British Columbia, (BC) Canada’s 2016 gold revenues were about $650 million. Most of that gold was a by-product from copper mining. $650 million is a useful amount of money, but to put it in perspective, 2016 real-estate sales in BC were 100x bigger.

It wasn’t always this way. Eighty years ago gold mining was a vital component of the provincial economy. Here’s a clipping from the 1936 Annual Report by The Minister of Mines.

In 1936, BC’s gold sales totalled $15,418,594. The price of gold then was $35 an ounce. The same weight of bullion would sell today for $748 million.

The province was crawling with gold prospectors, and gold investment promoters. Some of them were unscrupulous. A clipping from a rural BC newspaper confirms a new law whereby fraudulent gold promoters could be fined and imprisoned.

Just as gold speculation was getting frothy – WWII broke out. The miners crawled out of the tunnels, grabbed their Lee-Enfield No. 4s, and went off to fight the Germans.

47,000 of them didn’t come back – the BC gold industry had lost its mojo.

That may be about to change as a number of savvy mine developers have picked up gold properties in BC with historical high-grade mines.

Enter Feisel Somji

Not Keyser Söze – yet other CEOs would do well to fear Feisal Somji, based on his track record alone. It’s been said that he can make a Buddhist monk order a round of daiquiris.

As the founding president of Rio Alto Mining, Somji oversaw the construction of a mine in Peru which achieved annual production of 150,000 oz gold. That plucky little Canadian company was sold in 2015 for $1.3 Billion.

As the founding president of Rio Alto Mining, Somji oversaw the construction of a mine in Peru which achieved annual production of 150,000 oz gold. That plucky little Canadian company was sold in 2015 for $1.3 Billion.

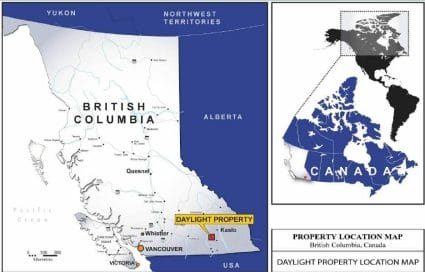

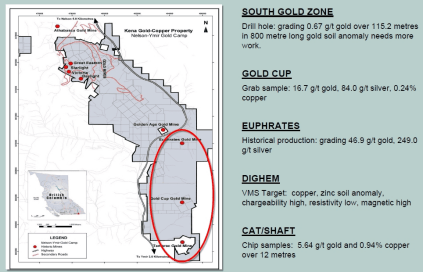

Somji is now the CEO of Prize Mining Corporation (PRZ.V) that owns an 8,000 hectare property in the Nelson BC gold camp.

The property has a bulk tonnage resource of around 2 million ounces, but Somji is taking a targeted approach to the project development. He wants to build a compact low-capex, high-grade gold mine to generate quick cash so that the company can explore the high tonnage project without diluting existing stock.

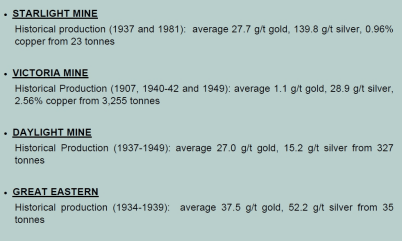

Prize Mining’s land package contains a number of high-grade deposits that were economical in 1936.

A recent technical reports states: “Four gold-bearing targets, the Great Eastern Porphyry Gold Zone, the Starlight Shear Zone, the North Star Shear Zone, and the Silver King Gold Corridor, require further exploration. Geological indications suggest the potential for more than 3.0 million ounces of gold in the four target areas.”

Prize is also required to spend a further $100,000 on exploration this year, $400,000 next year, $1 million in the third year and $1.5 million in the fourth year of the option agreement.

Meeting these requirements will earn Prize an 80% stake in the property. To acquire the final 20% stake, Prize will have to make a $2 million cash payment, whilst also granting it a 1% Net Smelter Royalty.

PRZ recently issued 14.3 million non-flow-through units at $0.35 and 2.22 million flow-through units at $0.45 per unit to raise a total of C$6 million.

About 26 million of the existing 50 million shares are in the hands of management and insiders. That’s good news for new shareholders. It means the objectives of the management and shareholders are aligned. We’ve done some due diligence on the Prize Team and they are company builders.

The key question is: How is the company going to spend the $6 million cash currently sitting its account? If Somji repeats his performance in Peru, PRZ will move rapidly closer to production, closer to profit – and the shares will become more expensive.

Prize Mining has everything going for it: multiple historical high-grade mines, close to a highway, water and cheap power in a mature mining jurisdiction.

Adjusted for inflation (+ 1,600%) British Columbia’s 1936 gold production was worth $12.3 billion in today’s dollars.

Gold exploration in BC is finding its mojo again.

Prize Mining is trading at .69 with a market cap of $35 million.

Prize Mining is trading at .69 with a market cap of $35 million.

FULL DISCLOSURE: Prize Mining is an Equity Guru marketing client.