Gold has been a good teacher.

Between 2011 and 2013 we lost a fortune on a portfolio tilted recklessly toward precious metals.

As the price of gold fell from $1,800 to $1,200, The Junior Gold Miners ETF (GDXJ.NYSE) plummeted 80% from $166 to $30.

As the US dollar gained strength over the last 5 years, the Canadian gold price went up.

So the carnage in bullion hasn’t been as violent for Canadian investors. In fact, gold in CAD is only $240/ounce (12%) off its all-time high.

Over the last five years, gold has rallied a number of times, only to sag back down in exhaustion.

2017 wasn’t a great year for gold.

But it wasn’t that bad either, it rose 14%, up $160 USD.

But let’s face it, other asset classes performed better.

The question is not: why is gold so shitty?

The question is: why isn’t gold more shitty?

The U.S. stock markets have reached new highs and the Federal Reserve is jacking up interest rates as the US economy “improves”.

We put “improves” in quotes, because our ears are still ringing from the thunderous clatter of money-printing presses grinding 24 hours a day.

The Federal Reserve, the United States central bank, has printed more than $2 trillion since the global economic crisis began in 2008. This has more than tripled the size of its balance sheet.

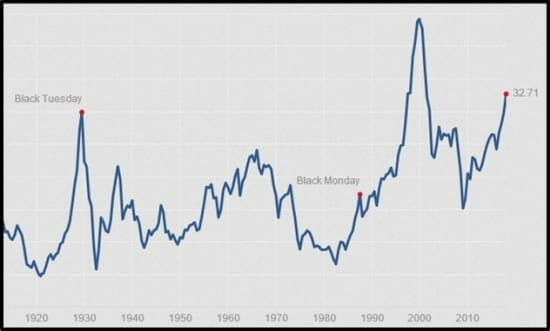

The Price-to-Earnings ratio of the S&P 500 is double historical levels – and headed exactly where it always goes before a stock market crash.

When that bubble pops, there will be a stampede to gold.

So in 2018, we’re going to talk a lot about gold.

Here are a few of the gold companies we are focused on:

- Ashanti Gold (AGZ.V) is a West African-focused gold development company with a veteran management team.

The CEO of Ashanti is Tim McCutcheon is a former investment banker with a track record of finding inefficiencies in financial systems – and exploiting them for profit.

Western Africa has overtaken Southern Africa as the continent’s gold-mining epi-centre. New gold projects are coming on stream in Burkina Faso, Ghana, Mali and Sierra Leone.

“We asked ourselves a basic question:‘what do we know that others don’t know?’”, stated McCutcheon. “We put a team together that had a competitive advantage. Because we had been Kinross’s JV exploration partner in Ghana, we had a huge database from that experience. We identified an opportunity to cherry pick the best assets out of the Kinross portfolio”.

Ashanti’s Anumso Gold project in Ghana is close to Newmont’s (NEM.NYSE) Akyem Mine which began production in 2013. For the last five years, the average annual gold production from Akyem is 400,000 ounces with an all-in sustaining cost of about $800 per ounce.

Ashanti’s 29 sq km mining lease covers 5 km of strike length in the Ashanti Gold Belt.

In Mali, a 53-hole, 6,000 meter RC drill program for the Kossanto East project has been completed.

Since 1998, about 40 million ounces of gold has been discovered in this area resulting in the construction of dozens of mines.

2. Cabral Gold (CBR.V) is a brand new junior explorer that is in the process of updating its Resource Estimate for Cuiú Cuiú project, Brazil.

The updated resource will incorporate an additional 22,068 meters (72 holes) of 2011 diamond drilling that took place after the issuance of the 2011 technical report.

On December 19, 2017 CBR announced that it is begun to review of all of the historic data from the Cuiú Cuiú project. This work is expected to be completed by late January 2018.

Cabral’s neighbor is Eldorado Gold (ELD.NYSE), a $1.2 billion global gold developer with revenues of $84 million last quarter.

Eldorado controls the Tocantinzinho gold deposit which currently has Proven and Probable reserves of 39.6 million tonnes @ 1.43g/t gold for 1.82 million ounces. The company received its construction license in April 2017.

Cabral is also benefitting from Eldorado’s mine-supporting infrastructure. ELD has constructed a new 70km road to the Tocantinzinho project. The Cuiú Cuiú project is accessible through a spur road. There are also 5 new dams planned on local rivers, projected to generate a total of 10,682Mw.

Previous exploration work revealed a gold-in-soil anomaly 18 kilometer in length, much of which has still to be tested.

-

Metalla Royalty & Streaming (MTA.C) recently acquired a portfolio of three (3) royalties and one (1) stream from Coeur Mining (CDE.NYSE).

Coeur Mining has a market cap of $1.7 billion. It operates five precious metals mines in the Americas (Mexico, Nevada, Alaska, South Dakota and Bolivia). The company also has a non-operating interest in the Endeavor mine in Australia.

Coeur Mining took control of about 20% of Metalla’s stock through a Convertible Debenture. Coeur will be paid interest on the $13 million investment, while the investment converts into common shares of Metalla during future equity financings.

Acquisition bullet list:

- 100% Endeavor Silver Stream –Endeavor is expected to deliver just under 1 million ounces of silver to Metalla according to the updated mine plan from CBH through June 2019.

- 1.5% NSR on the Zaruma Gold Mine – Between 2012 and 2014 the Zaruma mine produced 72,430 ounces Au and 152,292 ounces Ag. The Zaruma gold mine has an estimated Measured and Indicated resource of 1.094 million ounces Gold (Au) with an average grade of 12-13 gpt.

- 2% NSR on the Hoyle Pond Extension –The deposit is trending toward the extension property at depth. Goldcorp, the operator, completed the Hoyle Pond Deep Project at a cost of $194 million to access and develop lower levels with the #2 winze being only 600 meters west of the property boundary.

- 1.5% NSR on the Timmins West Extension – Metalla has a 1.5% Royalty on the Wallingford claim which lies on the extension of the Timmins deposit. The Timmins deposit plunges towards the NW onto Metalla’s claims and is expected to cross the boundary at depth.

- 15% Silver Stream on the NLGM – The New Luika Gold Mine produced a record 87,713 ounces Au and 126,572 ounces Ag in 2016. The company also reported AISC of US$661/oz Au in its Q4 2016 production and operational update.

- 2% NSR on the Joaquin Project –Pan American recently purchased the Joaquin project from Coeur for US$25 million. The Joaquin project is estimated to contain a M&I resource of 65.2 million ounces Silver (Ag) and 61,000 ounces Gold (Au). An update is expected from Pan American in Q4 2017 on a production timeline.

Last week, Pan American finalized a preliminary feasibility study on the La Morocha deposit, which is part of Joaquin, located in Santa Cruz, Argentina. The study recommends the development of the La Morocha deposit as an underground mine.

Based on the Pan American Disclosure, Metalla estimates that future production and cash flow from the Joaquin project will be about 3.9 million for 2019, 2020 and 2021 inclusive.

- Nexus Gold (NXS.V) has 3 gold projects in Burkina Faso:

- The 178-sq km Niangouela gold concession where the company has delineated a 1km quartz vein and shear strike. Eight of the first nine diamond drill holes on the property returned positive gold results, highlighted by a 4.85m intercept of 26.69 g/t.

- The 38.8-sq km Bouboulou gold concession with historical drill results including 40m of 1.54 g/t. The property contains three distinct gold trends, each extending 5000 metres (5km) in length.

- The 250-sq km Rakounga gold concession contiguous to Bouboulou property, contains many artisanal mines.

Burkina Faso is the fastest growing gold producer in Africa. Eight new mines have been commissioned there over the past six years. The country has a mining corporate tax rate of 20%, and a sliding royalty on gold production from 3-5%.

Some big gold companies operating profitably in Burkina Faso like Endeavour Mining (EDV.T) – a $2.7 billion gold miner – building the Houndé project with a projected annual production of 190,000 ounces at a cost of about $700 an ounce.

NXS spring 2017 drill program hit gold on eight of nine holes, with four of those being classed as ‘significant’. The best intercept was 4.85 metres of 26.69 grams per tonne. That’s almost an ounce per tonne across an almost 15-foot section at a depth of about 165 feet.

On December 13, 2017 Nexus announced assay results from the Rakounga gold exploration drill program.

According to the Nexus Geos, “Drill results now outline a trend of gold occurrences extending for 16 kilometres between the Company’s Rakounga and Bouboulou concessions.”

Burkina Faso, the little African country that no-one talks about, is getting hot.

- Prize Mining (PRZ.V) has a gold and copper project located near Nelson. BC.

Prize picked up the Kena Project in April 2017 and then raised about $6 million to explore it.

Using a base-case cut-off grade of 0.3 grams per tonne gold, the current Kena Project resource estimate is:

- Indicated mineral resources of 24.89 million tonnes at 0.6 grams per tonne gold for 481,000 ounces gold

- Inferred mineral resources of 85.79 million tonnes at 0.48 grams per tonne gold for 1,318,000 ounces gold.

The resource estimation used gold intercepts from 176 drill holes.

But the Kena Project is not a one-trick pony. The Prize geologists believe there is a copper porphyry target on the property. This copper target is currently untested by exploration.

President and CEO of Prize Mining is Feisal Somji, the founding president of Rio Alto Mining. Somji oversaw the construction of a mine in Peru which achieved annual production of 150,000 oz. gold. Rio Alto was sold in 2015 for $1.3 Billion.

Historical producing mines on the Daylight Property have historical grades as set out below.

- Great Eastern mine area with grades of 37.53 g/t gold and 52.2 g/t silver (B.C. Minfile 082FSW172).

- Starlight mine area with grades of 28 g/t gold and 140 g/t silver (B.C. Minfile 082FSW174).

- The Daylight mine area with grades of 27 g/t gold and 15 g/t silver (B.C. Minfile 082FSW175).

- Victoria mine area with grades reported of 28.9 g/t silver and 2.56 per cent copper (B.C. Minfile 082FSW173).

We wish to stress to our readers that the “historical grades” means that the data does not meet modern geological standards.

Last summer PRZ acquired the 1,010-hectare Toughnut Property which lies contiguous on the west side of Prize’s Daylight Property. The Toughnut also has high grade historical grab samples.

“Collectively, the 1,550-hectare Daylight and the 1,010-hectare Toughnut Properties strategically cover a five-kilometre strike length of the central and eastern segments of the one kilometre wide Silver King shear system.” stated Somji. “With the Kena Property, Prize has consolidated the ownership of the district for the first time and will be completing a district wide exploration effort for years to come.”

“As global complacency over the trajectory of U.S. rates continues to be astoundingly low, precious metals in general should continue to benefit,” Jeffrey Halley, senior market analyst at Oanda Corporation in Singapore, said in a recent note.

On January 2, 2017, bullion gained for an 8th consecutive session – it’s the longest stretch of daily wins for 6 years.

Like a charismatic wayward child, gold may disappoint, it may teach us bitter lessons, but we can’t stop believing in it.

Full Disclosure: Ashanti, Cabral, Metalla, Nexus and Prize are Equity Guru marketing clients, we also own stock.

curious as to why there has been no specific articles on ashanti gold to date?

There has, but we took them down as the BCSC wanted them updated on a compliance issue. Ashanti’s QP has been too busy with on the ground work to line edit our piece looking for whatever word was missing, which we understand.

Thanks Chris, btw great job with the website. I jumped on early this year and you and your team have done a great job. As someone who got in on qmc early purely because your article put them on the map for me I am in your debt my friend and will be recommending many others to the site.

Cheers

Appreciated! Congrats on the QMC run. It’s been quite the journey.

Any news on nexus gold?

Koldest, I’ll consider that an official nudge. We’ll get on it. Expect an update on Nexus soon.

Thanks

Nexus rolled back 10-1, I’ve a good chat with the CEO, I’ll publish and update on Monday.