It’s been more than 30 years since the iconic movie Trading Places, staring Dan Ackroyd, Eddie Murphy and Jamie Lee Curtis, hit the big screen.

In case you haven’t seen it 100 times (like we have), here’s what you missed (*Spoiler Alert*)

Louis Winthorpe III is the gun trader for the Duke Brothers (Randolph and Mortimer), who run a commodities brokerage firm in Philadelphia. Meanwhile, hustler and two-bit con man Billy Ray Valentine is scraping out an existence on the streets.

To settle the age-old Nature vs Nurture argument, the Dukes engage in an elaborate one dollar bet whereby they arrange to have Winthorpe arrested and all the trimmings stripped from his life while employing Valentine at the firm to see if he can swing with the big dicks.

Winthorpe resorts to crime and shacks up with a hooker (Jamie Lee) while Valentine makes a fortune for the firm trading pork bellies.

Randolph wins the bet, exclaiming “We took a perfectly useless psychopath like Valentine and turned him into a successful executive. And during the same time, we turned an honest, hard-working man into a violently, deranged, would-be killer!”

At the firms annual Christmas party Winthorpe and Valentine’s paths cross and, having learned how their lives were inverted, decide to join forces to take their revenge on the Dukes.

Cue a fake crop report, a Gorilla and a sting whereby the Dukes are caught on the wrong side of a trade in Frozen Concentrated Orange Juice. Realizing they have both been bankrupted, one of the brothers is heard to utter the famous phrase “Turn the machines back on!”

Winthorpe and Valentine are last seen somewhere in the Caribbean with hot women and cold champagne.

Roll credits.

Trading geeks, and anyone else confused by the FCOJ trading mayhem might enjoy this piece.

For many, the film was an insight into the wild west of open outcry where traders yelled at each other in a trading pit accompanied by enigmatic hand signals. When a price was agreed upon, a chit was filled in containing the trade details and made its way to a data entry clerk whereby the trade was entered into a computer system and became a legally binding contract on both parties.

Open-outcry has gone the way of the dinosaur. Now all futures are traded electronically.

What to know more about futures? Check out the primer we’ve put together.

What this means for Bitcoin

It’s huge news. Like, totes amazeballs.

You’ve no doubt noticed we’ve been spewing out a raft of articles here on the site covering the movements in the space and with good reason. Bitcoin is worth more than gold, in fact, it took BTC a fraction of the time to achieve what gold took decades to do.

Gold is old, coin is cool. Got it?

Last week the CME announced they were launching BTC futures contracts in the fourth quarter. A game changer in many ways adding instant legitimacy to the cryptocurrency.

“Given increasing client interest in the evolving cryptocurrency markets, we have decided to introduce a bitcoin futures contract,” said Terry Duffy, CME Group Chairman and Chief Executive Officer. “As the world’s largest regulated FX marketplace, CME Group is the natural home for this new vehicle that will provide investors with transparency, price discovery and risk transfer capabilities.”

What will the BTC futures contract look like? Here’s what we’ve learned so far:

• Each contract is composed of five bitcoin.

• Each tick (the minimum fluctuation) will be $5 per bitcoin, amounting to $25 per contract. This means that every time the contract moves by the smallest increment a trader will gain or lose $25 per contract they hold.

• Bitcoin futures will trade on CME Globex and CME ClearPort from 5 p.m. to 4 p.m. CT Sunday to Friday. The long trading hours are typical of futures contracts that are traded electronically.

• There is a spot position limit of 1,000 contracts. Futures contracts always have limits on the number of contracts one person or entity owns. This prevents someone from being able to “corner the market.”

• Bitcoin futures will have a price limit of 20% above or below the prior settlement price.

• Price settlement will be based on the Bitcoin Reference Rate, or a daily reference rate of the US dollar price of one bitcoin as of 4:00 p.m. London time.

As we see it, futures will change the Bitcoin landscape. Initial thoughts include:

- Allow folks to easily short BTC outright thus profiting from a fall.

- Bums on seats: Anyone with an account authorized to trade futures can now participate in the BTC revolution

- Companies engaged in streaming deals with coin miners will be able to hedge their position.

- Spread trading against other cryptocurrencies become a reality. i.e. BTC vs Ethereum

Or how about these:

Think BTC is the new gold? Get thee long BTC futures and simultaneously sell gold futures short.

Calling bullshit on the crypto-bubble? A short BTC / long gold position is just the ticket.

You get the picture.

This will surely pull the institutional investors off the bench.

A futures primer

Traded in units known as contracts, futures allow you to punt on the future price of an underlying asset.

Think Gold, Crude and also financial indexes such as the S&P 500. That’s just scratching the surface. Now you can trade futures over pretty much anything you can think of including pepper, sunflower seeds and even the weather.

Hence futures are classed as derivatives. They derive their value from something else.

If you’re running an airline or mining for gold they are a necessary tool to control the cost of doing business. These are the hedgers – who seek to control the risk of adverse future price movements in underlying commodities.

If you’re running an airline or mining for gold they are a necessary tool to control the cost of doing business. These are the hedgers – who seek to control the risk of adverse future price movements in underlying commodities.

Then there are the speculators who seek to profit by predicting those price fluctuations. Heard of Nick Leeson? He single-handedly put Barings Bank out of business trading Nikkei futures on the Singapore Monetary Exchange (SIMEX) back in 1995.

Thus the term rogue trader was born.

How did futures come about? They’ve been around for quite some time, since the 17th century in fact.

The futures contract, as we know it today, evolved as farmers (sellers) and dealers (buyers) began to commit to future exchanges of grain for cash. For instance, the farmer would agree with the dealer on a price to deliver to him 5,000 bushels of wheat at the end of June. The bargain suited both parties. The farmer knew how much he would be paid for his wheat, and the dealer knew his costs in advance. The two parties may have exchanged a written contract to this effect and even a small amount of money representing a “guarantee.”

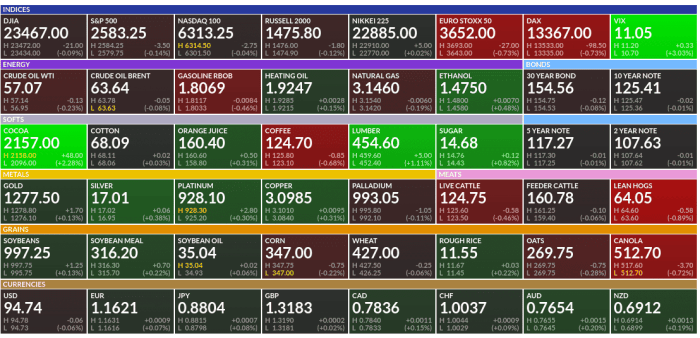

Here’s a peek at current futures prices for a raft of commodities, currencies, metals and energies.

We ♥ finviz!

So you want to be a player..

Firstly you need to find a broker, open an account, and deposit your cash. We’ll leave that part up to you.

Then you need to decide what you’re going to trade and be familiar with the correct codes and contract specifications. Thankfully we live in a time of Google. Use it!

Let’s take gold, for example.

You’re a contrarian and feel it’s golds time to shine in the near future. What do you do?

Some research for one.

The contract code for gold is GC and December is Z7. So GCZ7 is the code for December gold. Below is a quote displayed from Marketwatch.

If you think the price will rise you go long, or purchase a contract (GCZ7). Conversely, if you think the price will fall you sell short a contract, hoping to buy it back at a lower price.

A phone call or a few mouse clicks later you’re all set and, depending on your outlook, are either long or short GCZ7. By this stage, you should already know (remember – the research part) that a single contract covers 100 troy oz of the shiny stuff which equates to controlling a position worth roughly $127,000 of the barbarous relic.

Did we mention you only have to put up a fraction of the total value of the contract? You don’t have to stump up 127K, that’s the magic of futures.

What do you have to pay?

You are hit with an initial margin of around USD 2,000 and should you hold the position overnight a similar maintenance margin will also be deducted from your trading account.

These margins are designed to ensure you can meet your obligations and are intended to protect the clearinghouse more so than you. The clearinghouse ensures you get paid, even if the counterparty goes bust – the big difference between exchange-traded and OTC (Over the Counter) markets.

Why are clearinghouses necessary?

Because a futures contract is exactly that – a contract, and a legally binding one. When a trade is executed it’s a zero-sum game. Someone on the other side of your trade holds the polar opposite view as to the expected outcome of future price movement, and only one of you will be right. Without the role provided by the clearinghouse, the market would cease to function in an orderly fashion.

Pay the piper

Unlike a stock position, your futures position is marked-to-market (MTM) on a daily basis and any losses or gains will be reflected in your account balance. There is no such thing as a paper loss when trading futures.

So, say you’ve paid your margins and are now long 1 Dec Gold contract. If gold rises fifty bucks you will show a profit of $5,000 likewise if it falls 50 bucks a loss of 5K. As you only had to stump up around 4K you are seeing the effect of leverage – it amplifies both your profits and your losses.

When things go wrong trading futures it get’s ugly quickly. What if gold moves up 100 bucks overnight and you’re short?

That’s what happened not too long ago when Brexit caught the market by surprise.

You’re in the hole for a 10K loss per contract.

What if you decided to trade 3 contracts instead of 1? Ouch, now you’re looking at a 30K loss on the position. There goes a car or an overseas holiday.

You’ll likely wake to the sound of your broker screaming at you to put more money into your trading account. This is a margin call and no trader wants to be on the end of one. Those surplus funds were intended to pay the rent and feed the dog, right?

Can’t cover the loss? They’ll come for your first-born, your autographed Britney Spears poster and those rare Beatles records you had hidden in the attic.

Just kidding! Should your account be in debit (and you’re unable to bring it back to zero) they’ll likely just sue you and send your account for collection.

Meanwhile, gold longs are popping bottles of Krug and packing their bags for Bora Bora.

Futures trading is not for the faint of heart. The risk of financial loss is very real and ever-present.

–// Craig Amos