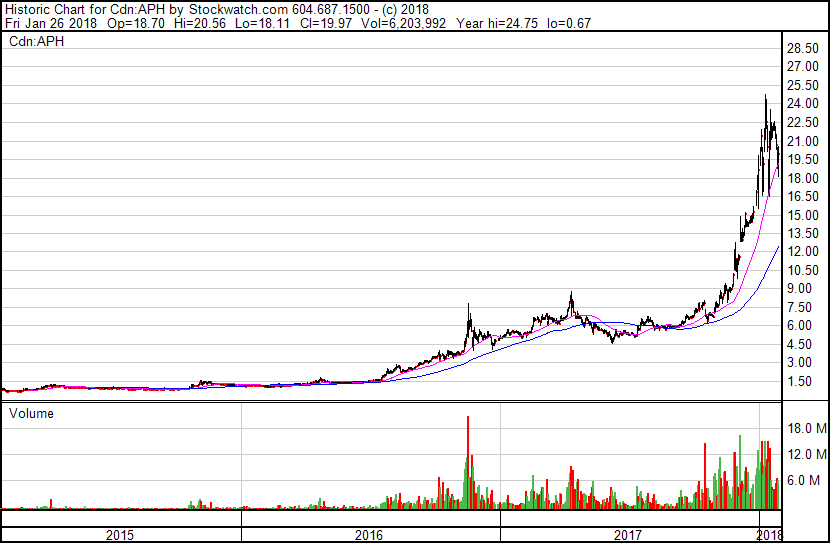

Aphria is the same:

Hell, Tinley shows the same trends.

What you’re seeing here is long term trend lines showing weed has had this run before, and before that, and before that, always around the same time of the year (post summer market slump), and that while crashes don’t follow, you do get a long period of lull while other sectors start motoring after tax loss season.

In fact, the rise of HIVE Blockchain (HIVE.V) and its predecessors ended almost to the day the weed run of late 2017 began.

So take this forward: Is it more likely that sitting on as many weed stocks as possible is going to bring you a fat return in February, or should you be particular about looking for value deals that aren’t in super-dumb market cap territory yet?

We continue to like IMH because it has a long way to run to reach comparable value. DOJA is about where we wanted it to get to, short of news changing the picture. Abcann feels like it has some juice left in the tank.

But careful now.

We continue to hear the brokerage houses are prepping for a run at Artificial Intelligence going forward, which will dovetail into blockchain nicely, and perhaps bring about the entry of VR/AR.

If that happens, the same money that went into weed will likely start to draw back into blockchain. And that’s a place where value can be readily had right now.

PS: We wrote about a private placement financing at The Village Dispensary months back, as maybe the first place to get into the dispensary end of town. We hesitated subsequently, however, when BC appeared to be nearing a liquor board-only distribution model, and when a neighbour to The Village went on a one man letter writing campaign to the Board of Variance, in an attempt to rid the neighbourhood of the Best of Vancouver Top Dispensary award winner.

The BoV has subsequently dismissed that complaint, The Village is back in business, the city is on side, and we just bought into that PP.

Here’s the pitch deck: https://e4njohordzs.exactdn.com/wp-content/uploads/2017/08/Pitch-Deck-The-Village.pdf

Here’s the sub doc: https://e4njohordzs.exactdn.com/wp-content/uploads/2017/08/CDN-Subscription-Agreement-CDN.docx

We don’t get any finders fees on this, and the deal is private, so getting your money back may prove difficult. We leave it here simply for your own information.

— Chris Parry

FULL DISCLOSURE: Abcann, Tinley, DOJA, and Invictus MD Strategies are Equity.Guru clients. The author owns stock and/or warrants in all of the above, and HIVE, and The Village.

NB: Doja Cannabis (“DOJA”) announced a name and symbol change on January 30th, 2018 as a result of its merger with TS Brandco Holdings Inc. (“Tokyo Smoke”). Effective 31 January 2018, the company trades as Hiku Brands under the ticker symbol HIKU.C

You also called it wise to take IMH gains off the table just last week:

https://equitystaged.wpengine.com/2018/01/19/weed-stocks-time-dad-talk/

…and this was a paying client of yours? Only to purchase some stock on your own after publishing that fatherly advice? Cmon Chris, give up the blatant puffing of your chest and you will get more respect. I appreciate your perspective but really have a hard time stomaching your arrogance at times.

Yep. Sure. Any time you’ve run from $1.70 to $2.20 in a week or so, it’s smart to take some off the table. Same thing applies today. Take your stake back, let your profits ride.

i don’t disagree re: philosophy in taking profits, but i also believe you should let your horses ride when there is room to run and this stock has barely got out of the barn – IMO IMH has potentially the most immediate upside in the LP space at this stage (and even more so last week). time in the market here is key, not trying to time the swings.

personally, i am letting it all ride and waiting for the acreage pharms license to drop and phase 1 to complete before i shed any shares. if these guys don’t get acquired and whoever is keeping the price down lets go, this thing should pop, should it not? do you have a sell target in mind?

I’m a ‘double your money, take half your winnings’ kind of guy, regardless of upside potential. Leaving some in to ride isn’t dumb, but I don’t consider missed winnings to be lost money. I’m generally considering the weed market to have reached maturity for the most part, so while I still think there’s value to be had in picking cherries the market might have missed to date, I’m very itchy on the trigger finger. This hasn’t been a poor habit in previous years.

to each their own. i’ve learned lots from you so thanks man for that.

how long as the village PP been open? you wrote about this back in August for 2MM raise, now it is scaled back to 1 MM? i am interested. looks like no warrants on offer?

also, big bold asterisk on this pitch disclaimer:

“In comparing our data to industry data, it’s important to know that the industry data is calculated in USD and our data is calculated in CAD”

As I understand it, the first raise went to opening stores 2 and 3. This one is for 4 and 5. But that’s unconfirmed, take with a grain. Also, the BoC issues took some money off the table while that was open ended.

Hey Chris,

Wondering if you have any thoughts on BLOC, HIVE and XBLK. I know you cover them, they have been sliding lately – even on decent news.

I noticed you mentioned FIRE may have run up too much. Considering it’s ~600m market cap compared to ABCN (now about the same) I would have thought FIRE now has more upside. Curious on your thoughts.

Also, is The Village Dispensary only open to accredited investors?

As always I appreciate your candor.

Thanks,

Clayton

I believe the PP is for accredited investors, yep.

FIRE is a weird one, because it always moves less than the others. Fowler doesn’t market the stock at all, and investors aren’t as into b2b as they should be. On current comps, it likely has room to move but Fowler would need to spend some of his war chest for that to happen.

The blockchainers are off their highs enough to warrant a nibble. HIVE numbers will be coming out soon and the next batch of free trading founder stock that comes off in early Feb almost all belongs to Frank Holmes, who won’t be selling any, so thatll be interesting. If HIVE goes on another run, the others will follow.

Thanks for your thoughts Chris. Looking forward to EG’s continued coverage on Cannabis and Blockchain.

What is ur take on bldv

Blue Domond ventures

You still think ABcann has some gas in the tank after they basically just admitted that their “high tech” “proprietary” “organic” closed box grow facilities aren’t variable and are ditching any further development of them?? https://www.reddit.com/r/weedstocks/comments/7tditt/abcann_abandoning_their_high_tech_advantage/?st=JCXRJAAW&sh=9d0160bb

Of course. The landscape has changed. Low cost of production is now everything, with govt distributors likely to haggle for budget pricing and eventual imports. I like that ABCN is evolving.