Every now and then, a junior miner comes up with a savvy trick to make the markets notice who they are. This is important because, as anyone who has walked the halls at a Cambridge House Investor Show will have noticed, most resource companies sound an awful lot like all the other ones.

We’ve seen the ‘we don’t need a 43-101’ crowd, the ‘roll it forward’ crowd, the ‘make the data open source’ crowd, but one thing you don’t see very often is a company that has a 43-101… and decides to reduce the size of it so that it makes more sense going forward.

That’s the plan – kinda – at Prize Mining (PRZ.V), where a historic resource and lots of previous work done has left them with a 43-101 that, frankly, they think is too big. Too fluffy. So they’re bringing it back.

No, really.

An existing NI 43-101 says Prize’s Kena property in the Nelson BC gold camp has a low-grade bulk tonnage resource of just under 2 million ounces. That’s a fair wack of gold, guys.

And if they wanted to blow that out into a humongous, miles long, miles wide, miles deep play, they could keep themselves in salaries for the next few years just plunging more drills holes into it, raising more money, drilling more, raising more money, drilling more…

Or: They could dive headlong into the best grade of the existing resource, focus in on the good stuff, and reel that resource back into a near term production, low cost, near revenue play that will drive value sooner rather later, and without needing to raise a billion dollars to build a mega-mine in a decade.

I mean, if you wanna build a mega-mine in a decade, by all means. But, for now, let’s drive some value and get at some shiny.

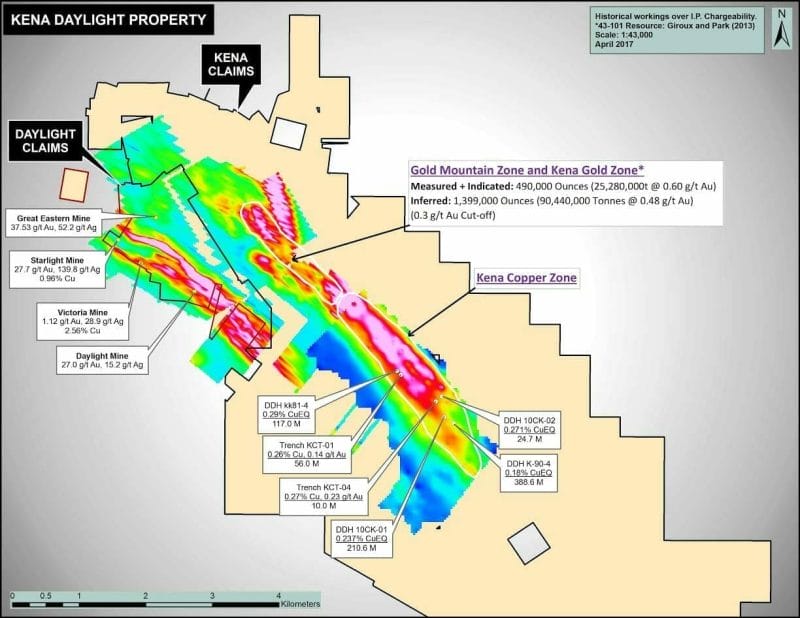

If you look at the various pieces of the map above you can clearly see that there are some rich pickings in among the bleh. Some seriously rich pickings.

37.5 g/ton at the Great Eastern. 27.7 g/ton at two different parts of Starlight.

So, sure, why not plunge into that?

But hey, even if you just play by the ‘bank on what you’ve got’ theory, that existing 43-101 outlines around $2 billion of gold at today’s prices. Prize’s market cap right now? $3.2 million, pre-financing.

That financing was impressive for several reasons. 1) It contained a million bucks in flow-through financing, which means the money HAS to be spent on the project proper. 2) They raised $6 million total, so the company has removed a ton of risk going forward. 3) The people participating in the financing are BEASTS of banking. Pat DiCapo of PowerOne Capital Markets brings serious heft to the deal.

I like this all of this, partly because it tells me we’re not dealing with a balls-out promo production that’s doing everything it can to spell the word ‘bonanza’, but also because this A-list mining crew are presenting a sensible middle ground approach that costs way less to move forward, but with high upside, with the right money, financed in the right way, without diluting everything to hell.

Let’s get to brass tacks: Prize has grabbed the Kena and Daylight properties, bringing them together for the first time. They’re smack dab in the middle of a decent BC gold camp, that gives them a ton of places they can toss a drill if another drill hits something sweet nearby. The joint is closer to the Teck Resources smelter just down the highway than you are to your nearest video rental store. There are train lines and highways and workers and power and water and I’m pretty sure they could hail a passing zeppelin if the need arose because nearby Nelson is a big BC city, and it has a history of coughing up gold plays. A long history.

In fact, it’s not only the place where Teck-Cominco was born, it’s BC’s second largest gold camp, with the nickname of ‘the golden arc.’

Within their 8,000 hectare property, there are high grade vein type deposits that grade at over 10g/ton. And that’s where it gets intriguing; Historically, this property has already pounded out a lot of gold. In fact, it’s had grades from 1.1 g/ton to 37.5 g/ton. On the silver side, it goes as high as 139.8 g/ton.

Prize knows where those high grade plots are, and they interest CEO Feisal Somji greatly. Somji is no slouch – he founded and served as President and CEO of Rio Alto Mining, which went into commercial production in Peru in 2011. Tahoe Resources picked that up for $1.3 billion.

Somji’s presence adds to that ‘this is serious’ notion I have about this company, that I talked about earlier. He’s got more letters after his name than any one of you, he’s got a big mine he previously took to production, he’s got a fat billion dollar exit on his bio, and now he’s landed in the middle of this BC plot that, previously, folks yanked gold out of with buckets and ropes. He’s going in with more sophisticated workings.

In fact, the property contains six historic gold mines, all untested and which could be their own nifty cottage industry.

Which is why he doesn’t need to lean on a big floppy low-grade resource designed to try to wrap everything into one thing.

Streamline it, focus it, zero in on the premium stuff, raise only what you need to in order to get that smaller plot working hard, make great use of that Teck smelter that, to be frank, Teck has been trying to fill with feedstock for a few years now, which will bring Prize a low cost to partner up on, and make it well within Teck’s best interests for Prize to get where it needs to go, which could lead to all sorts of tasty dealings down the line.

I’m rambling here. It’s run-on sentence city. But that’s what happens when I get excited, and I’m excited by this play.

It harkens me back to Integra Gold (ICG.V), a play that I often cite because its team walked into my office a few years back, explained that they’d taken on a ‘problem property’ that a few other operators had botched, and they were wondering if they should change the name and get past all of that bad history by just wiping the slate clean.

“No,” I said. “Own it. Fix it. Work small and nimble, zero in on the stuff you know is good, and work your way out from that as you earn revenue. And when you’re done, people will look at you as gods, because you fixed the unfixable and started a gold mine without spending hundreds of millions.”

Integra has a $374 million market cap today, and they earned that through a down market, from scratch.

Prize Mining’s market cap? $2.35 million pre-trading return. You could sell the whole company at that price and buy a bungalow down the road in Nelson proper from which to laze out your remaining years, or you could turn it into another big deal.

That, to me, speaks to a massive potential to profit from any decent news.

Added to that? The drilling that’s been done on the KGM gold property has largely gone down 200 metres and done nicely through the **176** drill holes that someone else paid for over 3 km. But two of those holes went deeper, and confirmed mineralization as deep as 400 metres down.

25.2 million tonnes measured + indicated containing 490k ounces of gold. On the inferred side, you’re looking at 90 million tonnes containing 1.39 million ounces of gold.

This is where Prize pushes back from the table and says, hey, those are nice numbers, but they’re low grade averages and meh to that. Numbers like that don’t make sense for a giant player to bother with, because of the low grade average. But a smaller player can go in exactly where the high grade averages play out and rip in.

That’s the deal here. And it makes sense. They’re not playing for a lottery ticket 50-bagger, they’re playing for a scratch-n-win 15-bagger. Substantially lower risk and cost, only marginally smaller upside and, let’s face it, when they get to near term production on a small, manageable scale, the money they make can be put to good use expanding outward as they need to – later.

If Prize came in and said they were going to take this resource to the moon, I’d be the first to tell you to steer clear. They ain’t going to the moon. But Vegas? That’s far more doable.

Prize went back into trading Thursday and has held nicely after a long halt. That shows me strength, especially as the story isn’t really out yet.

Yet. Watchlist.

[pdf-embedder url=”https://e4njohordzs.exactdn.com/wp-content/uploads/2017/04/PPT-May-2017.pdf”]

— Chris Parry

FULL DISCLOSURE: I own some Prize stock because I believe all of the above, and the company is an Equity.Guru marketing client because we think it’s going to be a great story to tell.