Scene in a casino: Two men at a roulette table, beers in hand.

You: I love roulette!

Me: Yeah, me too. How much are you putting down?

You: $10k on red! Spin it!

[red comes up]

Me: Hey, nice going! What are you going to do now?

You: Double down! Let it roll!

[red comes up again]

Me: Wow! You lucked out!

You: It’s not luck. I’m really good at this. Double down again. $40k on red.

Me: Are you sure you wanna…

You: GO! GO! GO!

[red comes up again]

You: Hey everybody, you gotta come play red! It never loses!

Me: It will lose eventually.

You: No way! My advice is everyone here should put everything they own on red. I know what I’m doing.

Me: That’s a really irresponsible thing to advise. If red doesn’t come up..

You: You just don’t understand the table! It has so much potential! Haven’t you noticed how it just keeps coming up? Double down again! $80k on red!

Me: Wait a second, why don’t you take some money off the table and…

You: I’ve studied the charts. I know red inside and out. Red ALWAYS WINS.

[black comes up, dealer takes all chips]

You: Well, that’s clearly manipulation.

The above scenario is the stock market so far in 2018. I’ve never seen so many self-proclaimed experts telling anyone who will listen that they should all buy the stock ‘you’ is in, because it’s gone up so much and that means, obvs it’s going to go up more.

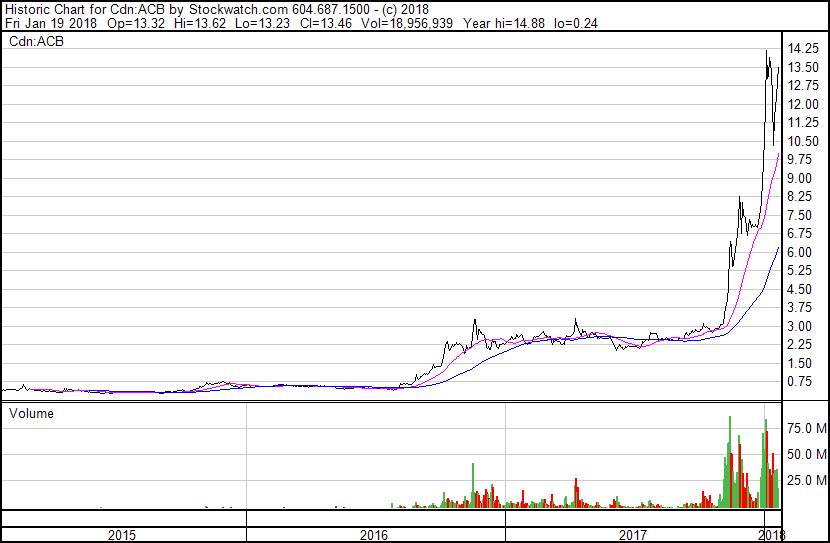

This stock chart encapsulates the weed market right now.

Back in 2015, we had this big weed run because it was new and exciting. In late 2015. it went nuts. Valuations were doubling and tripling. But it was okay because there were catalysts: Who will get the next grow license? Who is getting their inspection? And Aurora Cannabis (ACB.T), like many, more than doubled, running from $0.30 to $0.75. Aaargh, crazy!

In late 2016 the craze went harder. Now there were big players, and they were expanding hard to stay ahead of new licensees. ACB went from the $0.75 they’d been at for a year, and leapt to $2.25. WHOA!

Market caps were now getting out of control but again, it was okay, because there were catalysts. Expansion, recreational weed on the way, California opening up, Colorado opening up, Washington State and Australia and Oregon and Germany…

Then late 2017 happened and, kids, what did you do?

You bought in. You went all in and you got grandpa in and you needed somewhere to put your Bitcoin proceeds and you just didn’t think about the consequences.

Good on you. You bet right. You made money.

You ascended to the ranks of those with more than three digits in their bank account and those who don’t have to worry about making rent and you went to Vegas with that girl and she didn’t put out but it was okay because you got stoned AF and lost a K on the tables and didn’t get married in the Elvis chapel.

What a time to be alive!

But when you got home, the stocks were down and you started to worry. Maybe this is a bubble. Maybe it’s a crash? So you sold some. You took some profits and bought the kids something nice for Christmas and then, when you had too much time at the keyboard, full of turkey and better scotch than you’re used to, instead of resetting you thought to yourself… “This is a buying opportunity.”

At the same time you were thinking that, so were 10k others, fueled by Facebook and Twitter and messageboards and self belief that any time money falls into our laps it’s because WE ARE SMRT, not lucky. And weed stock prices, at a time when most industries were sleeping on the couch waiting for New Years Eve to get past and wishing the get would get out of the way of the TV, started moving.

With every newly wealthed up first year investor sitting at home bored, and with crypto currencies topping out, folks started burying their dough back in weed stocks and they FLEW. Doubled, tripled, stupidled.

Let’s look at that chart again.

Christ on a bike, kids, WHAT DID YOU DO?

This time, it’s not okay. This time it’s not fueled by anything but straight up dough parking and group mentality and blind optimism and maybe a little product. Let’s be clear, the weed companies are doing everything they can right now to reward you for these riches you’ve bestowed on them by growing faster than is sensible and buying anything that’ll take stock as payment and moving from ‘we sell vapes online’ to ‘we just bought a weed grow applicant’ to ‘we’re on a plane to Israel to buy, we don’t know, but it’s something,’ and companies like Aurora that have literally only 55k growing capacity currently (they’re building more, but this is the business they have today) and earn revenue in the single millions and have just been told their online business will be wildly curtailed and they’ll be selling most of their product to the government at, trust me, NOT NEARLY the same price they’re getting from you now…that company is worth 4x what it was worth three months ago, which was already looking a little on the heady side.

Now, Aurora fans, and there are many, will say “but it’s going to be huge!” and “recreational will change everything!” and “they’ll do deals in Germany!” and “they’re buying all these cool companies!” and…

Look man, who are you trying to convince? Me, that I should buy in at some of the most wildly inflated market prices since the dotcom days, or you, that you are making a smart move in not taking your crazy profits and locking in the rest of your ‘better scotch than you’re used to’ lifestyle?

I mean, today, the markets are fine. Prices are stable enough, if volatile on a day to day basis. Companies continue to rise on the fumes of promise, and there’s always a comparable you can find that is far less sensible than the unsensible option you’re invested in.

Take this guy, on a Facebook investor group I watch, in defense of Namaste (N.C), which had a $43m market cap six weeks back, and has a $750m market cap now because people think they’ll be selling bud in their online vape stores soon, and because they invested in an ACMPR applicant that hasn’t yet actually built a building, let alone got a license.

They’re expecting their sales license soon so they can sell bud on their sites.

They already sell a large selection of hardware/devices. Adding bud will make them a one-stop-shop.

Everyone makes a huge deal about them not growing but who cares about growing weed if you can’t sell it? The way I see it, smaller cap growers will begin approaching Namaste because of the increased exposure they can get through Namaste sites.

An online store with a large selection of hardware/devices, bud from *multiple growers, and an already established international presence. How is that not a good thing?

It’s not a good thing because under current law, it’s not legal.

Namaste sells vapes online at a variety of websites, and they’re REALLY good at that. But they can’t sell weed on those sites, not even if they get a weed growing license, which they won’t do for at least six months, if they get one at all. And even if they could sell weed on those sites (again, they can’t), the government doesn’t allow online marketing, which is how they get people to their sites.

But these guys online are investing in them, even at the current market cap, which is 3x the size of Invictus MD Strategies (IMH.V), which has taken a chunk out of TWO ACMPR licensees, and has money in the bank for more. Supreme Cannabis (FIRE.V)., which has 360k sq. ft greenhouse built out and grows madly and has a vault full of product and cheap ass power, they’re cheaper than Namaste.

Namaste’s investment in Cannmart, the aforementioned license applicant, amounts to them currently owning a stake in a pile of paperwork that’s been submitted to Health Canada, and a large hole in the ground on which a building will one day spring forth. And vape websites that earn $2m a month.

That’s $750m?

And even if that cap was justified; let’s be generous and say it is, that vapes are all going to be sold at Namaste and not 7/11 and Loblaws, and that Namaste will be selling weed on Amazon some time soon and every grower will want them to handle their sales (Sweet Jesus, that’s a long bow to draw) and so $750m in value is TOTALLY JUSTIFIED.

Even if you go with that, it’s only a good investment, in a hot market, if it’s going to go up further from there, and soon.

Let’s be clear: I’m not saying Namaste is crap. It’s a nice little earner, and good for them for saying words that made guys on the internet believe in fairies. But at some point the grown ups need to loudly announce, “I’M GOING TO TURN THIS CAR AROUND IF YOU DON’T SMARTEN UP.”

You’ve made your money. You put a few thousand in and it became twenty thousand or fifty thousand. Take that money back now and record your win.

Look, I really like the guys at DOJA Cannabis (DOJA.V). I think they’re smart and well funded and learn from mistakes and get up in the morning driven to succeed. They’re young and well positioned and they just did the Tokyo Smoke deal which the market adores, and we’ve been talking about them for a year and I SOLD A BUNCH OF MY DOJA STOCK.

You know why? Because I bought it at $0.60 and, a week ago, the company was suddenly at $3.45. So I sold half of what I owned.

It’s at $4.58 today, on an absolute tear, and looks set to go higher – and I’m fine with that, because I still hold half my original stake, I got all of my original stake back and 3x more on top, and I’m still making money. If DOJA went to zero tomorrow, I’m fine. If it keeps going up, I’m fine.

That’s how you invest in a rising market that may just be top heavy.

This thinking applies to every sector. In blockchain, the guys investing right now are totally chasing the market and investing in promise and at least 2/3 couldn’t explain blockchain to you in 30 seconds or less. But it’s made them richer.

Same with crypto. Nobody believes Bitcoin will ever replace the dollar. Maybe something else will, but not clunky old BTC. But you can’t move for guys online who are telling strangers “You totally have to make sure you’re in Bitcoin, it’ll be worth $500k by September..”

In mining, the old timey investors (who think I swear too much and that the font on the site is too small) understand this basic investment concept because they’ve been through it a few times, to the point where the mature mining investor space has moved beyond it.

What usually happens instead of the blind “AAARGH, We’RE GOING TO THE MOON!” rubbish is, a mining exploration deal has several sets of investors who’ll move through it as it grows, and they each understand their place in the ecosystem, when to get in, and WHEN TO GET OUT.

The first kind of investor gets in when the company is raising a few hundred K to tape off a cow paddock in Manitoba and file a claim for cobalt or lithium or coal or vanadium or amyl nitrate of whatever the hell folks are into that second. They’ll take the ride from $0.03 to $0.06 when the company does its first round of promo and when the drills start going in, they’re out. They take their money, the stock drops back to $0.04, and the next guy shows up.

This guy is all about the drill results. When a company says “we’re going in behind the lake and sticking a hole in the ground,” he’s in. And when the results are good, he’ll ride that thing to $0.12, maybe $0.15.

But he doesn’t stick around for the next results because HE’S MADE HIS MONEY AND MAYBE THE NEXT HOLE IS DRY.

If the next hole is terrific, he doesn’t care because he’s gone 3x or 5x on his money. He’s on to the next deal. This is why mining explorers sometimes see a stock drop between result news #1 and result news #2, even if the news is good. It’s a transition. Nobody cares if you’re really sure you can keep up the good work, they have their money and now you’re just waiting for the next guys. Maybe they’ll leave some money in for a bit, just for shits and giggles, but mostly they’re on to the next silver or tungsten or hydrogen dicarbonate explorer that’s pretty sure they’re about to start drilling as soon as they’ve unpacked their Ikea furniture.

Now, assuming that mining deal hits enough continuous great drill results that the company starts moving toward production, now you’re into a new investor who wants less risk and will wait longer for his return. That guys knows the now $0.50 stock may fall away to $0.35 in the next year, because getting permits from the government and talking to First Nations bands and renting portapottys isn’t the sexiest part of mining, but they’ll keep buying on the way down because now it’s not an if, it’s a when.

In contrast, the weed market has two kinds of investors: The guys who love and protect their money, and the guys who love and protect their stock.

I talked to a friend a few days ago who got in on Invictus when we said a few weeks back that it was really nicely positioned. Then, a few days later, one of their subsidiaries got its weed license.

He was pretty happy and really likes the company. I asked him what his selling point is and he laughed.

“I sold on the news. Free money.”

See, y’all new investors are out here treating your stock picks like you treat your favourite football team. You go on the messageboards and you try to convince people your picks are the best and you’re the smartest and the gravy train is NEVER GOING TO END, but you know the only certainty in the markets?

It always ends, guys. Maybe it won’t be a crash. Maybe it won’t be a bursting bubble. Maybe it won’t even be a drop. Let’s look at that Aurora chart again.

Look at those first two jumps, in late 2015 and late 2016. You could go further back to late 2014 if you wanted and see the same thing. Notice anything about them?

Nope, not that they all came late in the year (although that’s worth remembering in September). Try again.

Yep. They were all followed by a year long dormant state where the stocks just lolled around on a more or less horizontal line for months.

You know what was flying while weed was dormant and everyone’s money was tied up in 2016? Lithium.

You know what was flying in early 2017? Cobalt.

Late 2017? Crypto and blockchain.

The guys that stuck in on weed through those months, because they were really sure the doubling and tripling would never end, missed the doubling and tripling that was happening in other places.

Now, I can already hear the true believers saying, “Hey, if my weed stock starts to drop, I’ll just sell. It’s not like it’s going to drop to zero.”

That would make sense if we were talking about companies that had built assets and investor bases over years. On penny stocks though? They go up a lot less on good news than they come down on bad. That’s because a lot of penny stock buying (or smallcap buying if you want to be lah-de-da) is not about the company at all. It’s about the action.

Early last year, when I was publicly kicking Lifestyle Delivery Systems (LDS.C) for being a shit company (they’ve sorted themselves out since, and are now a client and thriving), I bought stock in the thing.

It wasn’t that I liked the stock. I didn’t. I even suggested there was pumping going on.

It wasn’t that I didn’t have other places to invest. I have nothing but.

It’s because it was running too hard to not take a piece of. And I did well out of it before trading out a few days later.

Half the weed market right now is doing the same thing, only it’s NOT TRADING OUT when the money has been made. Instead, it’s convincing itself that there’s more to come and, even if it drops hard, that’s just a buying opportunity.

I started this website to help you guys (and me, natch) make a lot of money. And I’m really glad that it’s done that. Your stories about how you turned your lives around from info you found here, that’s soul replenishing. It’s nectar of the gods. May you all experience the feeling of knowing you’ve helped even one person improve their life in that way.

But if you don’t take some money out of the game after that fourth double up, it’s all for nothing.

Honestly, buy some land. Buy a small business. Take the wife (or husband, I see you ladies) on a trip for hot sexy times. Get yourself in a position where, if/when it all falls down, you’re safe and prosperous (and can capitalize on the lows).

I see people on Facebook talking about maxing their credit cards for stock purchases, “But it’s okay because I’m up 41%,” and it makes me a bit ill.

Look, I could sit here and cheerlead this stuff and make money doing it. Everyone wants to be told the fun will never end. None of my client companies want to see me saying, “Sell half your stake,” but that’s what we’ve been doing because IT’S THE RIGHT THING TO DO.

I’m begging you, Sparky. Sell half of what you hold, take a little out of the market, secure your future, and reinvest the rest in things you believe will double not in a month, but in a year. Real companies that do more than just grow in stock price. Look at other sectors – blockchain is getting real, now that prices have retraced, and mining is starting to rev its engines in ways that haven’t happened since the lithium crank.

I’m going to be at the Vancouver Resource Investment Conference put on by Cambridge House this weekend, where I’ll be giving a keynote at 1pm Sunday called, “Weed, Blockchain, Mining, or…?” which will probably feel a lot like this article.

It may end up with a catchier title since 2017’s “Five people in this room will be dead by this time next year so we better start replacing you” wasn’t near the room emptier I thought it might be.

I’m also doing a panel on lithium at 2:20 on Sunday with Pure Energy (PE.V), MGX Minerals (MXG.V), and RockTech Lithium (RCK.V). We don’t have a booth this time out because we just don’t have room for new clients right now.

But I’d love to catch up with some readers and chat. Find registration details at https://cambridgehouse.com/e/vancouver-resource-investment-conference-2018-69

— Chris Parry

FULL DISCLOSURE: Still own some DOJA, who are also a client. Invictus is also a client and though Supreme is not, I own a little. That may change in the coming days, as I’ve made a good return on it – the fifth time I’ve dipped in and out with a profit in the last two years.

please fill us in on the small , revenue generating business you bought with your market money, Mr. Parry

RHT.V

Thanks for another solid article! I check your page daily and I always appreciate the content. Any way we can stream your keynote after the fact?

Thanks

I’ll likely to a livestream of it in the weeks ahead. Thanks for reading!

Love this article!! I have a friend who made $250K on HIP and think’s he is a guru now….

My question though, are you long and strong on IMH? I love this company and just can’t wrap my head around its current valuation. You state that they are a client of yours but you don’t say you are currently holding any shares?

Thank you so much for this website! I have been following you for awhile. This is my first post!

After writing the article I went and picked some up. Spoke to their IR yesterday and they’re very content with the way things are shaping up. No plans to sell, maybe time to add.

Chris, some good points, but most could of been made in a few sentences. You seem like a nice person but trust me, every trader must learn by his/her mistakes.

Exactly thank you sir

This article I had to actually print off to hang on the wall.

Betting on red vs black has two outcomes. You hit the right colour and you double your money or you hit the other colour (or double zero/green) and you lose ALL your money.

Weed stocks, even though inflated right now, are not a game of roulette. I am a long time reader and really like reading your articles. This one however is filled with too much fear mongering. I have heard people tell me to take money off the table when Canopy was $3, then $6, then $12, then $24 then $40. Weak hands don’t deserve big gains!

Keep up the great articles.

Now, I am thinking to invest in stocks! Cannabis stocks really make money! I appreciate you sharing this article!

Great article resource to read!

I really appreciate those people who keep on sharing these kinds of the article this could really help many people just like me who loves exploring many kind of things that are related to cannabis.