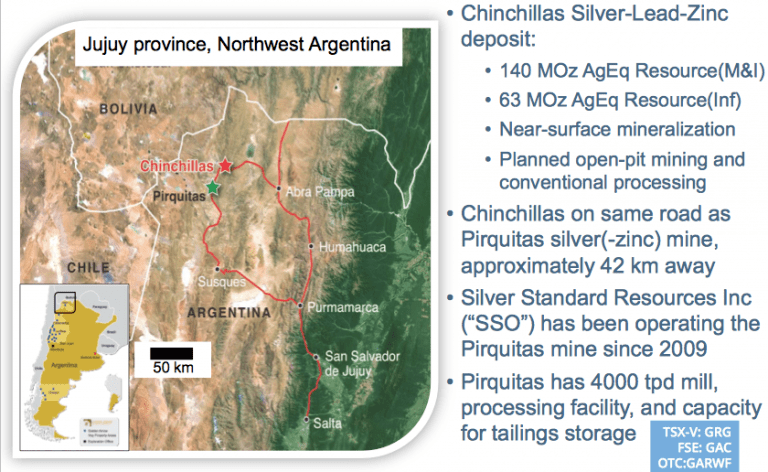

After reading a few articles & interviews of Chairman, President & CEO Joseph Grosso, I’m struck by the lack of investor appreciation of Golden Arrow Resources‘ (TSX-V: GRG), (OTCQB: GARWF) blockbuster news of it entering into a 25%/75% JV with mid-tier gold / silver producer Silver Standard Resources (NASDAQ: SSRI) (TSX: SSO). In the 18-month period since agreeing to evaluate a combination of Silver Standard’s Pirquitas mine and Golden Arrow’s Chinchillas Silver project in Argentina, it invested ~US$ 16 M (plus a C$ 2 M option payment) into the Company. Among other things, this capital paid for 24,000 m of drilling, engineering studies and metallurgical test work, culminating in a Pre-Feasibility Study (“PFS”). Overnight, Golden Arrow jumped from explorer to 25% owner of a producing mine and Mill.

After reading a few articles & interviews of Chairman, President & CEO Joseph Grosso, I’m struck by the lack of investor appreciation of Golden Arrow Resources‘ (TSX-V: GRG), (OTCQB: GARWF) blockbuster news of it entering into a 25%/75% JV with mid-tier gold / silver producer Silver Standard Resources (NASDAQ: SSRI) (TSX: SSO). In the 18-month period since agreeing to evaluate a combination of Silver Standard’s Pirquitas mine and Golden Arrow’s Chinchillas Silver project in Argentina, it invested ~US$ 16 M (plus a C$ 2 M option payment) into the Company. Among other things, this capital paid for 24,000 m of drilling, engineering studies and metallurgical test work, culminating in a Pre-Feasibility Study (“PFS”). Overnight, Golden Arrow jumped from explorer to 25% owner of a producing mine and Mill.

Does the Company’s valuation embrace this monumental de-risking event?

I believe there are 3 primary reasons for the under-appreciation of the [Chinchillas / Pirquitas Mine] JV. At first blush, the PFS for a proposed 8-year mine life at the Company’s Chinchillas project with a post-tax NPV of US$ 178 M left investors underwhelmed. 25% of US$ 178 M = US$ 44.5 M = C$ 60 M (equal to about C$0.60/share). Second, the PFS used a fixed, long-term Ag price assumption of US$19.50/oz vs. the current spot price of about US$17.25/oz.

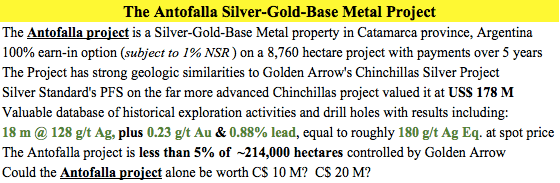

Third, there’s uncertainty as to how management will fund Chinchillas’ estimated US$ 20.25 M capital requirement over the next 18 months (and also be able to fund other important exploration activities, such as at Antofalla; see below). Although not the focus of this article, Golden Arrow controls ~25 other land packages totaling ~214,000 hectares. NOTE: {Please see Corp. Presentation for more info}

Tackling the idea of a funding challenge is not difficult. Once the JV transaction closes the Company will have roughly C$ 27 M = US$ 20 M in cash. On top of that, there’s an additional C$ 7 M from in-the-money options & warrants, plus an estimated C$ 11 M stretching out into mid-2018 from its share of cash flow from processing stockpiles at the Pirquitas mine.

Combined, that’s C$45 M = US$ 33.3 M in cash, equal to C$0.40 per fully-diluted (“fd”) share. If readers are still not comfortable with Golden Arrow’s ability to fund both its 25% JV Interest obligations and exploration of other exciting projects, there’s little else I can say, the numbers speak for themselves.

Is the PFS a Good Measure of Potential Upside in Golden Arrow’s Share Price?

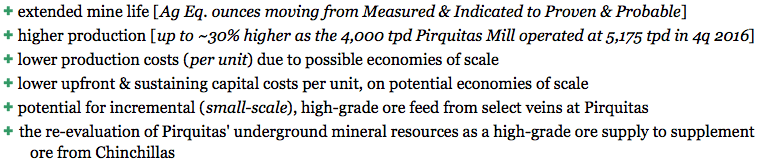

Regarding the PFS, there’s a substantial amount of upside to the NPV. The following factors could have a large impact on the NPV:

The PFS is just the beginning of a valuation exercise, not the end of it. Touching briefly upon the above bullet points, it’s very important to recognize that Silver Standard’s Mill at Pirquitas operated at an average of 5,175 tpd in 4th qtr 2016. That’s ~30% above nameplate capacity. All else equal, incorporating this single change (from a 4,000 tpd assumption to 5,175 tpd) in the NPV calculation found in the PFS would increase the economics by ~40%. To be clear, this represents only the operational potential of the Mill with respect to Chinchillas, it’s not a sure thing (otherwise it would have been reflected in the PFS).

Regarding extended mine life, the PFS conservatively includes ~71 M Ag Eq. ounces, but Chinchillas has a NI 43-101 resource of 140 M Ag Eq. ounces (Proven+Probable+Measured+Indicated). Continued drilling will upgrade a portion of M&I to P&P. There’s also 63 M Inferred ounces, plus ongoing exploration that could result in new discoveries. Therefore, mine life could be meaningfully extended, and/or annual production increased. With this in mind, (in my opinion only), a mine life beyond 8-yrs is the expectation, not the default.

The last 2 bullet points, high-grade ore feed from select veins and the re-evaluation of underground opportunities at Pirquitas are noteworthy as well. These are tangible scenarios that make a lot of sense with the Pirquitas Mill operating at high utilization, but would never work on a standalone basis.

Various Scenarios Suggest a Higher Company Valuation

Readers might have noticed I don’t mention potential upside in the NPV from silver, lead or zinc prices. I leave that out because the PFS already incorporates a strong Ag price assumption of US$19.50/oz. vs. a current spot price of ~US$17.25/oz. NOTE: {lead & zinc prices in the PFS economics were set close to spot, offering potential upside in those metals relative to the Ag price}.

Another factor possibly under-appreciated by the market is the robustness of this PFS compared to that of other PFS-stage projects around the world. How many PFSs have an established, operating Mill & tailings facility in them? How many PFS-stage projects are fully funded? NOTE: {Silver Standard also has strong liquidity; C$ 582 M in cash and marketable securities}. I believe the Chinchillas project is more de-risked than it appears, especially if one accepts that the cash liquidity estimate mentioned above will satisfy Golden Arrow’s share of upfront capital.

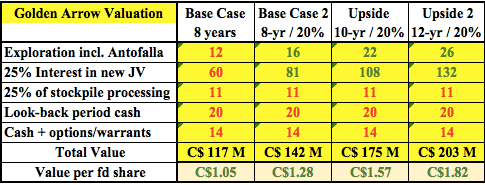

In the above chart I take a stab at quantifying the potential value per share under 3 simple scenarios. I start with the base case, which takes the PFS at face value (25% of US$ 178 M = US$ 44.5 M = C$ 60 M), adds existing cash (incl. proceeds from warrants & options of C$ 14 M), + ~US$ 15 M (~C$ 20 M) in “look-back” JV cash flow + Golden Arrow’s 25% share of Pirquitas stockpile processing cash flow, estimated to be a total of C$ 11 M (from April 1, 2017 through June 30, 2018). That total value is C$ 105 M, but it ascribes zero value to an additional 214,000 hectares of prime exploration property in Argentina, including the highly prospective Antofalla Ag-Au-Base Metal project. For that I attached an amount equal to 20% of the calculated valuation of Golden Arrow’s 25% Interest in the Chinchillas / Pirquitas JV. In the “base case,” that’s C$ 12 M. C$ 117 M divided by 111.3 fd shares = C$1.05. The current share price is C$0.65.

If one looks no further than the base case, one is missing the real opportunity here. In the scenarios that I show (all calculations my own, based entirely on extrapolation of the cash flow model on page 210 of the PFS), the value per fd share ranged from C$1.28 to C$1.82. These are indicative figures only, and of course the market does not always give companies 100% credit on underlying valuation!

Scenarios are derived from assuming an 8 to 12-yr mine life and 4,800 tpd throughput at the Mill (20% greater than the assumption in the PFS). To reiterate, the Pirquitas Mill operated at 5,175 tpd in 4th qtr. 2016. Should GRG.v shares be trading at a 60% discount to the indicative value of C$1.57/share, based on a 10-yr mine life at 4,800 tpd? That’s for readers to decide, but I’ve been investing in Golden Arrow in recent weeks as I think it offers a compelling risk/reward opportunity.

Finally, consider a bullish scenario not included in the chart. In the eyes of a prospective acquirer of Golden Arrow’s 25% stake in the JV, a potential mine life of even greater than 12 years would be contemplated in their overall due diligence. The JV interest is arguably worth more to a suitor with multiple mines, as it would serve to diversify its asset portfolio and the suitor could more efficiently spread overhead expenses across the entire enterprise. Not to mention a lower cost of capital and other prospective synergies.

Readers paying close attention may have noticed that I’ve sneakily switched a PFS with an 8-yr mine life for one extending 15 years…. That’s not the point at all. I’m not saying that Chinchillas will be a 10-15 year mine, just that it could, under very reasonable assumptions, be longer than 8 years. The upside optionality of Chinchillas is valuable, but might not be priced into shares at C$0.65.

Disclosures: The content of this article is for information purposes only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein, about Golden Arrow Resources, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered, in any way whatsoever, implicit or explicit investment advice. Further, nothing contained herein is a recommendation or solicitation to buy, hold or sell any security. The content contained herein is not directed at any individual or group. Peter Epstein and Epstein Research [ER] are not responsible, under any circumstances whatsoever, for investment actions taken by the reader. Peter Epstein and [ER] have never been, and are not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and they do not perform market making activities. Peter Epstein and [ER] are not directly employed by any company, group, organization, party or person. The shares of Golden Arrow Resources are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Peter Epstein owned shares of Golden Arrow Resources, but neither Peter Epstein nor Epstein Research have any prior or existing relationship with any person or company mentioned in this article. Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. Mr. Epstein & [ER] are not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. Mr. Epstein & [ER] are not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. Mr. Epstein and [ER] are not experts in any company, industry sector or investment topic.