Waaaaaay back in July, 2017 when Harvey Weinstein was just another lovable philanthropic movie mogul – we pointed out that there is an opportunity brewing in the weed space for beverage companies:

According to Transparency Market Research, the $1.6 trillion global non-alcoholic beverage market will reach $1.9 trillion by 2020 – expanding about 4% a year over that time.

In 2016, The North American marijuana market reached $6.7 billion – up 30% from 2015, according to ArcView Market Research.

It doesn’t take a genius to predict that these two mega-trends are going to make kissy face.

The collision of the two industries happened faster than we anticipated.

In an October 31, 2017 article, we reported the first mega deal.

Constellation Brands (STZ.B:NYSE), which has so many alcohol brands the major ones are stretched out over seven pages on their website, but you’d know them best as the guys behind Corona beer, agreed to buy 9.9% of Canopy Growth Corporation (WEED.T) for CAN$245 million. The market celebrated by joining in on the buying, driving WEED.T stock up 17.1% as I write this, to $14.98, and a market cap of $2.56 billion.

When deals like this happen, there is often a ripple effect.

It isn’t always good.

One technology company we helped build, woke up one morning to discover that Google (GOOG.NASDAQ) had purchased a competitor, and would now be providing the exact same service for free.

In the case of the Constellation/Canopy deal, there has been a spin-off effect for a number of companies in the weed, value-add space.

For instance, Nutritional High (EAT.CSE) experienced a nice little bump. It’s up about 35% in the last 11 days (rising from .13 to .20) although EAT is known mostly for chocolates and vape oils.

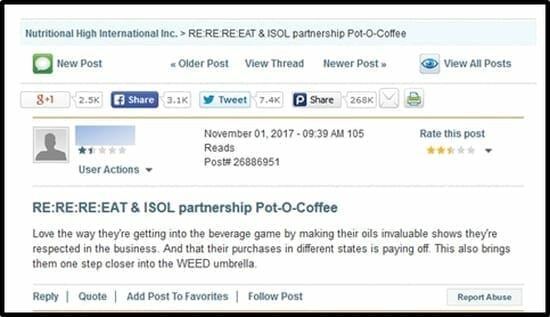

That didn’t stop the EAT share-holders getting on message boards and expressing their excitement about the opportunities in cross-pollinating the beverage industry with weed ancillary products.

Why paddle when you can just push your canoe into the water and float downstream?

Sure enough, on November 8, 2017 EAT announced that it will be entering the beverage market via a partnership with Xanthic Biopharma to manufacture and distribute “cannabis-infused powdered drinks”, fruit drinks and “sport drinks” [emphasis ours].

Sport drinks? Nothing like getting wasted at half time during your Sunday soccer pick-up game.

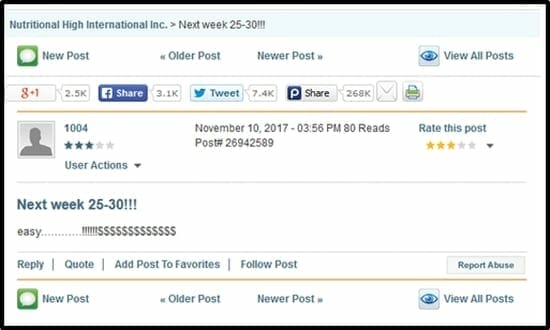

This partnership generated a new flurry of thoughtful analytical comment on the message-boards:

The route from chocolates to beverages may be navigable – but we can think of a couple of shorter pathways.

1 Tinley Beverage (TNY.C), is an established marijuana drink company with a THC-infused core product line is known as, “The Tinley Collection.”

The Dark Rum features Caribbean spices with dark rum extracts and 80mg THC (8 x 1.5oz. servings). Recommended on the rocks or with soda, orange juice, black tea.

The Cinnamon Whisky is a blend of cinnamon, whisky extracts and 80mg THC (8 x 1.5oz. servings). Drink straight up or mix with cider, tea or milk.

Tinley’s other product, Hemplify, is a non-THC health drink containing hemp stalk, terpenes, essential oils, and other non-psychoactive constituents. The product is sugar free, vegan, non-GMO, gluten-free and is jammed with Vitamins C, D and B12), Omegas and electrolytes.

On October 25, 2017 Tinley released an operational update, announcing that Hemplify, “is currently being setup for shelf placement at a 14-store premium grocer, representing the Company’s largest customer to date.”

The chain offers a line of CBD products in locations in Los Angeles and throughout Southern California,” stated the press release, “The Company has also placed Hemplify in a 4-location natural grocery store and café chain, as well as in numerous independent grocers and convenience stores throughout Los Angeles and Orange Counties.”

Tinley’s has made strong inroads into the retail market since we first starting talking about them and the stock price has doubled in the last six weeks.

As Equity Guru’s Chris Parry wrote last week:

“Tinley’s consumers can enjoy an experience that more closely resembles the social and psychoactive effects of alcoholic beverages. This more directly supports the consumer value proposition of the Tinley ’27 alcohol-inspired product line. The technology has been incorporated into Tinley’s latest formulations, and the company remains confident that it will go into production in the coming weeks.”

Creating a commercially viable marijuana drink isn’t just stirring weed-oil into a smoothie.

In the race to market, Tinley has a significant head-start.

2. DOJA (DOJA.C) is another weed company well positioned to create future revenues in the beverage market.

On the surface, DOJA is a just new Canadian leaf grower with big ambitions.

On November 2, 2017 the company announced that is has completed its first harvest and “requested a Pre-Sales License Inspection from Health Canada. The Pre-Sales License Inspection is the last step prior to the issuance of a Sales License under the ACMPR. Once licensed, DOJA can begin selling cannabis and position itself as a premium handcrafted producer in advance of the impending recreational market.”

“Our growers focus on bringing out the fullest expression of the plant’s genetic potential and the love and hard work they have put into their craft really shows in our first four strains,” stated Trent Kitsch, CEO of DOJA. “Post-harvest, our flowers were expertly hand-trimmed, hang-dried and artisanally cured. Our handcrafted approach is aimed at producing the finest cannabis with exceptional aroma, flavor and effects.”

But there are two other things going on with DOJA, worth noting.

Firstly, the company has strong branding DNA which will be necessary to create a beverage that will get onto the shelves, and then later – be removed from the shelves – by customers.

The CEO of DOJA, Trent Kitsch is an established branding wizard.

When we say that Kitsch is good at branding, it’s not because he says he is – it’s because he’s already disrupted an industry that was dominated by mega-cap companies like Under Armour (UA.NYSE) and Nike (NKE.NYSE).

We are talking about men’s underwear. This is not small potatoes. The underwear market is worth a couple of billion dollars.

Cracking the underwear market is like trying to put a new soft-drink on the supermarket shelves. Basically impossible. But Kitsch did it.

This is how you brand a weed company.

The second reason is that the Kitsch family operates a wildly successful winery in Kelowna, BC.

“The Kitsch family’s Okanagan roots stretch back to 1910, when Kelowna was still a small, lakefront pioneer settlement. Four generations later, this entrepreneurial family takes great pride in helping to shape the past and the future of the Okanagan Valley.

With a little help from some friends, the young family transformed overgrown fields into lush vineyards, set on historic apple orchards that originally served as the Kelowna Land and Orchards (KLO) headquarters.”

The booze business, like the weed business, is destined to exist in a matrix of local and federal regulations.

When two worlds collide, it’s instructive to recognise which players are already straddling both realms.

Full Disclosure: Tinley and DOJA are Equity Guru marketing clients and we own stock.

NB: Doja Cannabis (“DOJA”) announced a name and symbol change on January 30th, 2018 as a result of its merger with TS Brandco Holdings Inc. (“Tokyo Smoke”). Effective 31 January 2018, the company trades as Hiku Brands under the ticker symbol HIKU.C

did doja say they were getting into beverages?

DOJA is run by the Kitsch family, which has a Kelowna-based vineyard and wine brands, and existing relationships with liquor distribution channels. The moment alcohol/weed is okayed, they’ll be into that like a bolt from the blue. The fact that they’ve established a Kelowna ‘lounge’ to promote their brand is also important, as it’s a short change to make that a ‘tasting room’…