At a dinner party this week in a suburb of Los Angeles (Altadena), the following conversation took place:

Q: It is a good time to invest in weed?

A: Yes.

Q: What should I buy?

A: Depends if you like production or auxiliary products.

Q: I just want to invest in weed – can you recommend a stock?

The mutual fund industry provides a service to sector-investors who don’t have the confidence to pick individual stocks. The service is popular. There are about 9,100 mutual funds globally, with $8.4 trillion under management.

It should be no surprise that fund-like products are now being marketed to newbie weed investors – like the dinner guest in Altadena.

On November 27, 2017 Kelowna based Cannabis Growth Opportunity Corporation (CGOC), filed for an IPO of up to 30 million units at a price of $2.50 per unit, for gross proceeds of up to $75 million.

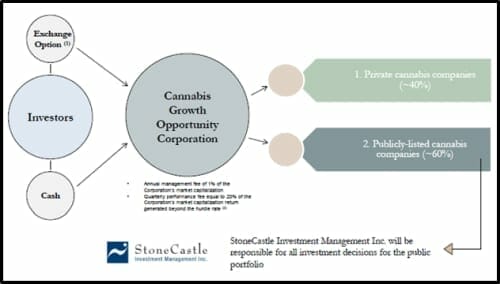

“Kelowna, BC-based CGOC Management Corp. will act as the manager and promoter and will provide all management services. Toronto based StoneCastle Investment Management Inc. will act as the investment manager with respect to the public portfolio.”

CGOC does not currently have a website. But marketing documents registered on Sedar give some insight into the investing philosophy of the new weed fund.

“The corporation believes most public opportunities aren’t being vetted with enough precision and thoroughness, leaving significant upside potential for those who use the right methodology,” the company stated, “In addition, the Corporation holds the flexibility to invest in private businesses, which can provide significant private-to-public premiums.”

CGOC’s Chief Investment Officer is Bruce Campbell who is also a senior portfolio manager at Stonecastle.

According to the StoneCastle website, “Employees and employee’s spouses are encouraged to invest alongside our clients in the funds. We eat our own cooking.”

Website images suggest that a typical Stonecastle investor is a harmonious, multi-generational family dressed in white.

This family will soon be loading up on weed stocks.

The following issuers would initially form part of the public portfolio: Aphria Inc. (TSX: APH), Canopy Growth Corporation (TSX: WEED), MedReleaf Corp. (TSX: LEAF), CannTrust Holdings Inc. (CSE: TRST), Cannimed Therapeutics Inc. (TSX: CMED), Cronos Group Inc. (TSX: MJN), The Hydropothecary Corporation (TSX-V: THCX), Organigram Holdings Inc. (TSX-V: OGI), Friday Night Inc. (CSE: TGIF), Supreme Pharmaceuticals Inc. (TSX-V: FIRE), DOJA Cannabis Company Limited (CSE: DOJA), Emerald Health Therapeutics, Inc. (TSX-V: EMC), Harvest One Cannabis Inc. (TSX-V: HVST), Maricann Group Inc. (CSE: MARI), and Village Farms International Inc.

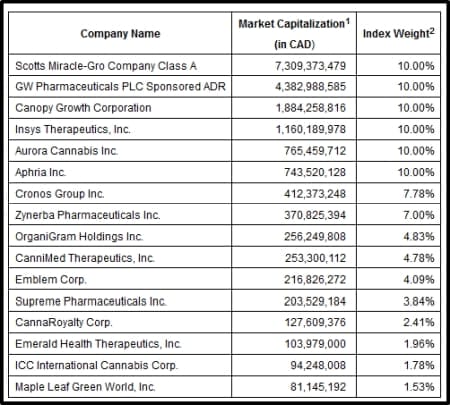

CGOC is not the first weed instrument to outsource stock-picking. On April 5, 2017, the Horizons Medical Marijuana Life Sciences ETF (HMMJ.V) began trading on the TSX.

HMMJ is a passively managed ETF, which seeks to replicate the performance of Solactive’s North American Medical Marijuana Index, providing exposure to the performance of a basket of North American publicly listed life sciences companies with business activities in the marijuana industry.

HMMJ debuted at $10.84, fell to $8.38 in July 2017, and is now trading at $14.17. With a current market cap of $197 million, the ETF is up about 50% in eight months.

These fund-like instruments do serve a useful purpose allowing investors to get their feet wet in a sector they may not yet fully understand.

At Equity Guru, we have a more targeted approach. Rather than participate in the IPO of the Kelowna-based Cannabis Growth Opportunity Corporation – we sauntered down the road and loaded up on Kelowna-based DOJA Cannabis (DOJA.C).

We wrote about DOJA on August 9, 2017, the day of its IPO. The stock price is up 100% since then.

On November 29, 2017, DOJA published a Q3, 2017 update:

- Secured a License to Cultivate Medical Cannabis under the ACMPR

- Completed a public listing on the CSE

- Began cultivation of DOJA’s first four cannabis strains

- Harvested and cured the Company’s first batches of premium handcrafted cannabis

- Opened the first DOJA Culture Café

- Purchased a 22,580 square foot building, bringing total potential production capacity to 5,000 kg/yr;

- Requested a Pre-Sales Inspection from Health Canada

- Commenced construction of the FUTURE LAB’s 2,000 square foot state-of-the-art extraction facility and lab.

Not bad for a few months work.

But here’s why we’re really like DOJA. We believe that selling marijuana into a frontier market – will require branding expertise. And this company has branding credentials up the ying-yang.

We also notice that the CGOC fund has DOJA in its initial pick list.

We’ll soon be co-investing with these beautiful ignorant white people.

Full Disclosure: DOJA is an Equity Guru marketing client. We also own stock.

NB: Doja Cannabis (“DOJA”) announced a name and symbol change on January 30th, 2018 as a result of its merger with TS Brandco Holdings Inc. (“Tokyo Smoke”). Effective 31 January 2018, the company trades as Hiku Brands under the ticker symbol HIKU.C

Mr Kane also looks and sounds like an ” ignorant white guy”! Imagine he has the skill to pick a weed stock which has grown 100% in the past 6 months…. brilliant! My 3 year old daughter could have picked 6 weed stocks that have met or exceeded that return in hindsight.

Dear Alan, thank you for reading. Congratulations on your daughter, this is best time of life! I agree with your opinions. You have correctly diagnosed me.

I don’t think Alan looks at timestamps. The 100% pick was from back in December. It since climbed 4x. Nice job, ‘Ignorant White Kane.’