Micro cap graphite operator Berkwood Resources announced today that they’re mobilizing crews to their Lac Guerette South property to prep for an August drill program. The market likes it so far. The TSX.V company is up 27% this am on 125,000 shares on nearly twice their average volume before 10 am Vancouver time.

Berkwood is working with a familiar playbook. They’re a small company whose affordable equity offers the potential that comes with proximity and geological / geophysical similarity to a neighboring company with a business that is gaining traction both in the market world and the real world. Familiar playbooks have the advantage of being simple to understand, which is often an under-rated trait in juniors with dreams.

For the full picture, we must first look at Mason Graphite.

Mason was early to the graphite boom. They took the main Lac Gueret project (North of Berkwood’s Lac Gueret South) from prospect to feasibility in record time, and the market loves it. Mason went from a $40M market cap in 2013 to a $188M market cap today.

The ongoing graphite boom infecting the venture capital markets has seen the arrival and departure of many exploration stocks, and the stagnation of many others. Through it all, Mason diligently built something that can only be considered the Real Deal. The property is in Quebec, the home of exceptional government subsidies and the largest Western commercial graphite producer Imerys.

They took the property through the various stages of exploration diligently, and were able to work through a consistent, surprise-free timeline and achieve regular milestones partly because of the nature of graphite formations, and the ones at Lac Gueret specifically.

The high-purity graphite in these formations is structurally controlled. It consists of carbon that cooled and set along seams in structures. This isn’t a hydro-themral deposit where the mineral got bubbled through a network of cracks in water. The earth sorted this one into the layer cake based on density and temperature, and just happened to leave the graphite deposit in a long, tidy seam.

Mason got the deposit with work already done on it by a previous operator, and has been busy ever since. They moved it through PEA and into feasibility, increasing the tonnage, and are in the process of building a mine. One of the reasons they were able to move so quickly and efficiently is that graphite is highly conductive.

17% carbon graphite lights an EM up like a Christmas tree, giving geologists an easy way to follow the structure and inform their drilling. Now, the 65 million tonnes of material that Mason has identified is being given the full treatment. They’ve done the metallurgical work, figured out a processing circuit, and are going to be shipping graphite to industrial customers this year.

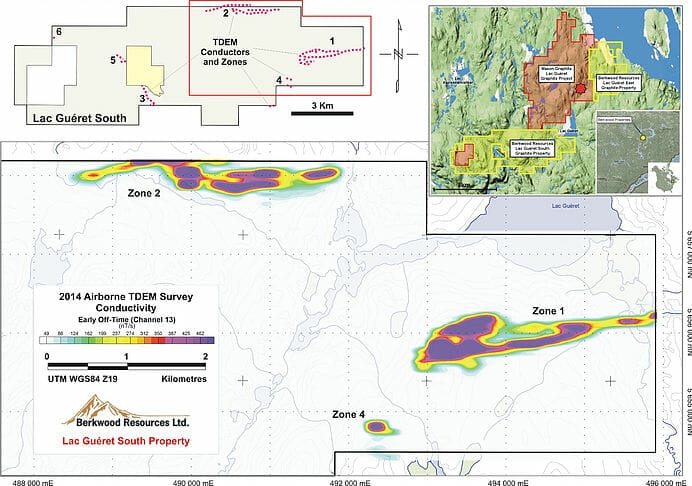

Berkwood graphite has two properties contiguous to the Lac Gueret property, one to the south and one to the east. EM surveys on both properties has identified conductive structures, and ground work has confirmed the presence of graphite on surface. The August drill program may give them a better idea of the depth and breadth of the structure. Should they establish that the EM signature is in fact a graphite structure of a similar consistency to the known deposit that Mason is building, the asset will benefit from the value added by the ongoing exploitation next door both in terms of infrastructure and knowledge of process. Clearly, Mason would be a likely suitor to any owner of a graphite asset contiguous to Lac Gueret, but Imerys may be a better eventual suitor for both assets.

The Berkwood team are believers in a shift away from hydrocarbons, and an associated importance of energy metals. To that end they’ve made acquisitions of lithium and cobalt properties in the past month or so, both of them in Quebec where they surely feel comfortable with legal and business landscape. The properties are exploration-stage and, as we’ve intimated before, that’s where the spring is wound the tightest in resource investing. A long position on Berkwood amounts to a bet that the team will be able to de-risk these properties in an environment where the world is shifting their transportation to battery-powered vehicles. Such an environment would likely include rising cobalt, lithium and graphite prices, and the ease-of-financing that comes with it.

Berkwood is up $0.075 to $0.42, about $.20 off of its 1 year low at the time of this writing. That’s about a $5M market cap at 15M shares outstanding, which makes it look tight and could represent good value. They showed $500,000 in cash at the end of February.

Glad to see you back Braden!

Not seen you guys on the stream or many articles from you recently. Always enjoyed your work.

Hope y’all continue!

James

We’ll be back soon. Just moving things about in the office, getting the best set up going forward.