Is Metalla Royalty & Streaming Ltd. [CSE: MTA] the next Franco-Nevada [NYSE: FNV]?

No. It’s still early days. It has a market cap of C$21.5 M (US$16 M), just 0.12% that of Franco.

But…

Precious Metals Royalties & Streaming Business

Most people understand the basics of the precious metals royalty/streaming (“R/S”) business models, at least enough to know they can be highly profitable. When an experienced, well-connected management team comes together and executes on robust, accretive transactions, a company can command strong market valuation multiples. A streaming company provides non-equity financing for mining companies via an upfront cash payment in exchange for the right to acquire a percentage of metals produced at a predetermined price from a select mine or properties. Since deals are frequently for the life of a mine, a streaming company typically stands to benefit greatly if additional zones are mined (i.e. increasing annual production and/or extending mine life).

Like streaming, royalties require upfront cash investment, but no further capital need be paid over the term of the agreement. In exchange for cash, the royalty holder receives a fixed percentage of explicitly defined revenues OR profits. There are several ways in which annual royalty payments can be derived, including a percentage of Gross Smelter Revenue = “GSR” (revenue-based) and a percentage of Net Smelter Revenue = “NSR” (profit-based). There are several iterations of these 2 conveyances. NOTE: {There’s a prodigious amount of information on the R/S business models on the websites of industry participants}.

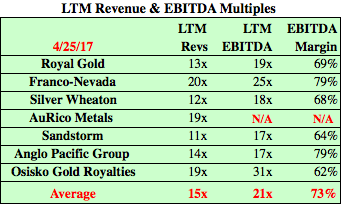

Strong Market Multiples, Trusted Blue-Chip Companies

An average EBITDA multiple of 21x (trailing 12 months), and as high as 31x, is quite impressive. And, industry multiples typically move higher in hot markets. For example, Franco-Nevada traded as high as a 30x multiple when gold was bouncing around $1,350/oz. last summer. Imagine the perfect storm if gold & silver returned to $1,800/oz. & $35/oz., respectively, a level seen in 1H 2013? Industry multiples, margins & production growth would soar. As underlying valuations rise, it becomes more attractive to acquire other R/S companies than to underwrite their own streaming & royalty transactions.

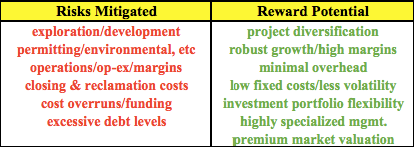

R/S agreements are long-lived and unique, offering diversification benefits unavailable from single project mining juniors. At any given time, a successful R/S player’s investment portfolio might have cash flow schedules extending 20 years (from existing cash flowing deals, plus ones expected to go cash pay in the future). That’s why many believe that R/S companies are the best risk-adjusted way to play precious metals bull markets…. and survive bear markets.

R/S companies invest in all stages of mining, from early-stage through production and (importantly) expansion. They invest with the goal of an attractive return on capital (base case), plus valuable optionality on a strong or even spectacular outcome. R/S managers can fine-tune their investment portfolios based on market cycles (i.e. enter into more bullish or more conservative transactions). With new deals they can steer away from jurisdictions experiencing an increase in (geopolitical, environmental, permitting, geological, etc.) risks.

Much of the Upside of a Junior Miner, With Less Risk & Volatility

Expertly structured transactions can yield outsized returns without the need of major discoveries. Instead, a meaningful expansion of an existing project can do the trick. Even if an expansion project experiences cost-overruns, R/S companies receive the benefits of increased production. Essentially, portfolio company margins don’t matter much, a luxury in an otherwise cyclical industry! Also avoided, closing & reclamation costs…. which can be significant, and might entail off-balance sheet debt. In addition to risk avoidance, the absence of these functions means low overhead and high margins.

The list goes on and on; R/S companies have limited to no risk exposures to key factors including; operations, legal issues, labor negotiations, taxes, environmental & permitting challenges. Anything that happens before or after actual production is largely irrelevant to a R/S company. This frees management to focus on new opportunities and jurisdictions, making new contacts, structuring and (if necessary) funding operations. Consider this, a real eye-opener for me, Franco-Nevada reportedly has something like 30 full-time employees, Newmont Mining [NYSE: NEM] has closer to 30,000!

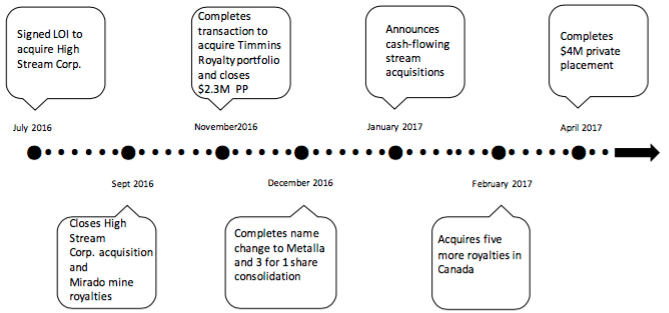

With this in mind, an emerging R/S company, Metalla Royalty & Streaming Ltd. [CSE: MTA / OTCQB: EXCFF / Frankfurt: X9CP] should be on investor’s radar screens. Make no mistake, Metalla is a highly speculative investment, not an industry bellwether company. As a newcomer, it’s not widely followed, but it has a strong management team, {see mgmt. bios below} great industry contacts and A LOT going on behind the scenes. NOTE: {I will leave for my next article the news of yesterday, May 4th, except to say that this transaction of multiple NSRs looks very attractive, and was a positive surprise}

On April 28th, Metalla announced the imminent closing of its first currently cash paying precious metal stream. The Company is investing US$1.86 M (net of initial streaming cash flow of US$138,136), in exchange for 15% of the silver (“Ag”) produced at the New Luika Gold Mine in Tanzania, successfully operated by Shanta Gold Ltd. since 2012. Metalla management estimates the stream will generate between 19k-22k ounces of silver per year through 2026. The Company is required to pay ten percent (10%) of the prevailing spot price for each ounce produced.

Management is paying US$1.86 M (C$2.48 M) for an annual (un-discounted) cash flow stream of roughly US$325k (C$430k), assuming $18/oz Ag and 20k ounces/yr. However, Metalla has considerable upside in the form of higher prices and increased production. For example, if both production and the Ag price were to increase just 3% per year, ending in 2026 at ~26,000 ounces produced, net to Metalla, (on an Ag price of ~$23.5/oz), un-discounted cash flow in 2026 would be about US$550k (C$735k).

As a frame of reference, if silver were to increase 12% per year, it would reach ~$48/oz, equal to the high tick of 2011, generating cash flow of ~US$1.1 M (C$1.5 M) in 2026. NOTE: {the all-time, inflation-adjusted high tick on silver was about $150/oz in 1980!} I don’t mean to suggest that this particular deal is a company maker, I’m merely pointing out the tremendous upside (a valuable call option) on precious metal prices embedded in properly structured agreements.

Two things come to mind. First, C$430k per year nearly covers the cash burn of the Company, affording management the flexibility and breathing room to cherry pick the best opportunities. Second, a 10-20x cash flow multiple on C$430k suggests C$4.3 to C$8.6 M in market value. That’s from just one modest-sized stream. The Company fully expects to execute 2 – 4 R/S deals per year, in the US$2 – $10 M zip code. Not all will be cash flowing from day 1. Notably, small R/S players have an advantage in terms of deal flow, their opportunity sets are much larger than mutli-billion dollar giants that can only look at transaction sizes in the hundreds of millions.

That’s on top of 3 other prominent assets, royalties on 2 mines and a development project in Timmins, Ontario. NOTE: {On May 4th, Metalla signed a definitive agreement to acquire additional NSR royalties, not included below}.

- A 1% NSR on Goldcorp’s [NYSE: GG] Hoyle Pond Extension properties east of the producing Hoyle Pond Gold Mine, (in production since 1985). And, a 1% NSR on Glencore’s [LSE: GLEN] “Bint Property” also east of the Hoyle Pond Mine. This royalty is on a non-producing portion of an operating mine (no cash flow to Metalla yet).

- A 1.5% NSR on the West Timmins extension properties owned by Tahoe Resources [NYSE: TAHO / TSX: THO], (subject to a buyback of 0.75% for $750,000). This royalty is on a non-producing portion of an operating mine (no cash flow to Metalla yet).

- A 1.5% NSR on the Desantis properties, owned by Osisko Mining [TSE: OSK], (subject to a buyback of 0.5% for $1 million). This is a development-stage project.

While it’s difficult to value non-cash generating Royalties & Streams, transactions written on, “extension projects” are lower risk than development projects. Blue Chip counter-parties like [Goldcorp, Glencore, Tahoe, Osisko and Detour Gold [TSE: DGC] add credibility and a “vote of confidence” in the above mentioned properties of interest to Metalla. The Timmins gold camp in one of the world’s most prolific gold belts.

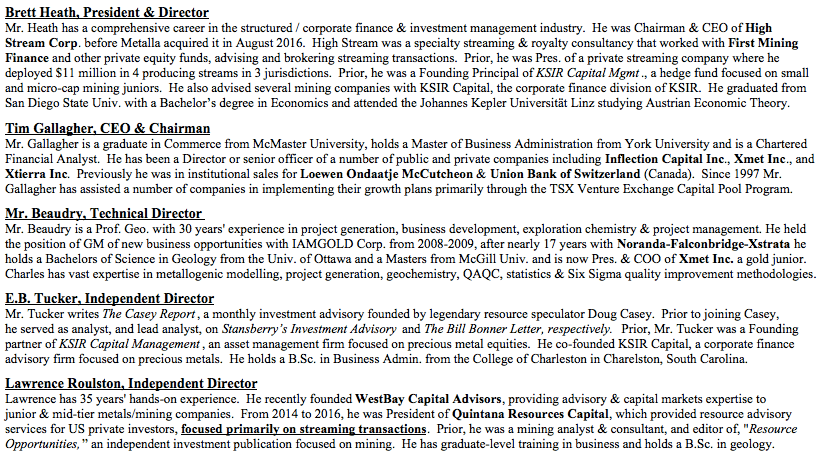

Management Bios

— Peter Epstein, Epstein Research

Disclosures: The content of this article is for information purposes only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein, about Metalla Royalty & Streaming, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered, in any way whatsoever, implicit or explicit investment advice. Further, nothing contained herein is a recommendation or solicitation to buy, hold or sell any security. The content contained herein is not directed at any individual or group. Peter Epstein and Epstein Research [ER] are not responsible, under any circumstances whatsoever, for investment actions taken by the reader. Peter Epstein and [ER] have never been, and are not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and they do not perform market making activities. Peter Epstein and [ER] are not directly employed by any company, group, organization, party or person. The shares of Metalla Royalty are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Peter Epstein owned shares and stock options of Metalla Royalty and the Company was a sponsor of Epstein Research. Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. Mr. Epstein & [ER] are not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. Mr. Epstein & [ER] are not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. Mr. Epstein and [ER] are not experts in any company, industry sector or investment topic.